Private investment and cross-border capital

Will private buyers remain active in 2023? We analyse data from our Capital Gravity Model to predict private capital trends.

4 minutes to read

Macroeconomic headwinds are expected to continue in many locations globally over the coming year, even if there are some green shoots of optimism and the IMF has revised its forecasts up for once.

In previous periods of dislocation, we have seen private buyers rotate back into the global commercial real estate market. Will we see it happen again in 2023?

Private buyers increase investment

Following the global financial crisis, private buyers increased investment by 44% and in 2021, following the first year of the Covid-19 pandemic, global private investment grew by 88%. The appeal of commercial real estate clearly remains, despite the economic backdrop.

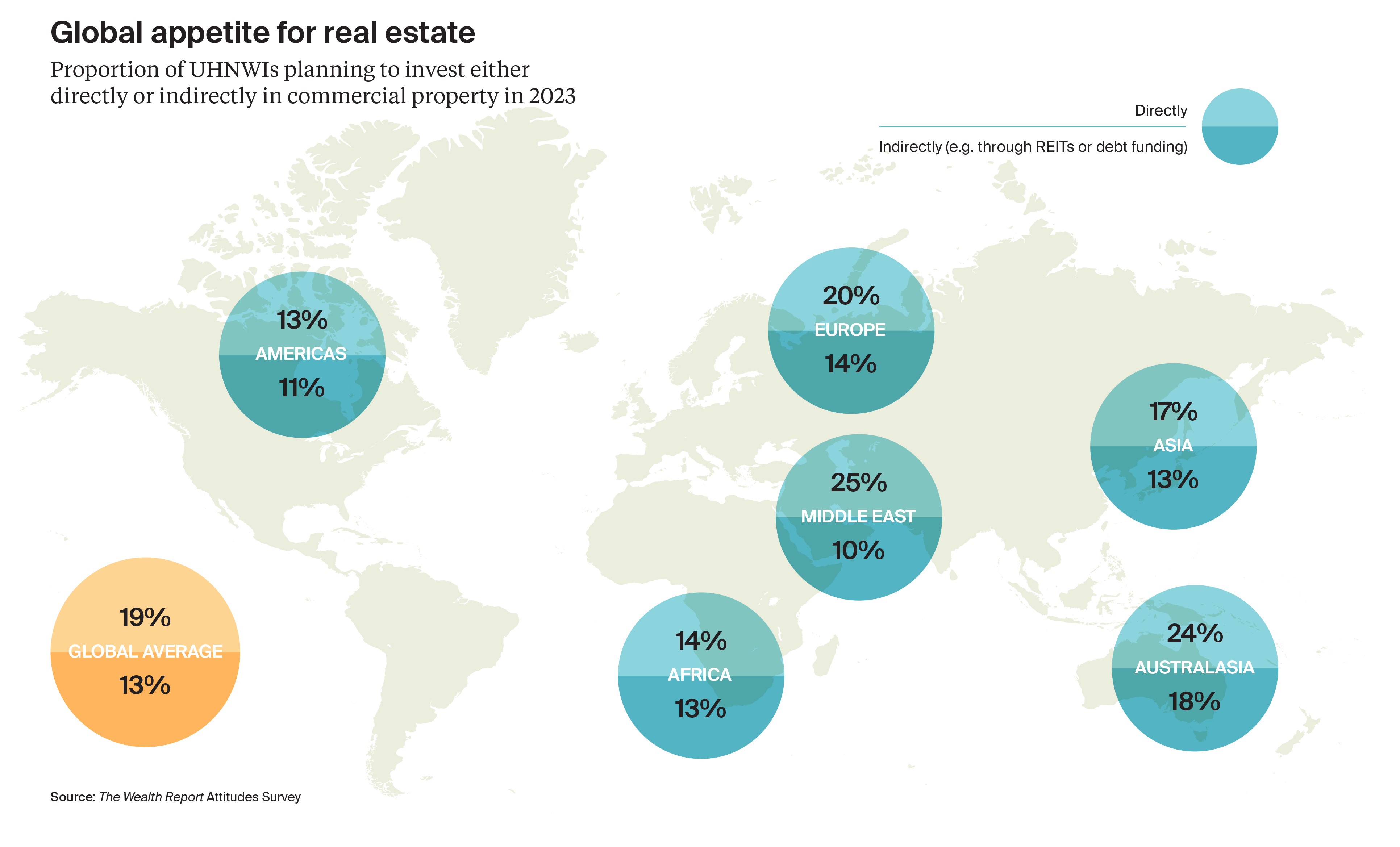

In fact, 19% of respondents in our Attitudes Survey were looking to invest directly in commercial real estate in 2023, while 13% were seeking to invest indirectly, for example through REITs or debt funding.

In line with this, our Capital Gravity Model, from Active Capital, forecasts 2023 to be the strongest year for cross-border private capital since 2019. This is reflected in our HNW (high-net-worth) Pulse Survey, with nearly 40% of respondents considering investing in commercial property outside their country of residence.

Debt looks set to be a key consideration for all investors in the year ahead. With interest rates at multi-year highs, and the all-in cost of debt elevated in most markets, we could see affordability challenges.

This is especially pertinent given that global commercial real estate investment was 19% and 31% above the long-term average in 2017 and 2018. If we assume a five year loan term, debt-backed buyers will be facing higher costs upon refinancing as these loans come to maturity this year.

"Debt looks set to be a key consideration for all investors in the year ahead"

Higher debt costs may lead to opportunities for equity injection or partnering, as well as assets being brought to the market, should investors choose not to refinance. This is where private buyers may be particularly well positioned in 2023 as private capital is typically less reliant on debt than other investors.

What will investors be targeting and where?

The US is expected to be the top destination for private capital next year, followed by the UK, Germany, Japan and the Netherlands. Of the top 10 destinations for private cross-border capital, seven are in Europe, with private investors favouring the continent.

