Tokenising the World

We take a look at how tokenisation and blockchain technology are being applied across industries – in particular, the way property assets will be owned and transacted.

4 minutes to read

Like most artists, Beeple (Mike Winkelmann) was a relatively unknown illustrator who enjoys producing works of art. However in February 2021, Beeple’s digital NFT (non-fungible token) was sold for a whopping USD$69.3million. The NFT was a digital collage called Everydays: the First 5000 Days.

Earlier in 2021, the first tokenised real estate (a condominium) was auctioned off for 36 Ethereum coins (ETH), approximately valued at US$93,000 at the time of selling. The starting price was at US$20,000.

CryptoKitties, an online NFT game powered by blockchain technology hit market capitalisation of over US$1.2M in value as of 31 July 2021. The game allows people to breed and trade fictional, customisable, virtual cats using the ETH cryptocurrency.

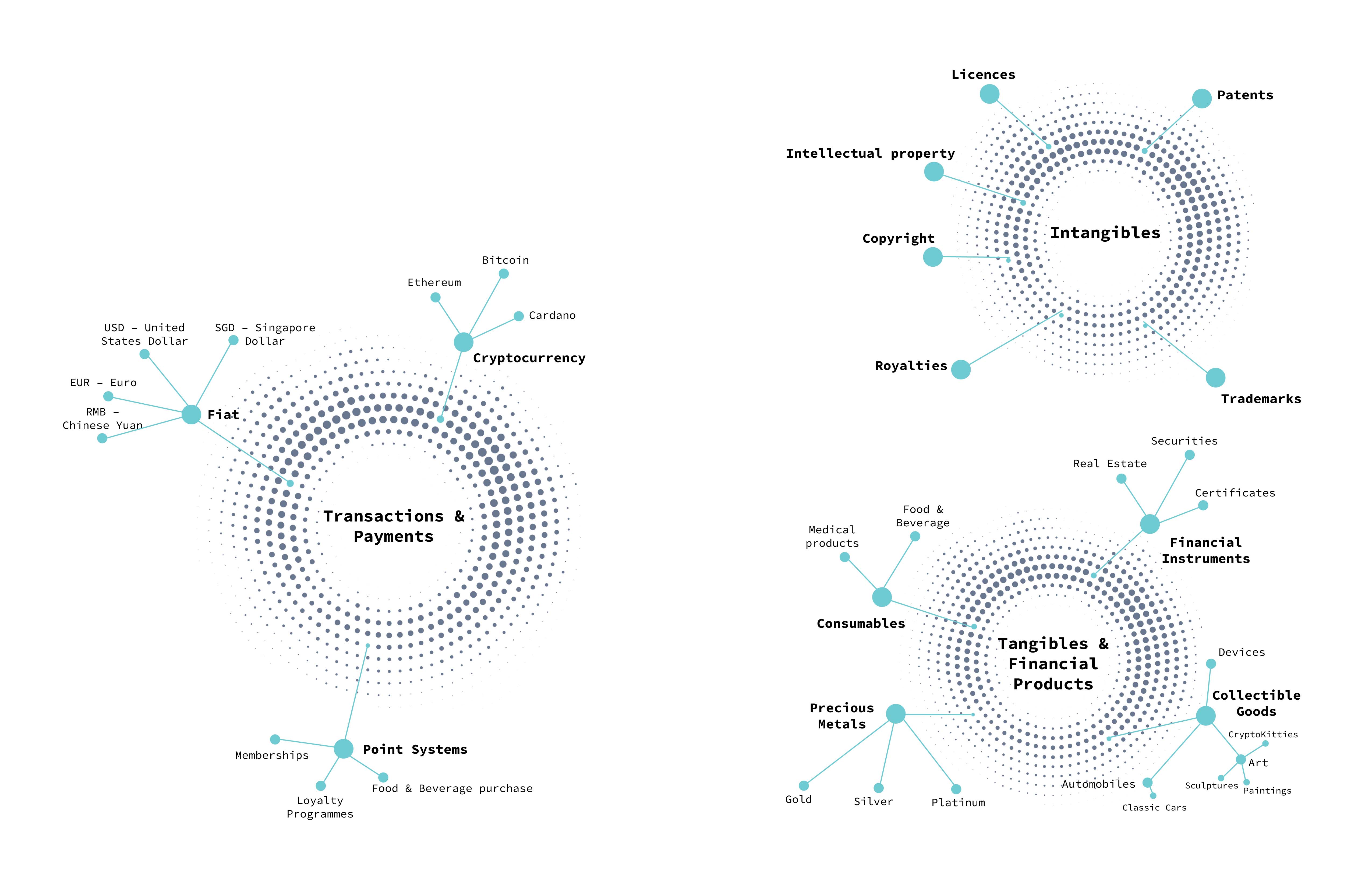

The hype around tokenisation and blockchain technology has been nothing short of phenomenal, and the list of their potential applications, and implications, on legacy systems is apparent. The possibilities for its application are infinite, ranging from polling systems and intellectual copyrights, to smart contracts and unlocking liquidity from traditional assets.

The closest manifestation of tokenisation technology that most can relate to is cryptocurrency, or stable coins, which has off spun to countless number of variants rife with speculation. Cryptocurrency proponents argue stable coins to be an exemplar of the main benefits of blockchain and tokenisation technology, and how it can be a viable replacement to the traditional fiat currency.

But while the technology presents a solution to some of society’s pressing problems, its potential remains largely unrealised.

