Spain office market attracting investment

Competitive prime average rents, pro-business policy and transport connections are encouraging occupiers into the thriving Madrid and Barcelona hubs.

2 minutes to read

Despite the fact that the economic situation is very similar in advanced economy countries, with high levels of inflation, interest rate hikes, and some countries on the brink of recession, the outlook for Spain is among the most positive, as it is expected that the GDP will experience growth of 1.5% for 2023 and 2% in 2024.

Similarly, inflation will gradually increase, with expectations of reaching 4.3% in 2023 and dropping to 3.2% in 2024.

The office market is still adapting to the new hybrid work models that have been promoted as a result of the lockdown during the Covid.

The figures recorded by the Spanish market during 2022 have been very positive, both in terms of investment, with around 10% more than the previous year, and in terms of occupancy in the main cities, with Barcelona experiencing almost 5% more than the previous year, and Madrid standing out with a 40% increase compared to 2021.

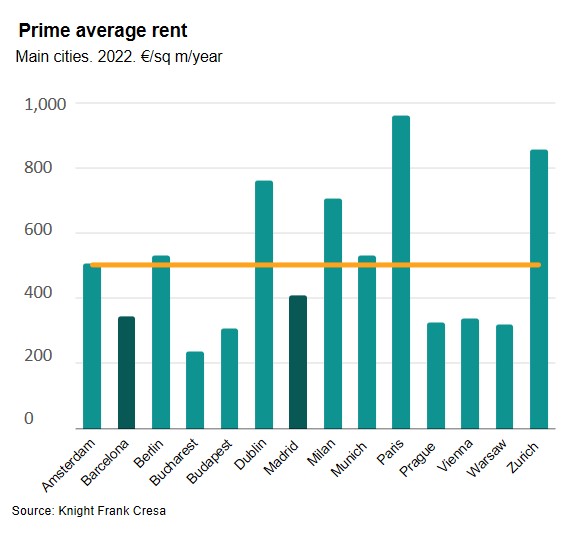

Comparison of prime average rent

Analysing the prime average rents of the main European cities, the Spanish markets of Madrid and Barcelona achieve very competitive prime average rents compared to other European countries, at 402 and 336 €/m²/year, respectively.

These figures are below the average of this sample and far from those achieved in Paris, Zurich, or Dublin. These prime average rents encourage many companies to establish their headquarters in Spain, also influenced by other interesting factors that make the country different from the rest, such as a pro business policy in its capital or its good transportation connections and climate.

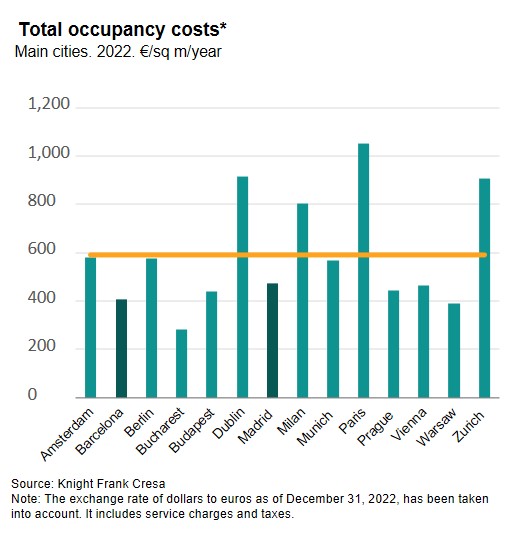

Comparison of total occupancy costs

Other aspects that make the country attractive for establishing companies are the total occupancy costs. Madrid and Barcelona are among the most interesting cities in this comparison, with around €470 and €405/m²/year, respectively, below the average of over €590/m²/year.

Among the most expensive cities are Paris, which exceeds €1,000/m²/year, followed by Dublin, Zurich, and Milan.

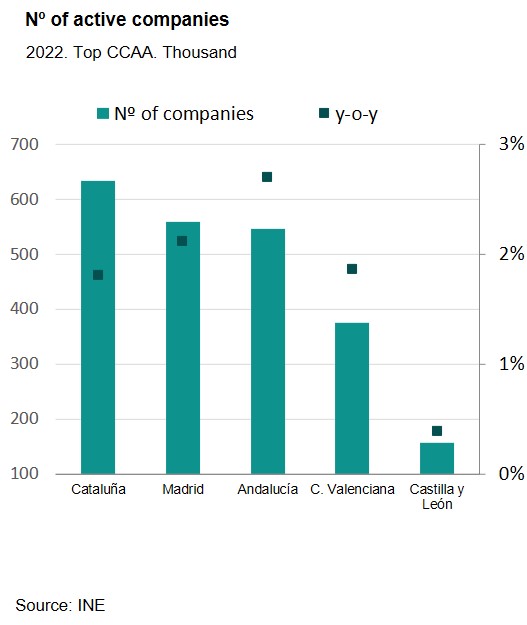

Number of active companies in Spain

The number of active companies in Spain continues to increase. During 2022, the increase was 2% compared to the previous year.

Analysing the Autonomous Communities with the highest concentration of companies, we find the main powers, Catalonia with more than 630,000 and Madrid with almost 560,000, closely followed by Andalusia with around 545,000.

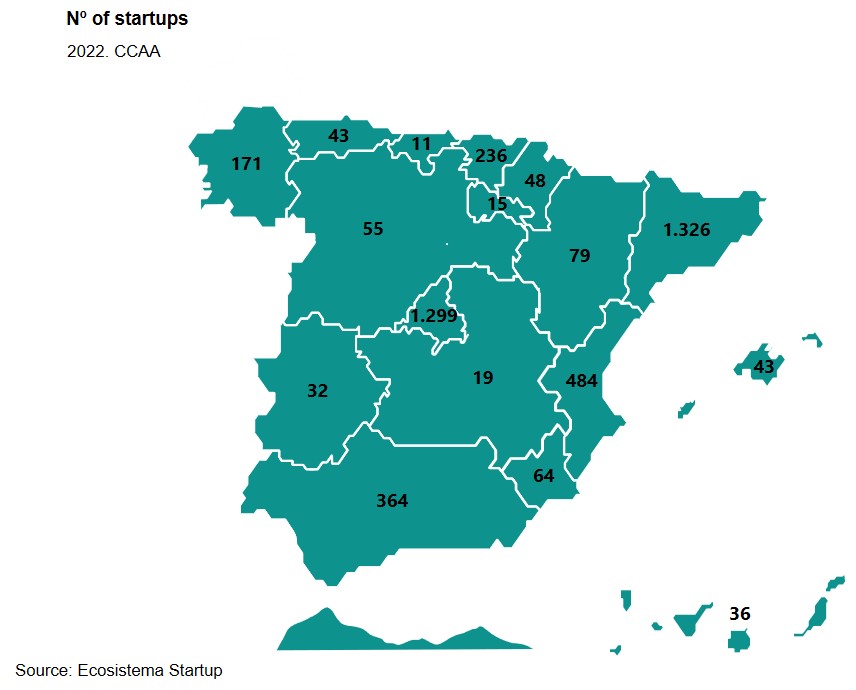

Number of startups in Spain

Spain ranks as the fourth European country in terms of the number of startups (according to PWC data), surpassed only by the United Kingdom, France, and Germany. This further reinforces the interest shown by the country towards new companies that want to locate their offices in the best areas.

It should be noted that the number of startups in Spain to date amounts to over 4,300, according to the database developed by EcosistemaStartups.

Among the autonomous communities with the highest percentage are Catalonia, with more than 1,320 companies, closely followed by Madrid, which has almost 1,300.

Discover more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here