The unmistakable signs of recovery in the prime London sales market

October 2021 PCL sales index: 5356.4October 2021 POL sales index: 264.3

2 minutes to read

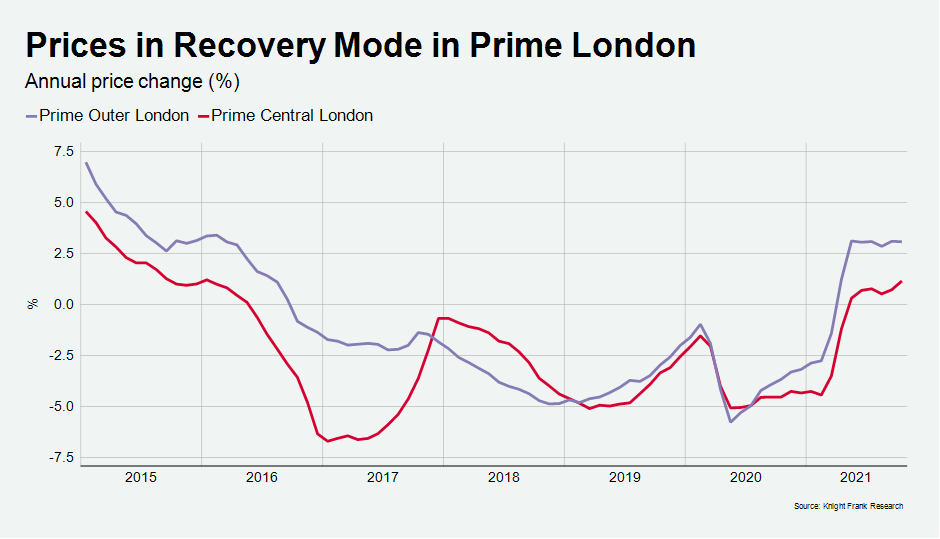

Average prices in prime central London increased by 1.2% in the year to October, which is a fairly unremarkable statistic on the surface.

However, what is perhaps more surprising is that the last time annual growth exceeded this figure was in September 2015.

The landscape has changed significantly over the last six years – politically, fiscally and in just about every other way since the pandemic struck.

A succession of uncertainties has kept downwards pressure on prices since they peaked in summer 2015.

The prime property market in London now appears to be gradually emerging from this tumultuous period.

September was the sixth consecutive month of annual growth in Prime Central London (PCL), something last achieved before the Brexit referendum in 2016.

It is a similar story in prime outer London, an area less affected by tax changes, political volatility or international travel restrictions.

Annual growth was 3.1% in October, the fifth time this figure has been recorded over the last six months. The last time growth was stronger in prime outer London was in February 2016, highlighting the ongoing strength of demand for space and greenery.

“We are not on the verge of the sort of dramatic double-digit bounce-back in prices seen after the collapse of Lehman Brothers in 2008,” said Tom Bill, head of UK residential research at Knight Frank. “But the prime London property market is resuming an overdue recovery that was interrupted by the pandemic.”

The return of overseas demand exemplifies the slower pace of this recovery.

While overseas travel restrictions have been lifted, it does not yet signal business as usual for the property market, as we explore here. In a similar way to the rest of the UK, next spring is likely to feel more normal as supply levels pick up.

Meanwhile, the latest data on exchanges shows how the prime London market has largely shrugged off the end of the stamp duty holiday in September. The number of exchanges in October was 3% below the five-year average (excluding 2020).

Furthermore, the strength of demand and future pipeline of activity is undeniably strong. The number of new prospective buyers registering in London in October was 56% higher over the same period, while the number of offers accepted was up by 57%.

However, supply is still playing catch up with demand, although the imbalance is less acute in the capital than other parts of the country.

The number of sales instructions in October was 7% below the five-year average in London, which compared to a drop of 14% in Country markets.