Why demand for homes in Barcelona looks set to outweigh supply for some time to come

Since the turn of the millennium, Barcelona has evolved into a key destination for the wealthy and that trend is set to continue.

2 minutes to read

The number of individuals living in the city with more than US$30m in assets is forecast to grow by 61.3% to 2,298 by 2026. But, Barcelona's property market is arguably one of the most regulated in the world.

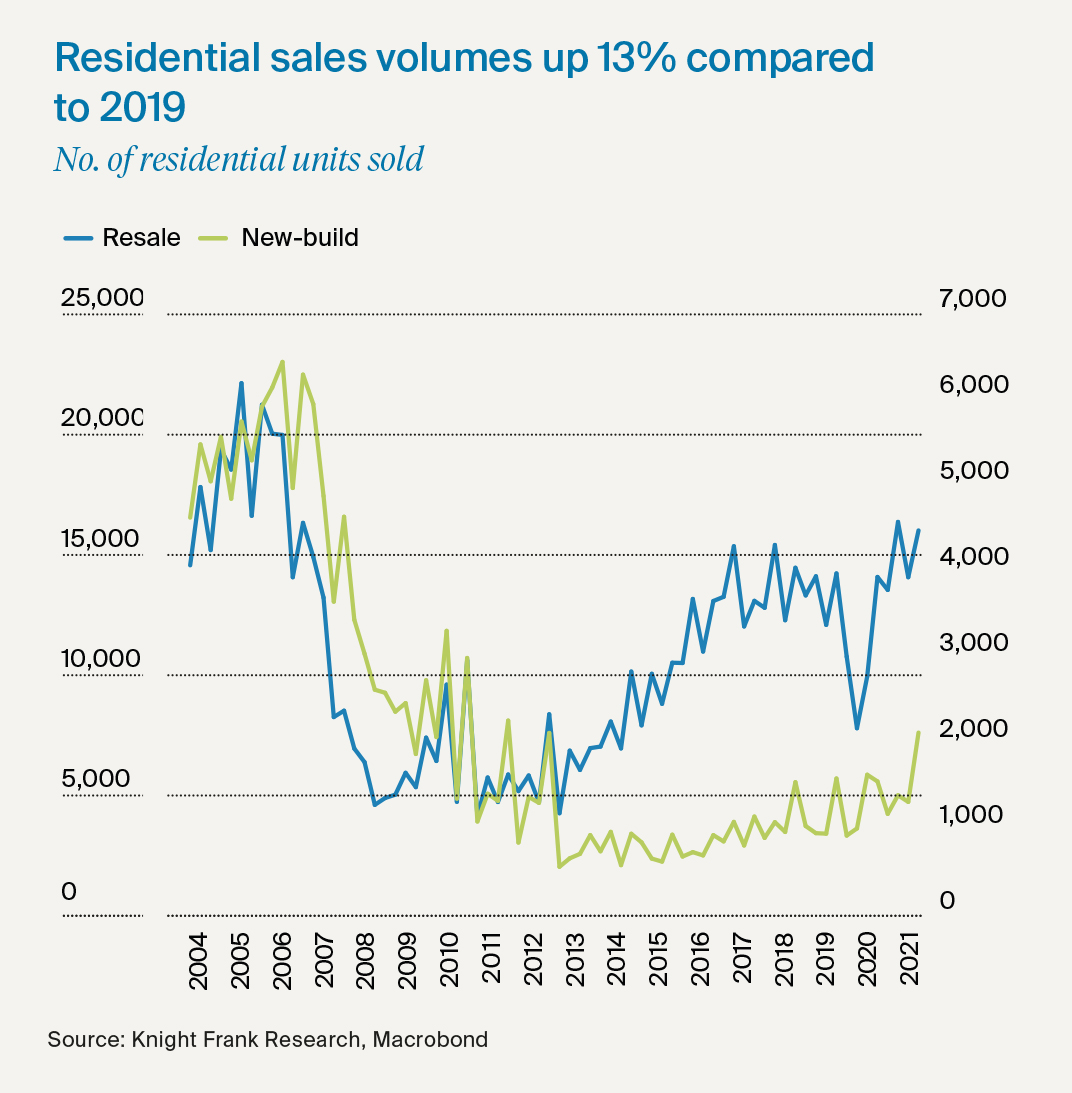

This means new supply is limited and demand continues to grow pushing prices higher. New supply has dipped in response to regulatory measures with only 8,119 properties completed in 2021, down from 44,160 in 2008.

