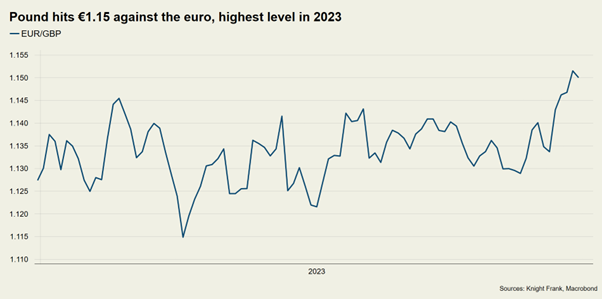

Homebuyer opportunity as pound hits high against euro

Key indicators point towards opportune moment for European residential property investment from GBP buyers.

1 minute to read

Jobs data, mortgage approvals, manufacturing and services are all showing signs of recovery and it’s giving the pound a boost.

Yesterday, the EUR/GBP rate hit a new high for 2023 reaching €1.15.

The rise in interest rates is behind the uptick.

Yesterday the Bank of England (BoE) raised rates by 25bps, its 12th hike since December 2021, taking the base rate to 4.5%.

Analysts envisage a further 60-70 basis points of hikes from the BoE before the end of 2023.

With the European Central Bank expected to tighten more than the BoE in the coming months the euro may make up some lost ground against the pound by the end of the year.

Plus, with Jerome Powell, the Fed Chairman, commenting they “are close, maybe even there” the dollar’s strength may start to wane slightly.

With some second home buyers opting to sit on their hands whilst the banking, energy and cost-of-living crises play out, this may prompt some to act, aware that stock levels have recovered from their pandemic lows giving them a broader choice of properties in some of Europe’s top second home markets across France, Italy and Spain.

According to Mark Harvey, Knight Frank’s Head of International Residential, “After a fairly gruelling run of form it will come as a much-needed boost to many who are seeking to buy, rent or indeed travel in Europe… equally and after several years of double digit growth it may be an opportune moment for sellers to consider a sale.”

Subscribe to our monthly global residential update or international newsletter to receive regular roundups on Europe’s top second home destinations.