Investors set aside £45 billion to target UK Living sectors

The past five years have seen investment into the Living sectors rise across the UK, from £7.6 billion in 2018 to £15.1 billion in 2022. Figures for 2023 suggest that institutions committed a further £4 billion in the first six months of the year.

4 minutes to read

The idea that UK Living investment has been robust despite broader macro-economic challenges is as much a reflection of the resilience of the sector as it is of the exceptionally strong operational performance it has delivered over the past few years. Rising interest rates, stubbornly high inflation and elevated build costs all present challenges to deploying capital, but the longer-term view remains positive.

Our fourth annual Living Sectors Investor Survey represents the views of 50 leading institutional investors currently active across the build-to-rent, purpose-built student accommodation and seniors housing markets. In total, our survey respondents account for more than £75 billion in Living assets under management across the UK.

Some of the key findings are below.

Investors look to double down on Living sectors

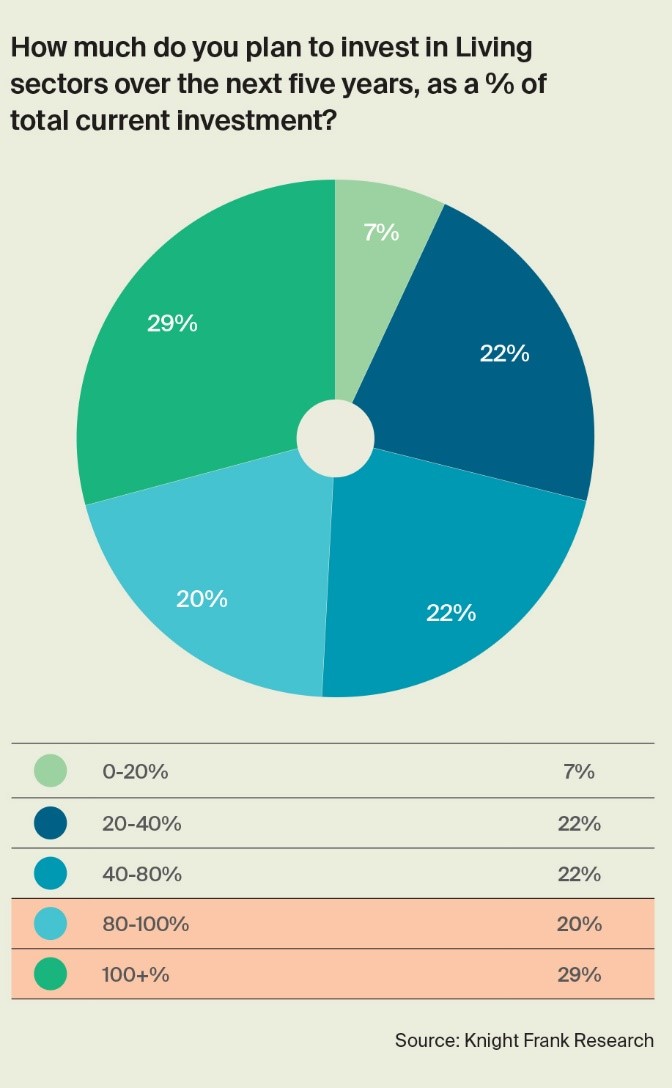

By 2028, close to 71% of investors expect to significantly increase their exposure to the Living sectors with 29% planning to double their current exposure and a further 20% increasing their exposure by between 80% and 100%. In total, our survey respondents alone outlined ambitions to invest a further £45 billion over the next five years.

Such growth is supported by both long- and short-term tailwinds, including a stark housing supply and demand imbalance, rising student numbers and an ageing population. There is a compelling case for investing in assets that benefit from changing ways of living and which provide strong counter-cyclical features and inflation-matching characteristics that can help investors achieve consistent returns during periods of uncertainty. The granular nature of income allows investors to tap into the reversion immediately making it a good hedge against inflation.

