Hotel Dashboard - UK Hotel Market Recovery, May 2021

A lack of clarity in terms of overseas travel is fuelling a strong summer ahead for UK Staycation.

2 minutes to read

Easing of lockdown restrictions across the UK, have allowed hotels in Scotland and Wales to reopen. In England, the scheduled reopening of hotels to all guests, from 17th May, cannot come soon enough, along with indoor hospitality to resume, albeit with social distancing restrictions in place.

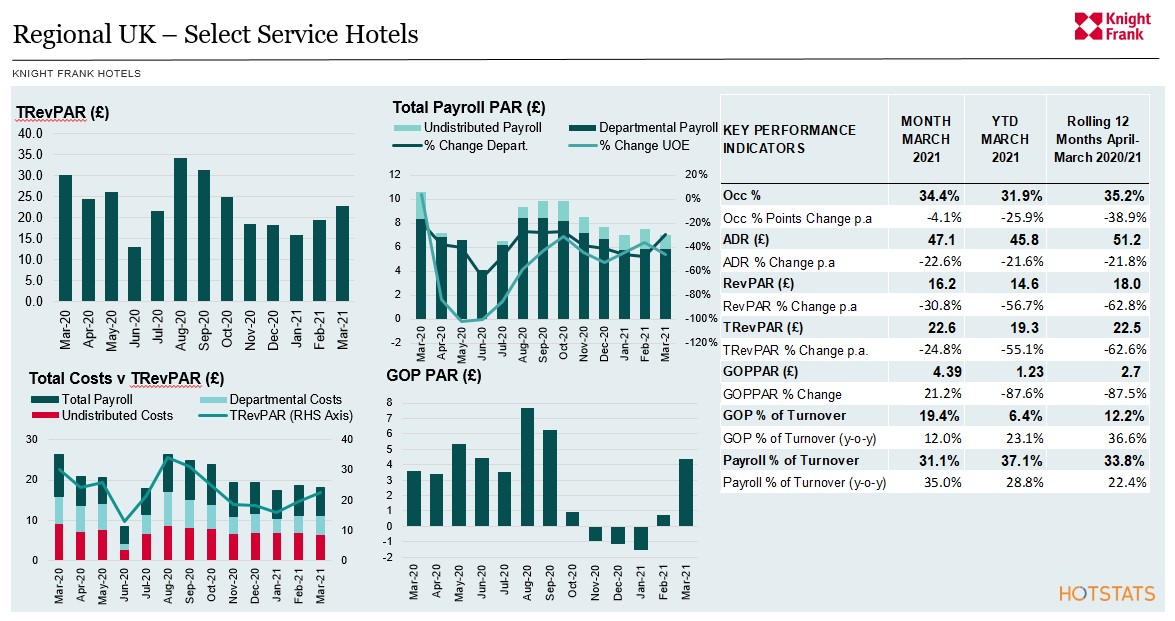

Given the limited trading conditions endured during Q1-2021, the Regional UK hotel market has seen small but encouraging positive steps, with improving month-on-month performance.

The latest trading performance indicates a widening gulf between limited and select service hotels and full-service upscale and upper upscale hotels. The ability to successfully adapt to an ongoing challenging and evolving operating environment will most likely distinguish between those businesses which flourish and those which flounder.

The elation amongst hoteliers following reopening will be tempered with the prospect that from the autumn government support will be tapering off. Of crucial importance will be to maximise working capital during the early months of recovery.

In our latest edition of the Knight Frank Hotel Dashboard, we look at how the Regional UK market has performed during Q1-2021, providing a spotlight analysis on two Regional UK hotel datasets – Select Service Hotels and Golf & Spa Hotels.

- The Regional UK hotel market has seen small but encouraging positive steps, with improving month-on-month performance. In March, for Regional UK hotels which remained open, an uplift in RevPAR of 11.2% and growth of 21.8% in terms of TRevPAR were recorded.

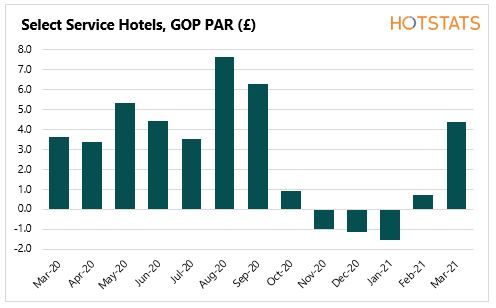

- Select Service hotels achieved RevPAR in March of £16.20, a premium of 72% versus Full-Service Upscale Hotels (£9.40).

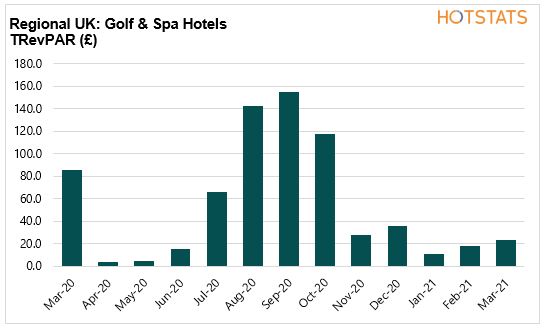

- Golf & Spa Hotels achieved a 32% uplift in TRevPAR, due to strong growth in golf revenue.

- Select Service hotels achieved a 29% decline in non-departmental payroll costs, which contributed almost exclusively to the 6.4% monthly saving in total payroll costs. Payroll costs as a percentage of total revenue, improved from 38% in February to 31% in March, this compares to a margin of 26% in February 2020, prior to the onset of the pandemic.

- The food & beverage (F&B) provision by Select Service properties is currently making up 16% of Total Revenue and contributing 10% of the total Gross Operating Income (GOI). For the Golf & Spa hotel dataset, F&B contributed over 32% of the total revenue in March, generating 36% of the total GOI.