International property: housing markets start to feel the squeeze but it may be short-lived

Market indicators suggest a short, sharp slowdown may be on the cards with some economies reversing rate rises as early as the second half of 2023.

2 minutes to read

House prices

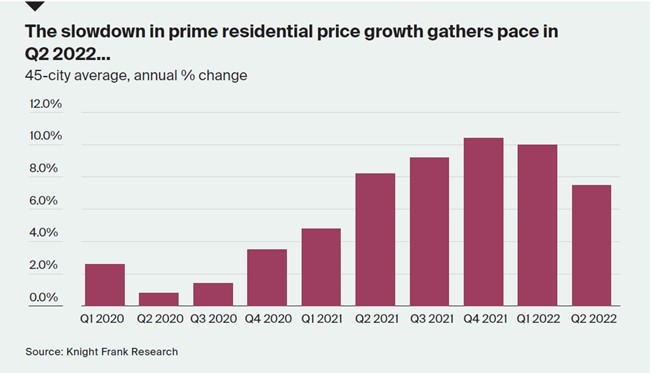

House prices are still rising but the latest assessment of prime prices across 45-cities globally confirms the rate of growth slowed in the year to June 2022. The Prime Global Cities Index saw annual price growth decline from 10% Q1 2022 to 7.5% in Q2 2022.

The size and pace of interest rate rises and the permanence of the surge in the cost of living will determine the extent of the slowdown in house price growth. But, the pain of rising mortgage rates will be harder to bear in some markets than others.

We’ve crunched a range of indicators, from house price growth to the proportion of variable rates mortgages, and from household debt to the size of rate hikes to date. Of the 26 markets tracked, we expect Canada, Sweden, Hong Kong, the Czech Republic and New Zealand are likely to see the biggest housing market slowdowns.

But this isn’t 2008. There are four key reasons we think price falls will be limited to a few key markets.

1. Demand: Although coming off pandemic-induced highs, remains relatively robust.

2. Supply: Most advanced economies are still suffering from a historic backlog of undersupply. According to The Economist, America is short of either 8m or 5.8m homes; England needs an estimated 345,000 new homes a year, and is building half that number; and Canada requires an additional 3.5m by 2030 at the current pace of construction.

3. Mortgage market: Bank lending adheres to a much tighter set of lending criteria.

4. Labour markets: Low unemployment in advanced economies means few forced sellers. Plus, household finances are in better shape post the pandemic due to accrued savings.

Anatomy of a slowdown

Analysis by Capital Economics suggests house price falls are often the final stage in a chain of events.

The forecasting house has broken down a housing market slowdown into four key phases:

1. House buyer sentiment surveys start to dip

2. New buyer enquiries slow

3. Sales and construction rates decline

4. House price growth weakens or falls into negative territory

In 2022, we’re seeing markets react quicker but in a more nuanced way due to the atypical set of circumstances brought about by the pandemic.

The staggered reopening of borders, variable supply chain shocks, differing inflationary pressures and the speed and scale of the resulting rate hikes will all have a bearing.

Read more or get in contact: Kate Everett-Allen, head of international residential research