Diversification within Living

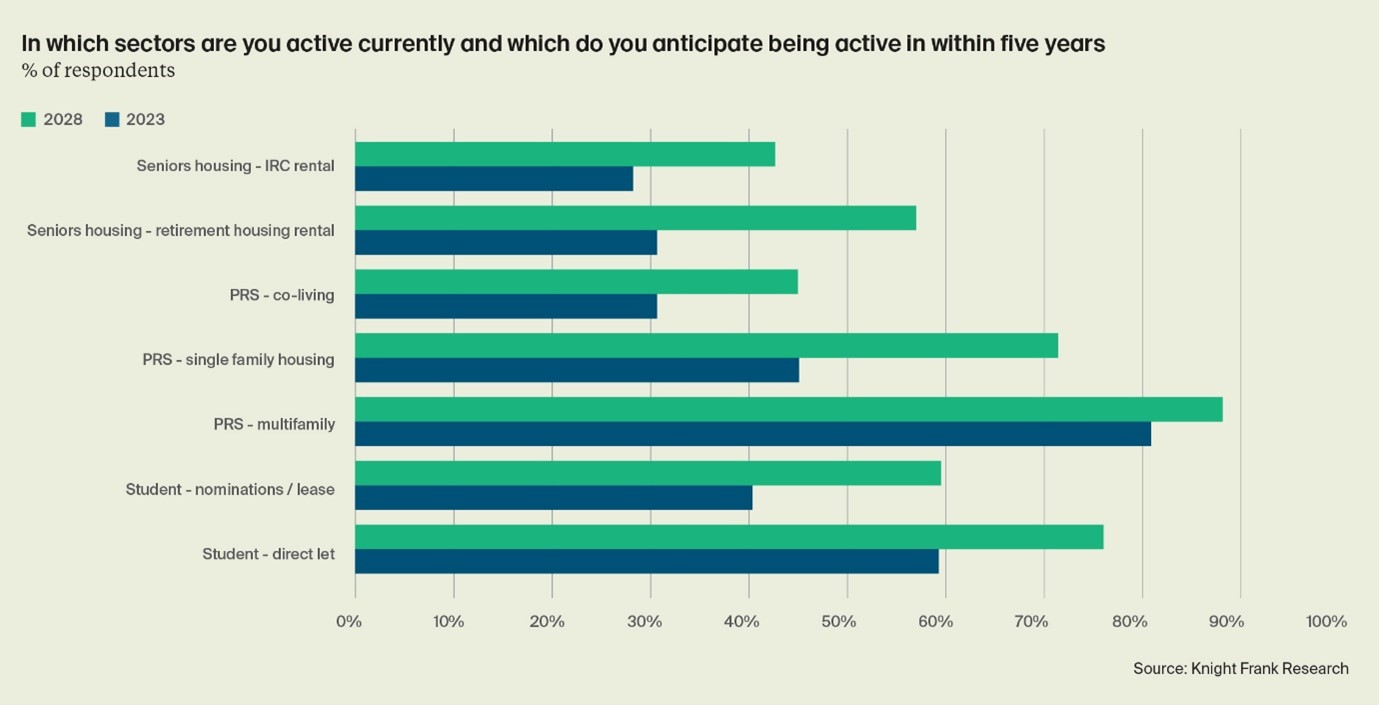

At present, the most common sectors for Living investors to have exposure to are Build to Rent (BTR) and PBSA, with 93% and 62% respectively of our survey respondents currently active in these sectors. In comparison, fewer investors are currently active within the Seniors Housing sector (40%). In part, this reflects the specialist nature of the sector, as well as its relative nascency. Over time this is expected to change, with 67% of investors planning to be active in Seniors Housing within five years.

