How to make the most of the Sustainable Farming Incentive - January 2024

Is it now time to exploit Defra’s new entry-level agri-environment scheme and maximise its income potential?

9 minutes to read

As English farmers experience the third year of the tapering of the Basic Payment Scheme (BPS) payments towards their potential cessation by 2027, most are seeking other sources to fill or mitigate the drop in income. With BPS funding being redirected into Defra’s Environmental Land Management schemes, the entry-level Sustainable Farming Incentive (SFI) is a possible option to explore.

Introduction

When the SFI was launched in 2022, it was generally met with a lukewarm reception by farmers and environmental organisations. It was felt it didn't incentivise enough and was slow at being rolled out. But since its initial release, Defra has listened to feedback and made some substantial changes which were unleashed in September 2023.

We take a look at why the scheme is now seriously worth considering and provide examples of how it could be applied on farms and what to do next.

Click on the farm type below to jump to the relevant examples and possible SFI actions

This is the first in a series of three articles exploring the SFI and Countryside Stewardship (CS) schemes. The second article looks at whether CS still has something to offer while the third considers the option of ‘stacking’ SFI and CS options.

Why is SFI 2023 worth engaging with?

So, despite the initial reluctance of many farmers and land managers to enter the 2022 SFI scheme, there are several reasons why the 2023 offer is now worth considering.

1. More flexibility – the pick and mix structure allows land managers to select the actions that may fit in with existing practice and rotation or are easy to adjust to and incorporate changes.

2. Higher payment rates – since the start of SFI the payment rates have been criticised, but they have now been increased, and some rates made the same across land types and schemes.

3. Tenant-friendly agreements – you don't need the permission of your landlord to apply for an agreement if you're a tenant farmer, and tenants can have an SFI agreement even if they are on a shorter, rolling tenancy contract.

4. Stacking of options – it’s possible to combine with other schemes' options such as Countryside Stewardship and Environmental Stewardship.

5. Management payment – payment of £20 per hectare, up to 50ha in total, for your time managing the scheme.

6. Simple application – A simple online application process and a rolling application window.

7. Paid quarterly – more frequent payments which help with cashflows.

8. You don't lose out – Defra has shown that previous applicants who joined prior to any changes will also benefit from the improved offer.

Mark Topliff of the Agri-consultancy team says: “If you are familiar with Environmental Stewardship (Entry Level Schemes), knowing there is some similarity between them and SFI may be reassuring. Around 60% of the 2023 SFI options are the same or comparable to the previous ELS or uplands ELS options.”