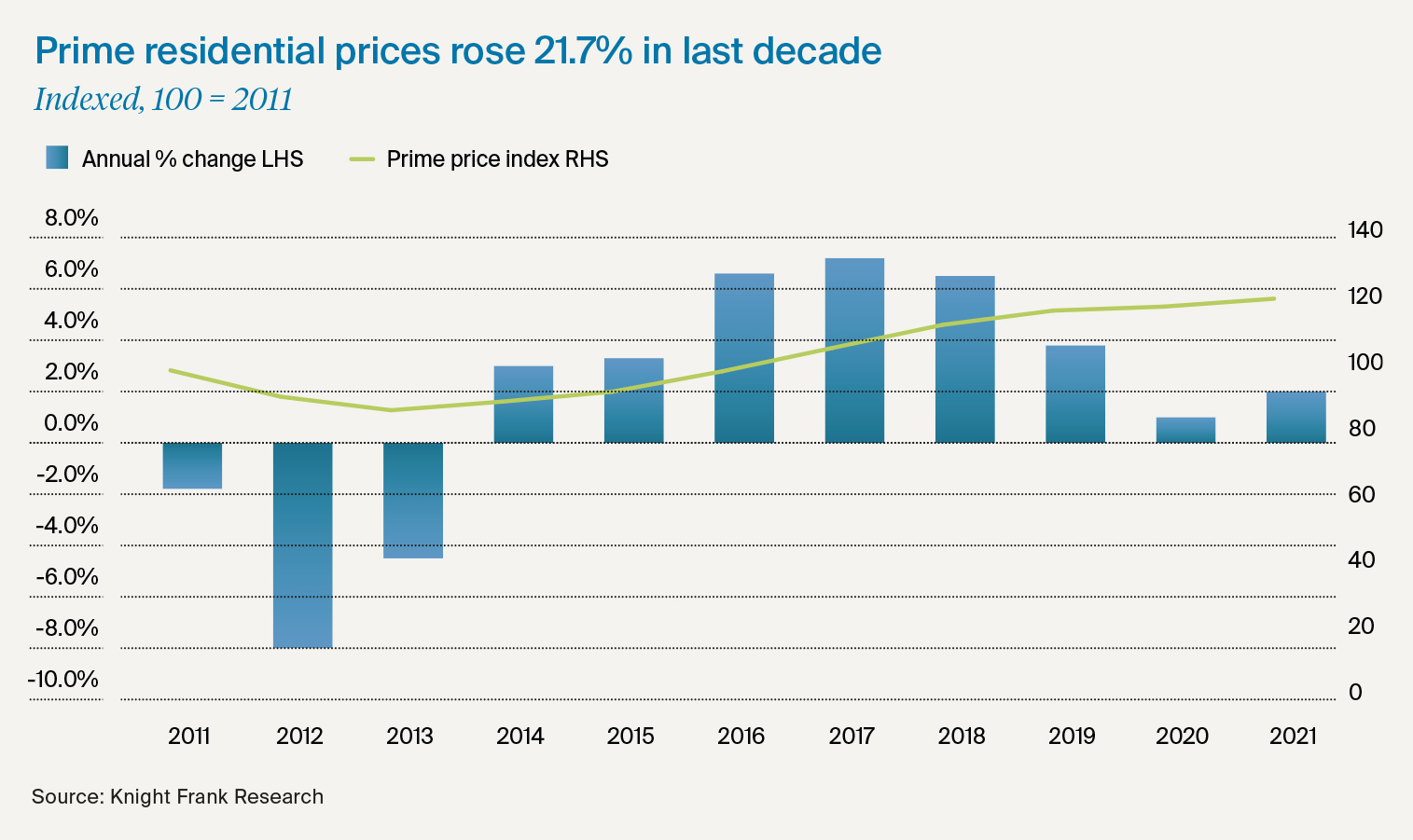

Prime prices, or the top 5% of the housing market in value terms, have increased around 21.7% in the last decade and are forecast to rise by a further 4% in 2022 alone.

Why Barcelona?

Its comparative value is a key draw for buyers with prime prices averaging around €8,200 per sq m and super-prime prices around at €20,000+ per sq m. Coastal resorts in the South of France achieve double these values and even northern Italy commands significantly higher prices.

The city is a beneficiary of the trend for co-primary living – those wanting to use their second home on a semi-permanent basis. Even for non-EU residents, such as UK purchasers, this is a realisable goal despite the 90/180-day rule post-Brexit.

Buyers in Barcelona are taking on a younger profile with thirty or forty-somethings relocating to join the city’s expanding digital and tech sector.

One of few major European cities to combine city and beach living, Barcelona offers almost 5km of coastline. Areas outside the old town, or Ciutat Vella, such as Diagonal Mar, home to Port Forum, the UPC University Campus and the National Sciences Museum, are emerging as key neighbourhoods given the social and cultural amenities on offer.

Around 15% of buyers in Barcelona are currently from overseas but according to Barcelona City Council, only 4.3% of the 827,557 dwellings are owned by foreigners, either directly or via a company structure.

Policy intervention

A ban on the development of new hotels in 2017 saw demand for holiday rentals surge. A year later developments above 600 sq m were required to set aside 30% for social housing.

In 2020, Catalonia introduced a new rent cap and in 2021 all short-term private room rentals were banned, this was recently overturned by the Constitutional Court but a new housing bill going through the Spanish Parliament might devolve rent control powers to the regions which could see its reintroduction.

Despite the policy intervention, which to date has largely targeted the buy-to-let market, residential sales across Barcelona reached 66,000 in 2021, up 38% compared to 2020 and up 13% compared to pre-pandemic levels in 2019.

Download the full Barcelona Residential Market Insight here

For more information on the Antares development Knight Frank is marketing in Barcelona please contact Oliver Banks