Farmland values dip amid uncertainty: the latest results from the Knight Frank Farmland Index

Andrew Shirley shares Knight Frank’s latest research on the value of agricultural land and residential property.

2 minutes to read

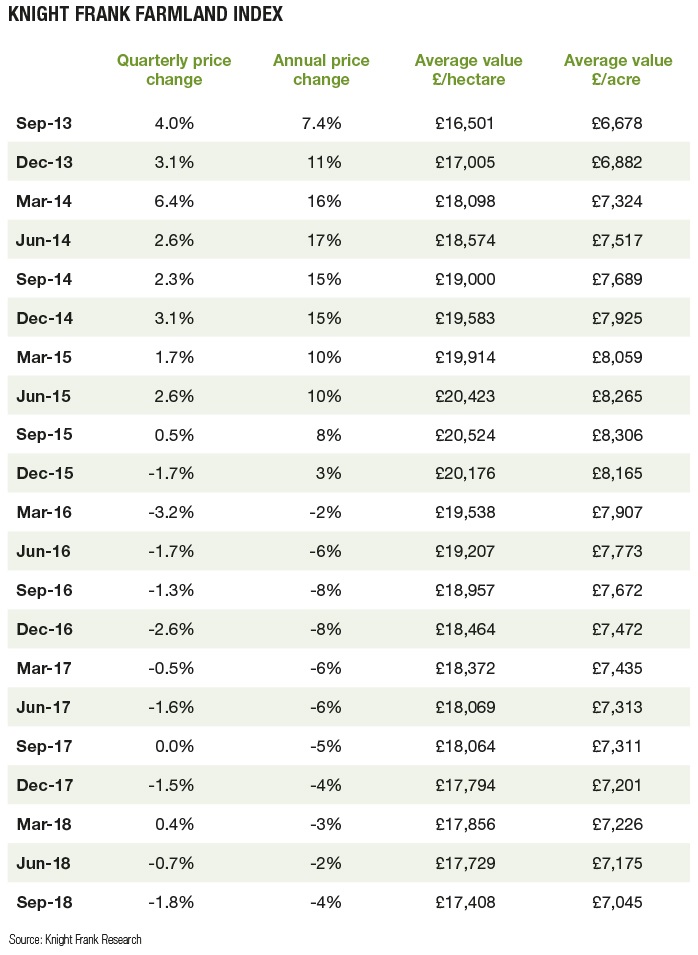

The average value of bare agricultural land in England and Wales dipped by 1.8% in the third quarter of 2018, according to the Knight Frank Farmland Index. The fall means prices have dropped by 4% overall during the past 12 months and now average £7,045/acre.

Uncertainty over Brexit and the political future of the UK means buyers remain extremely cautious and see no reason to rush into a purchase. Good land is still attracting strong bids, but lower quality parcels are struggling to sell.

"A significant proportion of farm sales are not solely driven by farming factors. Rollover buyers are still extremely active – one recently paid £12,000/acre for land sold by Knight Frank in the South-West. "

The government’s keenly awaited “Agricultural Bill”, which was published in September, confirmed that direct payments to English farmers will be incrementally phased out once we leave the UK, but it will take until 2028 before they are reduced to zero.

Unsurprisingly, the bill was somewhat short of detail and put more emphasis on the delivery of environmental benefits than profitable food production, but at least farmers and landowners now know they are not facing a subsidy cliff edge and have time to plan for life without direct payments.

However, while this means there is unlikely to be a glut of land coming to the market, it does suggest that the current two-tier market is likely to become gradually more pronounced as buyers focus on land that is either able to deliver the highest profits or the biggest environmental benefits (and payments).

Aside from future support payments, the UK’s trade relationship with the EU is a cause for concern as Brexit negotiators struggle to find common ground.

Particularly concerning is the growing perception that a “no-deal” outcome has become more likely. This could have serious implications for farming, in the short term at least.

It is of course worth noting, however, that a significant proportion of farm sales are not solely driven by farming factors. Rollover buyers are still extremely active – one recently paid £12,000/acre for land sold by Knight Frank in the South-West.

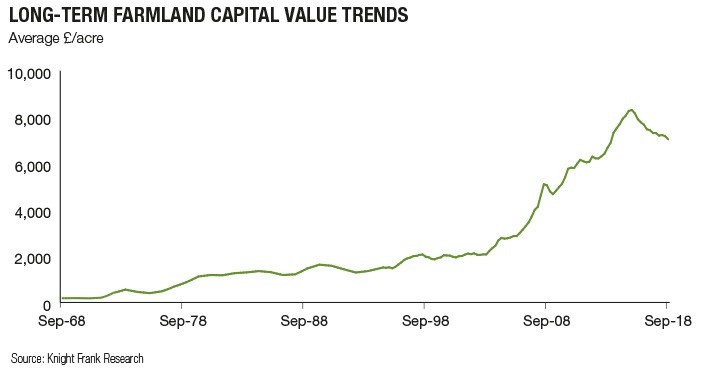

UK land also looks relatively cheap by European standards, especially given the weakness of Sterling, and its reputation as a long-term safe-haven for wealth in times of economic and political uncertainty could soon come to the fore again.

Visit Knight Frank's research library for the latest residential, commercial and agricultural property reports and indices or contact Knight Frank Rural to see how we can help.