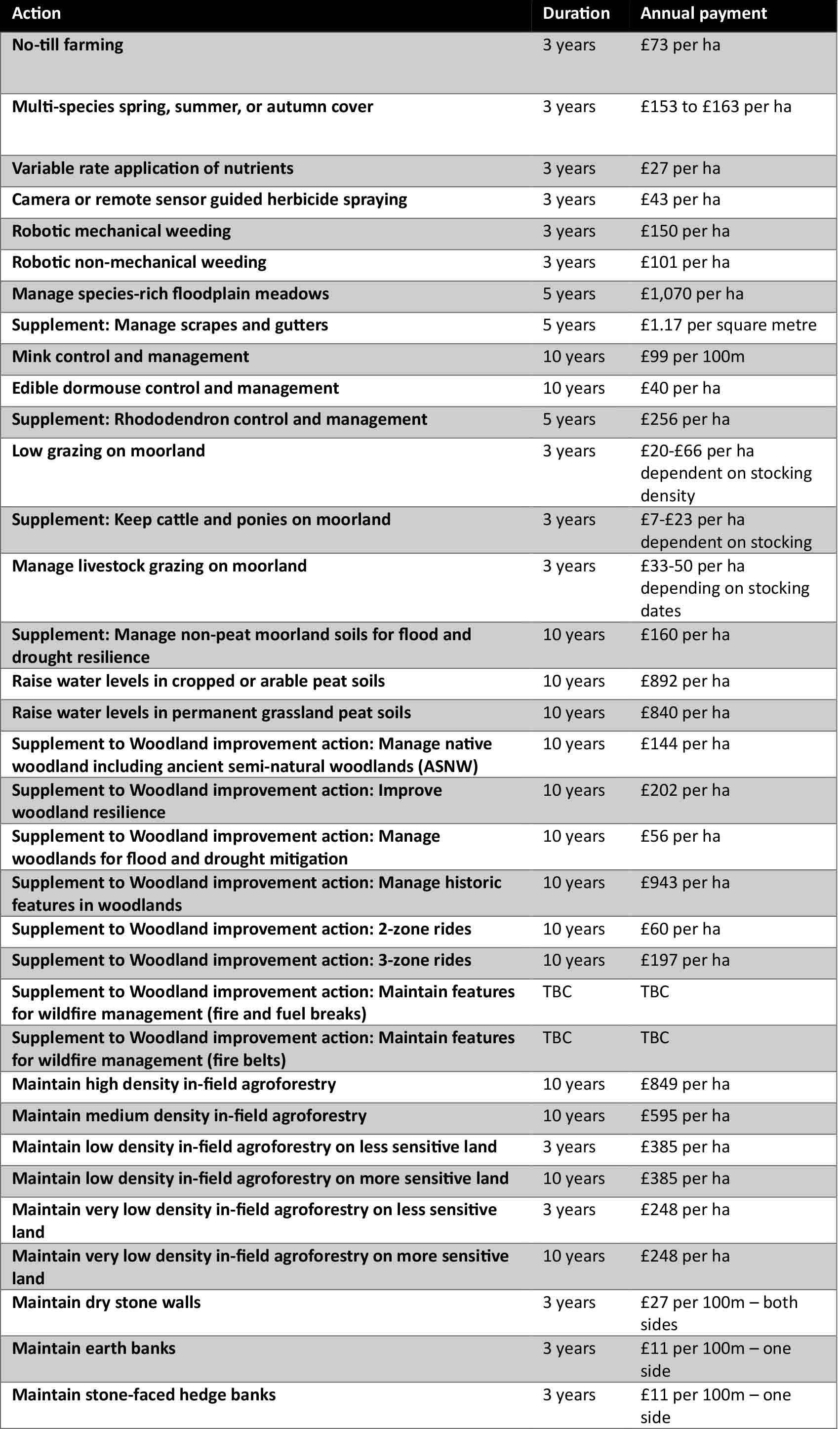

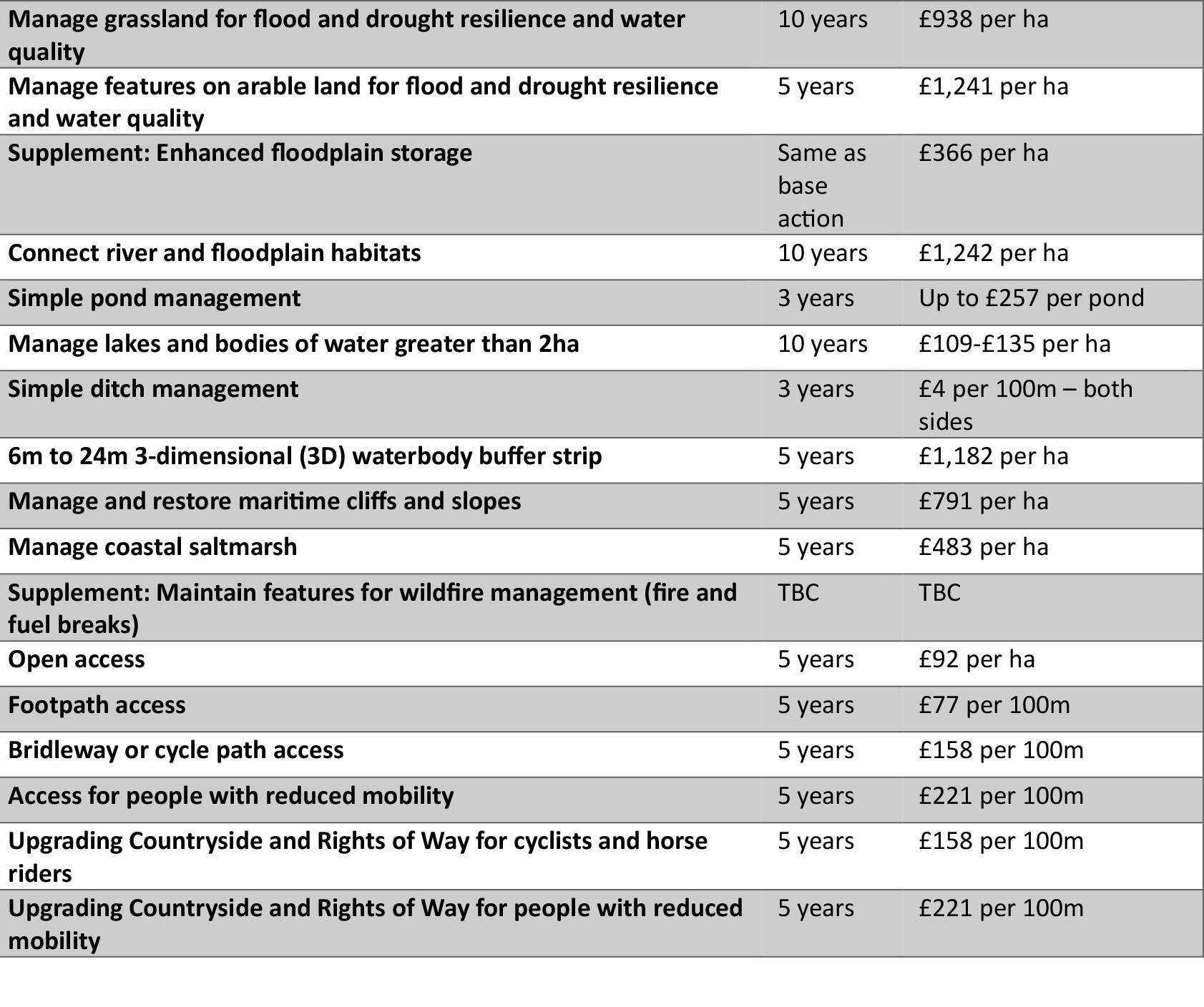

Defra has announced that further actions will be rolled out in summer 2024. A complete list of the new SFI and CS actions can be found in the appendix at the end of this article. The list includes new actions such as agroforestry, no-till farming, variable rate nutrient application and flood controls.

