The Ukraine war impact on UK consumers

One year on from Russia’s invasion of Ukraine, we examine the impact on energy, commodity and food prices, and ask: is it time for a UK food security strategy?

7 minutes to read

Little did the rural sector know how much a war that had started over 3,000 miles away would influence their businesses.

We take a look at the impact of the first 12 months of the Ukraine conflict on energy, selected agricultural commodities and input prices and ask if it's now time for a UK food security strategy.

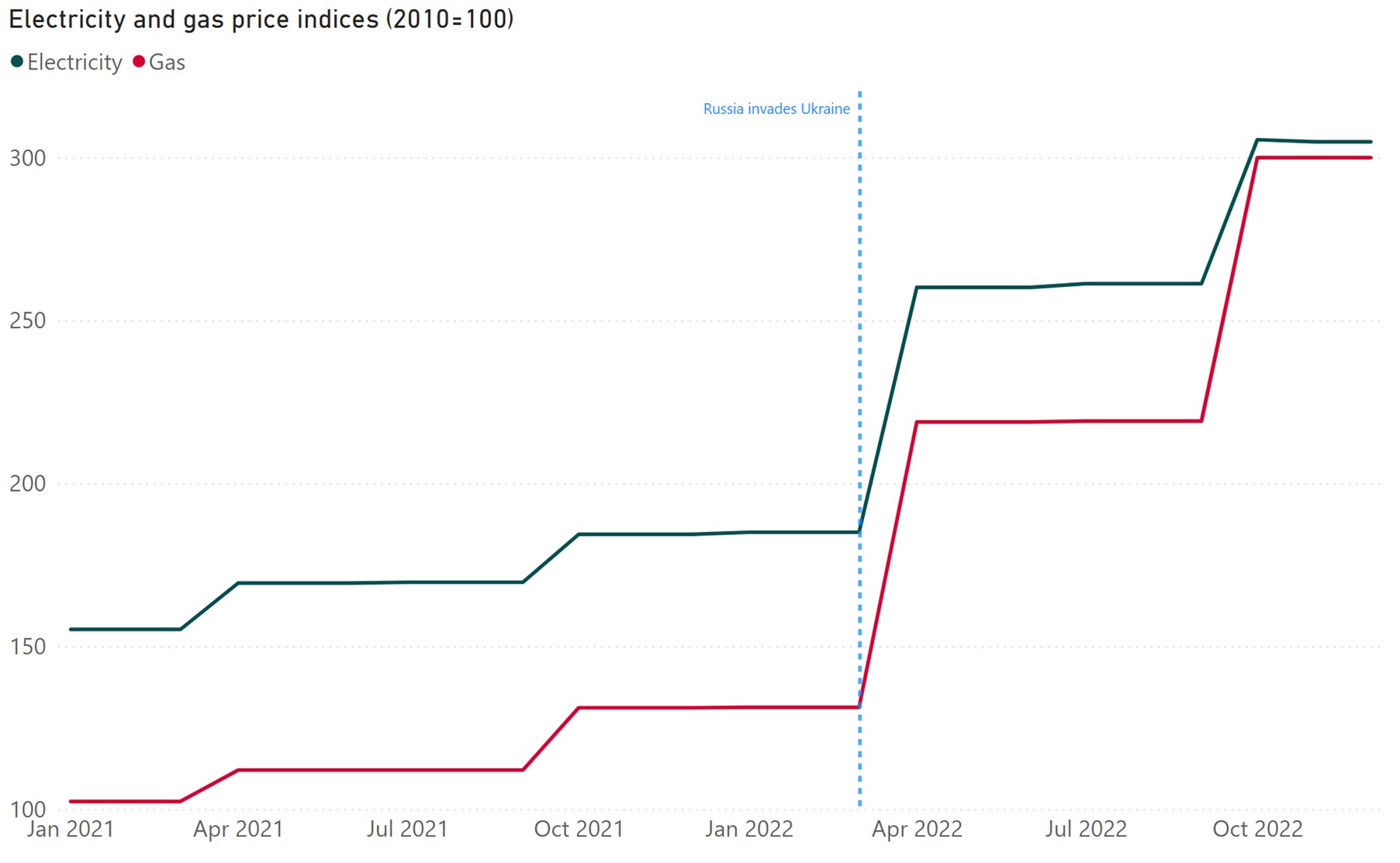

Energy prices

Prices were on the rise before Russia invaded Ukraine but were exacerbated by the West's sanctions and counteractions from Russia. Europe, in particular, relied on gas supplies from Russia to provide heat and electricity.