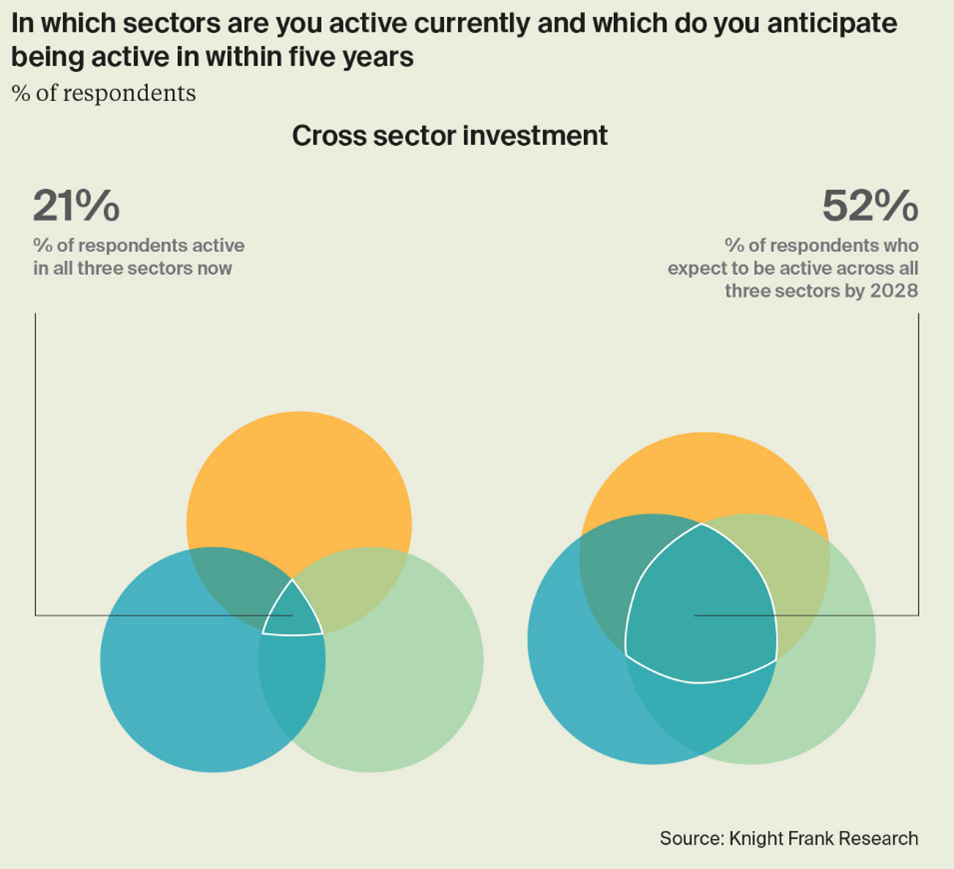

Whilst just 21% of survey respondents currently invest across all three primary Living sectors, this is expected to rise to 52% by 2028. While there are differences in market drivers, the desire for diversification within the Living sectors reflects the fact there are also synergies, particularly with regards to construction and operations.

Multifamily and PBSA are set to remain at the heart of most investors’ strategies over the next five years. More than 95% and 79% of investors expect to target, or continue to target, these sectors respectively. Additionally, Single Family Housing has been flagged by investors as the third most likely sector to target, with nearly three quarters (71%) looking to invest by 2028, followed by Seniors Housing and Co-Living at 67% and 45% respectively. This demonstrates the maturity of these more sectors, and the opportunities for growth that they offer.

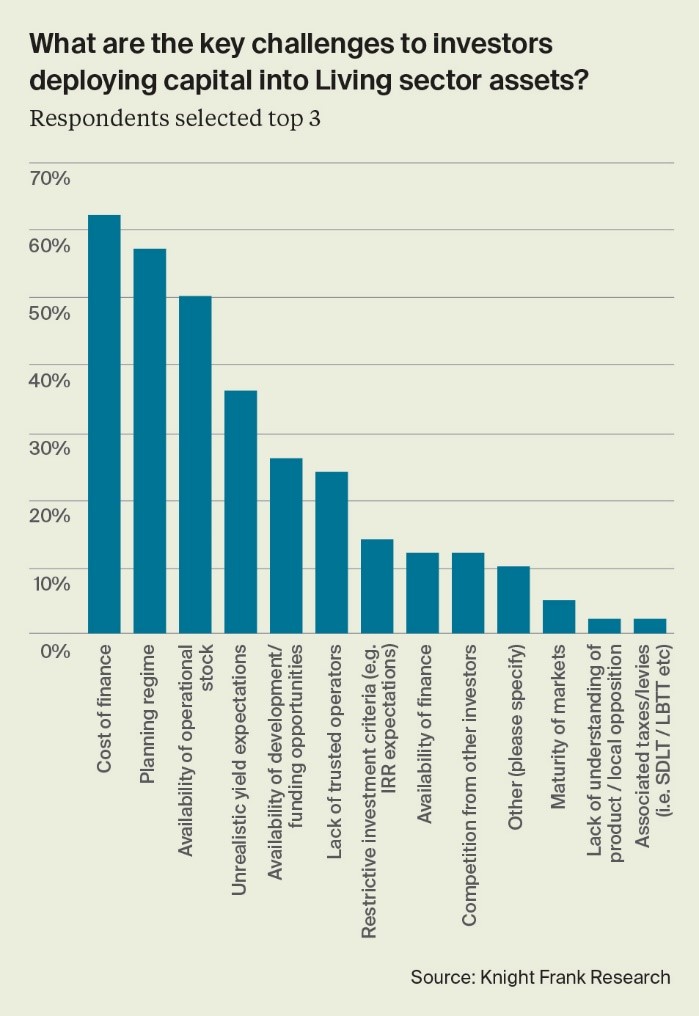

Finance, planning and affordability are challenges

Some 62% of investors highlighted the cost of finance as a major challenge to deploying capital into the Living sectors, reflecting the sharp rise in debt costs over the past 12 months which has resulted in some investors temporarily pressing pause. Investors are also facing challenges around planning, with 57% highlighting this as an issue, up sharply from 36% in last year’s survey.

Looking specifically at operational challenges across the Living sectors potential new regulation was flagged by 68% of respondents. Investors are also mindful of the constraints faced by tenants across age-groups, with affordability highlighted as a concern by 60% of respondents, up from just 33% in last year’s survey. The jump this year is likely to reflect the strong cross-sector rental growth seen over the last 18 months which has largely been the result of severe imbalances between supply and demand. Rising operational costs (58%) and fire safety requirements (42%) were additional challenges shared across the Living sectors.