What are the options?

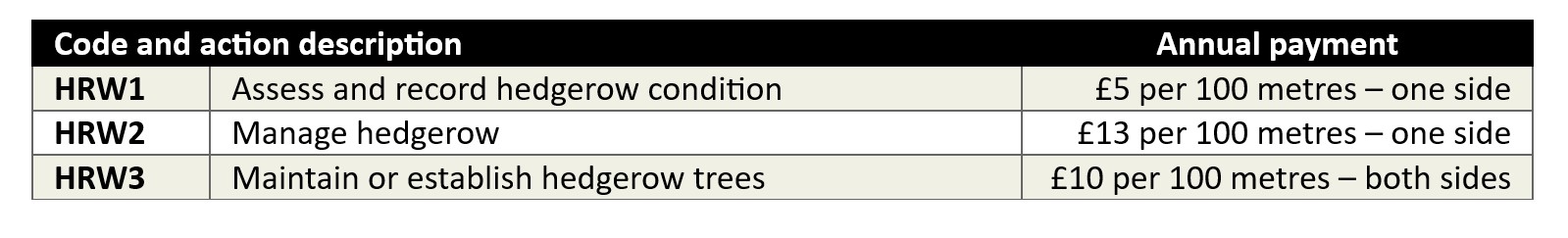

Let’s take a look at the options available under SFI 2023. Firstly, there are hedgerow management options that are available for all farms. Hedgerow payments are based on per 100 metres and either per side or both sides depending on the action.

