All you need to know about global wealth insights 2023

Liam Bailey, Knight Frank’s Global Head of Research and Editor-in-Chief of The Wealth Report, shares his key insights from the 17th edition.

7 minutes to read

Last year the Ukraine crisis fuelled the European energy crunch and supercharged already surging inflation. As a result, 2022 saw one of the sharpest upward movements in global interest rates in history, leading to economic conditions which Collins English Dictionary neatly dubbed the “permacrisis”.

It's time to look beyond the “permacrisis”. Significant risks remain for the global economy. Inflation in major economies is above target, interest rates are still rising, and consumers are facing a serious cost-of-living crisis.

In this year’s report, we argue that investors should look past these risks. As the interest rate pivot approaches later this year we believe market sentiment will shift, quickly, and investors need to be well placed to take advantage of the very real opportunities emerging across global real estate markets.

Discover global wealth trends in more detail

Visit The Wealth Report site and download the report to discover more detail about the latest key insights and trends impacting global wealth.

Wealth creation turns a corner

More on page 6

Challenging markets meant the majority of UHNWIs saw their wealth decline last year, with their collective wealth falling by 10% (equivalent to US$10.1 trillion). The epicentre of the crisis, Europe, was at the sharp end with an average 17% fall, while Africa demonstrated the most resilience with only a 5% drop. In a sharp reversal, 69% of wealthy investors expect growth in their portfolio this year, with confidence driven by asset repricing, perceived value opportunities and an expected economic rebound.

Changing investment strategies

More on page 8

This newly minted wealth will be put to work with investors targeting capital growth (31% of respondents), capital preservation (26%) and income generation (23%). Expect increases in investment allocations, with almost a third of investors looking at property investments to provide an inflation hedge and diversification. A cautious approach will see 29% of investors reduce debt volumes.

