ULEZ expansion: disruption and displacement of industrial?

Putting all political machinations to one side, what impact might the expansion of ULEZ have on the industrial real estate market across the capital – and beyond?

7 minutes to read

A temporary headache or a catalyst for change in the industrial landscape in Greater London?

What is ULEZ and where is the expansion?

As planned, but not without court challenges, the Ultra Low Emission Zone (ULEZ) expanded on 29th August 2023 to cover all 32 London boroughs and the City of London.

ULEZ in London has been in effect since April 2019, first following the same map as the Congestion Charge. The zone was expanded in October 2021 to cover a larger portion of Central London, with borders at (but not including) the North and South Circular Roads.

While the geographical area has now expanded to cover all Greater London, the charge and conditions of compliance remain fixed. As ‘carrot and stick’ government programmes go, the ULEZ represents a ‘stick’, pushing London residents and businesses to operate less polluting vehicles.

Aimed at improving air quality through a reduction of roadside emissions from older, more polluting vehicles and limiting congestion, the scheme charges a daily £12.50 fee (in addition to the Congestion Charge) for driving non-compliant cars or vans within the zone.

To be compliant under the minimum Euro emissions standards, petrol vehicles must meet Euro 4, diesel vehicles must meet Euro 6 and mopeds / motorcycles must meet Euro 3. While heavy goods vehicles (HGVs) and other, larger vehicles over 3.5 tonnes do not pay the ULEZ charge, these vehicles must meet Euro 6 under the previously implemented LEZ standards and comply to more stringent safety requirements.

Industrial heavily affected by expansion

What does this mean for Greater London industrial?

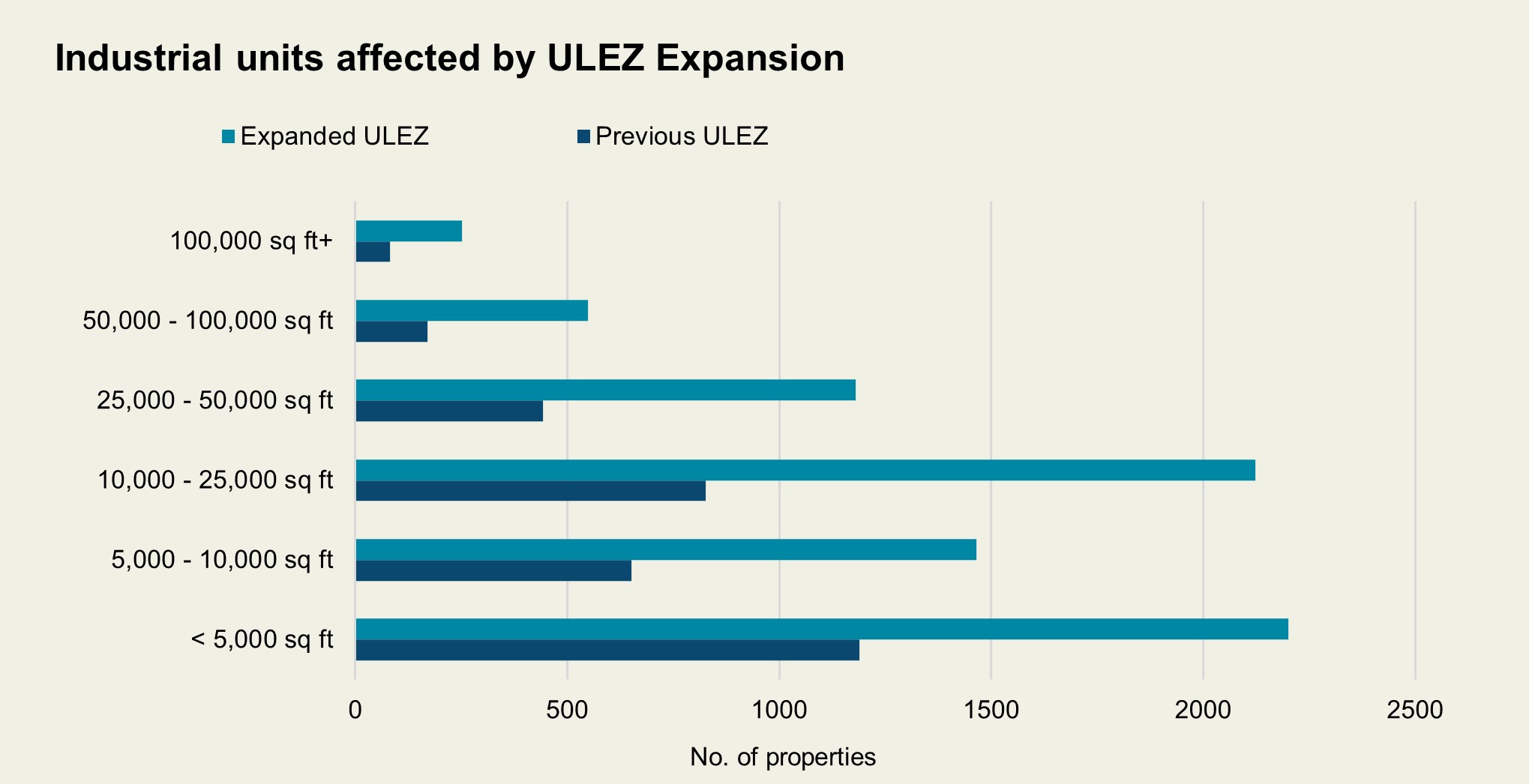

We examined data by CoStar and found that approximately 4,400 additional properties now sit within the expanded footprint. This represents a massive +130% increase from the approximate 3,400 properties that sat within the previous zone, bringing the total number of affected units to 7,800.