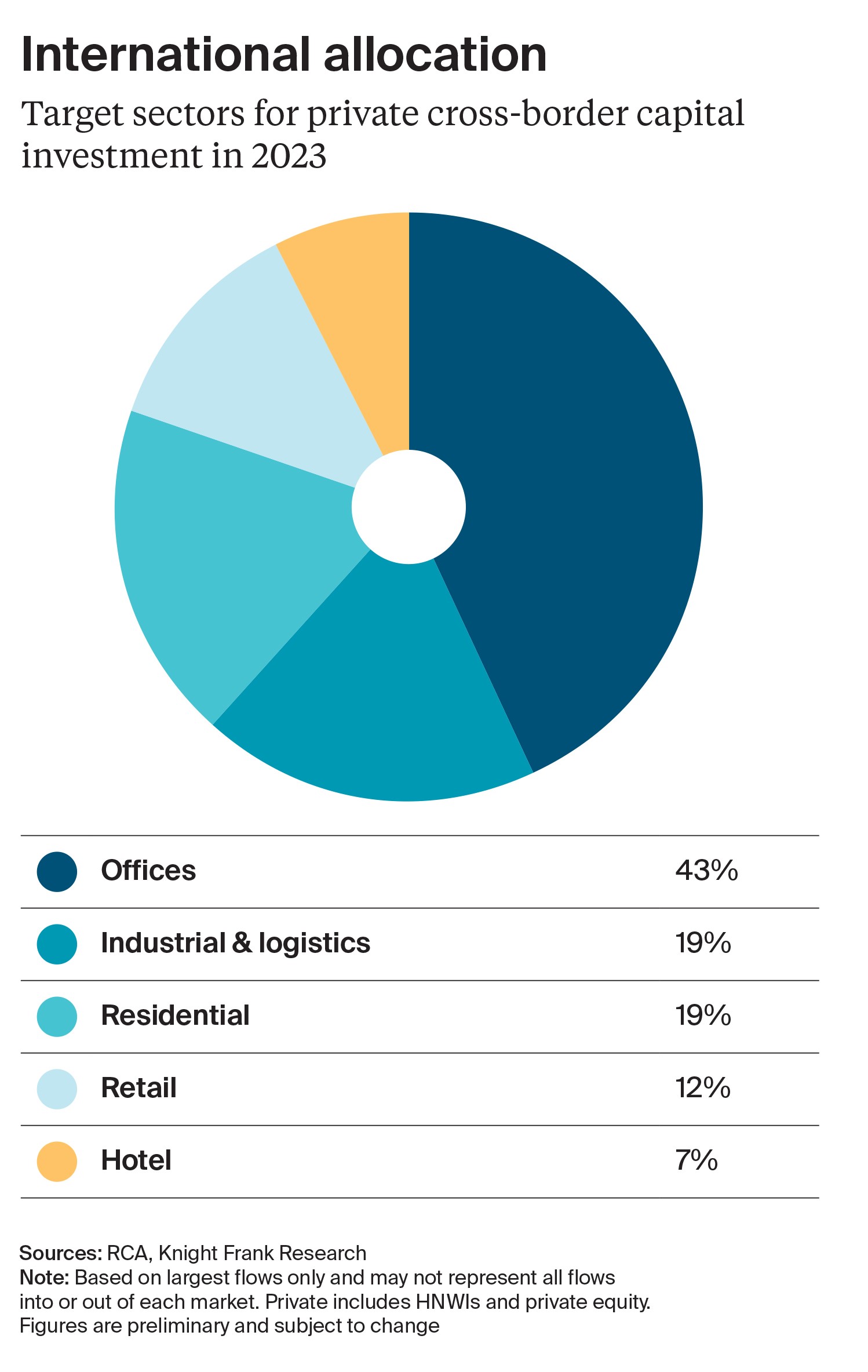

Offices will continue to dominate. More than 40% of total private cross-border capital is forecast to be targeted at the office sector, while industrial and residential are each expected to receive a 19% share.

We forecast UK offices to be the top target for private investors in 2023, with offices in the US, Germany, Australia and the Netherlands also likely to see robust demand.

