How geospatial analysis will drive real estate investment in times of climate change

Real estate investors have the ability to tap into more data than ever before when assessing investment decisions, but making sense of it is not always easy. Geospatial analysis brings clarity to their armoury. Here, Knight Frank’s experts examine changing global climate patterns.

2 minutes to read

There are many ways to evaluate the potential risks and opportunities relating to investment portfolios, and the implications of climate change are increasingly part of the mix. In this article, the Knight Frank Geospatial Research team looks at the world through one particular climate-related lens to illustrate the kind of factors that investors could consider.

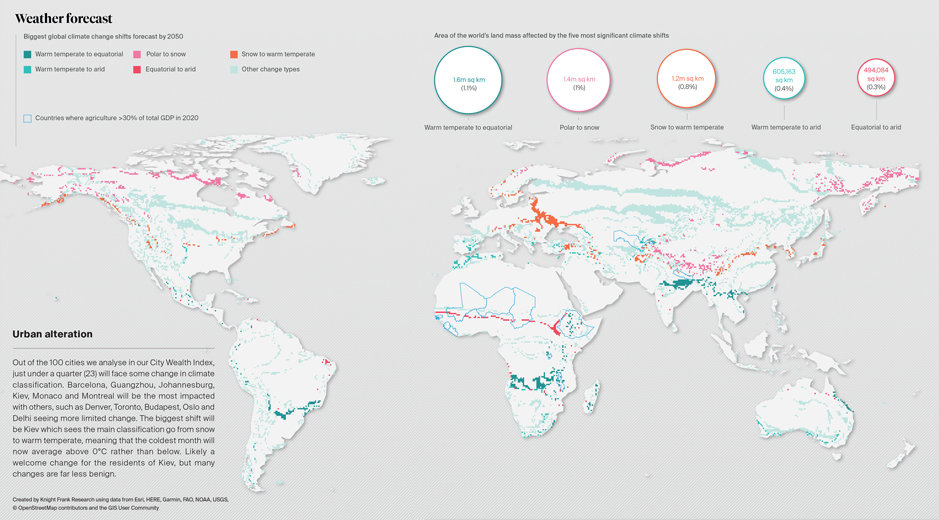

We have split the Earth’s land mass into more than 90,000 50 km squared blocks and, based on climate change simulations from the Special Report on Emissions Scenarios by the Intergovernmental Panel on Climate Change, identified those areas that will see potential localised climate change (as classified under the Köppen-Geiger system) by 2050. We have also highlighted those countries that rely heavily on agriculture – 30%+ of GDP – and that may therefore be more impacted, either positively or negatively, by the change.

Some 20 million sq km, equivalent to more than 13% of the world’s land surface, will see some change and 5% will see a “major” change in its primary climate classification. The map opposite highlights the five biggest changes.

The implications of these shifts have the potential to be vast. By way of example, the second largest change highlighted is from “polar” to “snow”. Where previously all months of the year averaged temperatures below 10°C, between one and three months will now be above that threshold, giving these formerly chilly regions a warming climate for up to a quarter of the year.

Urban alteration

Out of the 100 cities we analyse in our City Wealth Index, just under a quarter (23) will face some change in climate classification. Barcelona, Guangzhou, Johannesburg, Kiev, Monaco and Montreal will be the most impacted with others, such as Denver, Toronto, Budapest, Oslo and Delhi seeing more limited change. The biggest shift will be Kiev which sees the main classification go from snow to warm temperate, meaning that the coldest month will now average above 0°C rather than below. Likely a welcome change for the residents of Kiev, but many changes are far less benign.

Snow prospects

Although not one of the biggest shifts by land area it is worth noting a few cases where the classification moves significantly from snow to arid. This is the case for a large band across Kazakhstan and Mongolia and for a significant area of the great plains of southern Canada and the northern US. This could indicate a lower amount of snowfall, and dramatic temperature swings between day and night of as much as 20°C or more.

Farming futures

The climate classification of a large band across Africa is expected to change from equatorial to arid. In countries that are heavily reliant on agriculture, this could have a significant negative impact on output. Part of Ethiopia will switch from warm temperate to equatorial, which could indicate more rainfall, but also more extreme weather conditions including severe dry seasons.