The Rural Update: Food strategy realities

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership.

9 minutes to read

Viewpoint

The government’s new, hugely ambitious and multi-faceted food strategy (discussed below) acknowledges many of the issues facing the UK’s farm-to-fork food chain. These include the unaffordable economic costs of the nation’s junk food addiction and the need for more resilience in the face of climate change and increasing geopolitical uncertainty. Any attempt to draw all these threads together has to be welcomed, but it will require a huge amount of coordination and meaningful action from policymakers to encourage all the links in the food chain to play their part. Destroying the confidence of many farm and other family businesses to invest in the future by imposing a huge inheritance tax burden on the next generation of food producers (see News in Brief) seems altogether counterproductive.

Sign up to receive this newsletter and other Knight Frank research directly in your inbox

Commodity markets

The future of commodities

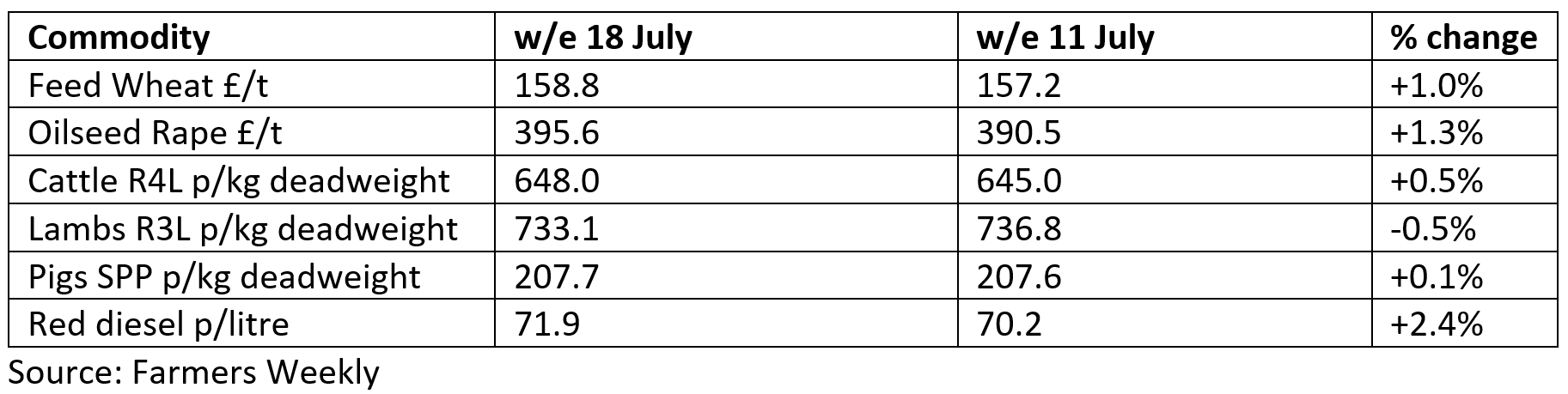

Although all eyes in the UK will be on current farmgate commodity prices as harvest progresses, the latest Agricultural Outlook report from the OECD and FAO makes for interesting reading. Covering the period 2025 to 2034, the report predicts a 14% increase in global agricultural production, largely based on a productivity boost in middle-income countries. Meat, dairy and egg output is forecast to jump by 17%, with grains rising by a more modest 1.1% annually. In terms of prices, red meat is expected to continue growing in the short term but will fall back over the longer term due to increased productivity. Greater efficiency also means greenhouse gas emissions from farming will rise at a slower pace than output.

The headlines

Welsh sustainable farming

The Welsh government has finally published the details of its long-awaited Sustainable Farming Scheme (SFS), which will replace the current system of direct payments from 2026.

Split into three layers, the SFS has been cautiously welcomed by farming organisations, although the lack of a multi-year funding framework, sharper-than-expected cuts to Basic Payment Scheme (BPS) rates, a lack of detail, and a £300,000 payment cap have caused some concern.

Environmental groups are less happy. They claim the scheme, which no longer includes a controversial proposal requiring all farms to devote 10% of their land to woodland, does little to protect the environment. Farmers wanting to join the SFS will, however, have to maintain 10% of their farms as habitat for nature.

The Universal layer of the scheme will be open to all farmers who establish a carbon baseline and complete 12 actions covering things like soil health, woodland management and animal welfare. Under the Optional layer, additional payments will be available for more complex, but as yet undetailed, actions, while the Collaborative layer will reward cooperation between farmers.

BPS will be phased out over four years, with farmers receiving 60% of their current claims in 2026, 40% in 2027, 20% in 2028 and 0% in 2029.

Llŷr Thomas, a member of our Rural Consultancy team and Welsh farmer, comments: “The SFS marks a moment of significant change for many farmers and landowners across Wales. While the overall budget has been maintained for 2026, the large reductions to BPS rates will create uncertainty for many rural businesses.

“With new conditions attached to Universal payments, and complex requirements expected for the Optional and Collaborative layers, seeking expert advice will be crucial when preparing and submitting applications.”

Food strategy launch

The government has just launched its English food strategy. The ambitious vision, dubbed The Good Food Cycle, sets out how the government will “create a healthier, more affordable, sustainable, resilient food system that restores pride in our British food culture and heritage”.

It features 10 priority outcomes that include: resilient domestic production for a secure supply of healthier food and greater preparedness for supply chain shocks, disruption, and impacts of chronic risks.

While the overall ambition of the strategy has been praised, concern has been raised about the government’s ability to deliver such a complex list of aspirations without including any statutory targets or new legislation.

