Revision

A quote from Lenin has been much in evidence across the media recently: “there are decades where nothing happens; and there are weeks where decades happen".

3 minutes to read

Lenin’s prescience has been evidenced by economists across the world scrambling to revise their forecasts at an increasing pace as Covid-19 turns the world upside down.

In this post we summarise the latest thinking with a comparison of forecasts made back in January, only three months ago but seemingly three decades ago if not an entirely different world.

In what has now been dubbed as The Global Coronavirus Recession (GCR), most forecasters are now expecting some of the sharpest economic contractions since at least the Great Depression.

This week the International Monetary Fund (IMF) released their updated World Economic Outlook which points to a global contraction of 3% in 2020 with a rebound of 5.8% growth in 2021.

However, they recognise that there is “extreme uncertainty around the global growth forecast” and list a number of factors that “interact in ways that are hard to predict”. These include, but are not limited to the intensity and efficacy of containment efforts, repercussions in global financial market conditions, shifts in spending pattern and behavioural changes.

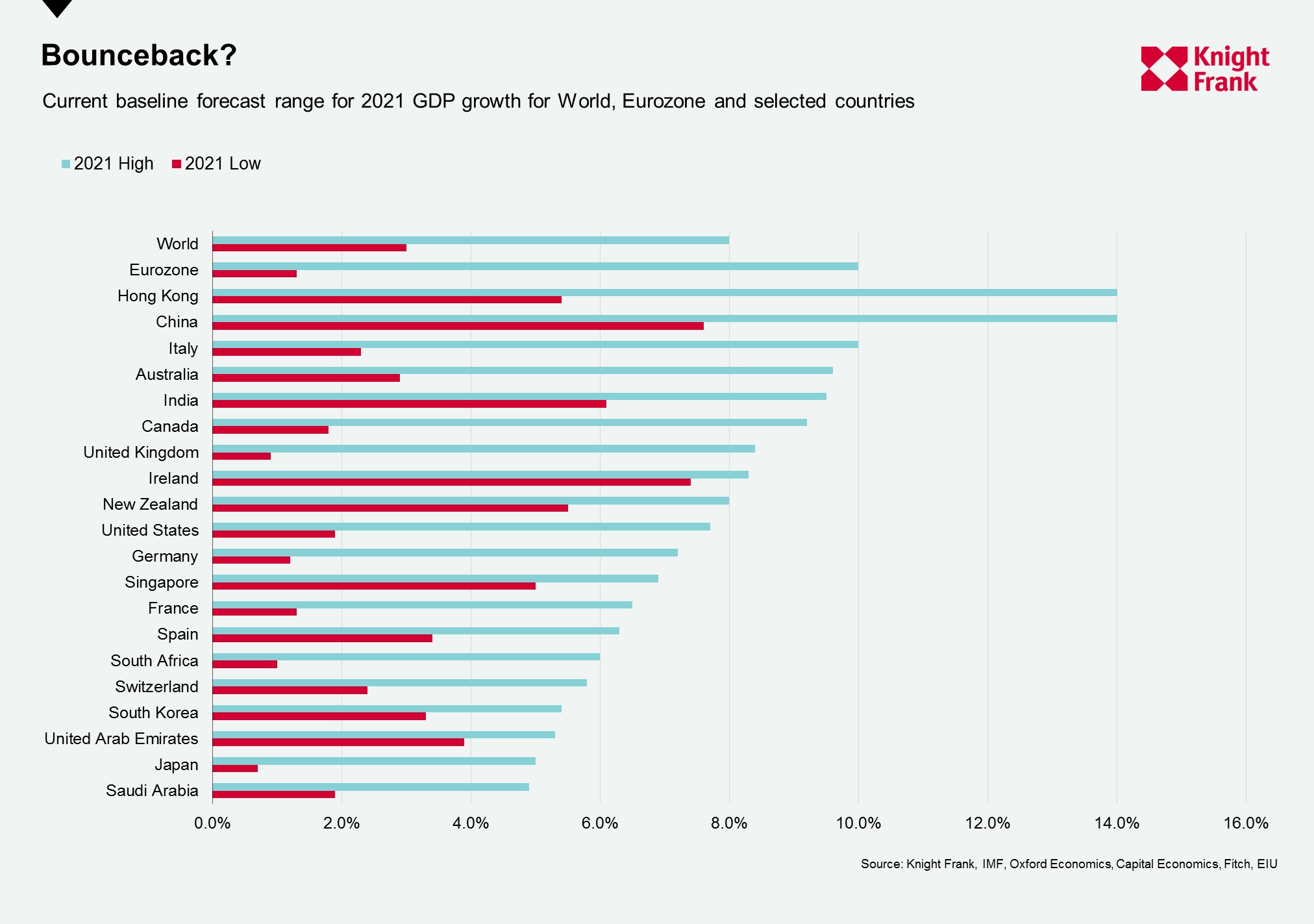

The figure below showcases the high and low estimates of 2020 GDP growth, from a range of sources, for the World, Eurozone and 20 selected countries.

The IMF’s global contraction of 3% sits mid-range with current forecasts ranging from a contraction of between 1.9% and 3.6%. The Eurozone, which even in January was expected to grow by between 0.7% and 1.3%, is now expected to see a contraction of between 5% and 9%.

In the locations studied the average downgrade in 2020 GDP growth is a huge 6.2%, most notable in some of the hardest hit areas such as Italy.

Italy’s economy was already weakened, having experienced three recessions in the past decade, with January’s estimates ranging between 0.2-0.5% growth, now replaced by expectations of a contraction of between 4.7% and 10%.

Australia, which has not seen a recession in nearly 30 years, has seen their 2020 forecast slashed from 2% to 2.3% growth to a decline of between 2.2% and 9%.

However, when we look at the forecast for 2021 we see, on average an upward revision of 4%.

For global GDP growth in 2021 forecasts range from 3% to 8%.

Countries with some of the sharpest downward revisions this year are expected to see a bigger upside in 2021, with China, Hong Kong and Italy all seeing upper estimates for next year’s forget in double digits.

It is worth noting that these are baseline forecasts with most assuming that the pandemic will fade in the second half of 2020, with containment efforts gradually unwound, helped by policy support. Some have modelled downside scenarios, for example in the IMF outlook with a longer than expected outbreak in 2020 then global GDP could contract by a further 2.8% in 2020 - a 5.8% contraction overall with growth of under 4% in 2021.

There is however hope for this benign outcome as we have previously noted, with unprecedented levels of monetary and fiscal stimulus being primed. Additionally many countries are beginning to outline their lockdown exit strategies. Most recently France announced an intention to reopen crèches and schools in mid-May, Germany hopes to open smaller shops next week and Spain allowed workers in “non-essential” industries to return to their jobs after a two-week ban.

This return to normality it is hoped will lead to weeks beginning to last for their expected seven days, hopefully even Lenin would approve.