January prime time for house sales

The first month of the year is the time when demand reaches its peak in the UK, new research shows.

3 minutes to read

Twenty months since the start of the pandemic, the UK feels closer to normality than it did in the final weeks of 2020.

Next spring has been cited as the time when the pandemic could largely be over although there are echoes of similar comments made last November, after the Pfizer vaccine proved to be 90% effective but before the arrival of new variants. The World Health Organisation is currently investigating the implications of the so-called Omicron variant.

However, hospitalisations have remained contained and last week Nadhim Zahawi, the former Minister for Covid Vaccine Deployment, raised the prospect that the UK could be the first major global economy to move from a pandemic to an endemic. For now, the prospect of further UK lockdowns this Christmas feels more remote than it did last year.

These are precisely the sorts of nuanced calculations that would-be sellers will be making over the festive period, traditionally a peak time for scouring property portals.

Added spring competition

When the New Year starts, sellers may benefit from acting sooner rather than later.

The first reason is that the competition will inevitably intensify in the spring. This happens every year but there are large numbers of frustrated sellers who were unable to move this year given how quickly the shelves cleared ahead of successive stamp duty deadlines.

To put this in context, while the number of UK sales instructions in 2021 is likely to be in line with the five-year average between 2015 and 2019, the total will be down by about a quarter compared to 2020. That’s quite a drop given the race for space has not yet run its course.

New buyers in January

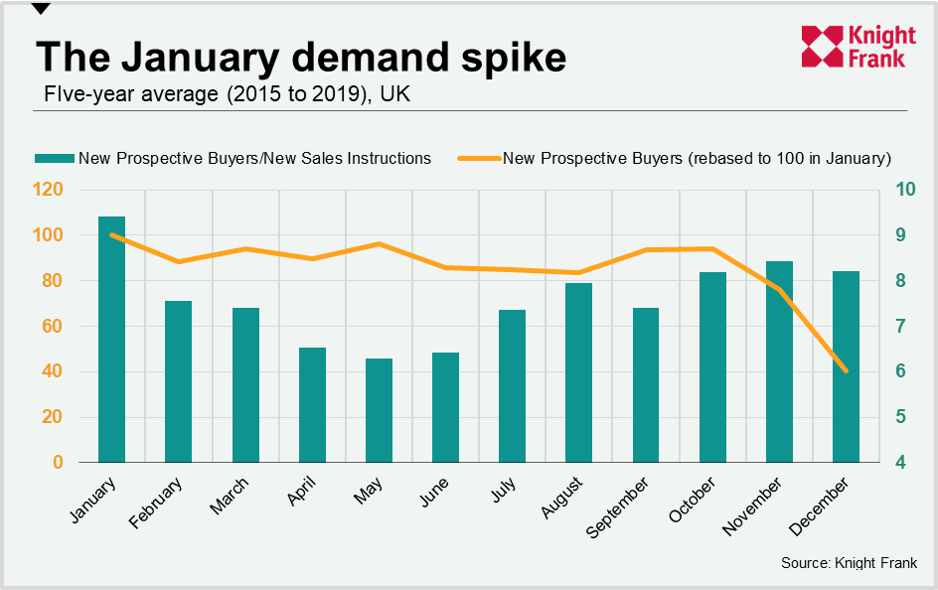

The second reason for acting early is the spike in new buyers that takes place in the first month of the year, a trend that pre-dates the pandemic.

As normality tentatively looms on the horizon, this is proving to be a good moment for opportunism in the UK property market.

Prime central London

We have seen buyers in prime central London take advantage of falling prices before overseas buyers return in meaningful numbers next year. Others are locking in fixed-rate mortgages before rates inevitably rise. Meanwhile, tenants are agreeing pre-let tenancies due to a lack of supply.

Listing a property for sale in January rather than April would be another example of taking a more resourceful approach.

Underlining how strong demand remains, the ratio of new buyers to new property listings in the UK was 10.7 in October, the highest figure for the same month in more than seven years.

In the five years between 2015 and 2019, January had the highest average number of new prospective buyers, as the chart shows. Furthermore, the month had the largest average ratio of new buyers to new supply (9.4) over the same period.

“Portal traffic over the Christmas break is always high so we are advising many clients to get their properties photographed and checks complete so they can make the most of the surge that we are expecting in January,” said James Clarke, head of London sales at Knight Frank. “Buyers get more active in January, so the sooner any potential ‘would-be’ vendors are in the shop window the better.”

When is best to sell?

Some sellers, particularly outside of London, won’t want to list their property before the daffodils appear to market the property in its best light. For those with more flexibility there is a greater logic in doing so next year as the UK overcomes the effects of the pandemic.

“Every year we see great sales taking place in January and February,” said James Cleland, head of Country sales at Knight Frank. “Our feeling is that this will be even more pronounced in early 2022.”

Photo by HiveBoxx on Unsplash