Italy’s prime market recovery accelerates post-Covid-19

With Italy in lockdown from 9 March to 4 May and the authorities enforcing one of the strictest lockdowns globally according to Oxford University’s Stringency Index, residential sales inevitably ground to a halt for several weeks.

4 minutes to read

However, Nomisma, the Italian real estate institute, is forecasting that residential sales nationally will total 494,000 in 2020, down only 18% on last year’s figure of 603,000 – this represents a relatively upbeat assessment which is supported by data from our Italian network:

- Since property viewings were permitted in Italy on 18 May, enquiries from Dutch, British and German buyers have accelerated.

- Demand is strongest within the €1.5 million to €2.5 million price bracket in most prime markets, as well as the market over €10 million.

Prices for lakeside properties on Lake Como have increased by 5% since May.

- Several markets have seen tenants that opted for long-term rentals at the start of lockdown make purchase offers on properties in the same area

- Knight Frank’s office in Lucca saw enquiries from German buyers jump from 12% of all enquiries to 39% in April.

Online viewings for properties in Tuscany have increased 112% since the Covid-19 pandemic hit Italy’s shores in February and interest has risen over the four consecutive months.

According to Mark Harvey, Head of International Sales at Knight Frank, “The announcement of a $750 billion coronavirus recovery plan by the European Union last month, re-emphasised Europe’s fiscal unity and positions the Euro as a compelling alternative to the dollar.

This, combined with the fundamentals offered by Italy both as an investment and second home retreat has sparked buyers’ interest post the pandemic.”

Serena Bombassei, Head of Sales in Knight Frank’s Venice office comments: “We have agreed a number of sales in recent weeks priced between €700,000 and €4 million with buyers coming from France, Greece, the UK and of course Italy.”

Some 200 miles north-west on Lake Como, Roberto Bordo from Knight Frank’s partners Reale Domus, is seeing an uptick in German, Danish and Swedish demand post-lockdown, but the key trend has been the demand for outdoor space, “Whether an apartment with a terrace or a villa with landscaped gardens, outdoor space is now a prerequisite for all our buyers” confirms Roberto.

Buyer profiles

There are two types of buyers emerging. Firstly, those that are re-evaluating their residency and looking to take advantage of Italy’s attractive flat-tax with many targeting high price brackets (often €10 million+) given this will be their primary residence.

Secondly, there are buyers seeking a second home for use over a two to three-month period each year. Increasingly, such buyers are wanting excellent broadband, proximity to cultural hotspots, good transport links and the ability to accommodate extended family.

According to Bill Thomson, Chairman of Knight Frank’s Italian Network”: Rural markets are in favour with buyers of all nationalities looking to Italy as a safe haven. The perception of Italy is of a country that has handled Covid-19 well, and that will provide real quality of living in the future.”

Italy is on the UK’s list of air corridors which means visitors returning to the UK do not need to self-isolate for 14 days. British Airways has resumed service to 16 Italian cities and EasyJet is flying direct to Milan, Naples, Rome and Venice from London Gatwick.