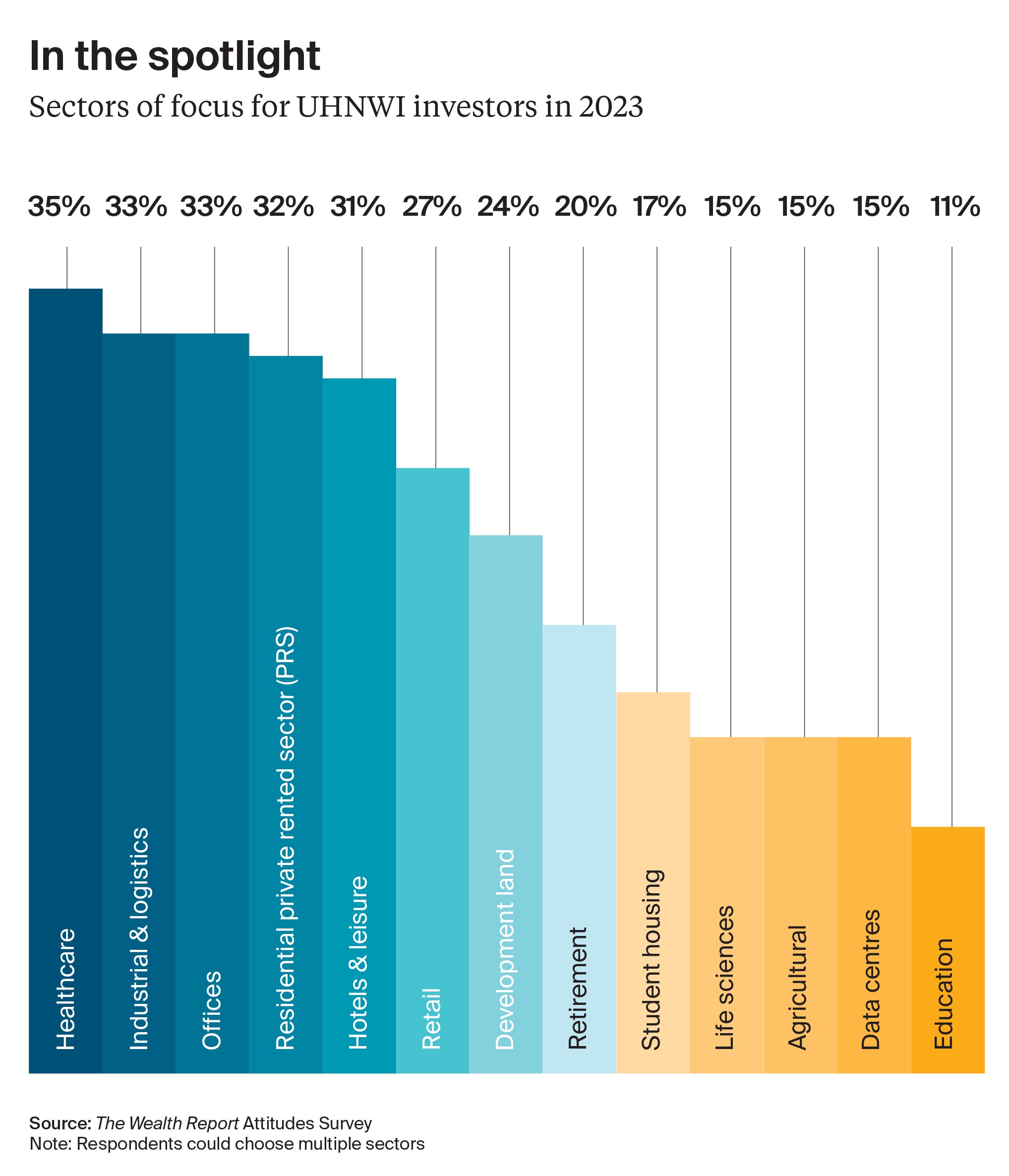

More traditional sectors will remain in demand for HNWIs (high-net-worth-individuals), albeit alternative asset classes are also likely to be targeted.

Our Attitudes Survey highlighted that just over a third of respondents globally were looking to invest in healthcare-related assets in 2023, the second year in a row that this asset class topped the wish list.

The results also pointed to strong demand for private rented sector, leisure, hotels, student accommodation, life sciences and data centres. These more specialist sectors are often countercyclical and benefit from structural drivers which typically prove popular with investors, especially in times of uncertainty.

Which regions will invest most?

Investors from the US are forecast to be the most active, accounting for roughly half of all global private cross-border capital into commercial real estate in 2023. Likely targets include offices in the UK, Japan and Singapore, as well as industrial assets in Germany, Japan and South Korea. Private investors from Singapore, Germany, the UK and Canada are also expected to be active this year.

More specifically, HNWI capital from Brazil, the US, UAE, Germany, Spain and Switzerland is forecast to be prominent in 2023, with offices and retail in the UK a particular focus. Close to 10% of respondents in our HNW Pulse Survey were looking to complete a transaction of US$20 million or more in 2023. This figure jumps to 20% for investors from the Chinese mainland and 14% for those from both Singapore and Spain.

Even as the global economic outlook becomes less gloomy, a heightened level of uncertainty remains and risks are skewed to the downside, as noted by the IMF in its January World Economic Outlook Update.

With almost half of our Attitudes Survey respondents citing real estate as an opportunity for wealth creation, private investors will continue to be active throughout 2023 as they diversify and seek capital appreciation as their primary goal.

Knight Frank Capital Gravity Model

We use the latest machine learning and regression techniques alongside unique datasets to predict the flow of real estate capital in 2023.

Discover more

Download the report to see some of the global opportunities – and associated entry points – on page 24 of the report.

Download the full report

Download the full report for more in depth analysis and the latest trends relating to global wealth.

Download the report