Resurgent demand for city living takes Edinburgh market to new high

Edinburgh Index 131.6 / House 131.6 / Flat 140.4

2 minutes to read

Continuing strong demand for family homes and the resurgence of the flat market in Edinburgh saw average prices climb by 4.4% in the three-months to June.

The market for flats in the Scottish capital has been relatively subdued since the pandemic, as buyers sought space, greenery and gardens.

However, flats recorded an increase of 4.5% in the second quarter, the strongest performance since the emergence of Covid, with larger properties proving popular with downsizers from houses and family buyers.

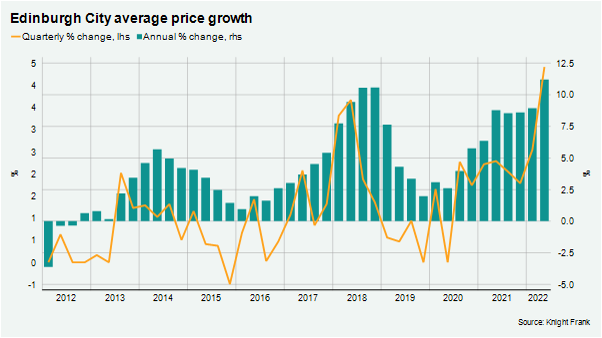

The annual change in the average price of a property in Edinburgh was 11.2% in the 12 months to June (see chart), which is the strongest performance since 2009.

It came as Halifax reported UK house price growth had accelerated to 13% in June, with the property market continuing to defy economic gravity due to resilient demand and tight supply.

“We’re still experiencing low supply but what we do have is selling incredibly well, and typically achieving a premium. While family homes with gardens remain in high demand, we’ve seen a sea-change for flats, with larger examples performing well even without outside space,” said Edward Douglas-Home, head of Scottish residential at Knight Frank.

The pandemic and successive lockdowns have put greenery and space at the top of buyers’ requirements for homes, fuelling sales and price growth in prime regional markets. Edinburgh, which has a compact layout and access to the countryside, has been a popular choice, especially as city centre living has experienced a resurgence in popularity after the reopening of the economy.

Property available for purchase in Edinburgh was 35% lower than a year ago in June, which is keeping upwards pressure on prices.

While Edinburgh’s ‘best of both worlds’ offer has proven particularly popular with domestic and expat buyers, there are signs that demand is peaking.

The number of new prospective buyers (demand) was 8% above the five-year average (excluding 2020) in the second quarter compared with a reading of +27% in the first three months of the year. New instructions (supply) was 5% lower than the five-year average in the second quarter, compared with -19% in the first quarter.

We forecast that prime regional price growth will slow to high single-digit by the year’s end as increasing headwinds such as the cost of borrowing and high inflation trim demand as supply continues to improve.