Five things you need to know about Italy’s residential market

With low ownership costs and growing interest in Italy’s flat tax initiative, we highlight five key trends influencing the Italian prime residential market.

5 minutes to read

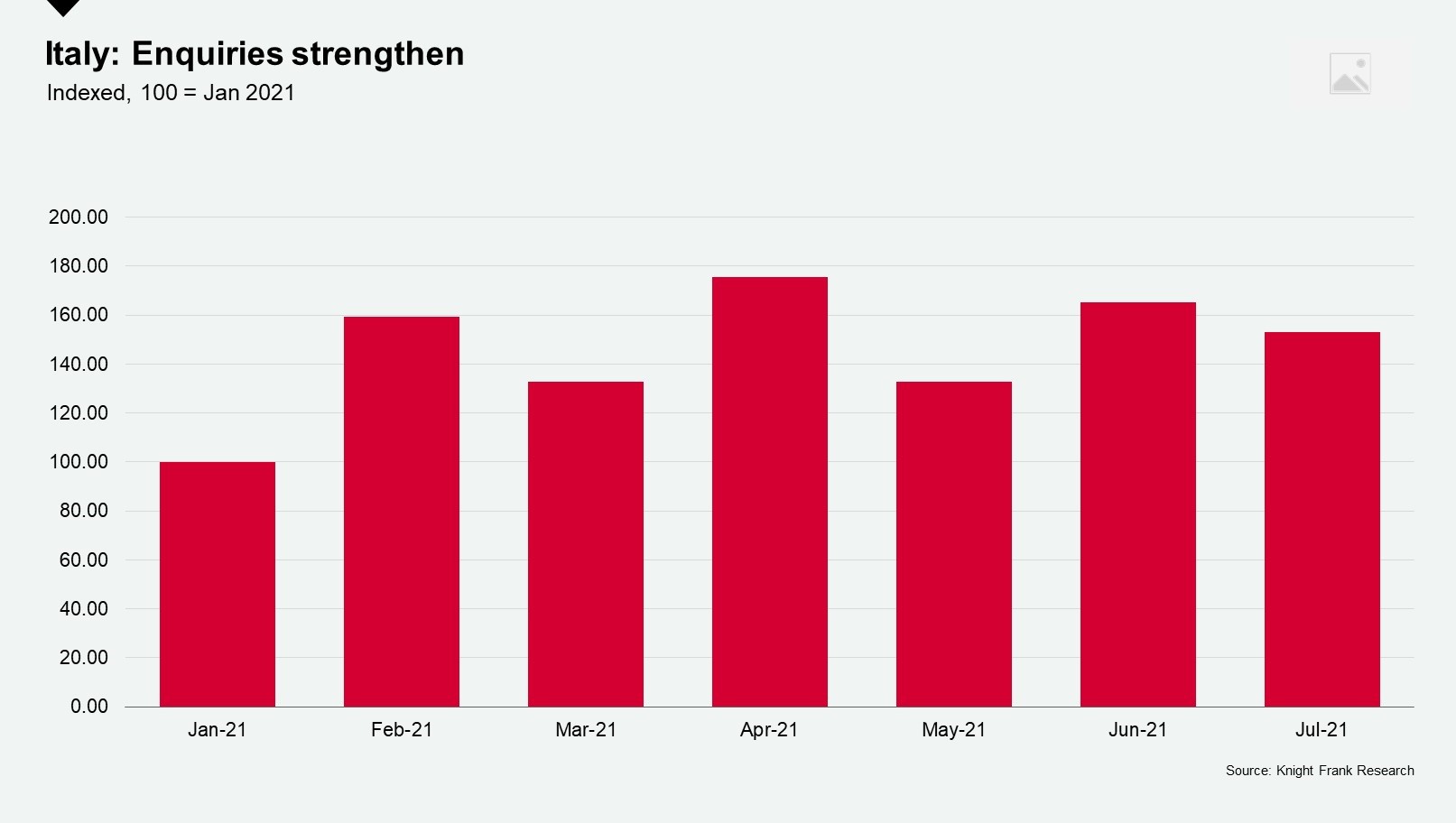

1. Enquiries jumped 76% in early 2021

“I do believe that Italy really purifies and ennobles all who visit her. She is the school as well as the playground of the world,” that’s how E.M. Forster described Italy's appeal, something the pandemic has only strengthened further.