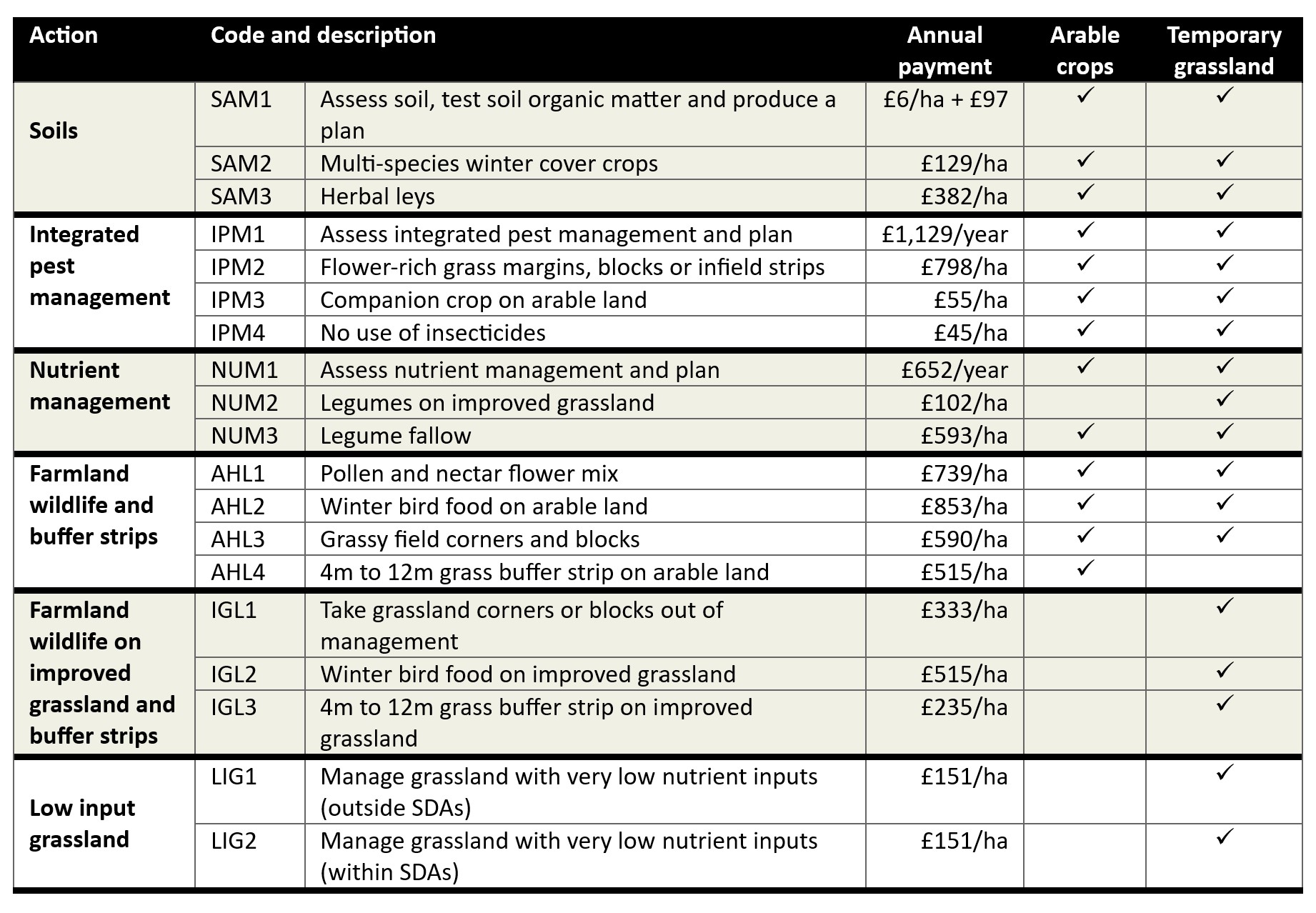

For all other options, they can be categorised by different farmland types: arable, lowland grazing livestock and upland grazing livestock. To put into context how the options could be selected, an example is provided for each of these farm types.

Arable farmland

The options applicable to arable farmland can be split between arable cropland and temporary grassland.

But what does this mean for an arable farm? Andrew Martin of Knight Frank’s Agri-consultancy team explores how these actions can be used on an example 100 ha block of arable land.

