Jersey Residential Market Update 2020/21

Residential property prices are up, and the quality of life and wealth management expertise that the island offers continues to attract high-net worth individuals.

3 minutes to read

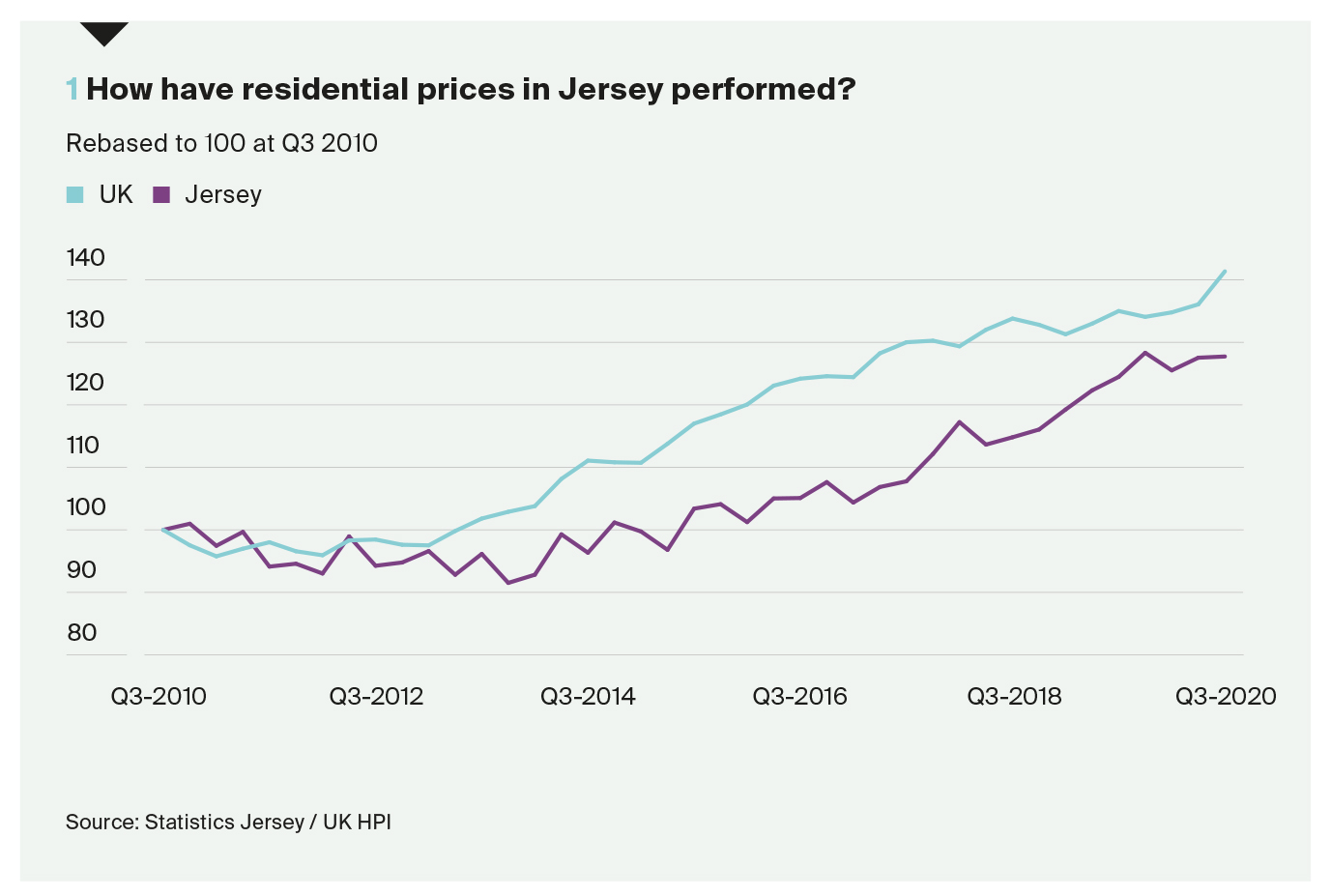

In a similar way to the UK, the property market in Jersey has performed strongly in the second half of 2020 despite the backdrop of a global pandemic.

Prices rose 1% over the third quarter of the year, lifting the annual increase to 3%. The average property price of £533,000 was close to the all time high reached at the end of 2019, as figure 1 shows below.

Furthermore, there were 380 transactions in the third quarter of 2020, an increase of 111% on the second quarter, when Jersey was in lockdown, and 24% higher than the same period in 2019.

Momentum has been driven by a growing economy, rising employment, sustained inward migration, and a lack of housing supply. Based on projected population growth, there is a shortfall of 2,750 homes for the three-year period to 2021, according to Statistics Jersey.

Jersey ranks above the OECD average in the Better Life Index, which compares well-being amongst 41 countries, ranking 19th overall. Some 80% of people of working age were employed compared to 75.2% in the UK in 2019. Education is also a draw for prospective buyers, with 32.3% of A-level students achieving an A or A* grade in 2019 compared with 27.6% in England. It also has fibre-optic connectivity speeds of 1-gigabit per second across the island, surpassed globally only by Singapore and Taiwan.

Jersey continues to attract highnet- worth individuals (HNWIs), drawn by the lower-tax environment and lifestyle, which supports a significant amount of transactional activity above £1.5m. Our Wealth Report Attitudes Survey of international investors highlighted that 21% of ultra-highnet- worth individuals intended to purchase a new home this year.

Jersey has operated as an international finance centre for close to sixty years. For financial services Jersey has access to the EU market through its own bilateral arrangements, independent from the UK. It has more than £600bn of private wealth under management via more than 30,000 trusts. Its extensive family and private office network is another attraction for high-net-worth individuals.

HNWIs wishing to relocate to Jersey can do so via the High Value Residency (HVR) scheme, which is run by Locate Jersey. Individuals are taxed at 20% on the first £725,000 of worldwide income and 1% on anything over that amount. Successful applicants are granted ‘entitled’ status on the island, which is necessary to rent or buy property, which is required to be valued in excess of £1.75m.

There were 21 approvals last year – versus the five-year average of 19 - and there were 20 properties purchased in the first nine months of the year, compared with 13 in 2019. HVR approvals accounted for a quarter of the 48 transactions over £1.5m in 2019.

Pandemic performance

By November there were close to 800 confirmed cases of Covid-19, with the island’s economy reopened under social distancing restrictions that are less onerous than in the UK. Our Global Buyers Survey, conducted in June to gauge reaction to the pandemic, found close to two-thirds of buyers looking for a second home abroad would be influenced by how well a government had handled the Covid-19 crisis, something that potentially casts Jersey in the same favourable light as the likes of New Zealand and Singapore.

Jersey entered lockdown on the 29 March before the property market reopened on 11 May. Pent-up demand has been released in recent months, mirroring the recovery seen in the UK as islanders look for more space to live and work.

Inward migration over the past four years has averaged more than 1,000 annually and the island’s population currently stands at more than 107,000. There were a record 61,500 people employed at the end of 2019, with the biggest employer being financial and legal services (22.4%); followed by education, health and other services (13.2%); and the public sector (13.1%).

Read the report in full here