Covid-19 and the resulting lockdowns have catapulted space, quality of life, an outdoor lifestyle, and cultural amenities to the forefront of buyers’ minds, all essentials of Italian living.

Add in rising asset prices, low interest rates and amassed savings and ‘la dolce vita’ has been brought within reach of more ultra high-net-worth individuals (UHNWIs).

According to The Wealth Report 2021, there are some 521,653 UHNWIs globally, 29% of them in Europe, and the world saw another 12,401 added to the tally in 2020.

Mark Harvey, Knight Frank’s Head of International Sales comments: “2021 has been a record trading year for Knight Frank in Italy. As the UK and northern Europeans emerged from lockdowns, the Italian way of life has resonated strongly with them.”

Between January and April 2021, Knight Frank enquiries for homes in Italy increased 76% and have remained consistently high.

2. Italian flat tax applicants prefer city living

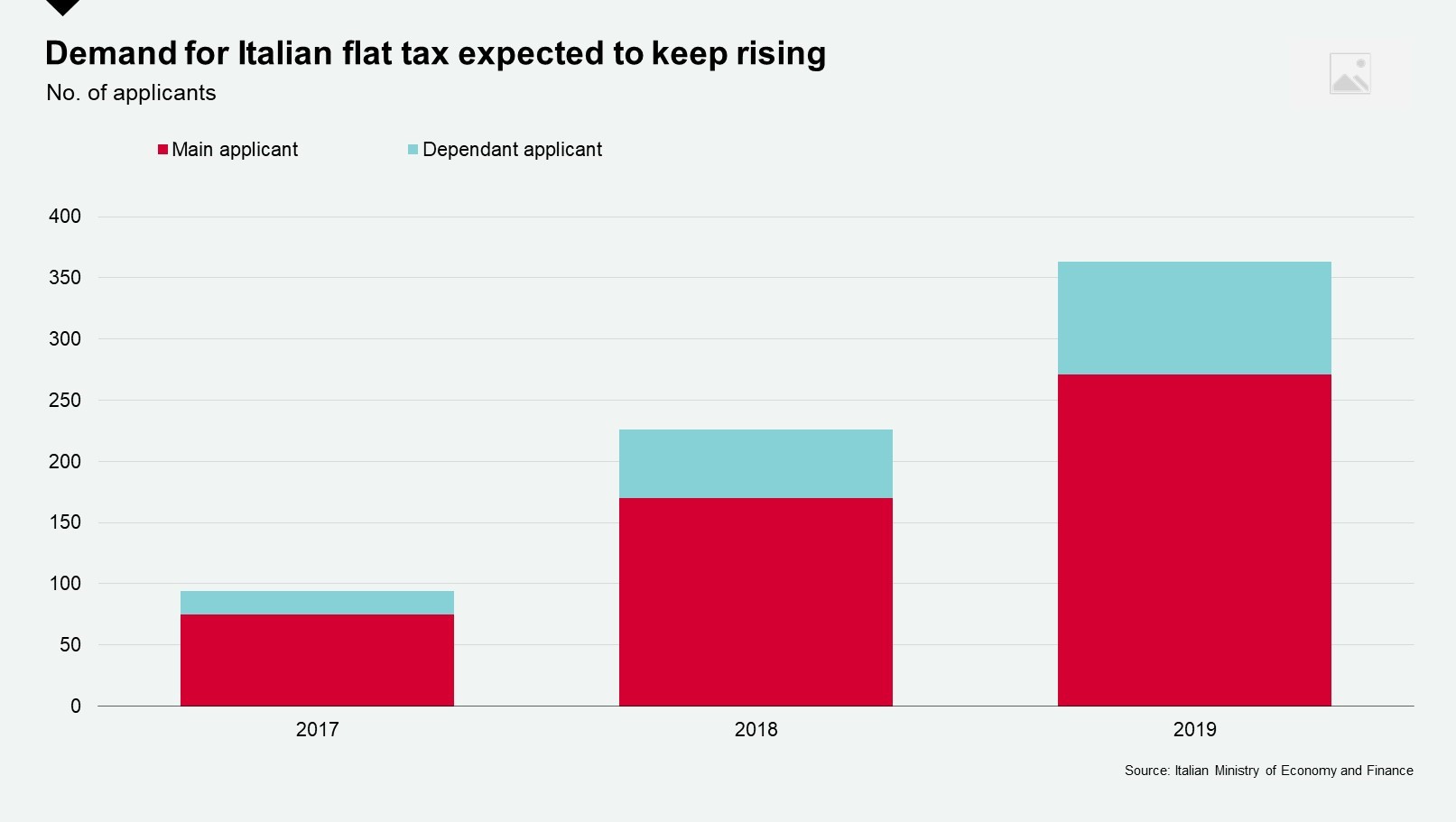

Introduced in 2017, Italy’s flat tax is growing in popularity.

Between 2017 and 2019, some 683 UHNWIs have applied for residency via Italy’s flat tax scheme, with a 61% jump recorded in 2019 year-on-year.

The initiative allows overseas residents (irrespective of their citizenship), who move to Italy and become Italian tax resident, to pay a lump sum form of taxation on all non-Italian sourced income for up to 15 years. After that date, beneficiaries will become subject to Italy’s normal tax regime.

For many UHNWIs, one key draw is their exemption from Italian gift and inheritance taxes in relation to assets and real estate owned abroad as well as the simplicity of the tax regime, which implies bare minimum reporting obligations for the applicant.

To date, main applicants (paying €100,000 per year in flat tax) accounted for 516 (76%) of the total, with 167 (24%) listed as dependants (paying €25,000 per year).

Although data for 2020 has yet to be published, Knight Frank’s associates at the Milan office of international law firm Withers Worldwide, expect the number of applications to have increased substantially once tax returns are filed in November 2021.

Exclusive analysis for Knight Frank by Withers Worldwide confirms that most applicants have so far originated from the UK, France, Switzerland, Brazil, Israel and the US. Interestingly, there has been a strong uptick in the number of people applying from the US.

As to where they settle, the focus to date has been on Italy’s cities: Milan, Venice, Rome, Florence (and other locations in Tuscany) as well as Turin.

