UK construction begins to wilt

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Are things that bad?

Average house prices fell 0.4% during October, the third decline in four months and the sharpest fall since February 2021, according to the Halifax index out this morning. That cuts the annual rate of growth to 8.3%, from 9.8% a month earlier.

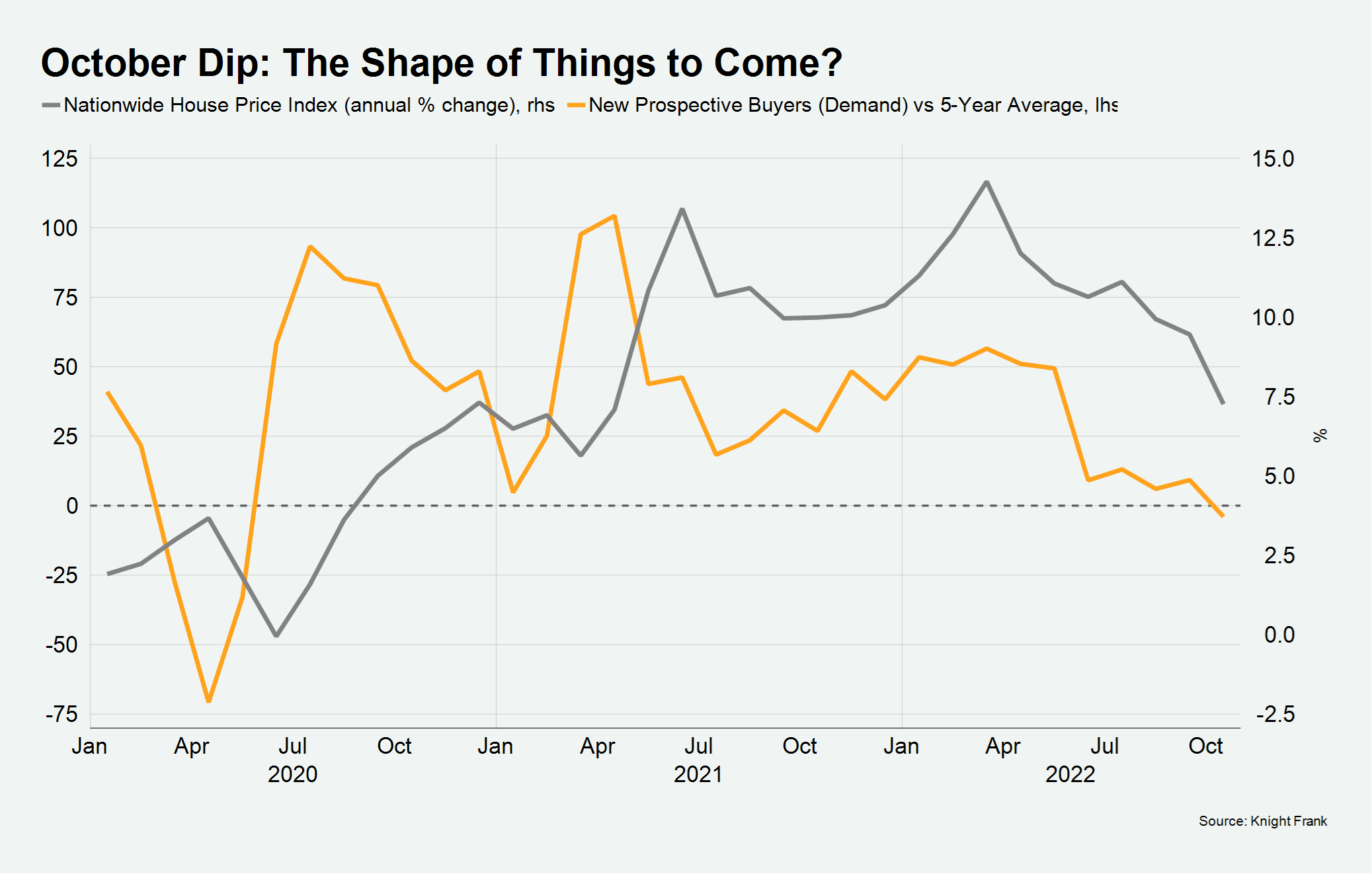

October was not a good month for the property market. UK house prices fell on a quarterly basis for the first time since July 2020, according to Nationwide, the Bank of England announced a pretty steep drop in mortgage approvals, and the number of new UK buyers registering - a key measure of future activity - fell below the five-year average for the first time since May 2020 (see chart).

We'd been expecting activity to cool but this quickly? So was October's dip a blip, or the shape of things to come? Tom Bill takes a closer look this morning.

New orders fall

Strong pipelines of unfinished work and a surge in new project starts that took place at the back end of the pandemic have sustained the construction industry this year. Industry activity rose at the fastest pace since May last month, according to an S&P Global/CIPS purchasing managers index published Friday.