But gas supplies were hit by a significant reduction in Russian pipeline flows. This left a lack of alternative gas and oil sources and meant shortages in meeting Europe's demand. In Britain, gas is one of the primary sources to generate electricity, and the power market's current structure means that electricity prices are linked to gas.

Source: Department for Business, Energy and Industrial Strategy – UK monthly consumer prices index: fuel components

Although UK natural gas prices peaked 350% higher in August than at the start of the war, much greater increases were being quoted to rural businesses trying to renew energy tariffs. Such was the uncertainty and volatility in the energy markets at that time.

Gas futures on February 22 2023 traded at levels not seen since September 2021 due to lower-than-predicted demand, replenished gas stockpiles and robust wind generation. Lower prices are expected to feed through to consumers during 2023.

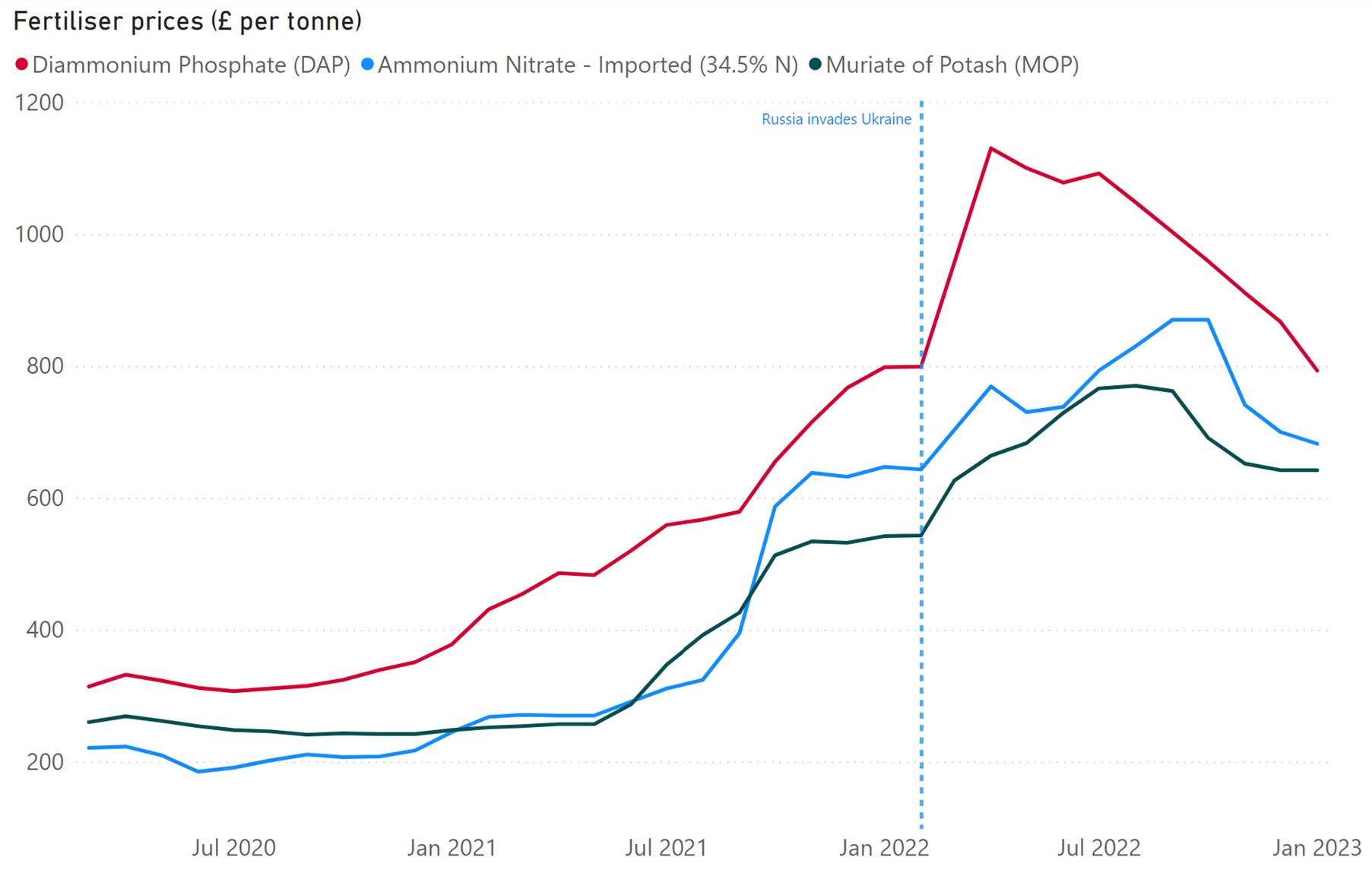

Fertiliser

Of course, natural gas isn't just a determinant of electricity prices. It is the key feedstock for nitrogen fertiliser manufacture, an energy-intensive process. But even before the Ukraine conflict started, the rising energy prices saw CF Industries halt ammonia production at its two UK plants in the autumn of 2021.

Nitrogen fertiliser prices soared. The further hike in gas costs following Russia's invasion sealed the fate of one of those plants during the summer of 2022. This left the UK even more reliant on imported supplies, which were hampered by Russian export bans and the Ukraine conflict - meaning prices remained elevated.

Source: AHDB monthly fertiliser report

In February 2022, ammonium nitrate (AN) prices were already at a historical high of, on average, £650 per tonne for imported products. Six months into the war imported AN reached £870 per tonne. This increase was greater than the price that AN fertiliser was selling, on average, in spring 2020. Prices have eased back to somewhere approaching pre-war values but remain stubbornly high.