Investors look to increase financial leverage

The cost of debt was pushed up substantially last year, making it more expensive than the income it could cover in many cases. Asset prices were pushed down to cover the increased cost of debt, while investors using core capital or all-in equity increased. Some 71% of our survey respondents said that access to the debt market was either very important or important to their investment strategy.

There are signs some of these pressures are easing. UK inflation continues to ease and swap rates have come down from recent highs. As the cost of debt comes down, transactional activity levels will pick up in the final quarter. This is reflected in our survey responses, with some 36% of investors saying they expect their requirement for debt to increase over the coming 12 months.

ESG factors continue to drive investor decisions

Some 36% of survey respondents say that sustainability considerations will be the key factor determining investment strategy during the next three to five years. The remaining 64% say the metric will be ‘somewhat influential’.

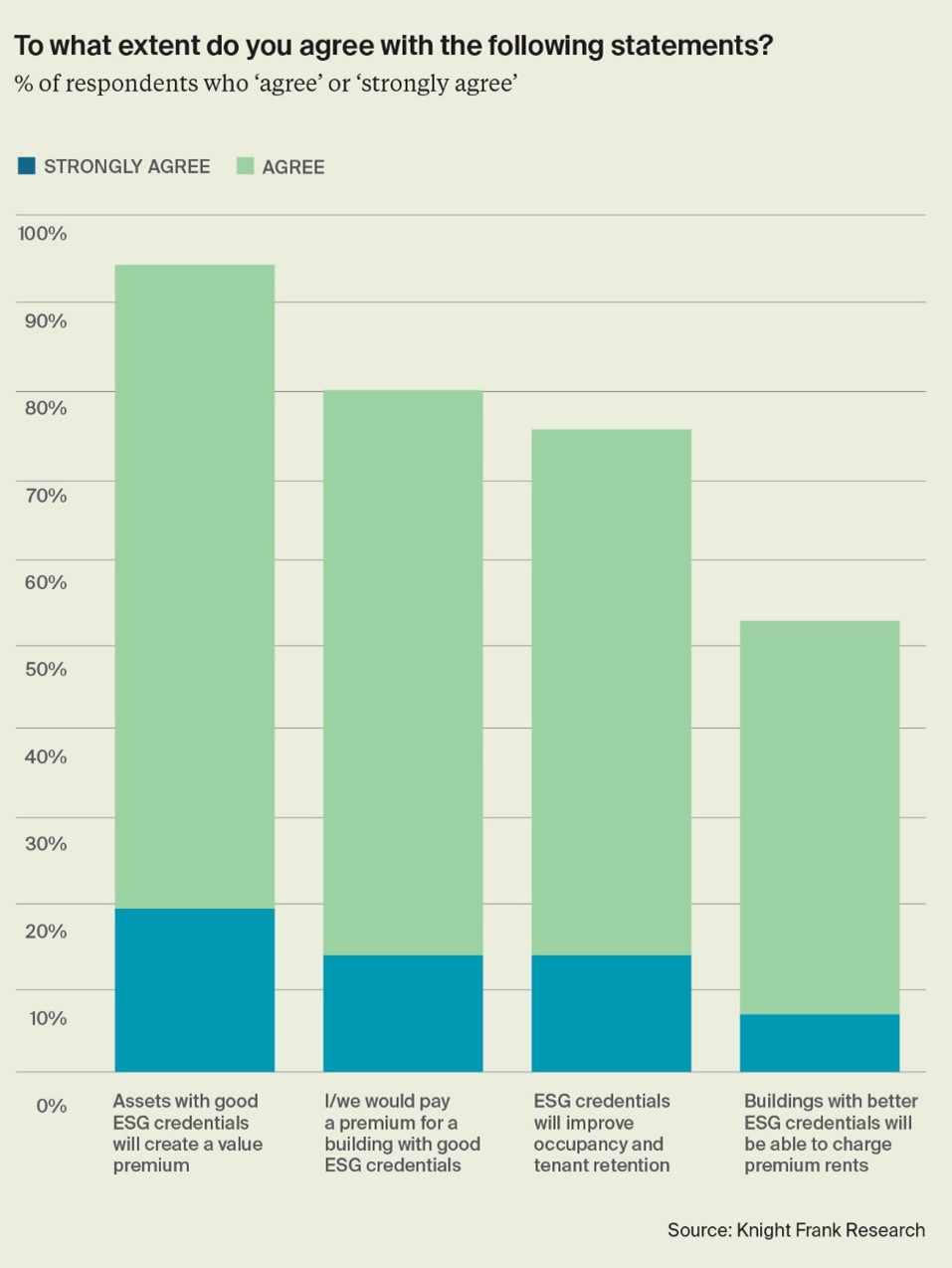

Competition for green buildings is set grow. Some 95% of our respondents agree that ESG credentials will create a value premium for assets, while 81% indicated that they would pay a premium for schemes with strong environmental and sustainability credentials.