The New Power Play

6 Trends Reshaping the Energy Sector & its Real Estate

10 minutes to read

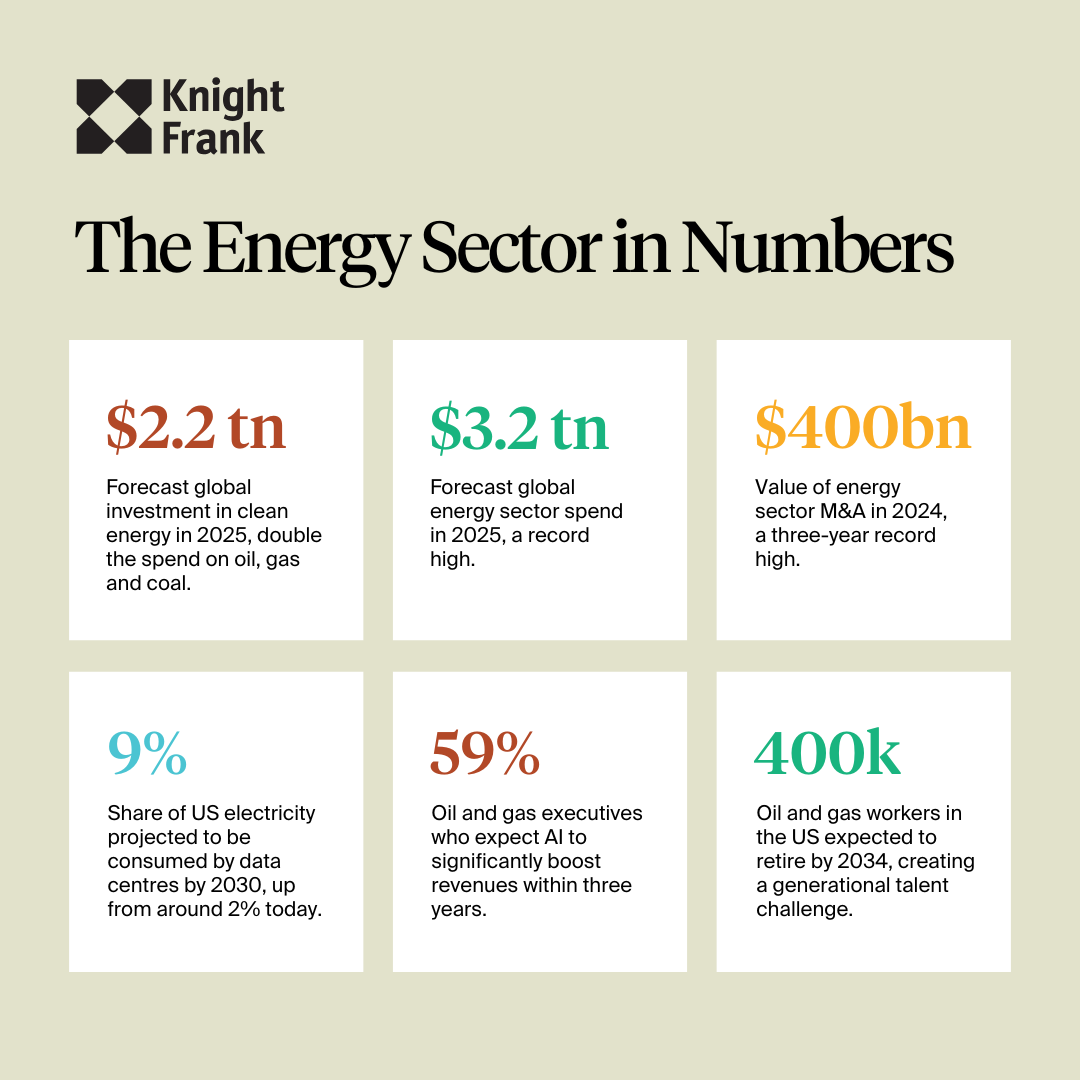

The energy industry is reinventing itself, as are the workplaces and facilities that power it. In 2025, global spending on clean energy will hit a record $2.2 trillion, roughly double the investment in oil, gas and coal. From the shift to renewables to AI-led transformation and changing workforce demographics, six seismic shifts are redefining how energy companies use real estate. These trends transform everything from offices and R&D labs to wind farms, manufacturing plants and distribution hubs. CRE leaders in the energy sector must take note and action.

1. The Renewable Build-out Goes Big

The world's pivot to clean power is visibly altering landscapes and corporate footprints. Solar farms are carpeting deserts and wind turbines are sprouting across plains and coastlines. Solar and wind now deliver roughly 15% of global electricity (up from 4% ten years ago) and are scaling fast. In fact, solar is set to attract more investment this year than any other energy source. Governments are fuelling the boom with aggressive targets (from the EU's Green Deal to China's 2060 carbon-neutral pledge) and streamlined permits. Germany, for example, saw onshore wind project approvals jump 150% after 2022 due to policy reforms.

