A polarised London office market

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Pressure on global house prices

House price growth across the world's key cities slowed rapidly during the first quarter in response to rising interest rates and the uncertain economic outlook.

Average annual growth across the 150 cities included in the Knight Frank Global Residential Cities Index averaged 3.1% in the first three months of the year, down from the 6.6% recorded in the previous quarter and well below the recent peak of 11.6% achieved in Q1 2022.

Prices fell in more than half of the cities we track. We saw quarterly drops of more than 5% in seven markets. The correction in prices that began in late 2021 has seen peak to trough falls of up to 24% in Wellington, New Zealand, followed closely by a 22% decline in Buenos Aires. Another 14 cities across Europe, North America and New Zealand have seen double digit price falls from their recent post-pandemic highs.

A decisive maybe

The key issue for all markets remains the outlook for inflation, interest rates and economic activity. Data for all three look considerably better than they did at the end of the first quarter.

Both the Federal Reserve and the European Central Bank opted to raise interest rates to 22-year highs this week. Both chose to drop guidance issued at previous meetings that borrowing costs would need to keep rising and instead opted to keep things ambiguous. Could this be the ECB's last hike? - "It’s a decisive maybe," said president Christine Lagarde. This piece by FT's Martin Arnold is well worth reading for more.

Both a hold and a hike are "possible" in September, according to Fed Chair Jerome Powell. Hot growth figures out yesterday reveal why the Fed wants to keep its options open. The economy grew by a strong 2.4% on an annualised basis in the second quarter, the Department of Commerce reported. That's up from 2% in Q1 and is well above the 1.8% that economists surveyed by Bloomberg had forecast.

The fabled "soft landing" or "immaculate disinflation", in which inflation returns to target while maintaining growth and avoiding massive job losses looks more likely with every month that ticks by.

Rate cuts spread

The Bank of England will get its turn next week. Economists polled by Reuters expect a hike to 5.25% with a meaningful chance of a move to 5.50%.

Expectations are now coalescing around a peak of 5.75% later this year. Market pricing of the peak has come down substantially from 6.5% a fortnight ago, which is underpinning falls in mortgage rates - see Wednesday's note for more. Those cuts are spreading, and Nationwide, Barclays and TSB have all announced reductions in the past 48 hours, according to yesterday's FT.

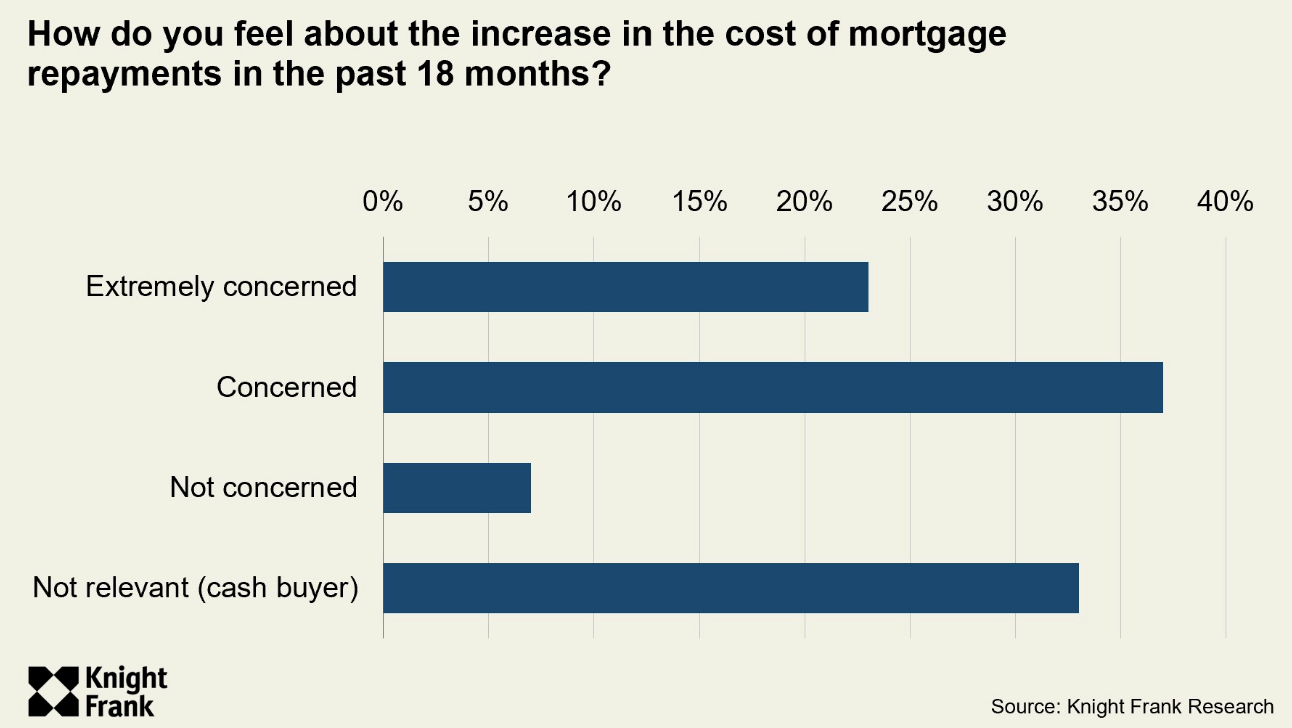

Barring any more nasty surprises, the mortgage market is stabilising, which will do a lot for housing market sentiment. The results of Knight Frank’s UK Summer Residential Property Sentiment Survey, out this week revealed the degree to which buyers are concerned about the cost of mortgage repayments (see chart).

A polarised office market

Knight Frank's Q2 London Office Market Report reveals the degree to which demand is polarising around the quality of space.

Economic uncertainty is acting as a drag on leasing activity. Transactions totalled 2.11m sq ft this quarter, up 8.6% on the previous quarter, but 30% below the quarterly trend. The flight to better quality buildings has driven the post-pandemic recovery so far. Annual take-up for prime space totalled 5.91m sq ft, which equates to 61.1% of the total and some 5% above the long-term trend.

The legal sector continues to lead the market, with two of the three largest deals this quarter. Goodwin Proctor acquired 89,645 at Sancroft, EC4M, and Dentons LLP signed a 66,372 sq ft pre-let at 1 Liverpool Street, 26 months ahead of expected completion. Demand from law firms has boosted take-up from the professional services sector over the last year, which has accounted for 27.7% of all transactions and exceeds trend levels by 61.8%.

Despite lower transaction levels, active requirements increased to over 9m sq ft, and are almost 10% above the long-term average. The financial and professional services sectors account for more than 70% of all near-term demand.

Competing for prime space

Availability has risen 7.5% to 25.8m sq ft this quarter, with the vacancy rate increasing to 10.2% against a long- term average of 6.8%.

That said, larger occupiers seeking sustainable, well located and amenity rich buildings face challenges. There are currently twenty-four active requirements in the City for offices over 60,000 sq ft, for example, compared to twenty-five prime buildings in the City Core.

In the West End, there are twelve equivalent requirements against nine available buildings across the market, only nine of which are in central West End submarkets. There are also a further twelve requirements for which occupiers are considering options in both markets. See the report for more.

In other news...

Two thirds of UK firms are concerned about short-term outlook, fewest since Feb 2022: ONS (Reuters), higher interest rates depress UK commercial property, survey finds (Reuters), out of office: the rise of the ‘workcation’ (FT), bullring owner Hammerson flashes cash (Times), and finally, UK home sellers are increasingly willing to compromise (Bloomberg).