Investors planning to up exposure to residential investment markets

Our survey of 40 leading investors, with a combined £62 billion already invested in student accommodation, PRS and senior living rental, signals further growth for the sectors.

1 minute to read

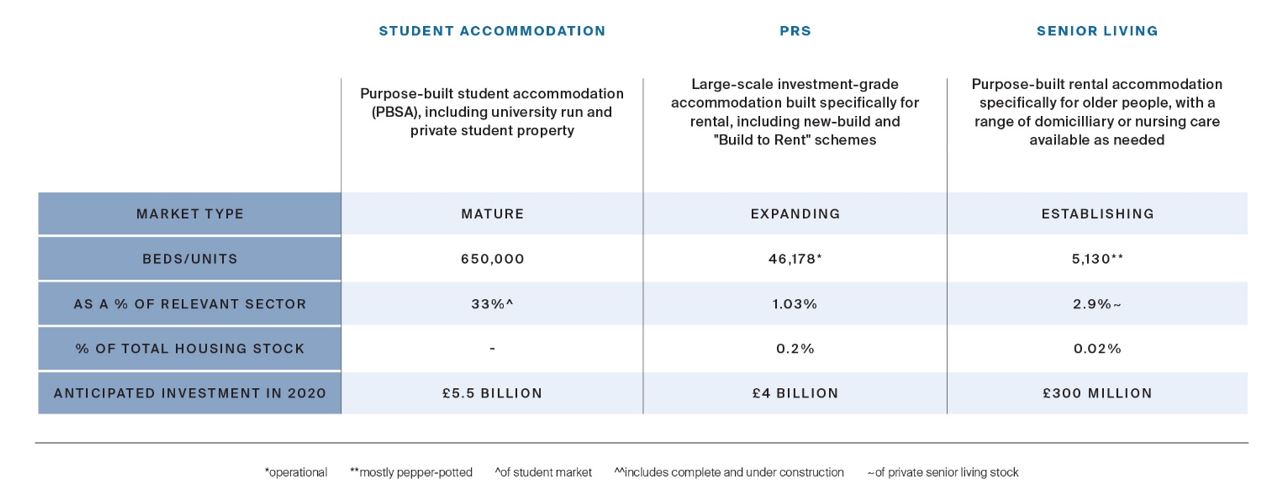

Institutional investment into residential assets, incorporating purpose-built student accommodation, investment-grade and purpose-built rented accommodation (PRS) and senior living, has continued to increase at a time when investment into some other asset classes has slowed.

The reasons underpinning this are well rehearsed - a search for diversification, finding value in the granularity of occupiers that comes with individual units, as well as wider demographic and tenure shifts which are taking place across the UK.

While this year may have presented investors with a new and unique set of challenges, the results of our survey show the appetite to increase exposure shows no signs of slowing.

Combined, our respondents said they expect to have invested an additional £10 billion across sectors in 2021 and have earmarked £42 billion over the coming five years. This represents a 68% increase on current capital committed.

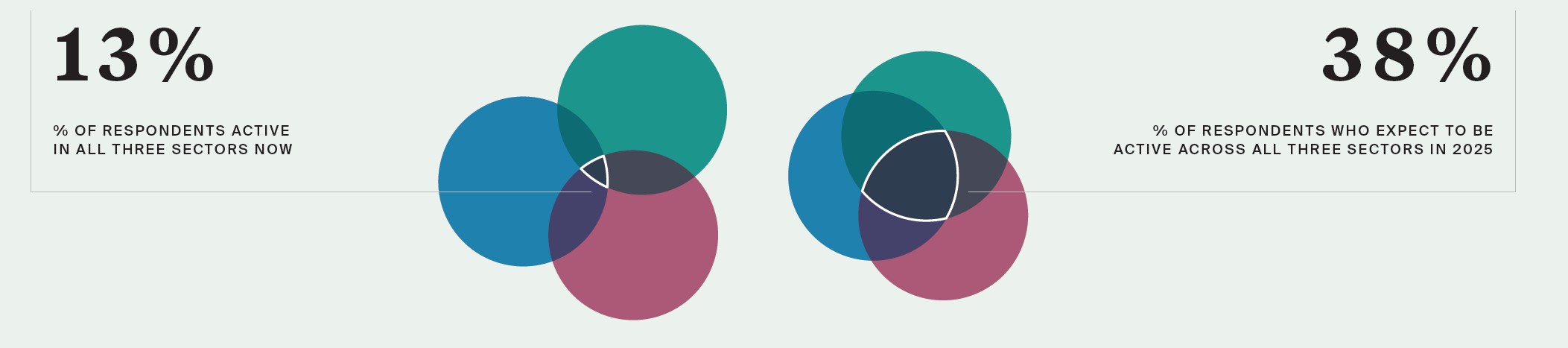

The current crisis is expected to be a catalyst for this growth. Not only are existing players committing to investing more, but new entrants are also keen to increase their exposure. Of the respondents surveyed, only 13% currently invest across all three residential investment asset classes – student, senior living and PRS. This is set to rise to 38% by 2024.

This echoes our expectations for increased diversification within the residential investment market, with investors spreading their exposure across age groups. While there are significant differences in market drivers, there are also synergies - particularly with regards to construction and operations - which will make the decision to move across sectors more appealing.

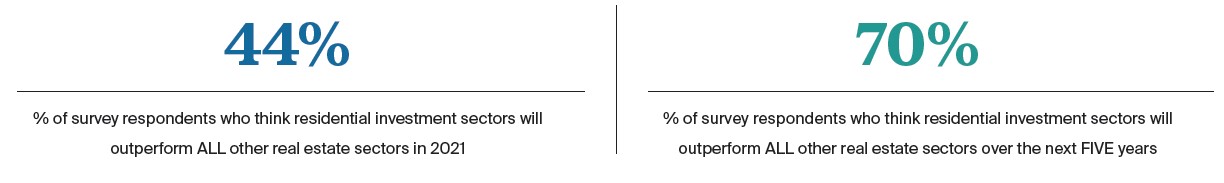

Additionally, while only 44% of the survey respondents think these residential investment asset classes (student, senior living and PRS) will outperform all other real estate asset classes in 2020-21, over 70% think these asset classes will outperform all others in five years’ time.