All signs now point to a slowdown. New orders contracted for the first time in 28 months during October. Construction firms noted weaker confidence among clients, headwinds from rising prices and borrowing costs, plus a drop in new work "due to heightened political uncertainty".

A third of respondents expect a rise in work during the year ahead, while a quarter predict a decline. That's the lowest degree of optimism since May 2020.

Supply chain snarl ups continue to ease, however. Delivery delays fell to the lowest level since the onset of the pandemic. Nevertheless, cost burdens continue to climb. Higher purchasing prices were overwhelmingly linked to the cost of energy, fuel bills and the pass through of rising wages.

Online woes

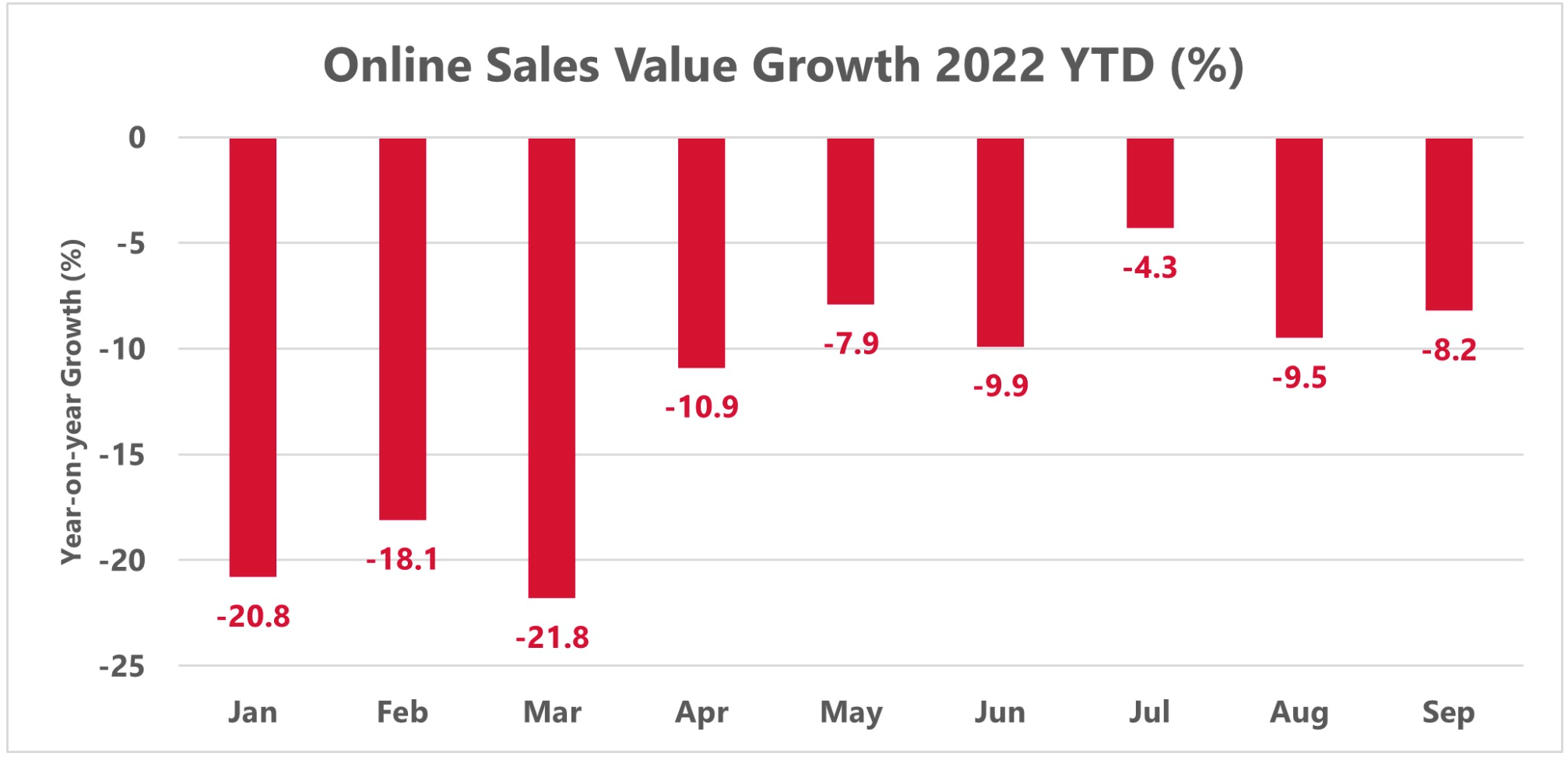

Amazon’s announcement earlier in the year that it was scaling back on warehouse development sent shockwaves through the retail market and investment community.