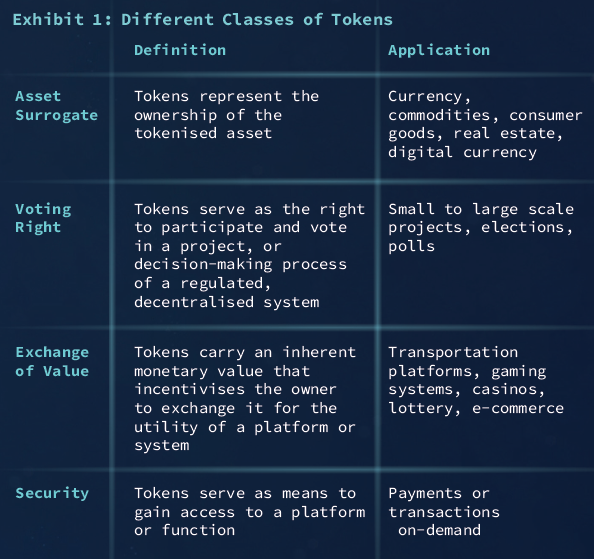

In any platform they work on, tokens principally represent something of utility, or value. They can take on a variety of type, or class, or purpose.

What is Tokenisation?

Tokenisation is a means of converting a piece of valuable information into a representative, digital asset form carrying a unique identity. This asset is identified and recorded using blockchain technology, or distributed ledger technology (DLT). DLT is a secured, decentralised virtual filing system that simultaneously publishes identical records across a network – allowing it to be accessed and referenced in a manner that makes it extremely difficult to be manipulated by fraud or ill-intent.

While many see the value of smarter, virtual ways of executing transactions in a global economy fraught with geo-political pressures and black swan events, there remains significant inertia that prevents companies and business owners from jumping on the tokenisation band wagon. In real estate, the implications on how property assets will be owned and transacted will be explored under Real estate tokenisation.

Data Security

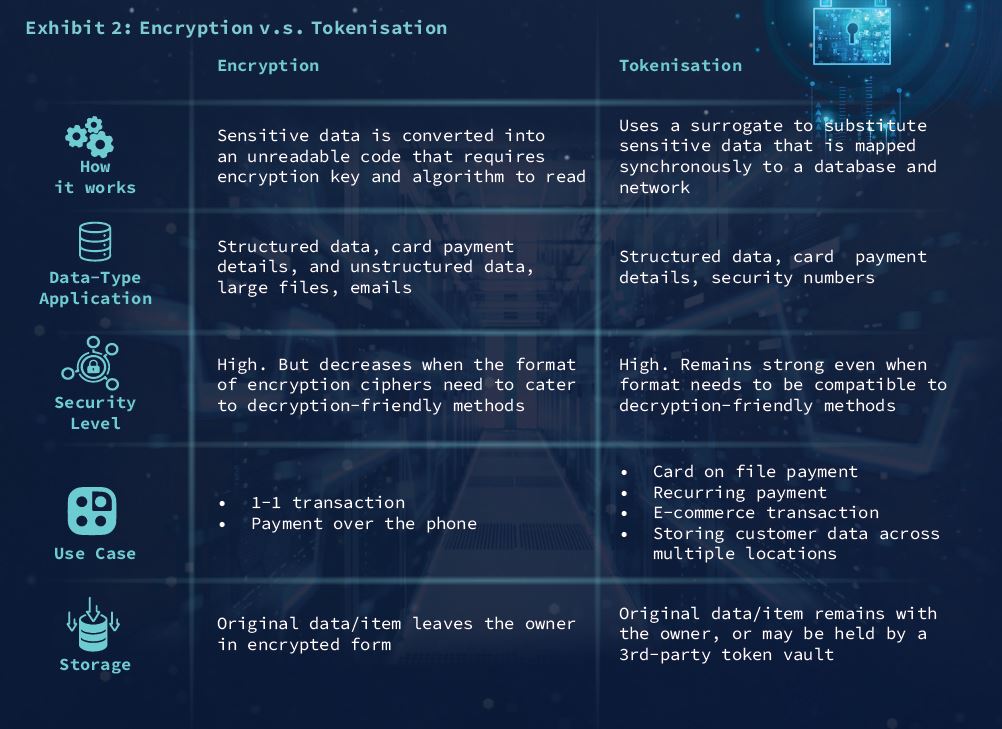

Securing data in ancient times involved using cipher text, or encryption, to make unreadable the original piece of data. Encryption in its first digital form began in 1970s with the Data Encryption Standard, which is still a popular and accepted method of securing sensitive data today. The first digital tokenisation occurred in ad hoc fashion around the same time, deployed in ad hoc instances where isolation of sensitive data is required when processing large amounts of information among separate systems.

Tokenisation offers an alternative means of securing sensitive data that serves better in situations where encryption may be encumbered. One of its main appeals is that it offers people the ability to mitigate the risks associated with the handling of the original article, lest its authenticity or access becomes compromised. By being a surrogate of same value as the original item or article, tokens can be used in all manner of transaction, transfer of value, and storage of the original property.

Unlike encryption, the strength a token’s security remains unchanged regardless of how it is read or shared. In encryption, there is a trade-off to the security strength of an encrypted article in situations where there is a need for more flexible cipher formats to cater to software that aid in the decryption, reading and sharing of the data.

Digitising Objects into Token Variants

Tokenisation converts real-world objects into a virtual form that allows them to be traded, transferred and stored in the digital space. They can be cryptographic or non-cryptographic, and single-use or multi-use. The level of security of tokens may be determined with preset parameters to make them reversible or irreversible, and authenticable or non-authenticable.

Exhibit 3 illustrates areas where tokenisation can be applicable and put to practical use. Its potential application is non exhaustive.