Tax, mobility and the generational divide, key takeaways from our Global Wealth webinar

The second in The Wealth Report Insight series of webinars focused on global wealth trends. Host Flora Harley shares her favourite insights from the event

4 minutes to read

Our expert panel comprised:

-

Julie Gauthier - Director at multi-family office Stonehage Fleming

-

Katie Good – Citizenship and residency expert at solicitor Fragomen LLP

-

Alex Ogario - Head of Private Office at Knight Frank Finance

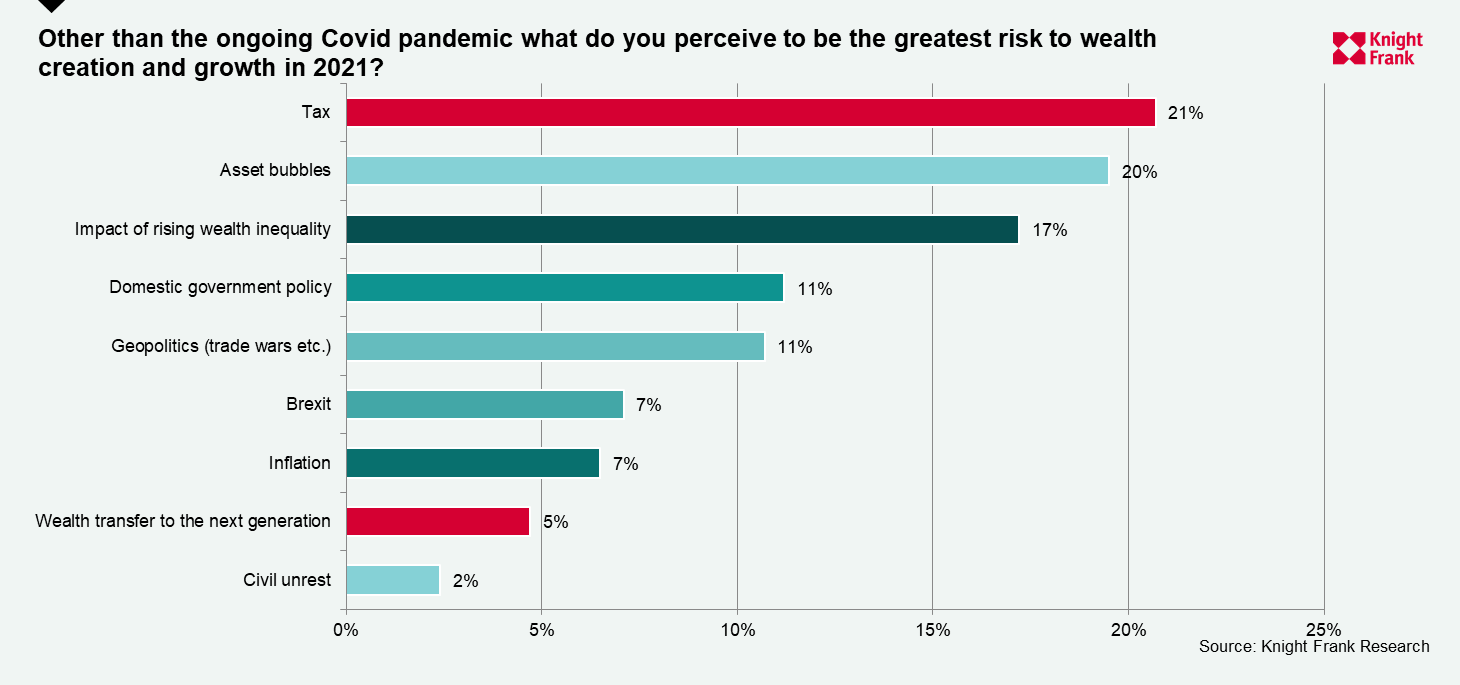

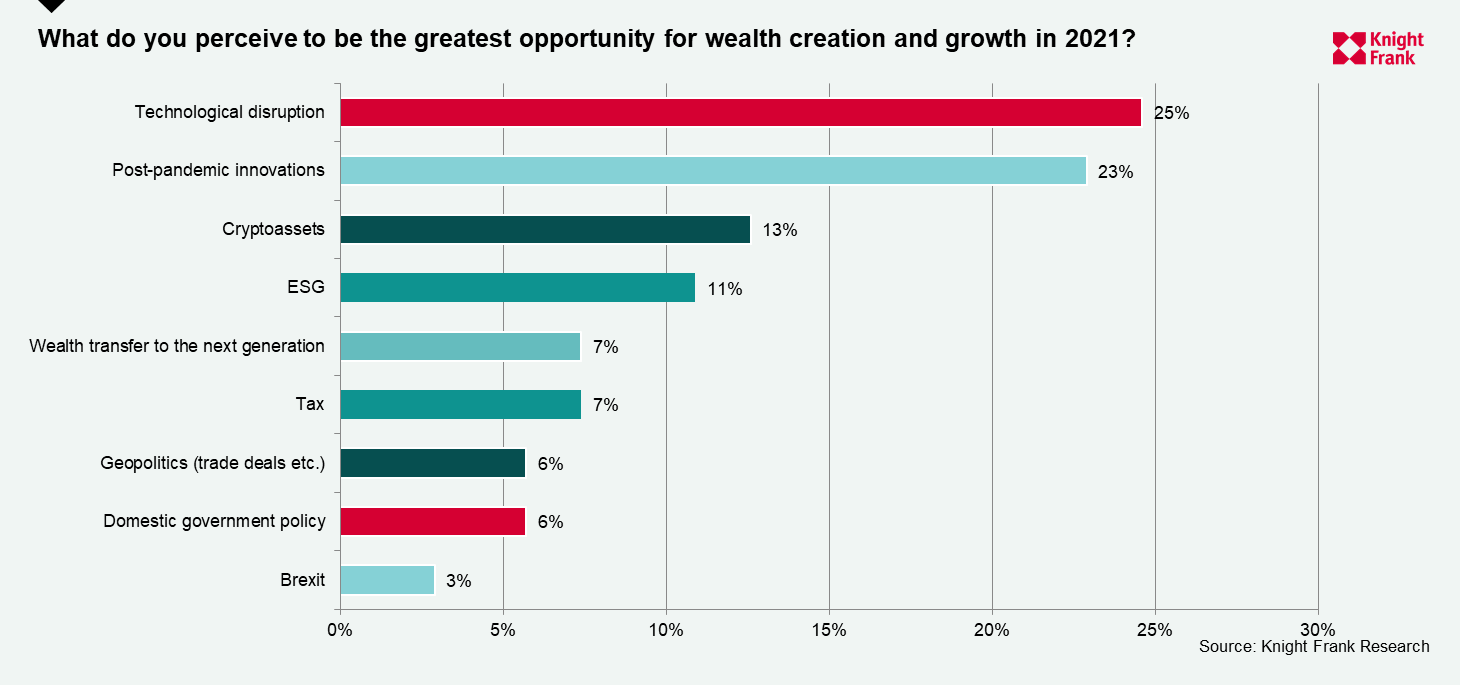

Before I delved into all things global wealth - from succession to migration and crypto assets - with my panel, we asked our viewers to take a simple poll asking them what they view as the biggest opportunities and threats facing wealth creators at the moment.

The influence of tax and tech

After the pandemic, tax was considered the single biggest issue facing wealth creators this year, according to our respondents.

Although it’s ‘too early’ to tell, exactly which direction governments will choose when it comes to paying for the pandemic and reducing wealth inequality, we’ve seen an indication that the wealthy could be in the cross hairs in the US, Argentina, Canada and South Korea.

Tech disruption was labelled as the top opportunity, but this also plays into one of the biggest risks.

Equity markets rallied in the latter half of 2020 and into 2021, led largely by tech companies. In addition, 2021 has been a bumper year so far for crypto assets with Bitcoin hitting new highs of over US$60,000 and artworks sold as blockchain-based non-fungible tokens (NFTs) selling for as much as US$69 million.

It’s no wonder these assets register high on the list of opportunities, but our respondents were also wary. Potential asset bubbles were considered the second biggest risk facing ultra-high-net-worth investors (UHNWIs). See the full results in the charts below.

These factors will need to be taken into consideration by wealthy individuals who are seeking more residency and citizenship options because of Covid-19. Yet the pandemic has also brought succession to the fore for many families and there are clear divides in generational attitudes to investment.

Mobility in favour

Due to the effects of the pandemic, one thing that UHNWIs are considering is where they have residency. Our Attitudes Survey found that 24% of them are looking to get a second passport or relocate this year and beyond.

