How valuable are classic cars as an investable asset?

Classic cars have been one of the top performers in our Luxury Investment Index, but how are they faring now? We ask the man with the numbers

3 minutes to read

Following on from our Q1 2020 updates on the rare whisky and wine markets, Dietrich Hatlapa of HAGI, which provides the data for the classic car category in our Luxury Investment Index (KFLII), answers some key questions on the market for rare automobiles

How was the market for classic cars performing prior to the Covid-19 outbreak?

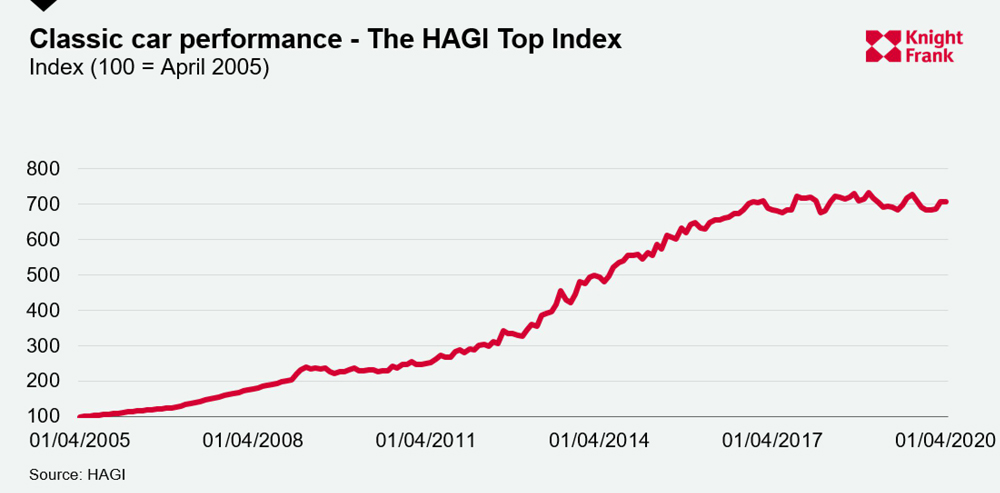

The market (as measured by the HAGI Top Index for rare classic cars) was doing fine until the end of February 2020 and even through April with a rise of 3.29% for the first four months of the year. Digging a little deeper, our Ferrari index has been the strongest performer so far in 2020.

Good prices were paid for cars at all the major auctions, such as Paris, Scottsdale and Amelia Island, that took place before the lockdown.

A few examples, include a 2003 Ferrari Enzo (picture below) that made US$2.8m (RM Sotheby’s), a 1914 Rolls-Royce Silver Ghost that went for US$2.2m (Gooding & Co) and the year’s top-seller so far - a US$7.1m 1932 Bugatti Type 55 Super Sport Roadster (Bonhams).

Above: David Bush ©2020 Courtesy of RM Sotheby's

Longer term we have been on a gentle decline since the Top Index peaked in September 2018. The market lost almost 7% during 2019, but is still only 4% off the peak following the aforementioned price rises so far this year.

How has the outbreak affected the market?

It’s a little early to quantify the impact on prices as we are still in lockdown in the most important classic car areas of the world such as the US and Europe.

Market activities have slowed down significantly on the traditional sales channels. Almost all classic car events have been cancelled for 2020 and the industry is suffering. It will take many months if not years to recover.

That said, we have early indications that the online business in classic cars has seen a significant increase and some dealers have seen an uptick in the number of requests and even sales.

Interestingly, the value of a car is not always a good indicator of whether somebody will be prepared to buy it without a physical inspection.

The provenance and condition of the world’s most desirable cars are generally already in the public domain, but serious collectors will know exactly what they are buying.

It is possible that we see a further surge in sales after the global lockdowns have ended.

How do you think the market will react once the world has recovered from Covid-19 and what will be the key trends to watch?

The key things to watch are macro-economic indicators: interest rate levels, inflation and asset prices in general, in particular those that are considered tangible, hard or alternative sectors.

These will likely be influenced by the massive government spending and central bank action on the back of the crisis. One outcome may be that classic cars constitute an attractive inflation hedge and tangible asset opportunity for collectors once again.

In terms of the cars people will want to buy, it’s difficult to specify types or ages, but what I do know is that collectors are desperate to get out on the road again.

With so many events cancelled, activities this year will be confined to private driving, so cars that are in good enough condition to be driven hard may prove more popular I think.

KFLII tracks the value of 11 luxury collectables. Click here to see their performance in 2019.