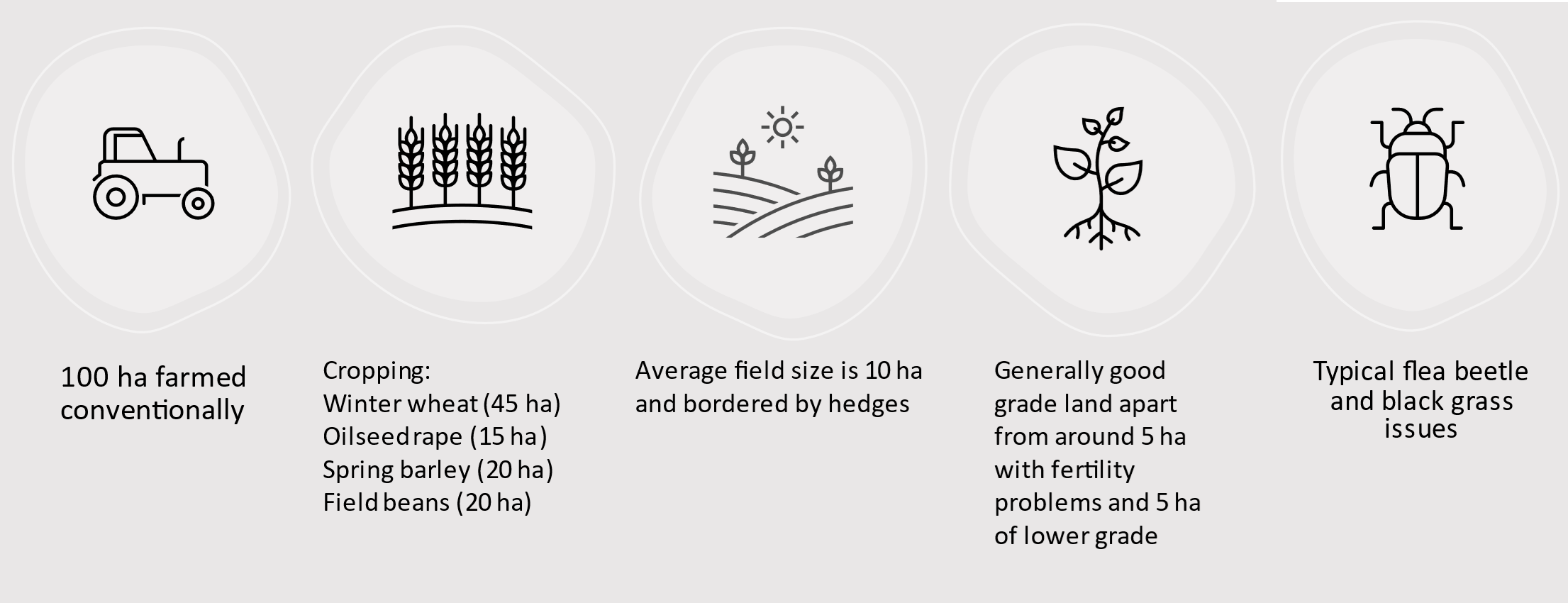

Arable land example

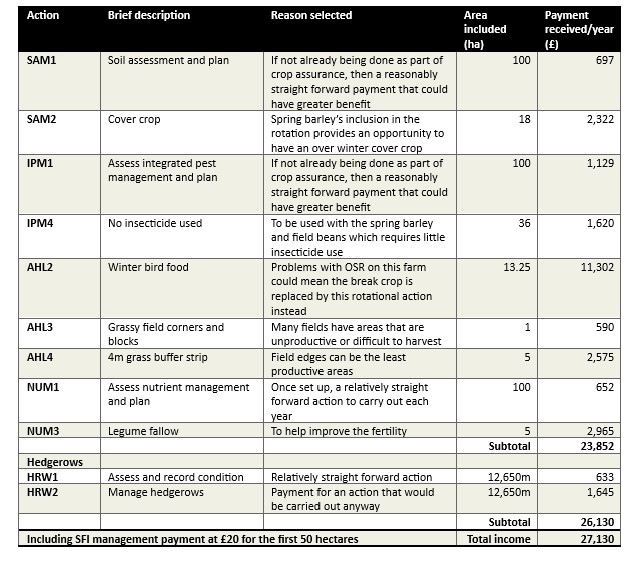

Possible actions that could be selected in this example

For this 100 ha block of arable land, the options in this example would return an income of £27,129 or £271/ha. This is higher than the Basic Payment Scheme payment (BPS) pre-tapering but before any costs involved in the implementation of any of the SFI actions.

The non-rotational areas that take the low fertility and productive areas out of production (see table below) would return an average guaranteed income of £557/ha/year.

*note that the legume fallow option can be used rotationally but in this example, it is used to improve the fertility of the 5 ha parcel.

Typically, the average net margin across a crop rotation similar to that in the example would be in the region of £200-£250/ha/year before rent and finance costs.

When SFI establishment and maintenance costs are deducted, the fallow and grassy area margins are likely to be similar if not better than compared to the crops, when spread over the lifetime of the SFI agreement.

