London's prime postcodes feel the early Christmas cheer

Making sense of the latest trends in property and economics from around the globe.

2 minutes to read

Build cost inflation and years of economic uncertainty disrupted the supply of new office buildings across many UK cities, exacerbating a shortage of prime space.

Occupiers must now begin their search for new space well ahead of lease events if they hope to secure an office that meets their needs, which is driving leasing activity. Take-up of office space across ten key UK cities climbed 27% in Q3 compared to Q2, according to Knight Frank's UK Cities report. The competitive pressure fuelled prime rental growth in seven of our ten cities during the first nine months of the year.

Elevated borrowing costs and the gap between purchaser and vendor expectations continue to prove a hurdle to investor activity. Investment volumes are around 60% below the same period in 2022. That may pick up over the course of 2024, given the brighter outlook for interest rates - see Friday's note.

A busy November

UK house prices are proving remarkably resilient. Values notched higher in November, the third consecutive monthly increase, Nationwide said on Friday. That cut the annual decline to -2%.

Trading is thin, so we shouldn't read too much into the recovery, but more than four months of falling mortgage rates and the brighter economic outlook has unquestionably had an impact.

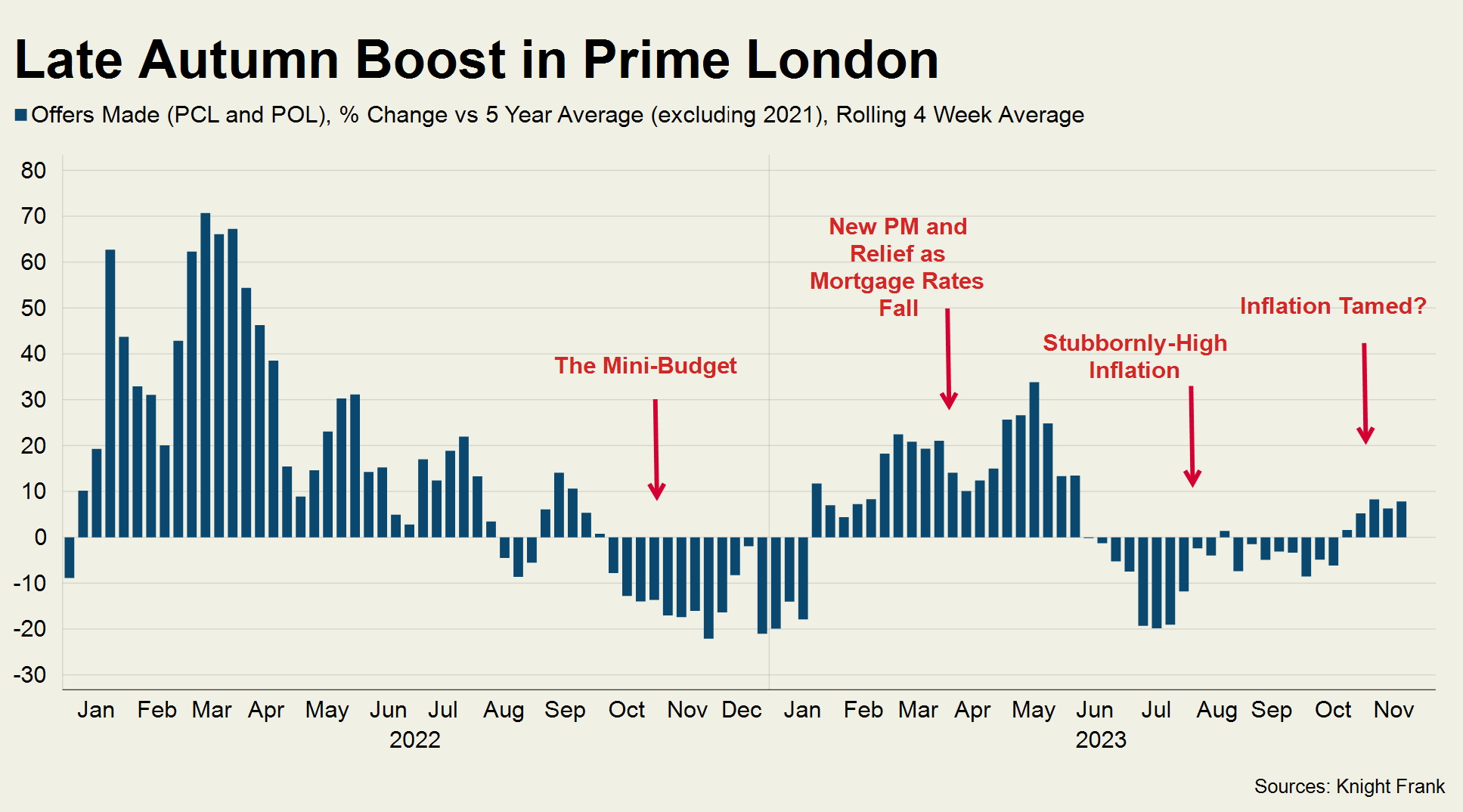

The early Christmas cheer has also been felt in London’s prime postcodes, writes Tom Bill this morning (see chart). The number of offers made, a good indicator of buyer sentiment, has been running more than 5% above the five-year average in recent weeks.

Again, price declines have been limited by subdued transaction activity. Average prices in PCL fell by 1.8% in the year to November, while there was a 1.5% decline in POL.

Housebuilding

Nutrient neutrality rules preventing new housing developments in certain areas from adding contaminants to rivers and streams have contributed to subdued housing delivery.

The official register of housing output was flat during the year to March, according to figures out last week, but more recent indicators suggest delivery is now contracting markedly. The housebuilding section of the purchasing managers index, for example, has contracted for eleven consecutive months.

It's impossible to know which slice of this can be attributed to nutrient neutrality. Higher borrowing costs and various other planning system snags are also to blame, but the government appears aware that the nutrient neutrality system is flawed and pledged to spend £110 million this year and next to deliver high quality nutrient mitigation schemes. Will that really unlock 40,000 homes as Jeremy Hunt suggested? Anna Ward considers the likely impact on delivery.

For a new edition of Intelligence Talks, Anna also speaks to rural surveyor Steph Small and Irwin Mitchell partner Sam Knight to find out more about the nutrient mitigation market.

In other news...

Selling your home may be about to become harder (Times), Labour won't turn on spending taps if it wins UK election, Starmer says (Reuters), and finally, the condo king betting that Miami’s Covid-era boom is here to stay (FT).