As Katie Good explained: “The pandemic is the first real period of travel restrictions, meaning UHNWIs are looking around the world for where they would like a base to work and live freely, which is more relevant with a remote working style”

“Second residences or citizenship offer more mobility as people can return home or to second homes more easily, despite the restrictions.”

The pandemic has also focussed minds on healthcare, she added. “Fragomen have seen an increase in interest in the healthcare capacity of countries [people are thinking of moving to]. This is a now a big consideration whereas before it was not particularly high.”

Julie Gauthier noted that her clients “are thinking where they want to locate to optimise the transfer of wealth to their children”.

Generational divide

Succession has been propelled to the forefront of UHNWIs mind. This is something we point to in The Wealth Report where 57% of our Attitudes Survey respondents said their clients had reviewed their succession plans since the outbreak of the pandemic. Something reiterated recently by reports that in the UK a quarter of individuals were prompted into action or consideration on their will since the first lockdown.

Julie explained that her clients have long been focusing on growth, but with the pandemic they realised the need to preserve what they had accumulated, as discussed in our Family Office deep dive in The Wealth Report. What was of interest is that there is a clear divide in generational attitudes to investing and philanthropy.

There are two groups, says Julie. “The older generation which has built their wealth are now at the point where they want to give back, they are looking at how to have an impact – whether it be socially or environmentally. They want to see a return but have already accumulated wealth and can contribute without having to see that short-term gain.

“However, younger generations, who also want to invest where they can see a change, have to figure out a way to do so whilst also generating a return as if they don’t do that they can’t reinvest and make that difference.”

I explore how that relates specifically to property here, but Julie explained why real estate is still popular with the next generation. “It allows them to have a common goal whilst also exploring their own interests. A lot don’t know where they want to live or what the future holds, but they see is as a blessing to have a footprint in other countries and the ability to live in, rent or flip properties across the globe.”

For more from our panellists and to sign up for future instalments of The Wealth Report Insight series watch the webinar on-demand here.