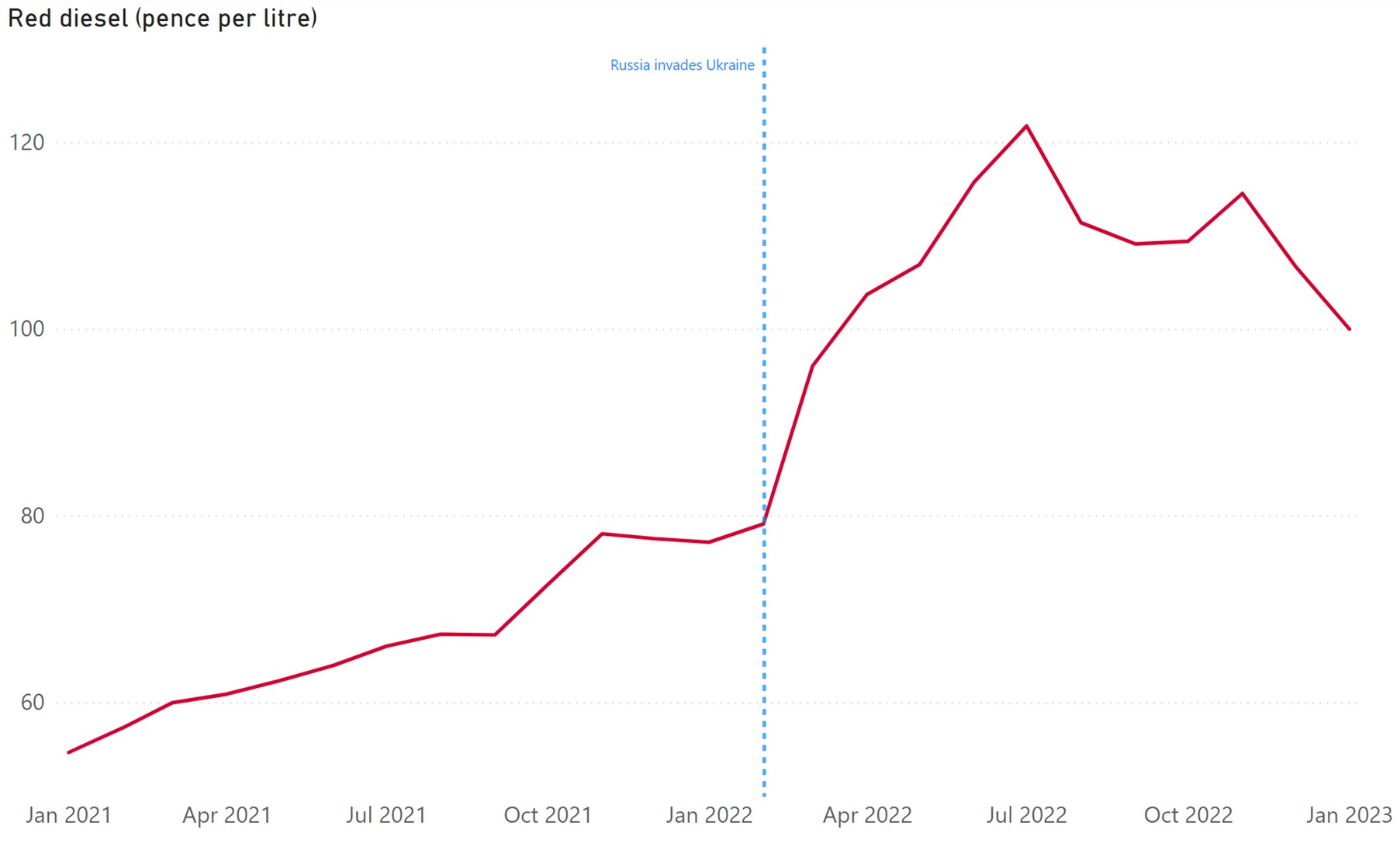

Red diesel

Before Russia invaded Ukraine, oil prices had been rising from a surge in post-COVID demand, supply chain disruptions and delays, a cold winter and the OPEC+ limiting supplies. When the conflict began, oil markets feared disruption to the global oil supply chain and potential oil shortages.

Demand grew to secure supplies including to replace lost gas supplies - oil and diesel prices rose rapidly.

Source: AHDB monthly fuel prices report. Prices include fuel duty.

Red diesel had already climbed to nearly 80p per litre, including fuel duty, at the start of the war. But this surged to over 120p per litre by July 2022. Some rural businesses even received quotes higher than this and were contemplating buying white diesel and claiming back the VAT.

Sentiment and energy demands have calmed over the winter. Prices have fallen back by around 18-20% since the peak but are still 20p per litre above 12 months previous.

