Analysing the Q3 2023 Corporate Real Estate Sentiment Index

The Q3 2023 Corporate Real Estate Sentiment Index (CRESI) provides valuable insights into the sentiment of Corporate Real Estate (CRE) leaders in the EMEA and APAC regions. In this article, we will delve deeper into the key findings from the survey, offering additional analysis of the overall sentiment, growth dynamics, portfolio dynamics, and workplace dynamics.

3 minutes to read

Overall Sentiment

Despite the overall negative sentiment, the improvement from the previous quarter is a promising sign. Occupier sentiment improved by 1.10 points q-on-q, reaching its highest level since Q2 2022. This generates some room for optimism, but it is important to acknowledge that the survey was conducted before the recent events in the Middle East, which may impact future sentiment.

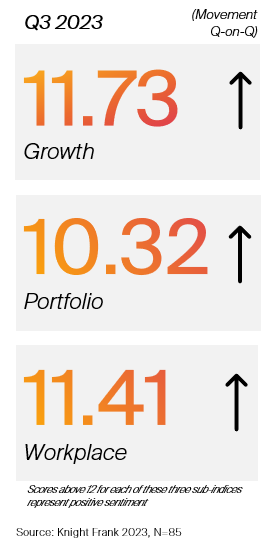

There are three sub-indices within CRESI, measuring sentiment in relation to growth, portfolio and workplace dynamics over the next six months. Each of the three sub-indices saw improving sentiment in Q3 2023, although each sub-index returned a negative score in Q3, with a score below 12.

Growth Dynamic

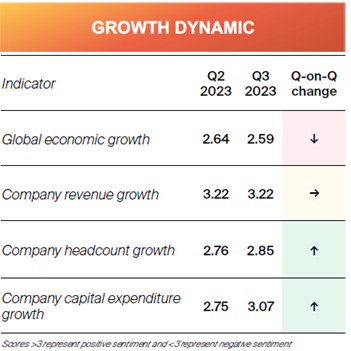

The sentiment around short-term growth dynamics improved significantly, with a score of 11.73 representing the strongest value since Q3 2022. It is now the closest out of the three sub-indices to turning positive. This improvement suggests that businesses are hopeful about future growth but it is worth noting that there was a slight decline in sentiment regarding the short-term prospects for the global economy, signalling the ongoing fragility and apprehension at the macroeconomic level. This decline serves as a reminder that while there is cause for hope, the future remains uncertain.

Of all the four growth indicators in CRESI, future corporate capital expenditure emerged as the standout performer in Q3. A 0.32 point increase in this metric drove the overall performance of the sub-index, signalling that occupiers feel more confident about short-term investment and expenditure. This is an auspicious sign for real estate markets, and if this sentiment persists beyond Q3, it could bring a robust uptick in market activity.

Portfolio Dynamic

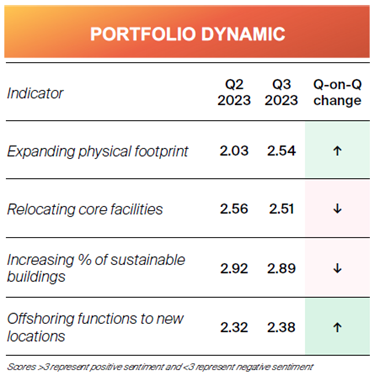

The Portfolio Dynamics sub-index exhibited the most substantial improvement among the three sub-indices, with a 0.49-point rise from the previous quarter. This is by far the strongest quarter-on-quarter increase since the index began. The increase suggests that occupiers are moving from strategising to implementing their portfolio management plans on a regional or global scale. The most substantial driver of this dynamic was prospects for the future expansion of physical footprints, which saw a 0.51-point rise to stand at 2.54 – the second-highest reading since the index began.

Although sentiment surrounding the expansion of physical footprint remains negative, the improvement in this area aligns with our findings from (Y)OUR SPACE research. As the impact of COVID recedes, businesses are emerging with a more forward-thinking and transformative mindset. This shift will drive a greater desire among occupiers to expand their physical footprint, which, again, bodes well for the real estate market.

Workplace Dynamic:

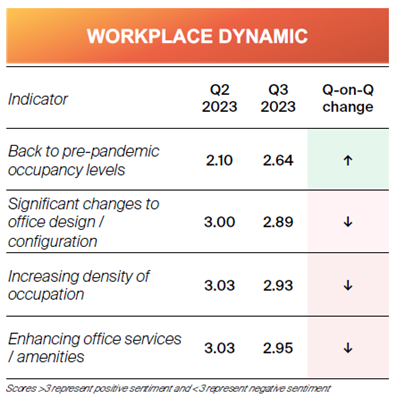

Sentiment surrounding workplace dynamics experienced a modest 0.25-point from the previous quarter, reflecting the momentum of return-to-office mandates rather than specific CRE initiatives in the physical workspace. Although many companies are witnessing a steady return to pre-pandemic occupancy levels, the future of work styles and office settings remains hotly contested. Some respondents anticipate a full reversion within the next six months, while others strongly oppose this notion. This divergence underscores the ongoing volatility in the discourse surrounding the return-to-office.

Conclusion:

The Q3 2023 CRESI presents a nuanced view into the sentiment of the CRE industry, disclosing an overall improvement in occupier sentiment. Growth, portfolio, and workplace dynamics show a positive movement, reflecting a generally optimistic outlook. However, the impact of external factors, including recent geopolitical events, should not be overlooked. By analysing these trends and considering external factors, industry players can make informed decisions and adapt their strategies in the dynamic CRE landscape.

2023 CRESI was undertaken in early October and secured 85 responses from Corporate Real Estate leaders based predominantly in the EMEA and APAC regions. To sustain the integrity of the CRESI time-series we have not included an additional 77 responses from CRE leaders located in North America. A fuller treatment of North American CRE Sentiment will be published by Cresa.