Renewable politics

Renewable energy is already set to be a key part of the next general election battlefield, with some of the UK’s established and emerging political powers setting out their stall.

Richard Tice, Deputy Leader of Reform UK, has sent a letter to eight of the country’s largest energy suppliers warning them that taking part in the forthcoming Contracts for Difference Allocation Round 7 (AR7), a key mechanism for delivering future renewable energy supplies, could be a “significant political, financial and regulatory risk for shareholders”.

Mr Tice said if Reform wins power, it will immediately reassess all the government’s net-zero commitments, including striking down contracts signed under AR7.

The Liberal Democrats are taking the opposite tack and believe the climate scepticism of Reform and the Conservatives is an electoral opportunity. Leader Ed Davey reckons cutting the link between electricity bills and gas prices, and reforming subsidies for renewable energy suppliers, will allow the party to deliver green power without consumers facing huge bills.

In a parliamentary statement responding to the Met Office’s latest State of the UK Climate report, Labour’s Energy Secretary Ed Miliband doubled down on his party’s climate change policies and claimed that diluting the UK’s net-zero ambitions would be “irresponsible and unpatriotic”.

Meanwhile, a cross-party group of 29 MPs and peers has called for a ban on siting solar farms on farmland categorised as Grade 3b or above.

News in brief

IHT impact assessment

Hot off the press, the government has just published the 2025/2026 Finance Bill, which includes an impact assessment of its controversial reforms to Agricultural and Business Property Relief. The document states: “This measure is not expected to have any significant macroeconomic impacts.” It adds: “The policy is not expected to have a significant impact on family formation, family stability or family breakdown.” In terms of food security, it says: “The UK has robust domestic production, and these reforms will only affect a small number of estates. Key aspects of UK food security include prices and physical availability, and changes to inheritance tax reliefs are not expected to have a material impact on either.” Some readers may disagree.

Planning bill tweaks

The government has just published a series of amendments to its Planning and Infrastructure Bill aimed at mollifying critics of the bill’s controversial Part 3. This introduces the concept of a national Nature Restoration Fund, but environmentalists argue that it does little to protect valuable areas of local biodiversity from development. Despite the amendments, the bill’s inherent flaws remain for both developers and the environment, says Alexa Culver of RSK Wilding.

Lost land

Defra’s latest review of the tenanted agricultural sector reveals that only 10% of the farmers questioned reported a drop in the amount of land they rented over the past two years. The most common reason for giving up land was due to a request from their landlord to surrender land before the end of a tenancy. One third of these requests were because the land was being repurposed for non-agricultural uses, a further 9% were for repurposing to renewable energy generation.

Drought deepens

A drought has been declared across the West of England and the East Midlands, with the regions joining Yorkshire and the Northwest. Across England, June rainfall levels were 20% below the long-term average. It was also the hottest June on record. Reservoir levels have fallen to 76% of capacity, with some farmers having their abstraction rights revoked.

CAP consternation

Farming groups across the EU have reacted angrily to cuts in the budget for the bloc’s Common Agricultural Policy (CAP). As part of the European Commission’s proposals for its next Multiannual Financial Framework covering 2028 to 2034, the CAP budget would fall from €386 billion to €300 billion. The Commission, however, claims the proposals will ringfence the farming budget, make funding rules simpler, and provide more support for young and new farmers.

The Rural Report SS 25 – Out now

The Spring Summer 2025 edition of The Rural Report, Knight Frank’s flagship publication for rural businesses, which looks in more detail at many of the issues discussed in The Rural Update, is out now. The new report includes the latest news, research and insights from Knight Frank’s rural property experts, as well as thought-provoking contributions from some of Britain’s most iconic estates.

Available online and in print, you can click here to access the full report.

Properties of the week

Devon delight

Those looking for a small residential estate with extra income in the southwest will want to take a look at Ebberly House at Roxborough, near Winkleigh. A Grade II* listed Georgian house with nine bedrooms sits at the heart of the picturesque 249-acre property, while seven further houses let under assured shorthold tenancies generate a significant rent roll.

For more information, please contact Will Oakes.

Historic Kent estate home to rent

For anybody looking to sample estate living without making a long-term commitment, Knight Frank’s Rural Consultancy team in Kent has an intriguing option on offer. Newhouse at Mersham, near Ashford, which was once home to The Countess Mountbatten of Burma and Lord Brabourne, is part of the idyllic 2,700-acre Hatch Park Estate. Now available to rent, the nine-bed period property costs £7,995 a month. For more information, please contact the team’s Katie Bundle.

Discover more of the farms and estates on the market with Knight Frank

Property markets Q2 2025

Farmland Q2 2025 – Uncertainty dominates

Despite cuts to support payments and lacklustre grain prices, the average price of bare agricultural land fell just 2.3% in the second quarter of the year, according to the latest instalment of the Knight Frank Farmland Index. “It’s really difficult to discern any clear value trends at the moment because of reduced transaction levels,” says Will Matthews, Head of Farms & Estate Sales. Download the full report for more data and insight.

Country houses Q2 2025 – buyers’ market

It’s a buyers’ market when it comes to rural homes, according to the latest research from Tom Bill, Knight Frank’s Head of UK Residential Research. The Knight Frank Prime Country House Index slipped by 2.5% in Q2, the second-largest quarterly decline since Q1 2009. At the same time, the number of properties for sale is up 9% compared with this time last year. On average, there are six prospective buyers for each new instruction, compared with 19 at the height of the Covid-19 pandemic, while sales are achieving 94% of the asking price. Read more of Tom's numbers and insights.