Prime London Sales Report: June 2021

Prime central London sales index: 5326.6Prime outer London sales index: 261.4

2 minutes to read

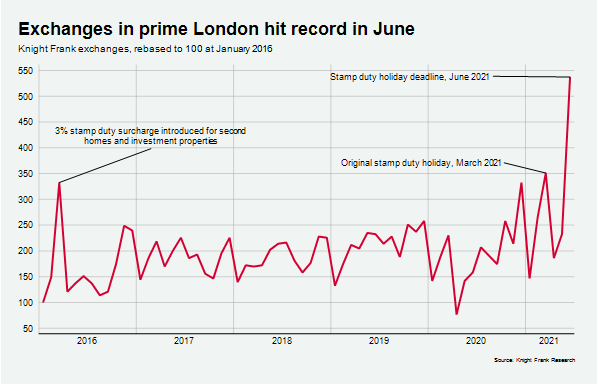

The number of transactions carried out by Knight Frank in prime London markets in June was the highest on record, as the chart below shows.

It was a record month individually for prime central and prime outer London.

The surge came ahead of a stamp duty holiday deadline at the end of last month. The tax-free threshold dropped to £250,000 from £500,000 on 1 July, meaning the maximum saving fell to £2,500 from £15,000.

It will remain at this level until the end of September, when the tax-free threshold reverts to £125,000.

The June figure was 53% higher than March this year, the second highest month on record when transactions spiked ahead of the original stamp duty holiday deadline, which was deferred to last month.

It demonstrates how a £15,000 saving has been a key driver of demand in high-value markets in the capital, despite the sum representing a smaller proportion of the sale price than in mainstream markets.

Buyers at all price points would rather save £15,000 than make an equivalent payment to HMRC, as discussed previously.

However, the fact the saving is relatively smaller will support transaction numbers across prime London property markets in coming months. This is underlined by the strength of leading indicators of activity.

The number of new prospective buyers registering in June was 42% above the five-year average for the same month. Meanwhile, the number of offers agreed was 86% higher than the five-year average.

“Frustrated demand will support UK housing market activity as the stamp duty holiday winds down and nowhere is this truer than in prime London markets,” said Tom Bill, head of UK residential research at Knight Frank. “Not only will the financial impact of the holiday ending be smaller, but the lifting of international travel restrictions will boost demand in a market where a period of price growth is long overdue.”

Prices in prime central London grew by 0.5% in the three months to June, which was the largest quarterly rise since August 2015. It took the annual increase to 0.7%, which was the highest it has been since March 2016.

In prime outer London, there was a 3.1% increase in the year to June as property markets in the London suburbs continued to recoup losses incurred during the pandemic.

Average prices in POL in June were 0.7% below the level recorded in March 2020. Prime central London prices were 3.1% below where they were last March.

Growing demand for space and greenery after three national lockdowns has led to strong annual price growth in markets like Dulwich (7.5% in the year to June), Richmond (6.8%) and Wimbledon (10.5%).