Residential stamp duty revenue hits £9.5bn in 2017

HMRC’s latest figures show revenue from purchase taxes in England and Wales rose last year.

1 minute to read

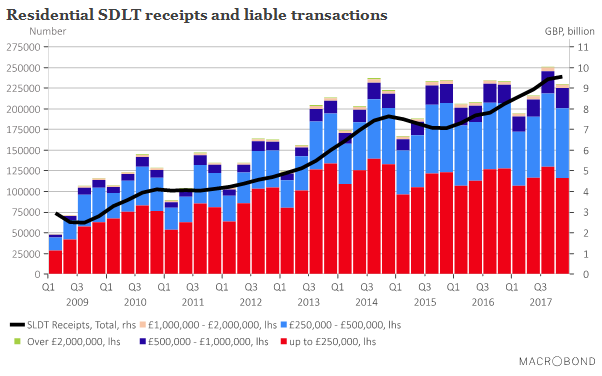

The government collected £2.5 billion in revenue from Stamp Duty in the fourth quarter (October to December) of 2017, provisional figures from HMRC show. This was slightly lower than the amount collected in Q3 2017, but 5% higher than the comparable period of 2016.

On an annual basis, residential receipts rose to their highest level ever at £9.5 billion in 2017, some 16% above the figure collected in 2016.

What about the 3% surcharge?

Introduced in April 2016 and applied to transactions which result in the purchaser owning more than one residential property (unless replacing their main home), the additional 3% SDLT rate was applied to just over 65,000 sales between October and December, raising an additional £554 million. In total, the surcharge raised £2 billion in additional revenue last year, though £194 million of this has been reclaimed.

What about transactions?

The HMRC data shows a 9% fall in the number of liable transactions valued under £250,000 in Quarter 4 of 2017 compared with the previous year, which may in some part be related to the introduction of the first-time buyers’ relief in November 2017. Any first-time buyers completing transactions post the November change would not have been counted in the liable transaction figures – though it’s likely to be too early to draw any firm conclusions.

HMRC is planning to include statistics on the number of first-time buyers’ relief claims in its next update.

Liable transactions between £250,000 and £500,000 were 6% higher in Q4 year-on-year, and above £500,000 11% higher.