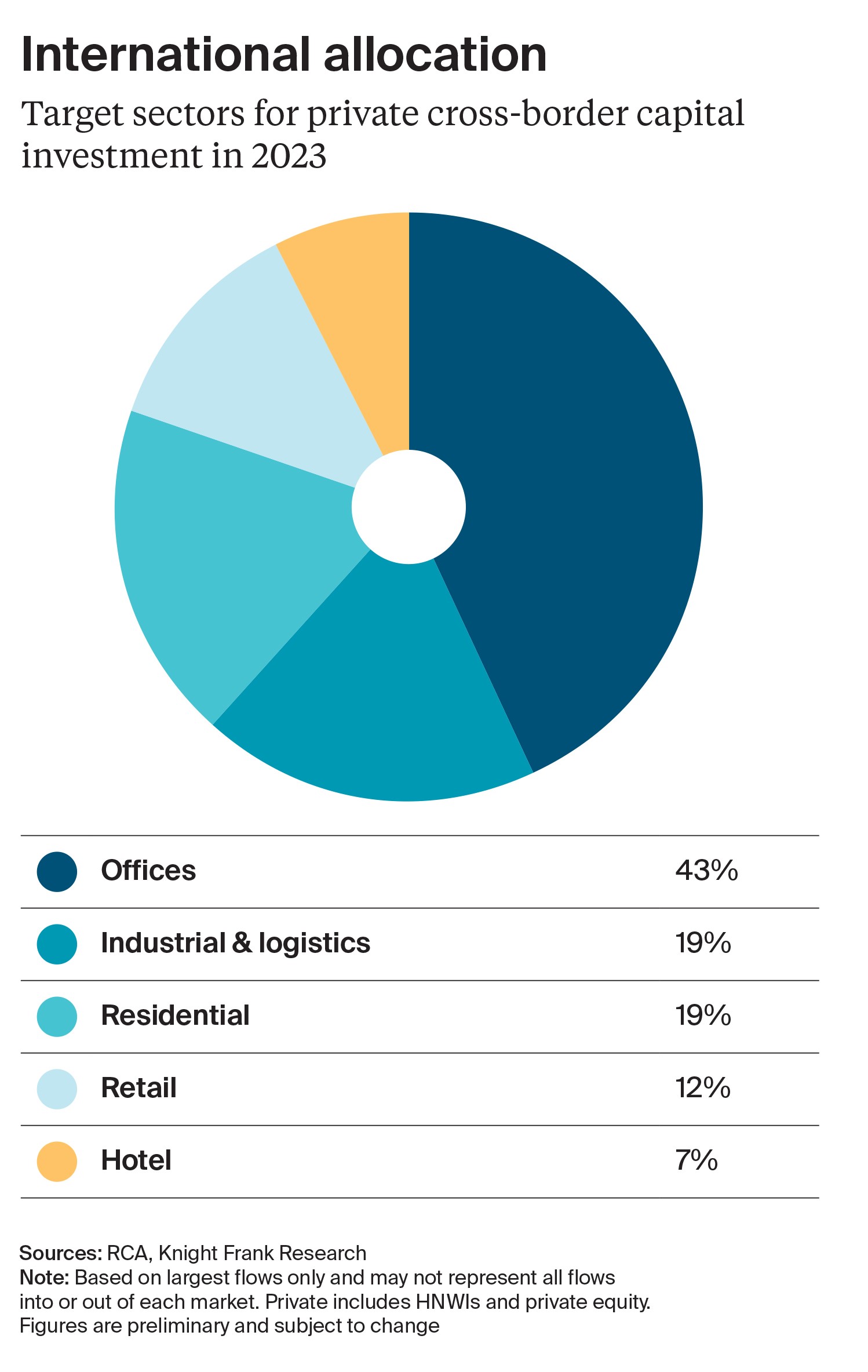

Private capital in ascendency

More on page 14

More expensive debt and heightened uncertainty saw investors retreat in the second half of last year. While institutions reduced real estate investment by 28% in 2022, private capital was less defensive, falling only 8% and accounting for a record 41% of the US$1.1 trillion committed by all investors. Private investment was dominated by allocations to residential (43%), offices (18%) and logistics (15%). While US cities led in terms of volumes, London took the biggest share (15%) of cross-border investment, followed closely by Singapore.

Prime residential growth slower but positive

More on page 32

Our Prime International Residential Index (PIRI 100) confirms that average luxury house price growth slowed to 5.2% last year, although with 17% of global UHNWIs buying a home in 2022 this was still the second strongest year on record. Some 85 of the 100 markets tracked saw positive price growth, led by Dubai (44%) and Aspen (28%). At the other end of the ranking, markets that led through Covid-19 saw big reversals – including New Zealand’s Wellington (-24%) and Auckland (-19%).

Sunbelt and snowbelt resorts in the lead

More on page 35

Wealth preservation, hybrid working and early retirement themes supported resort markets, with sun (up 8.4%) and ski (8.3%) locations outperforming average prime market growth in 2022. This strength is reflected by our research into the high diversity of buyer nationalities in markets such as France, Spain and Italy.

