Zimbabwe

Hyperinflation and the depreciation of the Zimbabwean dollar are major hurdles for the country’s real estate market, but some sectors, such as the suburban office market are seeing growth, as are smaller neighbourhood retail centres.

2 minutes to read

Suburban office boom

In the office market, many commercial landlords are sitting on high debtor balances. This is a result of many businesses that failed to pay their rents during lockdowns. The situation has been worsened by the depreciating value of the Zimbabwean dollar and average upward quarterly rent revision by a staggering minimum of 150% due to inflation.

With persistent issues regarding parking, street vendors and high levels of pollution, coupled with the increased rents, demand for CBD office space has fallen sharply, leaving voids of around 60% on average.

Demand has not necessarily dried up entirely, but occupiers’ focus has shifted to the suburbs. Indeed, many high-profile corporate occupiers have already relocated to suburban areas. In response, many residential properties in Eastlea, Belvedere, Milton Park, Alexandra Park and Belgravia have been converted into offices as landlords and owners move to capitalise on the geographic shift in office demand.

"Hyperinflation and foreign currency shortages are affecting economic stability, resulting in the erosion of real disposable incomes and hence negatively impacting confidence levels. The real estate market remains in limbo; however, the suburban office market remains buoyant due to ongoing relocation activity away from the CBD."

- Siza Masuku, Managing Director Knight Frank Zimbabwe

Domestic house hunters locked out of the market

Sales in the residential market remain stagnant as sellers continue to insist on payments in US dollars, in response to the depreciating Zimbabwe Dollar. This has weakened demand, with domestic buyers for the most part being locked out of the market due to their inability to make payments in US dollars. Diaspora have been unaffected and remain active in the market.

Retail investment activity rising

No major additions to the retail stock are expected in the short to medium term as funding for construction is both unavailable and unaffordable due to high lending costs. Many new developments are self-funded, which is limiting the scale and volume of new schemes.

Like other countries on the continent, smaller suburban shopping centres have remained resilient throughout he pandemic due to their ease of access and the same is true in Zimbabwe. We have tracked the recent completion of about 9,000 sqm of new retail centres in the suburbs.

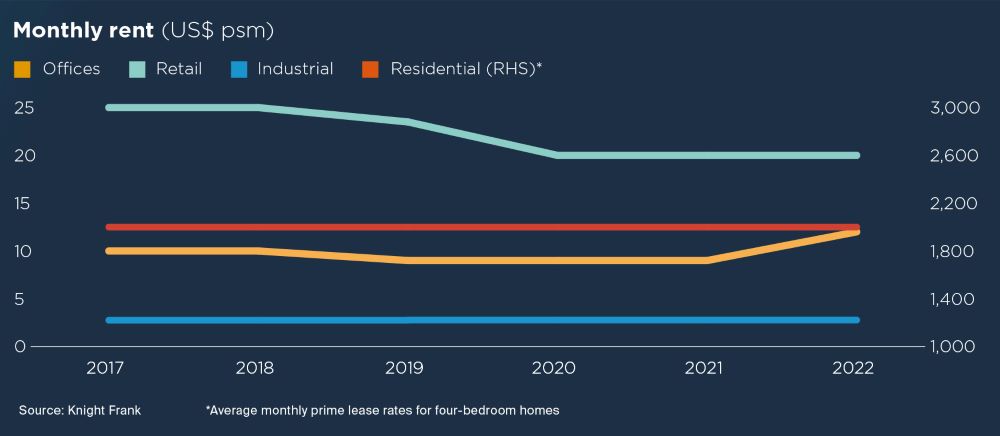

Interestingly, rents remain largely stable, which is prompting more investor activity in the sector. Furthermore, retail returns at c.7% remain attractive. Returns for office space, are similar at c.8%.

Warehousing space remains in short supply

In the industrial sector, demand remains strong but is largely unfulfilled due to limited supply. There have been no significant warehouse completions recently and most new developments are owner-occupied.

The positivity in the sector is to an extent continuing to be tempered by power outages, low capitalisation, poor water supply and deteriorating infrastructure.

Asset class to watch:

The demand for suburban office space remains high as voids are easily leased. Our data hints at the particularly high potential for office development in the Northern suburban areas.