The Rural Update: Food price conundrum

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership.

8 minutes to read

Viewpoint

When the May inflation figures were revealed last week, Keir Starmer predictably got a grilling from opposition MPs for failing to keep a lid on food prices. It’s certainly true that some of the government’s employment, regulatory and energy policies will have played their part in pushing up costs along the food chain, but they don’t account for some of the biggest hikes. Chocolate prices, for example, have skyrocketed due to poor weather affecting key cocoa-growing areas, while beef prices are up because farmers have scaled back production in response to lower prices in previous years. And this is the conundrum that politicians and the population at large face. Most seem to acknowledge that farmers don’t get paid enough for their produce, but when food prices do go up, it becomes a political hot potato. Governments can play their part by ensuring food supply chains treat the primary producer more fairly, and by not subjecting family-owned businesses to unsustainable tax and regulatory burdens. Ultimately, though, in an environment where taxpayer-funded farm support payments are dwindling, it’s the market that has to do the heavy lifting. That means the public and politicians accepting that food might just need to cost a little bit more.

Sign up to receive this newsletter and other Knight Frank research directly in your inbox

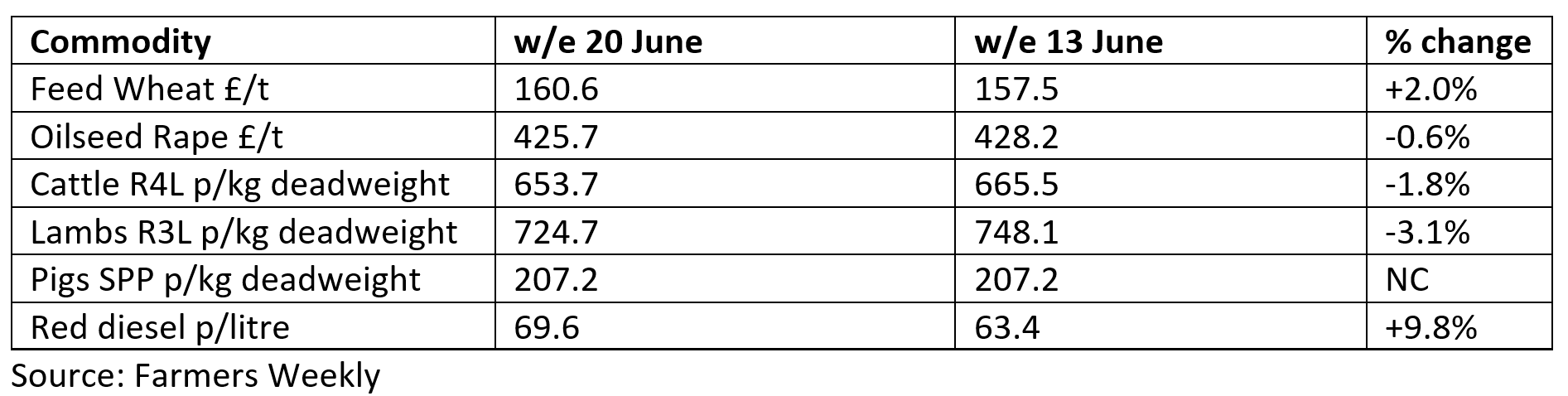

Commodity markets

OSR support on the way?

Rape prices could be set for a boost as the rise in crude oil prices following Israel’s attack on Iran filters through to the market for vegetable oils and oilseeds. It has also been indicated that US biofuels will need to include a higher proportion of plant-based feedstock. Trader Frontier is reporting that oilseed rape is currently trading at season highs of £430/t delivered. Brent crude ended last week at $75.48/barrel. On 5 May it was trading at just over $60/barrel.

The headline

Infrastructure strategy revealed

The government has just published its 10-year infrastructure strategy. The document will be of particular interest to landowners and farmers, given the amount of land that will be required to deliver Keir Starmer’s energy, water, transport, housing and digital ambitions.

As well as providing a framework for the £725 billion of public infrastructure investment that has been promised over the next 10 years, the strategy also covers the maintenance of the UK’s existing infrastructure.

A new body, the National Infrastructure and Service Transformation Authority (NISTA), has been set up to oversee implementation across the UK and coordinate efforts with devolved governments and industry partners.

NISTA will develop a new national infrastructure spatial tool that will consolidate data and modelling into a single platform for infrastructure planning. This will work in conjunction with the long-awaited Land Use Framework that is due to be published later this year.

A key feature of the government’s infrastructure drive will be the increased use of the Nationally Significant Infrastructure Project (NSIP) regime to steer projects, such as solar parks, wind turbines, roads, railways, electricity pylons and even data centres, through the planning process more quickly.

NSIPs bypass local planners, with the relevant Secretary of State having the final say on whether projects are approved or not. Tim Broomhead, a compulsory purchase expert at Knight Frank, says this could lead to less negotiating time for landowners and farmers. Read Tim’s advice for those affected by an NSIP.

News in brief

Food inflation up

Although the UK’s overall inflation rate remained flat in May at 3.4%, the cost of food was up 4.4% compared with prices 12 months ago. This was a sharp jump on April’s 3.4% figure and the biggest hike since February 2024, when prices rose 5%. Chocolate was the biggest contributor, but beef prices also rose again. Further increases are expected, with food price inflation predicted to peak at 4.8% by the end of the year.