The market pre-Covid-19

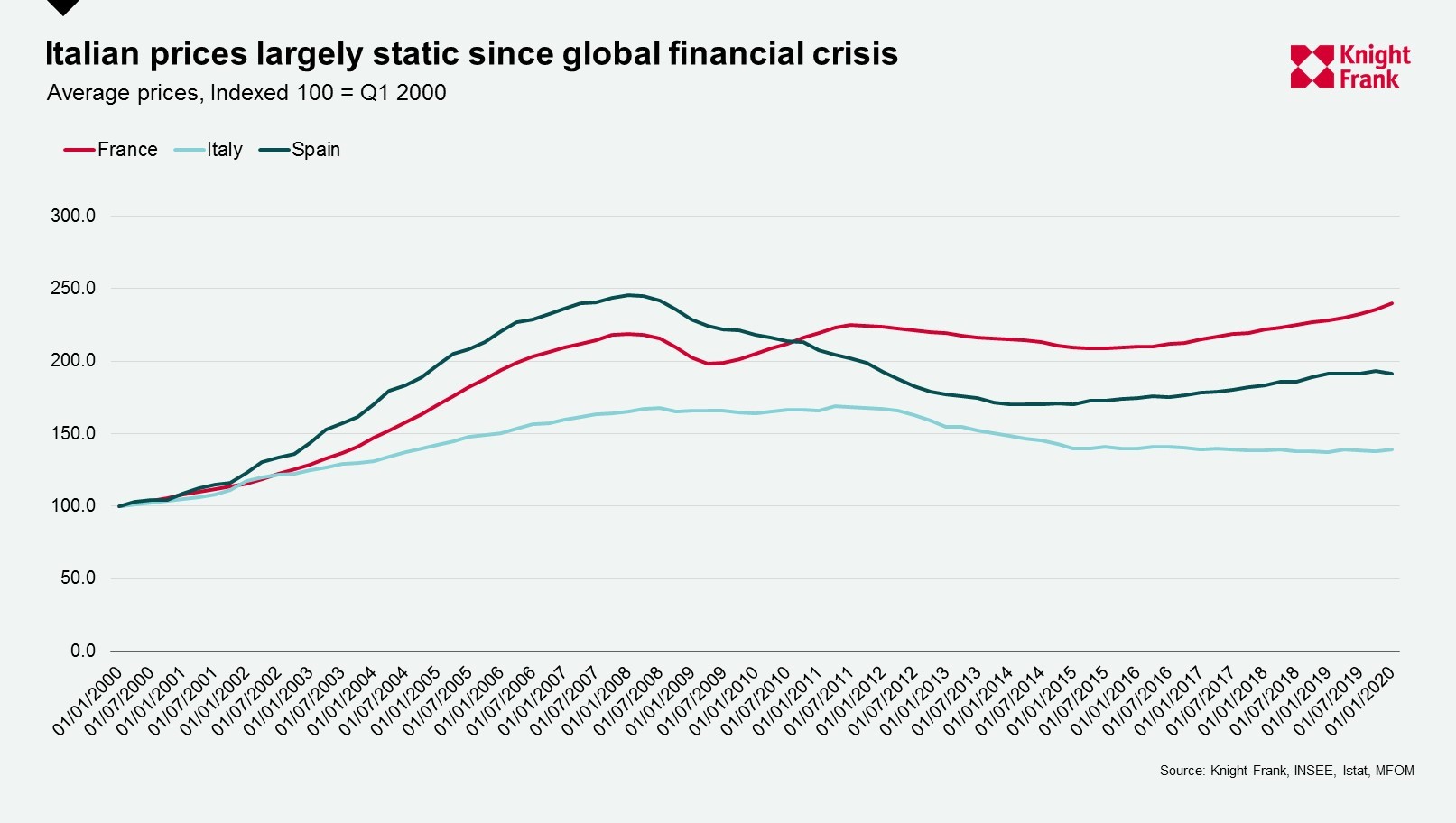

Prior to Covid-19 residential sales were strengthening on the back of low interest rates, a willingness on the part of Italian banks to lend and a rise in short-term lets which boosted demand from landlords. Average prices in Italy have remained largely static over the last decade presenting second home buyers seeking value with a potential opportunity.

What’s the outlook for the market?

Italy’s national market will weaken in the coming months as demand-side indicators such as employment and income levels falter. Italy has the second highest public debt-to-GDP ratio in the European Union and its tourism sector accounts for 13% of the country’s GDP.

Against this background, Nomisma estimates it will take three years for the country’s property market to recover.

The country’s prime segment, however, is better insulated and unlike in 2008, the market is at a different stage in its cycle having seen almost a decade of static or falling prices, interest rates are at historic lows and prime inventory levels are declining. The combination of these factors and the perception of a high quality of life is providing an upturn in enquiries in the international market.

View a selection of properties for sale in our 2020 Italian View, dive deeper into the Lucca market or learn what Italy’s flat tax can offer global high net worth individuals looking to relocate.

For more information on the Italian market or to discuss any property requirements you might have do get in touch with Mark Harvey

Photo by Noah Mayer on Unsplash