Andrew explains that: “The range of actions selected in this example could easily be applied to other situations. But the key to this selection is that it could fit in with the existing system and take out or improve the unproductive areas.”

“Even though in this arable scenario the SFI payments won’t cover the complete loss of the BPS, they will reasonably offset it and certainly more than was offered in the 2022 SFI standards,” adds Andrew.

Lowland grazing livestock

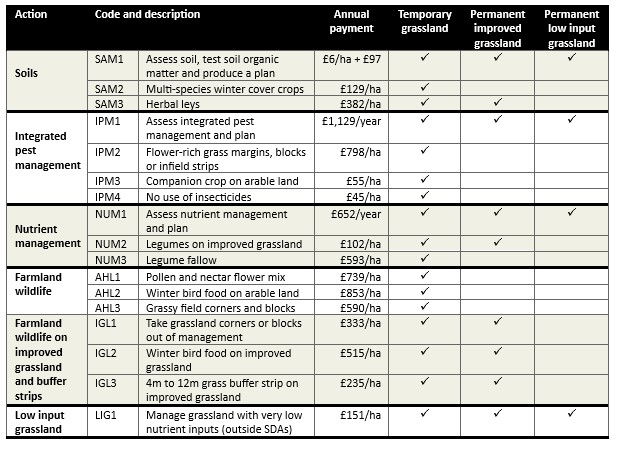

The arable options may also be applicable to livestock farms (see arable section) but below are the grassland actions on offer to the lowland grazing livestock sector.

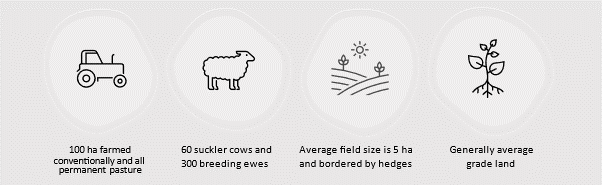

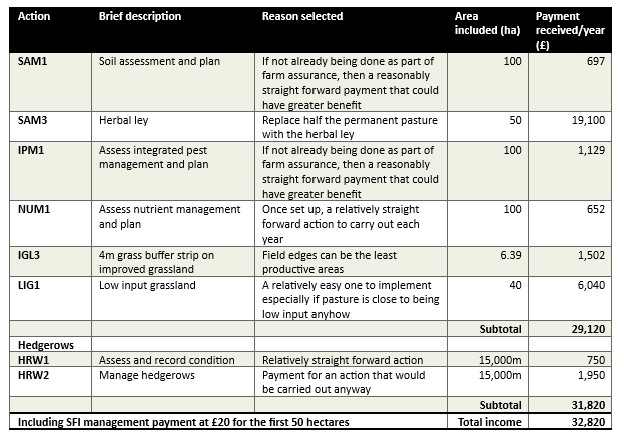

So, which are the most appealing options to select for a lowland grazing livestock farm? Agri-consultant, Elizabeth Smith has selected an example to highlight how these actions can be used on an example 100 ha grazing livestock unit.

Lowland livestock example

Possible actions that could be selected in this example

At £32,820, these options return an attractive income even after the initial costs of establishing the herbal leys.

Elizabeth points out that: “The per hectare income in the scenario above would be £318/ha before the management income. Compare that to a typical BPS payment of £220 and even after costs, the SFI income could mitigate the loss of BPS.”

Elizabeth further explains: “Although there are some changes to the farming system in this example, they are not expecting to affect the performance of the livestock. In fact, from my experience with clients, the proposed changes would make the farm more resilient and could even improve the performance of the animals but at a lower cost.”

