Superyacht market accelerates

The Wealth Report talks to Will Mathieson, Editorial & Intelligence Director at analyst Superyacht Intelligence, to get the latest lowdown on the world of superyachts

4 minutes to read

According to press headlines many yacht owners took to the ocean to escape the Covid-19 pandemic. Did the reality match the hype?

The reality rarely matches the hype, and this case is no different. There was plenty of lazy rhetoric about yachts becoming ‘safe havens’ for the ultra-wealthy. But retrospective analysis shows that Mediterranean cruising in 2020 was actually down 13% YoY – an unsurprising statistic, and by no means dramatic, considering the severity of the pandemic, but nevertheless in countenance to the hyperbole being purported the mainstream media.

While usage was understandably constricted, there have been some encouraging signs for the market, in ownership terms, with demonstrable growth in both the new-build and second-hand markets.

What are the key trends your data is showing you in terms of the new-build and resale markets?

Both of our industry’s ‘key market health trackers’, new-build orders and second-hand sales, show very encouraging signs. Some of this is down to the general increase in wealth around the world, but the “race for space” we have seen during the pandemic has also played its part.

Following two years of steady decline, the global order book (the cumulative figure for all ≥30m superyachts currently in build or under contract for construction), the end of the first quarter of this year had shown a notable rise to 397 vessels. This was a 14.7% increase on the figure at the close of 2020. It was also within touching distance of the previous five-year high of 418, recorded at year-end 2017.

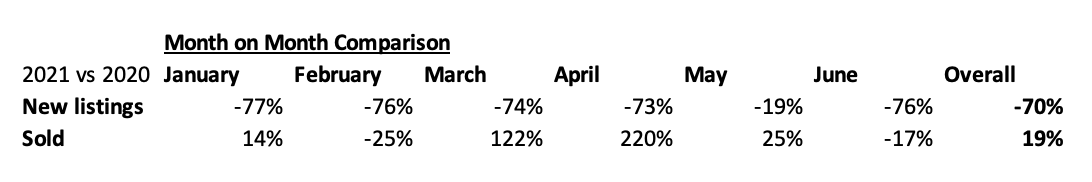

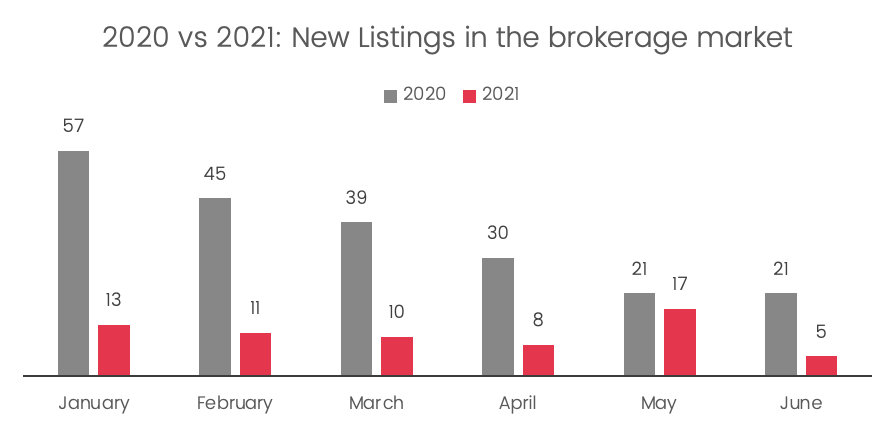

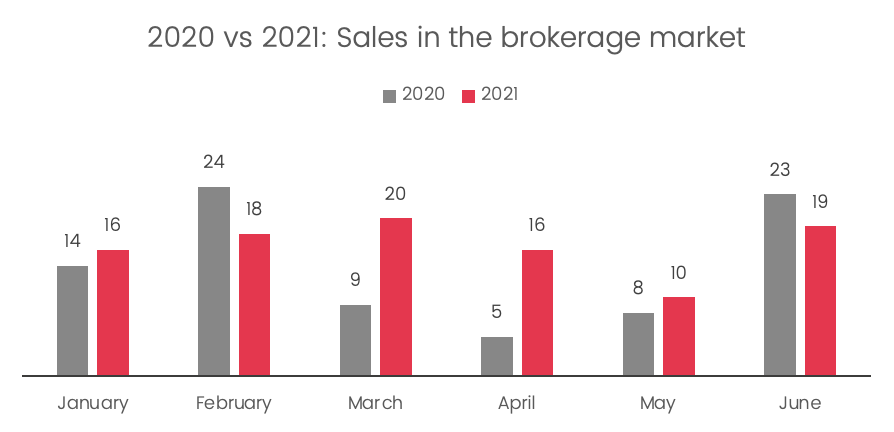

With regards the resale market, the picture is also encouraging. The first half of 2021 showed a huge 19% YOY increase in yacht sale/purchase transactions, while new listings were down a staggering 70%, a key indicator that yachts are in use or panned for use.

Crucially, the second six months of 2020 saw the market record 129 sale/purchase transactions. So, with the second half of this year beginning in earnest, a similarly prolific market dynamic has the potential to lead to a record-breaking year for second-hand sales.

And how is the charter market faring?

After the decimation of the charter market in 2020, charter brokers are facing completely the opposite situation this summer. With so many of 2020’s charters deferred to this year, for the benefit of both client and vendor, charter brokers have found themselves in a mad scramble to find enough inventory to furnish this year’s new market entrants.

Lawyers too have explained how the contractual process has become more protracted after a spate of disputes last year linked to the flimsy nature of traditional charter contracts; lawyers on both sides are being asked to fortify their terms of agreement. All in all though, these are welcome challenges for the charter market, and demands remains sky-high this summer.

Are you seeing an increase in demand from less traditional yacht-owning regions of the world like Asia?

Asia has long represented something of a conundrum for the superyacht industry. A number of the top production builders have enjoyed success through regional dealerships led by embedded local experts, but the custom builders have historically found it harder to gain traction. This however, is changing. Through more nuanced and region-specific sales and marketing, the top European builders are starting to enjoy modest success within Asia, and specifically Hong Kong and mainland China.

The issue impacting market growth now however, is the lack of berthing and service infrastructure. While Asian superyacht ownership is on the increase, many of these individuals are operating their vessels exclusively in the Mediterranean because of the lack of large yacht-specific infrastructure, particularly in the aforementioned locations.

How is the burgeoning ESG agenda influencing the superyacht sector?

This topic is a thorny one for me personally because for many years the lack of discourse surrounding topics such as diversity or sustainability was a bugbear of mine. I am happy to say, however, that there is an ever-greater shift towards professionalism within our industry and movements have emerged that address both our environmental and social responsibility.

As a manufacturing industry, sustainability is of particular importance and there are some serious organisations, such as the Water Revolution Foundation, evaluating how wastage of all types can be reduced. In my opinion, the quickest route to success and widespread adoption is in repackaging the concept of ‘sustainability’ into one of ‘efficiency and optimisation’. Ultimately, the two come hand in hand, but the latter better conveys the ROI that the clients are also looking for.

Charts courtesy of Superyacht Intelligence