Tanzania

Performance across all of Tanzania’s real estate sectors remains sluggish, with oversupply being a key challenge across the board.

3 minutes to read

Oversupply contributing to office market woes

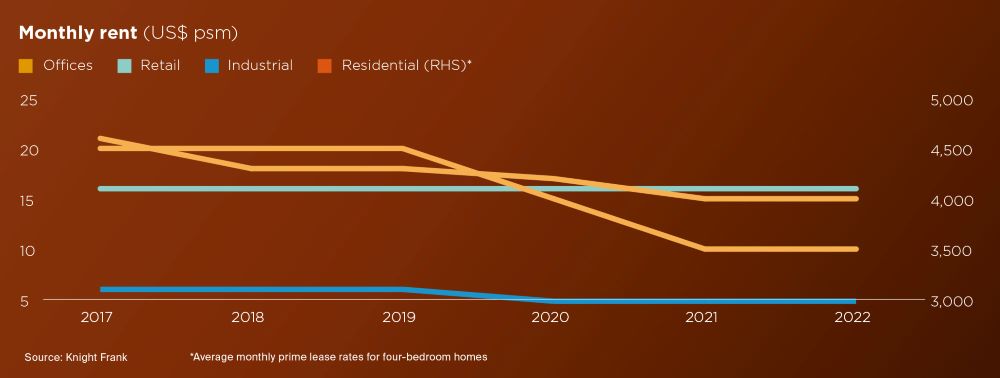

Like many other locations on the continent, tenants remain in the driving seat. Hybrid working patterns have bed-in as a result of the pandemic and there are few signs to suggest a sudden return to pre-Covid occupational strategies. In response, landlords are demonstrating a great deal of flexibility on lease terms, offering rent reductions to existing tenants, for instance, while also being willing to negotiate rents with incoming occupiers as well as offering extended fit-out periods. Contributing to the overall weakness in the market is the pre-Covid over-supply hangover, which together with the factors outlined above have driven average rents (c. US$ 15 psm) down by c.30%, when compared to late 2019.

"The pandemic drove office rents in Dar es Salaam’s office market down by an average of 30%, although lease rates appeared to stabilise during the second half of 2021 and this trend has persisted, with a distinct focus by tenants on prime space, which is where we expect the strongest rental growth."

- Ahaad Meskiri, Managing Director Knight Frank Tanzania

Affordability key to residential market performance

Residential lease rates across Tanzania have slipped by close to 50% in the last two years as an over-supply of rental properties, combined with weakened demand, largely due to the pandemic, has undermined the market. Positively, the weaker rents are now prompting tenants to upgrade to homes that may have previously been out of reach as a flight to quality starts to take hold in the low lease-rate environment. We have already seen evidence of this in PSSSF Towers, where 84 units were rapidly leased a short time after coming to market.

Weaker rents have also dampened capital values to an extent, which has aided the resilience in sales activity. Numerous recent launches have been 100% sold-out, highlighting the depth of demand for residential product at the right price point. Victoria Place and Morocco Square, for instance, were recently declared as fully sold. Lower sales prices are also driving some homeowners to use the opportunity to upgrade; a trend we expect to persist.

Covid-induced economic weakness hurting the retail sector

The retail market is dominated by small-scale, mostly domestic retailers in Dar es Salaam, chiefly Kariakoo and Manzese. This has been borne out of traditional shopping habits of consumers, which has always undermined the ability of larger malls to thrive. This continues to be the case, with large malls close to Kariakoo and Manzese reporting occupancy levels as low as 5%. Other retail centres, located in well-established communities, that are not competing with informal retail clusters, are faring better, although the Covid-induced weakness in the economy is resulting in consumers tightening the purse strings, forcing some retailers to downsize, or exit the market entirely. The 100,000 sqm retail pipeline that we are tracking is likely to keep rents under downward pressure for some time.

Incentives boosting industrial activity

Away from the retail market, the Tanzanian Government is committed to building a strong industrial base by promoting the creation of industrial parks to attract investors. Export Processing Zones and Special Economic Zones (SEZs) have been established to promote industrial activities and boost exports. The SEZs have helped to lift the performance of the industrial market, as evidenced by increased levels of development activity, as well as absorption rates. And developers are responding to the growing demand, bringing forward ever larger schemes. One such example is the 2 million sqm industrial park development proposed by Elsewedy Electric, a leading integrated energy solutions provider in the Middle East and Africa.

Asset Class to Watch

The residential leasing market is set to benefit from the construction of the new oil pipeline from Hoima to Tanga. We expect to see an influx of expatriate workers to help deliver the project, which will inevitably drive-up demand for prime rental properties.