Botswana

With the exception of the office market, all other property sectors are slowly finding their feet in the wake of the pandemic.

3 minutes to read

Resilient Retail

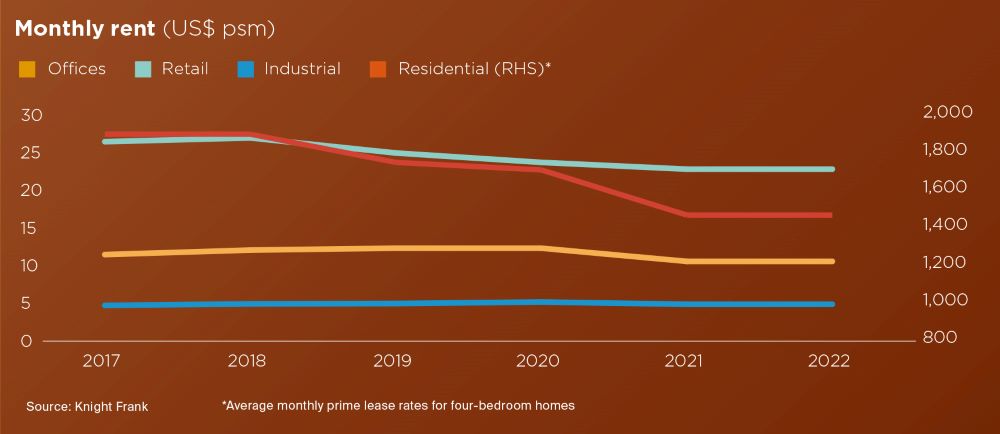

Rents in the retail sector have only declined by 4% over the last two years, largely due to increased flexibility amongst landlords who moved to cushion retailers from the impact of pandemic-driven lockdowns. To an extent this has helped to sustain occupancy levels, which stand at c.95% for established malls and at around 90% for new retail developments.

The sector is not yet out of the woods yet. An emerging threat to this relative stability is materialising in the form of falling real household incomes as inflation climbs which is already stymying footfall in major shopping malls, especially in Gaborone.

For now, demand for new space remains strong, underpinned by retailers who have improved their margins by boosting their online presence. Reflecting this trend is The Fields Mall (26,000 sqm), which is already 60% let and is due to complete in late 2022.

Office market still reeling from the pandemic

The office market in Gaborne has been hit by a triple whammy of factors that are driving a substantial slowdown in demand: post-Covid occupational plans continue to emerge, with many businesses still reducing their footprints to factor for greater remote working, while the pandemic-induced economic slowdown has dampened leasing activity; and an oversupply of office space means tenants are very much in the driving seat, with landlords undercutting one another to secure deals, driving down rents. Indeed, prime office rents in Gaborne are now 14% lower than they were at the end of 2020.

Residential leasing market remains buoyant

In sharp contrast, the residential rental market for more affordable homes has remained resilient, with demand outpacing supply.

In the sales market, stringent mortgage lending criteria for domestic buyers and legislation designed to curb the appetite of international buyers is limiting deal activity. This is especially noticeable at the top end of the market, where weak demand is expected to force average values down this year.

"The residential leasing market has remained steadfast and performed beyond expectations during the uncertain times of COVID 19, with multi-family residential developments leading the pack."

_Curtis Matobolo, Managing Director Knight Frank Botswana,

Clearly structural downside risks in the form of the wider economic weakness remain very real threats for both the rental and sales markets.

Government policies encouraging industrial activity

The government’s new industrial strategy and supporting policies, designed to foster and sustain growth in the all-important industrial sector, have translated into steady warehouse demand throughout the pandemic.

With the ultimate goal of stimulating and broadening the manufacturing, agro-industrial and diamond mining sectors in Botswana, the rising requirement levels highlight the success of the authorities’ intervention.

Perhaps unsurprisingly, average warehouse lease rates are rapidly approaching pre-pandemic levels of c. US$ 8 psm.

Asset Class to Watch

Increased finance for development, through the Citizen Entrepreneur Development Agency, as well as provisions of the Sectional Titles Act have encouraged the development of townhouses and apartment buildings. However, as outlined above, the residential sales market remains weak and further supply is likely to delay any return to growth, particularly as there is no evidence to suggest any imminent bounce-back in demand for home purchases.