Subsequent profit warnings from a string of online pure-play darlings such as ASOS, Boohoo and AO World have seen their respective values crash by as much as 90% from previous peaks. Other online pure-plays have succumbed to administration, including Missguided, Eve Sleep and now Made.com.

Did these problems stem from the businesses themselves, or has the potential of online retail been wildly overestimated? You can read Stephen Springham's take here.

Hong Kong

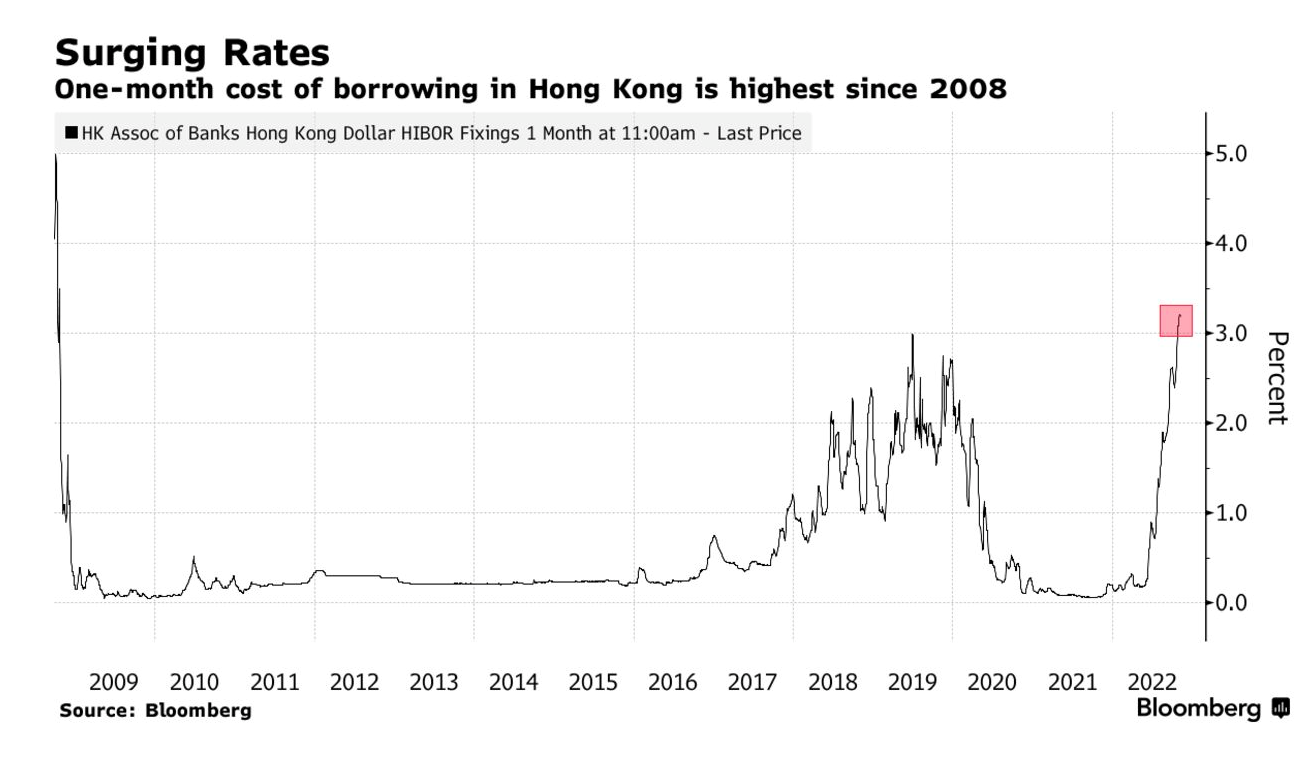

House prices in Hong Kong continue to soften. Prices fell 2% in the final week of October, according to Centraline - that caps a 14% fall from the 2021 peak.

Borrowing costs have soared since the start of the year to the highest level since 2008. (see chart courtesy of Bloomberg). That's weighing heavily on activity as buyers adopt a "wait-and-see" approach, according to our October update.

Sales activity in both primary and secondary markets recorded monthly drops of 8.2% and 5.2% respectively during October. Hong Kong’s overall stamp duty revenue from home sales recorded 202 cases in September, reaching a new two-and-a-half year low, according to the Inland Revenue Department. The number of cases involving Buyer’s Stamp Duty (BSD) was the lowest since December 2020, reflecting low demand from non-local buyers.

In other news...

Our mortgage market experts at Knight Frank Finance will be fielding your questions at 12:30pm GMT today. You can submit a question when you register here.

Elsewhere - Fed seen sticking to rate rises after jobs report (Reuters), three growth-friendly reforms for the UK’s broken planning system (FT), and finally, Bank of England risks a repeat of mini-Budget bond markets chaos, warn City traders (Telegraph).