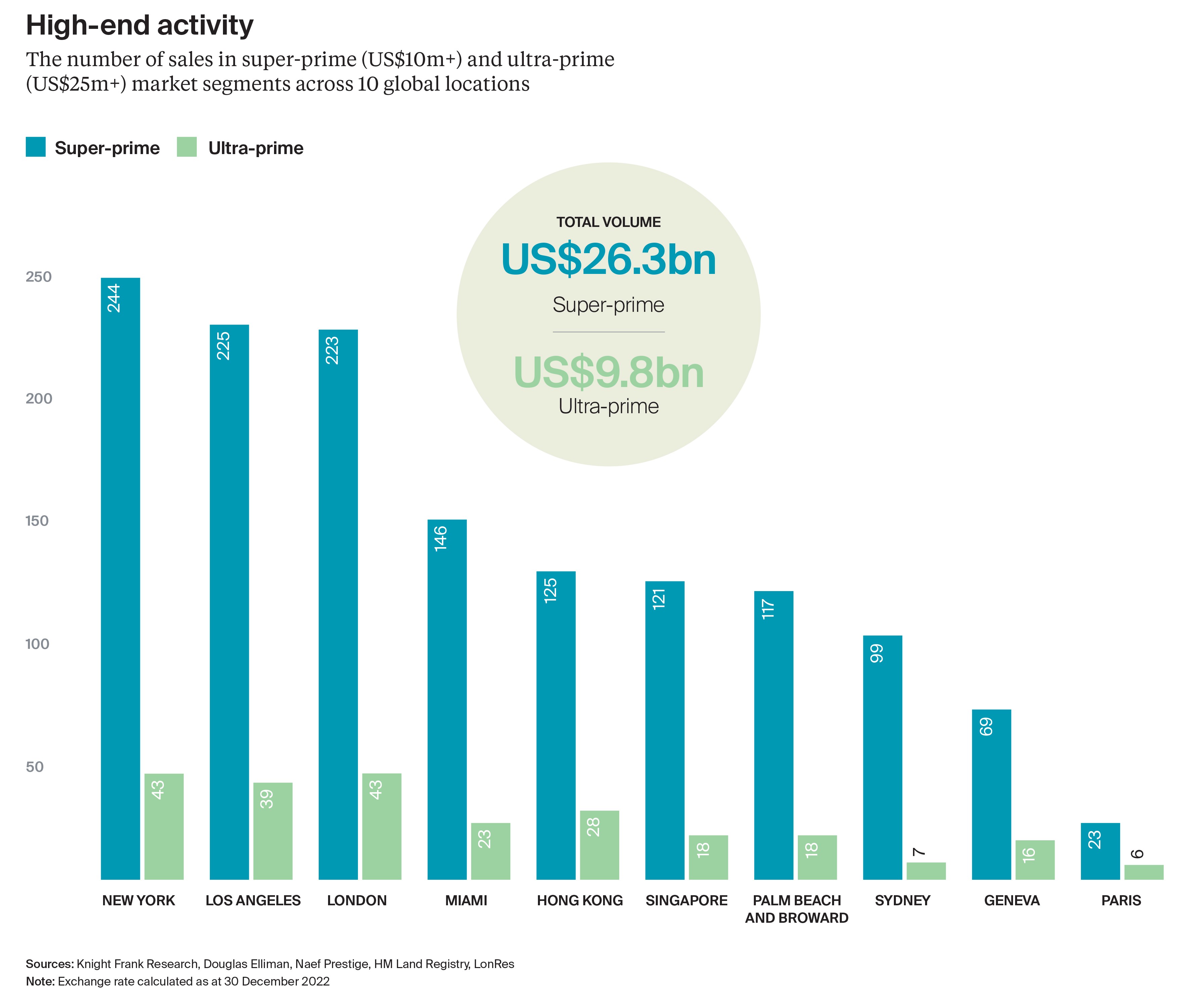

Super-prime growth

More on page 39

At the very top of the market the number of super-prime (US$10 million+) sales in 2022 slipped against the 2021 total, although it remained 49% higher than in 2019. New York, Los Angeles and London led the pack in terms of numbers of sales. The even more rarefied ultra-prime (US$25 million+) market was dominated by London and New York, with the former seeing the highest sales since 2014.

Wealth and talent on the move

More on page 10

An ironic legacy of Covid has been a massive growth in the desire for mobility. The 13% of UHNWIs who are planning to acquire a second passport or citizenship is the tip of the iceberg. The boom in so-called digital nomads is only just starting – promising disruption to outbound countries, destination markets, tax systems, residential rental demand and office requirements.

Government incentives for wealth

Competition to attract footloose wealth is hotting up. Alternatives to Western investor visa schemes are growing, with surging applications in Turkey, as well as more flexible offerings in Dubai, Singapore and Hong Kong. Singapore’s sevenfold growth in family offices is testament to the size of the prize for exchequers. While education remains a big draw for London, Italy’s flat tax scheme is a wake-up call for the UK as a replacement Tier 1 Investor visa remains absent and the non-dom regime comes under more scrutiny.

Property in demand

More on page 19

In the year ahead, 19% of UHNWIs intend to invest directly into income-producing property, with 13% set to take the indirect route. In terms of sectors in demand, healthcare leads, followed by logistics, offices and residential. Our own forecast for cross-border allocations suggests offices will lead in the year ahead, with London the top target. US investors will provide the firepower for almost 50% of cross-border volumes in 2023, with strong activity expected from Singapore, the UK, Canada, UAE and Switzerland.

Investment trends

More on page 22

Changes to investment criteria, funding and market trends will drive investor behaviour. The E in ESG dominates investor thinking, raising a question over the benefits of bundling it with the S and G. Refinancing with a widening funding gap will see debt funds grow. Grocery market disruption means a requirement for 10 million sq ft of last mile fulfilment space in the UK alone. China’s reopening means student accommodation demand will be boosted in the UK, US, Australia and Canada (page 24).