The additional volume of affected industrial space is in the region of 113 million sq ft, up from approximately 63 million sq ft in the 2021 ULEZ, bringing the total volume now affected to 176 million sq ft. The average sized unit within the ULEZ is now 22,644 sq ft, up from 18,887 sq ft in the previous zone.

Whether unit counts or floorspace, we’re talking big numbers.

What size properties are impacted?

In short, all sizes. Big and small.

The number of units between 50,000 and 100,000 sq ft now sitting within the zone has soared from 170 units pre-expansion, to 549 today, while the volume of space impacted has risen dramatically by 233%.

For units over 100,000 sq ft, the number of properties has increased from 81 to 252, with the volume of impacted space rising by 185%. However, we would stress that these statistics are from a relatively low base. Larger industrial properties are typically located further outside of Central London, so it’s not surprising that more sizeable properties are now affected as the zone spreads further from its former core.

Such businesses occupying larger units, including logistics and transportation companies, still rely heavily on diesel vehicles due to the limitations around the distance that electric vehicles can travel. Whether off a low base or not, the impact will still be very real for a large number of businesses.

At the other end of the size spectrum, smaller units and multi-let estates are also profoundly affected. There are now double the number of units under 10,000 sq ft, and a 157% increase in units between 10,000 and 25,000 sq ft now falling within the zone.

The potential impact is far ranging - it’s not just properties located within the boundary that are affected. Within a 25-mile radius of Central London, there are approximately 12,500 units, with many occupiers carrying out day-to-day business within the ULEZ, so even those sitting just outside the zone could be impacted by the daily charge. Possibly more so, as non-London based companies are not eligible for the scrappage scheme offered and so are at a further disadvantage.

Source: Knight Frank Research, CoStar

Feeling the impact of a declining footfall

What does this mean for various industrial sub-sectors?

Retailers and wholesalers are the most impacted from the zone expansion, occupying a combined 34% of industrial space within the entire zone. Logistics operators and warehouse storage account for a further 22% and manufacturers at 17%. Other prominent occupiers include catering companies and operators of creative or entertainment studio space. All are exposed to change on the back of the zone expansion.

Industrial occupiers such as building merchants, trade counter shops, auto traders and car repair garages also feature heavily. These businesses who are reliant on in-store custom may feel the impact of declining footfall / passing trade and could look to relocate further outside the zone. Car repair shops working at the lower or older end of the market may be best positioned to locate further from the ULEZ, as their customer base declines. Over time this may lead to displacement of demand for industrial units extending further outside the new ULEZ boundary and a potential rise in industrial market rents and property values towards, and outside, the M25.

In addition, over 4,300 businesses within the ULEZ boundary took occupation of their respective units between five years and 20 years ago. Those who have taken out leases may soon identify an opportunity to relocate when their ten, 15 or 20-year leases are up for renewal. Displacement may not be immediate – but perhaps expect evolutionary change in the coming years.

Positives outweighing the negatives?

The political maelstrom surrounding ULEZ has overshadowed basic reasoning of both the positive and negative implications. And basic facts are often overlooked.

While the effects of the expanded ULEZ on air quality are undeniably positive, they are limited by the large proportion of vehicles that already comply.

Recent TfL data indicated that nine out of ten cars, and eight out of ten vans, driving in the expanded zone on an average day already meet the ULEZ standards. Maybe not quite the sea change in air quality promised.

Some help is available to minimise the impact, with measures introduced to help those who own non-compliant vehicles. This includes an expanded scrappage scheme offered to small businesses (<50 employees), micro businesses (up to ten employees), sole traders or charities, to scrap or retrofit up to three vans - though businesses must have a registered address in London to apply. HMRC have also confirmed a tax relief will be available to businesses paying ULEZ charges when travelling for business operations.

As reported in the Mayor of London’s “Inner London Ultra Low Emission Zone – One Year Report”, the compliance rate of light commercial vehicles (LCVs) improved from 71% to 85% in the first 12 months following the 2021 expansion. More recently, data by the Society of Motor Manufacturers and Traders (SMMT) revealed 11,414 electric vans were registered so far this year (to August), up 16.4% on the same period in 2022. Some progress, with clear evidence of some operators already biting the bullet.

But sweeping generalisations are dangerous. Ultimately, the impact of the ULEZ on occupiers of industrial property will depend on the specific circumstances of each business and its location within, or just outside, the ULEZ.

On the plus side, minimising air pollution by deterring high-emission vehicles will result in better air quality and a healthier working environment for workers. Importantly, many businesses will have already upgraded their fleet as part of a broader sustainability initiative, and so have gained a head start.

But challenges remain for many other businesses; during a period of heightened inflation, businesses with ageing vehicles will be affected, as well as employees residing outside the ULEZ who commute in non-compliant vehicles.

Even with the scrappage scheme in place, upgrading vehicle fleets to meet stricter emission standards, or investing in electric vehicles and EV charging infrastructure, will prove costly for occupiers, particularly for smaller businesses, courier services, and those operating a ‘just-in-time’ service to Central London, where mobility and location are key. Further cost at a time when it is least needed.

Displacement?

Those facing a decline in walk-in custom may look to relocate. Over time, we may see some increased demand for, and value of, industrial properties outside the zone. One area’s loss may be another’s gain.

Disruption?

At a time when sustainability is a priority for many businesses, the expanded ULEZ represents a ‘stick’ pushing businesses to decarbonise. But at a time of ever-inflating costs, a ‘carrot-led’ approach may have proved less controversial.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here