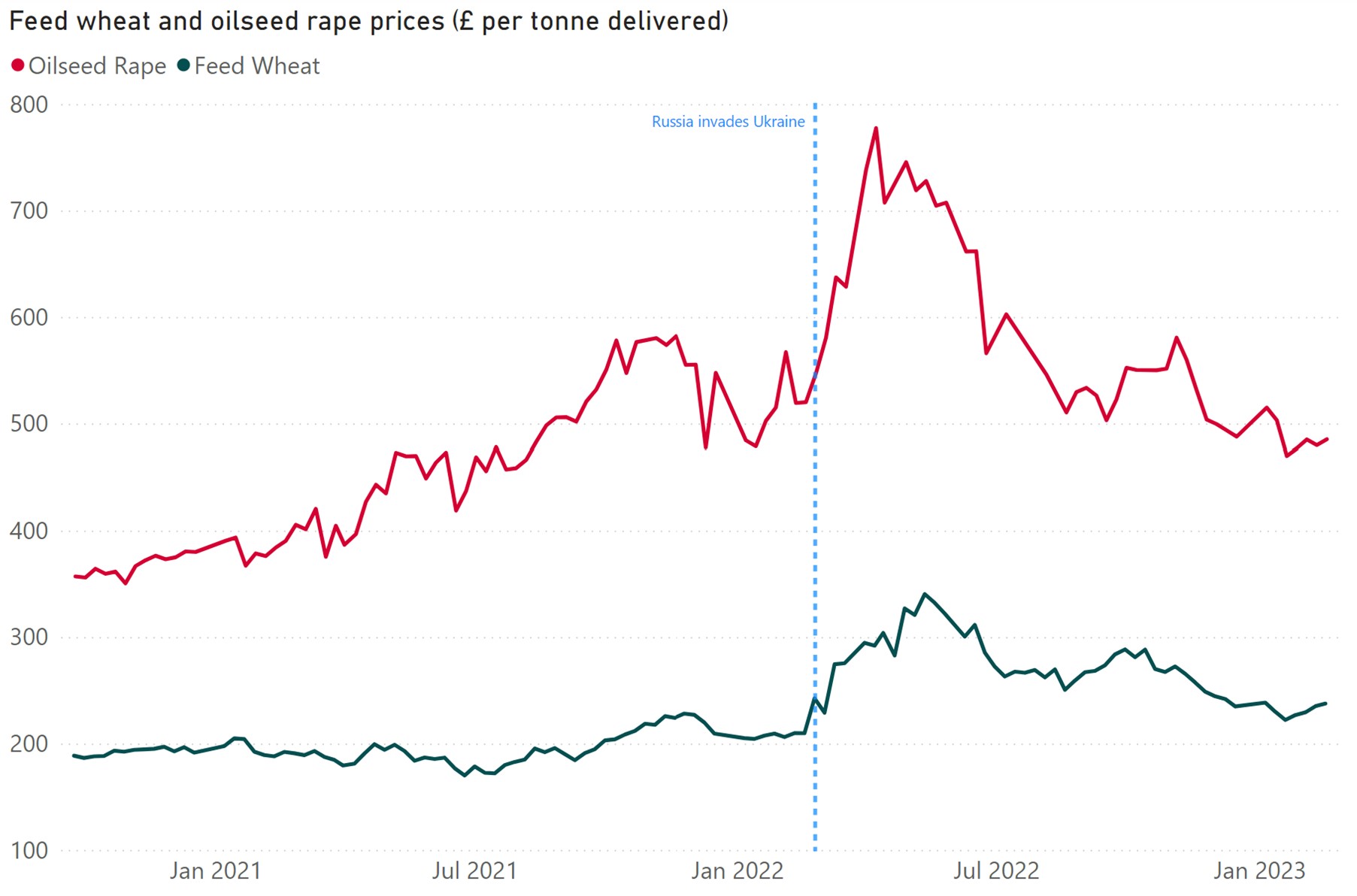

Wheat and oilseeds

It is no secret that Ukraine and Russia are significant and competitive players in the world wheat and oilseeds markets. They previously accounted for 25% to 29% of global wheat export volumes.

When the invasion started, there was an immediate contraction in Black Sea grain and oilseed exports. This tightened what was already a global market short on supply and so significantly inflated prices.

An agreement was struck during the following summer that allowed Ukrainian and Russian exports to continue for 120 days through a Black Sea corridor. Their discounted grains and oilseeds returning to the global market then negatively influenced prices in the UK. Exported volumes haven't reached pre-war levels and with volatility fuelled by uncertainty, nor have UK wheat prices either.

Feed wheat prices soared from £206 per tonne to £340 in the first ten weeks of the war before pegging back to £237 per tonne (23 February 2023).

However, oilseed rape prices tend also to track soyabean and crude oil sentiment; as such, oilseed prices have fallen more sharply. Prices gained, on average, £230 per tonne from the start of the war to their peak in April 2022 - a historical high of £777 per tonne. But by 23 February this year, it had lost about 38% of its peak value.

Source: AHDB delivered prices: Oilseed rape (Erith); Feed wheat (East Anglia)