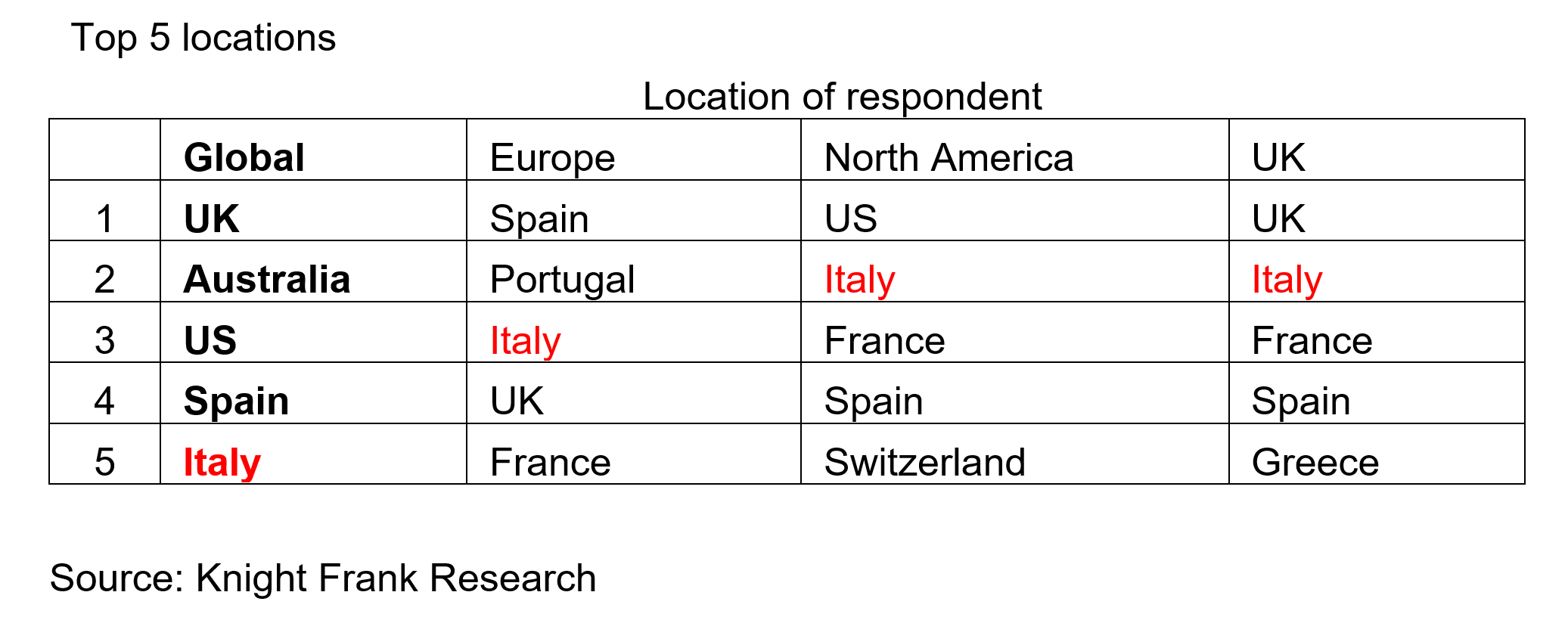

3. Italy is named as one of the world’s top five second home destinations

Knight Frank’s Global Buyer Survey which collated the views of over 900 clients found that Italy was among the top five top second home destinations amongst global respondents and also ranked highly with UK, European and North American buyers in particular.

If you're more likely to purchase a second home as a result of the pandemic which countries and territories would you purchase in?

4. Tuscany, and Lucca in particular, shine bright

Favoured Tuscan haunts such as Florence, Chianti and Siena continue to see strong demand, but Lucca has stood out from the crowd in the last year.

Knight Frank’s Amy Redfern Woods comments: “This small medieval-walled city has generated a real international following of late. It is a compact city with a friendly family feel, located just 25 minutes from Pisa Airport and also from the Mediterranean coast, plus, crucially it remains competitively priced.”

Amy adds: “Today more than ever, buyers want hassle-free, turnkey homes and on this front Lucca delivers with many homes renovated in the last five years.”

Florence too is breaking new ground. In 2021, the city registered a record sale price of €20,000 per sq m for a loft apartment, underlining the continued appeal of urban living and a new urgency amongst buyers to press ahead with their life goals.

According to Bill Thomson, Chairman of the Italian network at Knight Frank: “Homes priced above €3 million that are ready to move into are the real sweet spot. Turnkey homes in Florence, Venice, Como and Milan have generated consistent interest since initial European lockdowns first eased in June 2020.”

