Edinburgh maintains momentum as it makes a strong finish to 2021

Edinburgh Index 123 / House 122.7 / Flat 131.6

2 minutes to read

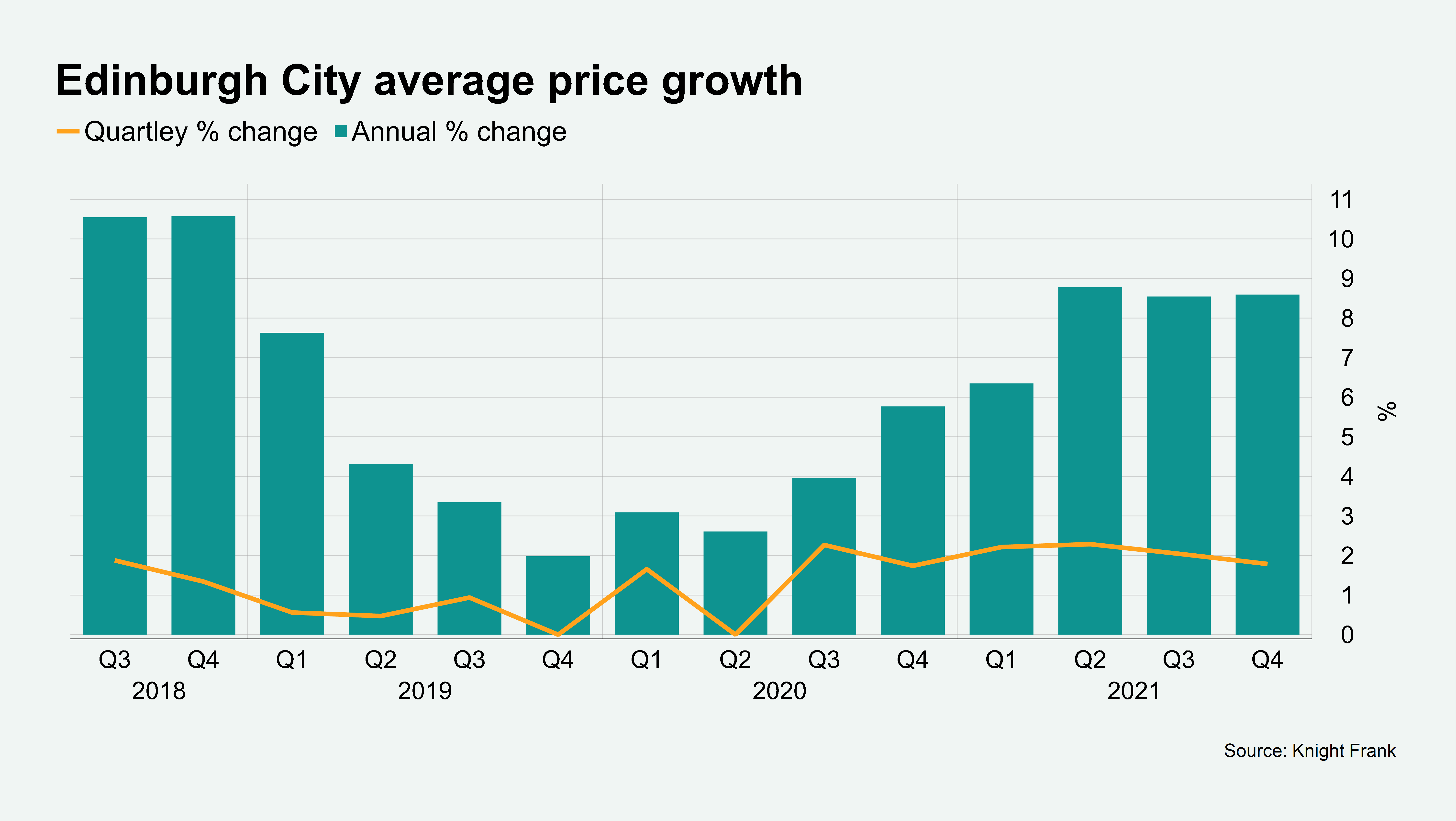

Edinburgh’s residential property market finished 2021 strongly after a year where high demand and limited supply pushed annual price growth to a three-year high.

While average prices in the three months to December increased by 1.8%, compared with 2% in the three-month period before, this was the strongest fourth quarter performance in 13 years.

This saw average prices in Edinburgh end the year 8.6% higher than 12 months ago. This was the strongest finish to a calendar year since 2018, when annual growth was 10.6%.

The average price of a property in the city has increased by 13% since the market reopened in June 2020 after the first national lockdown – with more space still a key requirement of buyers.

“We’ve seen significant competition for homes throughout the year and I can’t see that changing in 2022,” said Edward Douglas-Home, head of Scottish residential at Knight Frank.

Edinburgh’s broad appeal has kept it in high demand amongst domestic buyers from elsewhere in the UK as well as with expats looking to return home due to the pandemic during 2021.

In the first 11 months of 2021, new prospective buyers registering in Edinburgh were up by 66% versus the five-year average (excluding 2020). New instructions for sale were down by 10% in the same period, mirroring the supply/demand imbalance that has been characteristic of the UK market during the pandemic.

Residential areas of the city appealing to family and professional buyers looking for more space, amenities and good schools the top performing in Q4, as they have been throughout 2021.

Average values west of the city centre, which includes the areas of Murrayfield and Barnton, increased by 2.4% in the three months to December; south of the city, including Morningside and Merchiston, average values increased by 1.9% in the period. Average values to the north, including the popular residential areas of Trinity and Inverleith, were up 1.8%.

Demand heading into winter remains well above normal despite the developing situation with Omicron. New prospective buyers in November were 67% above the five-year average (excluding 2020) and offers accepted were up 23% in the same period.

Photo by Yves Alarie on Unsplash