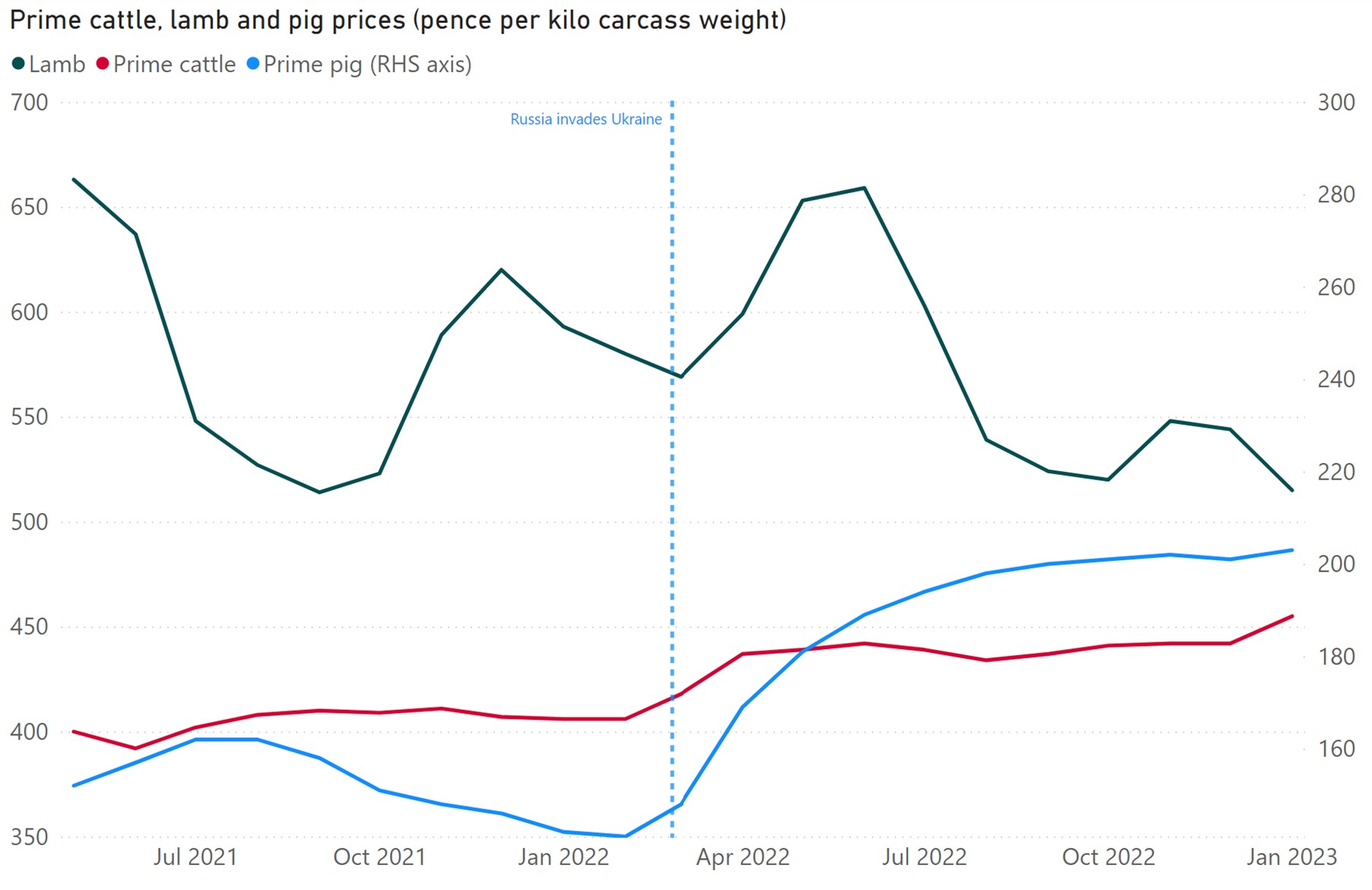

Livestock prices

The Ukraine war has less influenced livestock prices. Instead, the greater feed, fertiliser and fuel costs have heavily impacted these producers.

For beef farmers, this was somewhat mitigated by record prices in 2022. In the last 12 months, tight supply due to drought and feed cost pressures, increased demand on the continent and post-COVID food service demand helped drive up average prices. Prime cattle prices rose 9% from the start of the conflict to 455p per kilo carcass weight.

For lamb producers, prices remained above the recent five-year average. Slightly higher production and a drop in consumer demand – due to the cost of living crisis – did just temper values in the autumn of 2022. But good export growth helped support prices.

Source: AHDB: Lamb SQQ; Pig APP; Overall prime cattle

A 37% increase in prime pig prices hides a story of an industry that has had some of the most challenging times in its history over the last 12 months. The sector was already suffering from labour shortages and rising costs. The outbreak of war in Ukraine added fuel to the fire of increased input costs, with prices for feed and energy hitting record highs as uncertainties grew around supply. The result was a significant 15% contraction in the breeding herd.

Conclusions

The impact of the Russian-Ukrainian conflict on global supply chains has highlighted the vulnerability of the UK's energy and food security. The disruption caused by the conflict has resulted in significant price increases for energy and agricultural inputs, affecting farmers and rural businesses nationwide.