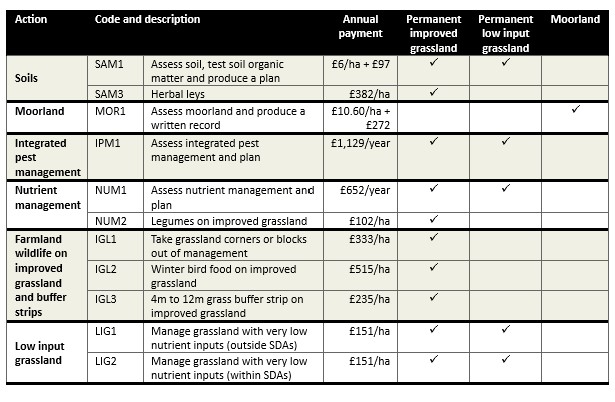

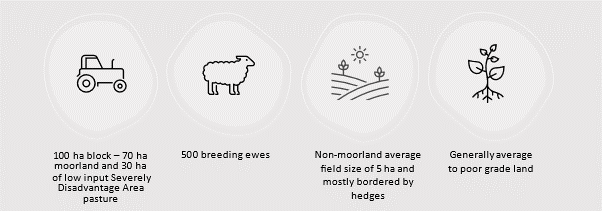

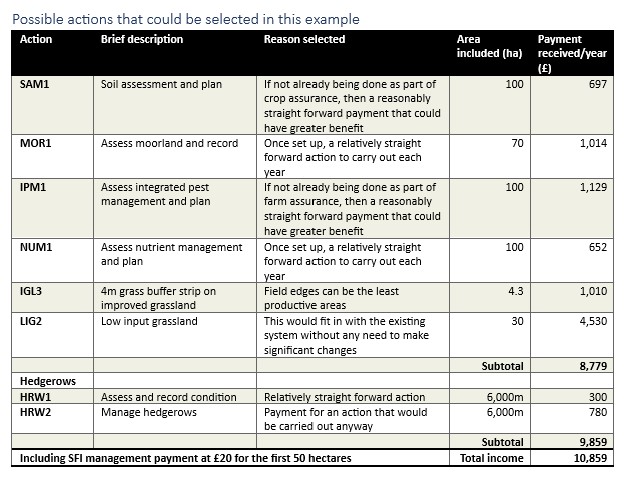

Upland grazing livestock

One of the criticisms of the 2022 SFI offer was the lack of actions applicable to upland/moorland farms. This has improved with the 2023 offer although the list of actions is not quite as extensive as for the other land types.

To assess which options could be considered in an upland situation, Elizabeth has pulled together an example of a 100 ha block of moorland and upland grass.

Upland grazing livestock

The list of actions above would be relatively light touch. However, income from these actions would only amount to £99/ha before the management payment is included. In comparison, the typical BPS payment for Severely Disadvantaged Areas was £232/ha and for SDA moorland it was £64/ha.

As Elizabeth explains: “For the upland farmer, there is less scope to achieve the level of SFI payment seen with the other farm examples. So, in this situation, it may be best to look at other schemes that could be combined with SFI to maximise the funding opportunities available.”

SFI and Grants

There are various grants available under funding streams such as the Farming Equipment and Technology Fund. It can be worthwhile exploring the grant schemes to discover whether funding is available to support the actions that are selected under SFI, for example, a grant for a direct drill or cattle handling equipment.

Next steps

• When does it roll out?

The application window for the 2023 SFI options is now open.

• How do you make an application?

Applications are made through the Rural Payments Agency online portal.

When you choose an SFI action, the online application service will automatically work out the SFI area available in each land parcel. It does this by taking account of the registered land use codes and other environmental land management actions or options you may be involved with.

However, there does need to be a manual check that the SFI available area is also an eligible land type (i.e., arable land, or permanent grassland) for the action that’s been chosen.

• When are scheme payments paid?

The total annual payment of the SFI actions will be paid on a quarterly basis, starting in the fourth month after your SFI agreed start date. However, due to a delay in the opening of the 2023 scheme, if you have a live agreement in place before the end of 2023, 25% of the annual value of the agreement will be paid in the first month after the start of the agreement.

Conclusion

SFI 2023 has improved its offer and flexibility over its initial launch in 2022 and the actions announced for 2024 will make it even more attractive for many land managers. It certainly isn't a perfect scheme, and it will evolve further in the next couple of years. But when considering SFI alone, it can now bring a reasonable income to arable and lowland livestock farms. However, it does require some careful thought to get the best mix of actions and maximise the income potential. True, there are probably many actions that would be a light touch on most farms but making some considered changes to your farming system may further increase the SFI income and potentially benefit your farm’s economic and physical performance.

How can Knight Frank consultants help with your SFI application?

• Help understand the jargon and breadth of SFI

• Provide advice on the optimal mix of options for your situation

• Give practical advice around the integration of the SFI actions into your farming system

• Guidance on how other schemes and grants can segway into SFI

Appendix

New land management actions for SFI and CS

The following table is a list of the new actions that Defra announced will be available in the summer of 2024.