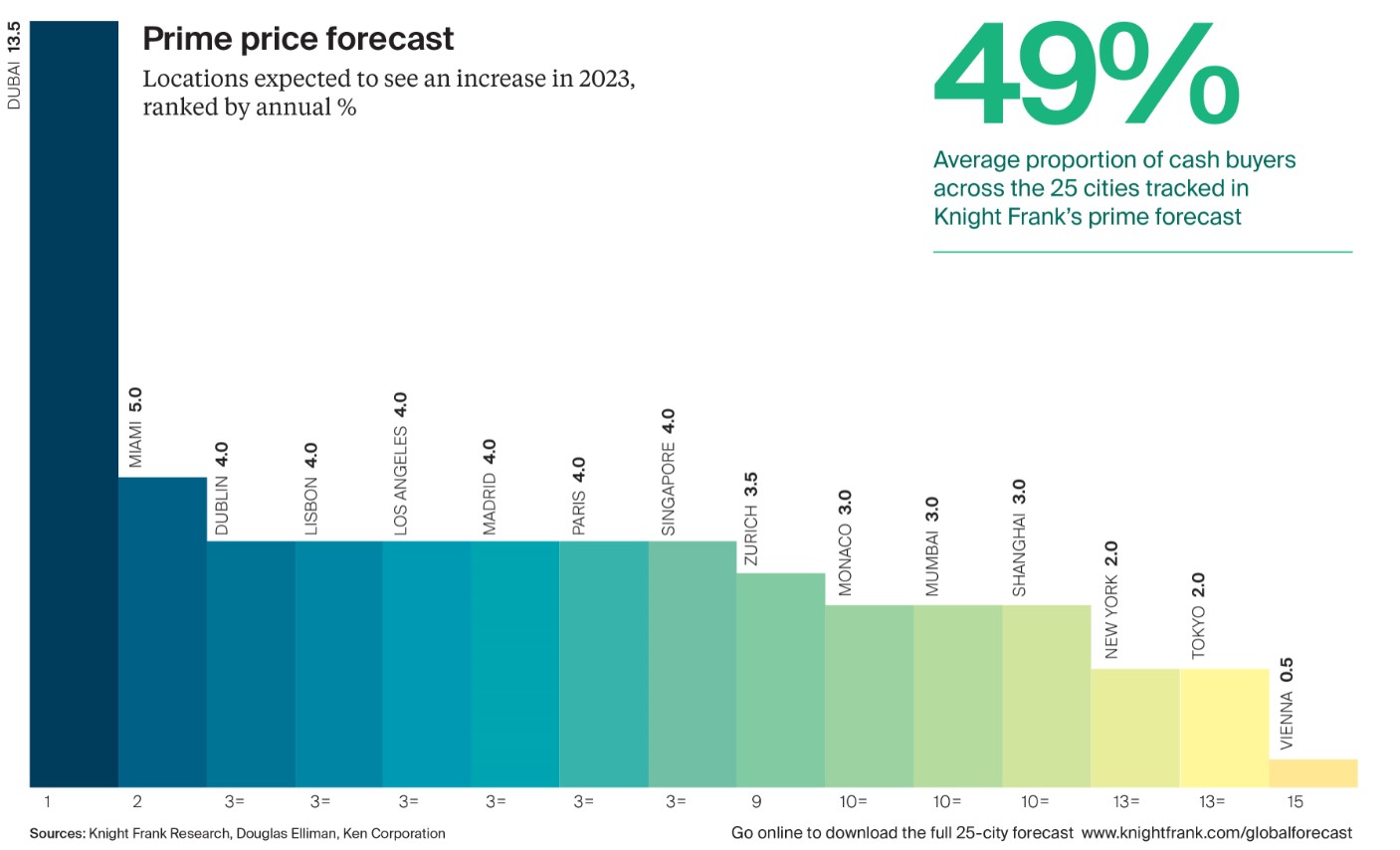

Cash cushioning property cost rises

More on page 40

While the proportion of UHNWIs set to buy residential property in 2023 (15%) is down slightly from 2022, the high share of cash purchases (49%) will cushion the impact of higher rates and support prices. Of the 25 cities we provide forecasts for we expect 15 to see price growth this year. Dubai leads at 14%, with a huddle of others expected to see rises of 3% to 5%. Supply – a constraint on the market since the beginning of Covid – will ease as UHNWIs rationalise portfolios, which now average 3.7 homes.

Residential buyers face new regulations

More on page 35

Purchasers need to navigate ever more global rule changes including a Canadian ban on non-residents buying this year and next, a new mansion tax in Los Angeles, tighter lending rules in Singapore, higher fees for Australia’s non-resident buyers and a new Spanish wealth tax. With buyers confirming they are actively seeking political stability and transparency of asset ownership, though, this is looking like the new normal.

Art and cars back in vogue

More on page 52

The ongoing passion for luxury collectibles pushed the Knight Frank Luxury Investment Index (KFLII) 16% higher in 2022. Art (up 29%) and classic cars (25%) led the table, propelled by record-breaking sales and some huge and unique collections coming to the markets. While rare whiskies only managed 3% growth last year, early adopters will be happy with a 373% 10-year return. Looking ahead, prospects are good for the two

leading categories with 59% and 34% of UHNWIs respectively looking to invest in 2023. Even whisky (18%) might be set for a rebound.

Subscribe for more

Subscribe for the latest insights and additional content from The Wealth Report below.

Subscribe

Download the full report

In this year’s packed edition, we also find space to introduce you to ESG-compliant wild venison, aquaponic trout (page 56), surfing tech millionaires in Portugal (page 46), defiant NFT investors ploughing US$1.6 billion into Bored Ape images despite a 50% price correction (page 55), a hopeful plea for “less speculation and more substance” in crypto assets, and a fecund range of natural capital investment opportunities.