Rates hikes in perspective, Spain’s digital nomads and travel’s uneven recovery

Your international property and economics update tracking, analysing and forecasting trends from around the world.

3 minutes to read

Interest rates

Policymakers are feeling the heat as inflation climbs higher. The issue is particularly acute in the UK, Europe and the US, prompting the Bank of England to act last week, while the European Central Bank and the Federal Reserve are making hawkish noises.

On the positive side, fixed rate mortgages are more popular now than a decade ago meaning there’s unlikely to be a sudden shock for most mortgage holders. According to UK Finance 74% of UK homeowner mortgages are on a fixed rate contract

On the downside, those who exceeded their budget to secure their home during the pandemic-induced buying surge and opted for a variable mortgage, could become overstretched.

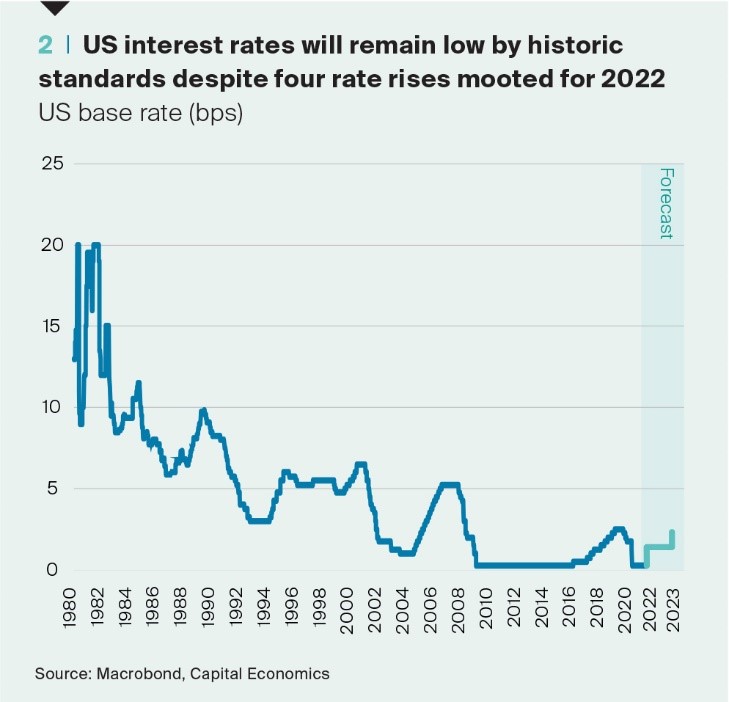

But even in the US where four rate rises have been mooted this year, rates will still remain low by historic standards. Capital Economics envisages the US base rate reaching 2.25% by the end of 2023.

Spain

Post-Brexit some EU governments are looking at innovative ways to allow British citizens and other non-EU nationals to stay beyond the permitted 90 days out of every 180-day period.

Spain is planning a new digital nomad visa that will allow foreign nationals working for non-Spanish companies to live and work in Spain without needing to apply for a full work visa.

The initiative follows in the footsteps of similar digital nomad visas introduced in Barbados and Dubai since the start of the pandemic. Their goal is to capture a new cohort of footloose remote workers no longer tethered to offices that will help boost their local economy and expedite the tourist industry’s recovery.

Applicants will need to meet some requirements including the need to make 80% of their income from companies based outside of Spain

For British residents that have had their wings clipped since Brexit, the Spanish government’s proposal is likely to be a welcome one. Data from Spain’s Ministry of Development show sales to non-residents have been in decline since before the pandemic.

We expect other governments to follow suit as they look to boost their economies and support beleaguered tourist industries.

Travel tracker

Turn to the inside page of our flagship publication The Wealth Report and you’ll find our definition of ‘prime property’ which includes the statement, “Prime markets often have a significant international bias in terms of buyer profile.”

Demand from domestic buyers has, to some extent, filled the void left by international buyers in resorts and global cities during the pandemic. The removal of travel barriers and the resumption of cross-border travel will, however, enable the normalisation of buyer activity.

Monitoring the seat capacity on flights across 48 destinations, Bloomberg’s travel tracker highlights the inconsistent nature with which travel is recovering. Parts of the Caribbean have seen air travel exceed pre-pandemic levels whilst Asia continues to lag Europe. Such patterns will have a bearing on sales activity in those property markets with a strong global appeal. Sight unseen sales were evident during lockdowns but most buyers – second home purchasers and investors alike – still prefer to view in person.

Elsewhere – Australia reopens its borders to vaccinated travellers from 21st February (Bloomberg), dollar up, euro down as pair face off in rate hike tussle (Reuters), the supply crunch gathers pace, but if the UK (FT) is feeling the pinch, try Seattle (Bloomberg) where estimates suggest some areas have less than a week’s worth of inventory left available.