Real Estate Tokenisation

Blockchain presents a strong case for its application to the real estate transaction process, reducing redundancies and over reliance on time-consuming analog process fraught with potential fault points.

1 minute to read

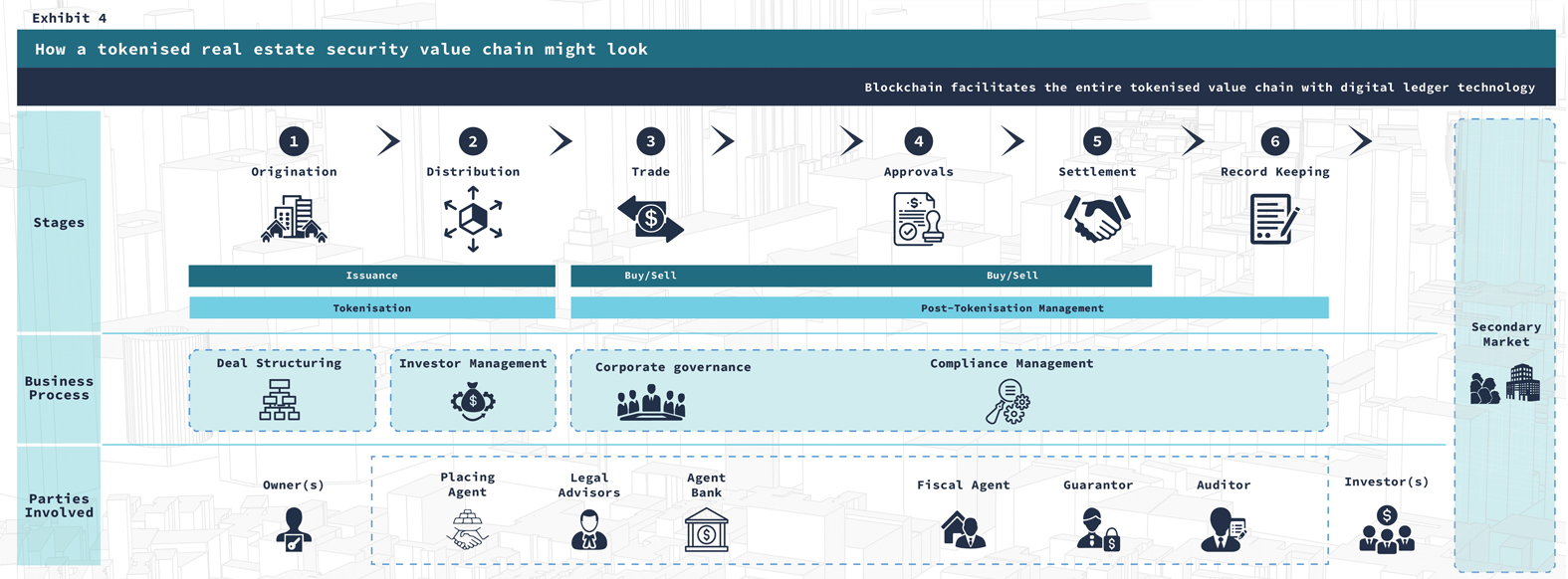

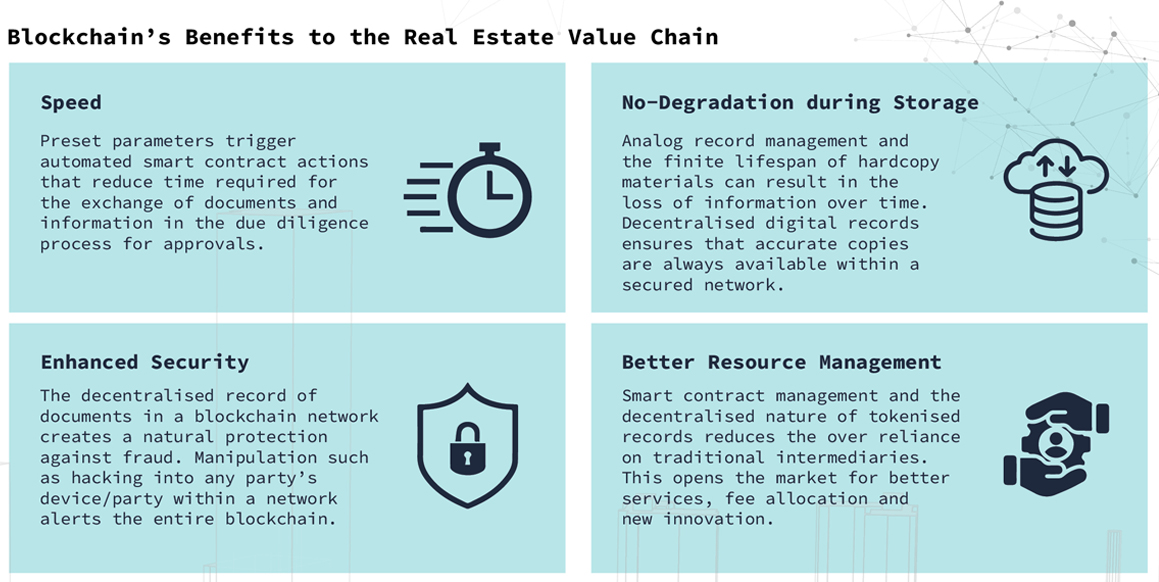

Blockchain, the underlying technology that powers tokenisation, presents a strong case for its application to the real estate transaction process. The lean and agile nature of digital ledger technology reduces redundancies and over reliance on time-consuming analog processes fraught with potential fault points among several parties in the typical real estate ecosystem.

While capital-intensive properties and the real estate ecosystem are inundated by a host of legal due diligence and legacy systems that impede the adoption of digital technologies, an increasing demand from new investors to gain access to real estate assets, as well as motivation from existing investors for greater liquidity, has placed pressure on institutions and private equity to explore avenues that can transform the real estate value chain. The positive performance of real estate securities such as Real Estate Investment Trusts (REITs) which provide retail investors a means to access property investments via lower barriers of capital requirements, has no doubt contributed to the increase openness of industry incumbents to research methods that can unlock greater value and transactional liquidity from real estate products.

Even so, there remains a multitude of issues that must be considered and fine-tuned before the tokenisation of real estate can become a reality.