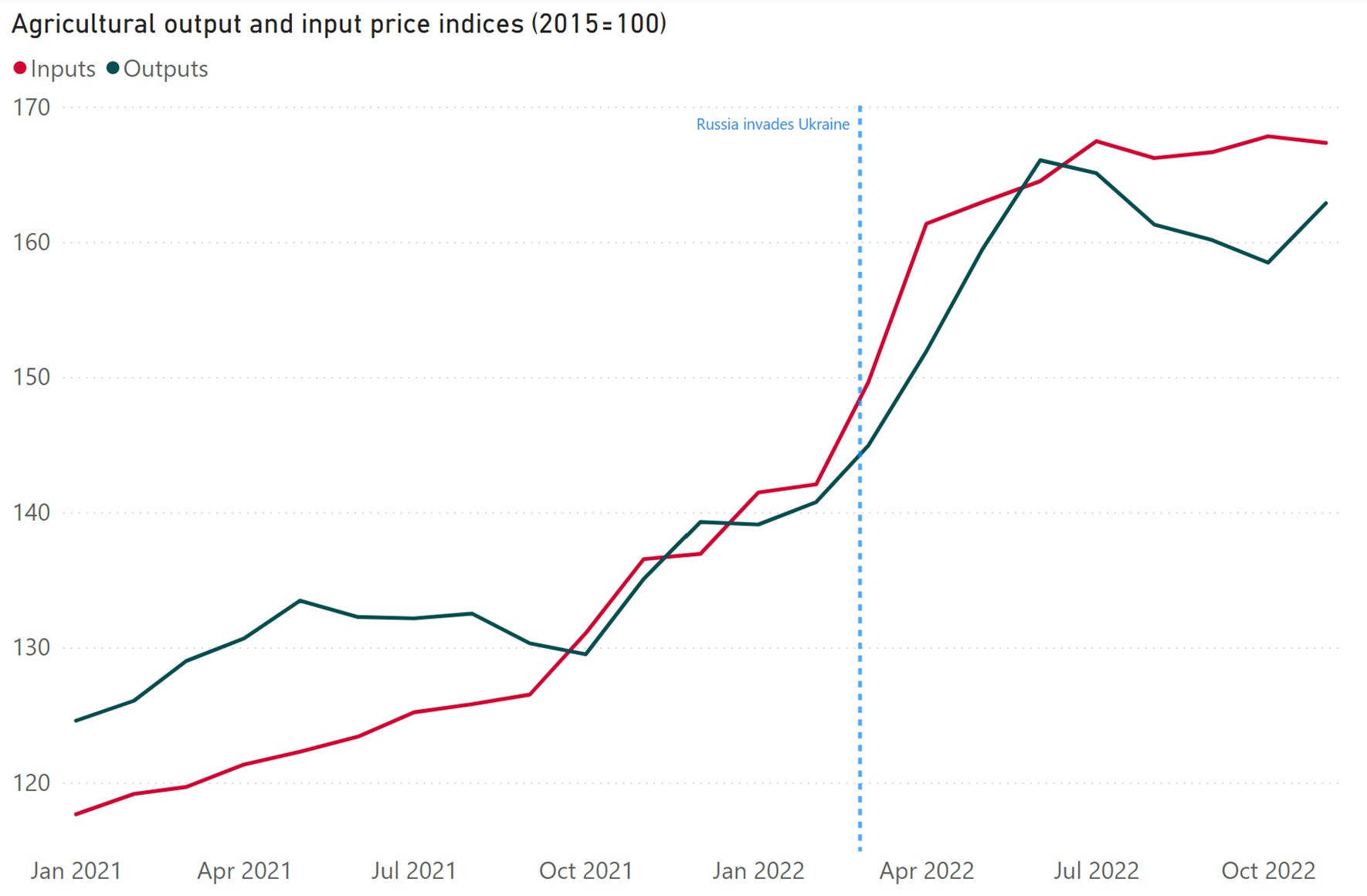

In the 12 months after the war started, both agricultural input and output prices rose sharply but then took slightly different paths – with output prices easing back but input prices essentially remaining high.

Across many farming and rural businesses, margins have been tight or non-existent, leading to reducing production in some sectors, such as pork and horticulture. Vertical farms, once seen as an investment to provide a constant and consistent supply of produce such as salad, have been seen as less viable with high energy prices.

Source: Defra agricultural price indices

Although inflation has been significant, there are signs that it may be slowing down in 2023. However, uncertainty surrounding the conflict remains, and the UK's energy and food security is still at risk if global events continue to affect supplies.

The UK government has taken steps to reduce the country's reliance on imported energy sources, but it is not clear what their approach is to ensuring food security.

It is important that the government develops a strategy to protect the UK's food security and limit the impact of future shocks resulting from events like the Ukraine conflict or significant weather events.

For rural businesses to thrive, it is essential that they have access to affordable energy and agricultural inputs. If input prices remain high, it may affect growers' willingness to grow certain crops or produce, and high livestock feed prices may reduce the number of livestock kept.

In conclusion, the Russian-Ukrainian conflict has exposed the UK's vulnerability to global events affecting energy and food supplies. The government must provide confidence to ensure the country's food security to protect rural businesses, the broader economy, and the public.