Lending rate flat

With inflation remaining stubbornly higher than its 2% target, the Bank of England kept the base rate unchanged at 4.25% when its Monetary Policy Committee (MPC) met last Thursday. However, three of the MPC’s nine members voted to cut the rate to 4%. The bank said: “Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.”

Delinked payments slashed

The final residue of the EU’s Basic Payment Scheme, which provided area-based support for farmers, was effectively terminated two years early in Rachel Reeves’ recent Spending Review. The first £30,000 of any payments, which were “delinked” from landownership or occupation in 2024, will be cut by 98% in 2026, effectively meaning a maximum payment of just £600.

Scottish carbon budget

Following a report from the UK’s Climate Change Committee (CCC) that Scotland was unlikely to hit its 2045 net-zero target, the Scottish government has agreed to introduce legally binding carbon budgets, similar to England’s, that will set emissions limits from 2026 to 2045. However, Cabinet Secretary for Climate Action and Energy Gillian Martin said: “To ensure we protect rural communities and have a thriving rural economy, we will not adopt all their recommendations on agriculture and peatland and will instead meet our targets in a way that works for rural Scotland, including supporting and protecting our iconic livestock industries.”

EU cuts greenwashing law

Meanwhile, the European Commission is set to scrap the rollout of new regulations designed to prevent firms from making false or misleading environmental claims about their products or services. The Green Claims Directive has been criticised by the EU’s largest political party, the right-leaning EPP Group, for placing too much of a burden on businesses. The commission has already pledged to reduce the administrative and reporting burdens on smaller businesses by 35% by 2029.

Welsh bluetongue restriction

In Wales, Deputy First Minister Huw Irranca-Davies, who also looks after rural affairs, is coming under increasing pressure to reverse his stance on bluetongue disease. Despite Defra announcing that England’s restricted zone will cover the whole of the country from the beginning of July, Mr Irranca-Davies is refusing to take the same stance. This means that any farmers wanting to move livestock over the Welsh border will need to get their animals tested first, which is expensive and time-consuming. Critics say the midge-borne disease will spread into Wales anyway.

Land reform in Scotland

The Scottish Land Commission has also been criticised for its interpretation of its latest Land Market Insights Report, which shows reduced activity in the forestry, natural capital and estates markets. James MacKessack-Leitch, the organisation’s Policy and Practice Lead, said: “The findings indicate Scottish rural land ownership is becoming more concentrated, reinforcing the need for land reform to continue improving transparency, participation, and public value in a changing land market.”

However, Stephen Young, Director of Policy at Scottish Land & Estates, said: “Year after year, regardless of whether market activity is rising or falling, the Commission uses the report to argue for further legislative intervention.” Mr Young says it is the uncertainty caused by the land reform proposals that is putting off investors.

The Rural Report SS 25 – Out now

The Spring Summer 2025 edition of The Rural Report, Knight Frank’s flagship publication for rural businesses, which looks in more detail at many of the issues discussed in The Rural Update, is out now. The new report includes the latest news, research and insights from Knight Frank’s rural property experts, as well as thought-provoking contributions from some of Britain’s most iconic estates.

Available online and in print, you can click here to access the full report.

Properties of the week

Cotswold classic

Lying along the scenic Cotswold Hills escarpment, the 960-acre Hawkesbury Estate at Badminton, Gloucestershire, is another cracking early summer launch from our Farms & Estates team. Split into five lots, the estate includes two Grade II listed farmhouses, a cottage, and 312 acres of common land. Court Farm comes with a four-bed house and 636 acres of land. It is guided at £5.85 million. Five-bed Pound Farmhouse has five acres and a £1.65 million price tag. The common land is available for £225,000. The guide price for the whole is £8.425 million. Please contact Will Oakes for more information.

Historic Kent estate home to rent

For anybody looking to sample estate living without making a long-term commitment, Knight Frank’s Rural Consultancy team in Kent has an intriguing option on offer. Newhouse at Mersham, near Ashford, which was once home to The Countess Mountbatten of Burma and Lord Brabourne, is part of the idyllic 2,700-acre Hatch Park Estate. Now available to rent, the nine-bed period property costs £7,995 a month. For more information, please contact the team’s Katie Bundle.

Discover more of the farms and estates on the market with Knight Frank

Property markets

Development land Q1 2025 – Market falls

The value of greenfield development land fell by 2% in the first quarter of the year. Urban brownfield sites, however, lost 5% of their value over the same period, according to the Knight Frank Residential Development Index.

Farmland Q1 2025 – Values resilient

The Knight Frank Farmland Index, which tracks the average price of bare agricultural land across England and Wales, showed a marginal drop of 1% in the first quarter of 2025 to £9,072/acre. This follows a similar small decline in the final three months of 2024, bringing the annual fall to just 1.9%.

Country houses Q1 2025 – Mixed picture

The average price of desirable homes in the countryside slipped by just 0.3% in the first quarter of the year, according to the Knight Frank Prime Country House Index. Over the past 12 months, values have fallen by 1.6%.