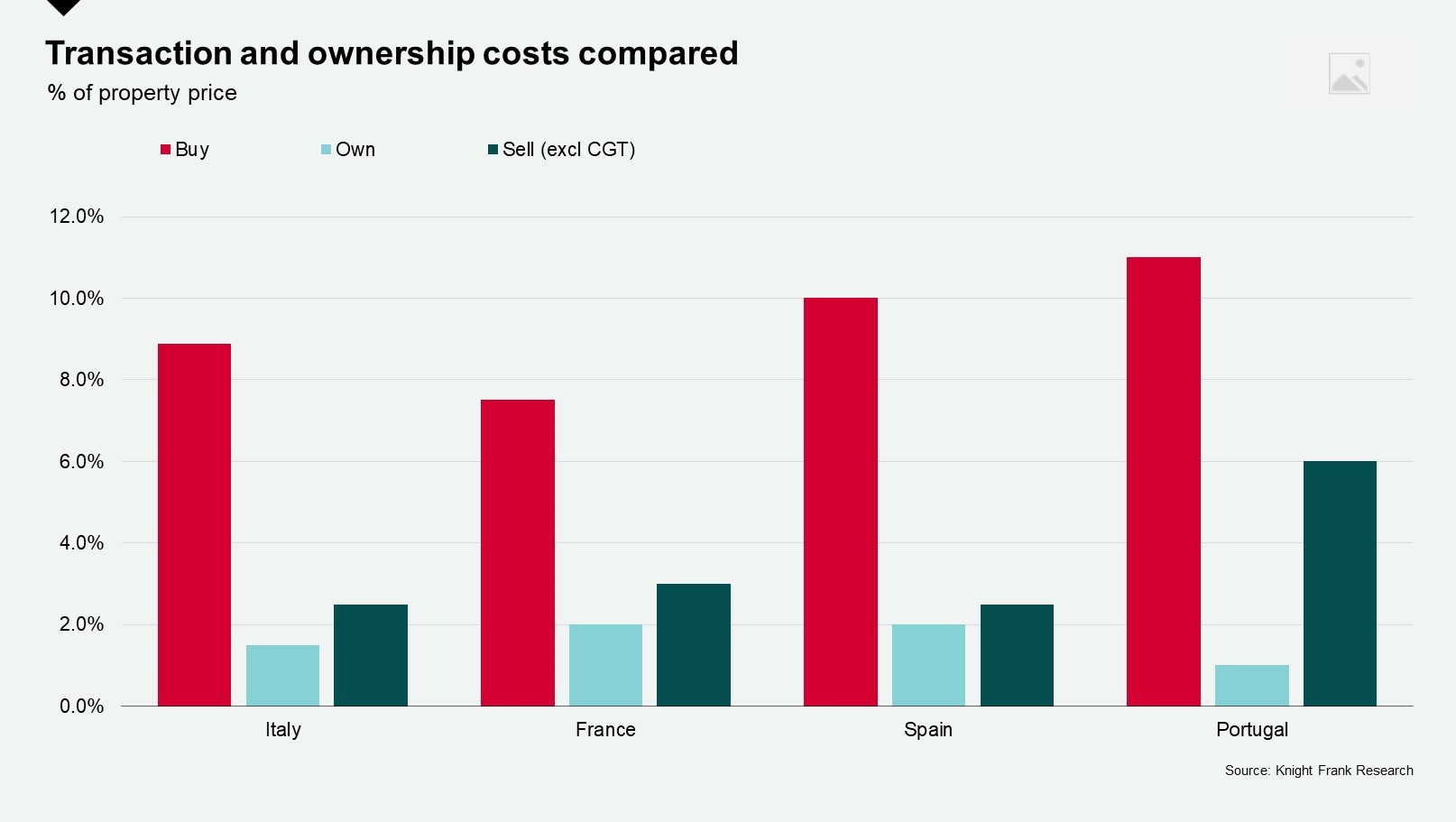

5. Italy compares favourably on property taxes

Globally, property taxes vary significantly, with some such as those in Asia frontloading the purchase cost and others such as the US placing a bigger burden on ownership.

In some cities such as Hong Kong SAR, Singapore and Vancouver overseas buyers also face an extra cost in the form of a foreign buyer tax or an additional buyer stamp duty (ABSD).

European taxes are relatively low compared to other parts of the world and Italy compares favourably, particularly in relation to ownership costs, which can be as low as 1.5% of the purchase price per annum.

Knight Frank has been selling property in Italy for more than 25 years and offers unrivalled knowledge and expertise when it comes to advising buyers, sellers, developers or investors.

With a comprehensive network of over 10 offices stretching from Lake Como to Rome, we are able to provide you with the advice you need when buying or selling.

Get in touch today to discuss your property requirement in Italy or sign up to receive our Italian research to keep up to speed with market conditions.

Photo by Food & Viaggi by Moira Nazzari on Unsplash