For energy companies, this renewables surge is fundamentally a real estate story. "Mega-projects" are the new norm. Giant solar parks, offshore wind farms, and battery storage sites requiring vast land or ocean acreage. The supply chain behind them demands its own real estate from new factories to assemble solar panels and wind turbine blades to logistics centres for moving massive equipment and battery gigafactories popping up from the U.S. Midwest to the German auto belt.

Traditional office and R&D spaces are shifting, too. To tap into talent, energy firms congregate their clean energy innovation teams in hotspots like Berlin, Shanghai, and Silicon Valley. These locations also offer the specialised spaces and university/research/startup links that help accelerate clean energy development. According to Deloitte, over half of all new energy jobs in 2023 were in clean energy roles, underscoring the need for workplaces geared toward this growing workforce.

2. Fossil Fuels Evolve: Resilience Meets Transition

The age of oil and gas isn't over yet, but it is changing. Global investment in oil and gas hit $1.5 trillion in 2024 (a 6% year-on-year rise), driven by energy security concerns and OPEC+ boosting output. Even as renewables surge, demand for fossil fuels remains robust, and many producers are doubling down in the near term. This means new pipelines, LNG terminals and petrochemical plants are still being built, each a massive real estate undertaking requiring ports, acreage and specialised facilities. At the same time, oil & gas majors are hedging for a low-carbon future by retrofitting and repurposing assets. Carbon-capture units are added to refineries, hydrogen production pilots at legacy sites, and old tank farms are turned into biofuel hubs. The classic oil "campus" now often hosts a mix of traditional operations and transition projects.

The energy industry is reinventing itself, as are the workplaces and facilities that power it. In 2025, global spending on clean energy will hit a record $2.2 trillion, roughly double the investment in oil, gas and coal. From the shift to renewables to AI-led transformation and changing workforce demographics, six seismic shifts are redefining how energy companies use real estate. These trends transform everything from offices and R&D labs to wind farms, manufacturing plants and distribution hubs. CRE leaders in the energy sector must take note and action.

3. Electrification Sparks an Infrastructure Boom

From EVs to AI, everything is going electric, turbocharging the need for new infrastructure. The electrification wave is crashing in from all sides: surging sales of electric vehicles (over 17 million EVs were sold worldwide in 2024, more than 20% of new cars), the proliferation of energy-hungry cloud data centres, electrified public transport and heating. All this is driving massive upgrades to power grids and industrial capacity. In 2024 alone, governments worldwide spent about $390 billion to strengthen grids and transmission lines. Utilities are racing to build substations and high-voltage lines to connect new renewable generation and meet rising demand.

In the U.S., data centre power needs are expected to roughly double by 2030 (from 29 GW in 2020 to 75 GW), potentially reaching 9% of national consumption, a startling statistic with utilities and tech giants snapping up land for electrical infrastructure near their facilities. Energy companies are finding themselves both suppliers and customers in the data centre boom. Saudi Aramco, for example, has backed Cognite and other AI ventures, and through its digital arm has been building high-performance computing data centres in the kingdom.

For energy companies, "electrifying everything " is an unprecedented construction spree. They find themselves developing or partnering on battery gigafactories, large-scale energy storage sites, and EV component plants. These facilities often rival automotive factories and require vast real estate plus proximity to supply chains for lithium and other inputs. Oil companies, too, are getting in on the act by transforming parts of their retail networks into EV charging hubs. Shell, BP and TotalEnergies have collectively announced plans to deploy hundreds of thousands of EV chargers.

Logistics and distribution networks are electrifying too. Major fleet operators are adopting electric vans and trucks, prompting the need for depot charging infrastructure and upgraded warehouse power supplies. Some energy companies are stepping in to provide "depot charging as a service," effectively adding electrical equipment and even solar canopies to warehouse real estate.

4. From Oil Rigs to Algorithms

In the energy sector, digital and AI is the new wildcatting. Big oil is hiring data scientists and building AI teams, utilities are deploying AI for grid management, and companies are transforming themselves into technology enterprises. The latest form of AI, “agentic AI” is being deployed in multiple ways. Agentic AI is being applied in “virtual power plants.” AI agents manage fleets of thousands of such assets, deciding when to charge, discharge, or bid into wholesale markets. In upstream oil and renewables, agentic AI is starting to run drilling and maintenance operations. A recent IBM survey found that 56 percent of energy executives believe AI will enable new business models and 64 percent are already revamping workflows with AI and automation tools.

One of the clearest effects on real estate is the rise of AI hubs inside energy companies’ property portfolios. BP has built a digital innovation centre in Pune, India, employing hundreds of software engineers and data specialists. In California, PG&E has partnered with Plug and Play, a Silicon Valley start-up, to create an AI centre of excellence in downtown San Jose, complete with an incubator, exhibition halls and a training space for students and small firms. And in Houston, Schneider Electric has opened what it touts as one of the world’s largest energy-innovation hubs.

Energy firms are also turning AI inward to run their estates more efficiently. In offices and industrial sites, AI systems already adjust heating, cooling and lighting in real time, anticipate equipment failures and monitor how space is used. In refineries, digital twins and computer vision enhance performance, extend the life of assets and bolster safety. At the same time, AI helps sustainability efforts by tracking emissions, benchmarking building efficiency and modelling routes to decarbonisation.

5. A New Energy Workforce & the Workplace Revolution

The people powering the energy transition and their expectations for the workplace are changing. Demographically, the sector faces a twin challenge: a wave of veteran oil & gas engineers nearing retirement and an influx of younger talent in renewables and tech fields. In the U.S. alone, an estimated 400,000 oil and gas workers will retire by 2034, while in cutting-edge areas like hydrogen, the workforce is so new that 80% of workers have under five years' experience. This generational turnover means energy companies must appeal to a new cohort while supporting the needs of older employees.

Workplace strategies in the energy sector have tilted towards hybrid patterns and employee-centric flexibility. Recruitment pages show the trend. Ørsted allows staff to work remotely for up to three days a week, while BP lets employees agree informal or formal arrangements on how, where and when they work, provided the role allows. Not all, however, are so permissive. A handful of firms, echoing broader corporate fashion, have reimposed stricter office mandates insisting that innovation and culture flourish best when colleagues are under the same roof.

Inside these offices, it’s all about experience and employee-centric design. Energy companies are adding functional amenities like wellness centres, training labs for upskilling in new technologies, and interactive digital equipment so colleagues can work seamlessly with remote teammates. Spaces are being tailored to support multiple generations. There’s also a strong push for visible sustainability with features like solar panels on the roof and timber or recycled materials in decor so the workplace itself reflects the company’s changing climate values. All of this not only boosts recruitment and retention but also aligns with broader ESG commitments.

6. The Cost Crunch & Supply Chain Upheavals

Even as money floods into energy projects, profits remain under pressure putting a premium on efficiency. Oil prices have been volatile and renewable projects, ironically, are grappling with rising costs that squeeze margins. This “cost crunch” is forcing energy companies to scrutinise every dollar and every square foot. Many are embarking on belt-tightening plans. BP launched a $5 billion cost-cutting program, Shell saved $800 million in the first half of this year through efficiencies, and utilities like Duke Energy are trimming O&M budgets by hundreds of millions. Real estate is a prime target for savings. Occupiers are reviewing portfolios for consolidation opportunities.

At the same time, supply chain upheavals are prompting a rethink of where to locate critical facilities. Trade tensions and import dependencies have led some firms to invest in domestic manufacturing with government incentives adding impetus. The U.S. Inflation Reduction Act, for example, unleashed a clean energy manufacturing construction boom. While rare, some political decisions can stop projects in their tracks. Ørsted famously had to halt an almost finished offshore windfarm project as a result of U.S government policy. Real estate strategy has become a trade policy playbook. Site selection is now shaped as much by tariff exposure and geopolitical risk as any other factor.

A Once-in-a-Century Reset

The energy industry is undergoing a once-in-a-century reset. Renewables are scaling, oil and gas are reshaping, and electrification is demanding vast new infrastructure. AI is becoming the unseen operating system of plants, grids and offices, while demographic shifts are redefining what workers expect from the workplace. Supply chain upheavals and geopolitics add yet another layer of complexity.

For corporate real estate, the message is clear. Portfolios are no longer simply collections of assets to be managed. They are platforms for transition, innovation and resilience. The winners will be those who anticipate disruption, design spaces that attract and retain scarce talent, and invest in infrastructure that is both digital and sustainable.

Key Considerations for Real Estate Decision Makers in the Energy Sector

- Enable transformation

Portfolios must be optimised to unlock transformation, adapt to changing business models and reinforce identity and culture at a time of rapid change.

- Embed AI

To support AI-led transformation and investment, real estate must double as training grounds for existing staff, talent magnets for new staff and as bridges to universities, startups and technology firms. Bricks and mortar will also be expected to house intelligence of their own, with embedded AI systems and adequate infrastructure.

- Prioritise talent

Workplaces should create a compelling employee experience that fosters productivity, continuous learning, and well-being. They must also be designed to support diverse demographics, attract new talent, and enable evolving ways of working.

- Embed adaptability and cost discipline

Flexible leases, reconfigurable layouts, and agile capital deployment will allow portfolios to adapt rapidly to cost pressures, supply chain disruptions, and organisational transformation. Early involvement of corporate real estate leaders in major business decisions, supported by scenario planning and data-driven insights, will be essential to building resilience.

- Locate for resilience and innovation

Site selection must factor in geopolitical risk, tariff exposure, and supply chain resilience for operational assets, while R&D facilities should be located where talent is abundant and research ecosystems are strong.