Restructuring for the next wave

How the tech titans are building the planet’s AI, data & energy backbone

12 minutes to read

In late June 2025, Amazon set a new bar for corporate investment with a £40 billion pledge to the United Kingdom –arguably its most significant country-specific commitment to date. Over three years, the company will build four advanced fulfilment centres in Hull, Northampton, and two East Midlands locations, create thousands of jobs, and modernise more than 100 existing sites to turbo-charge same-day and next-day Prime deliveries. Simultaneously, Amazon’s Shoreditch headquarters in East London will grow with two new office towers on Hewett Street and Curtain Road, reflecting its evolution from a logistics powerhouse to a full-fledged technology innovator.

In this article, we explore how the world’s leading technology companies are expanding their physical footprints and reorganising their operations to seize the next wave of growth. We examine how Amazon, Google, Microsoft, Apple, TikTok, Meta, NVIDIA, and Tesla have each restructured teams, struck landmark clean-energy deals, completed major acquisitions, and built new facilities from London to Singapore to Texas -all to support faster services, greener operations, and the AI-driven future.

Amazon: From UK fulfilment to global cloud power

That UK announcement was only the opening salvo in Amazon’s global expansion campaign. In June 2025, AWS signed a landmark power purchase agreement (PPA) with Talen Energy to source up to 1,920 MW of carbon-free nuclear electricity from Pennsylvania’s Susquehanna plant through 2042 - one of the largest corporate nuclear off-take deals ever struck. Amazon has also partnered on Small Modular Reactor (SMR) projects with Energy Northwest, X-Energy in Washington State, and Dominion Energy in Virginia to bolster its renewable credentials further, targeting over 1,200 MW of new nuclear capacity. These initiatives underpin Amazon’s ambition to match 100% of its global electricity demand with renewable or carbon-free sources by 2040.

As Amazon invests heavily in infrastructure and clean power, it is simultaneously reshaping its workforce for the AI era. Under CEO Andy Jassy, the company has deployed AI-driven automation tools across its logistics network, eliminating legacy roles while creating new openings for robotics specialists and machine-learning engineers. Since 2022, Amazon has reduced its headcount by nearly 28,000 employees, including 14,000 managerial positions cut in early 2025 to reinvest in high-priority areas like AWS and robotics research. Much of this headcount reduction is related to operational streamlining following AI deployments.

Beyond the UK, Amazon’s ambitions stretch across six continents. In the United States, AWS is commissioning “Generation 3” data halls in Virginia and Ohio, optimised for Graviton and Trainium chips. In Singapore, a new region promises sub-10 ms latency to Southeast Asian customers, underpinned by an offshore wind PPA that locks in green-power rates through 2035. In São Paulo, Amazon is converting an existing logistics campus into a hybrid fulfilment-compute hub, serving retail orders and core AI workloads. Across the Pacific, Amazon Japan has earmarked ¥500 billion (≈ £2.9 billion) through 2027 to expand fulfilment, robotics, and AWS capacity in Tokyo and Osaka, powered by solar PPAs on Kyushu and a 200 MW SMR pilot with the Japan Atomic Energy Agency. In India, three mega-fulfilment parks in Uttar Pradesh and Maharashtra will pair with AWS “edge zones” to meet surging e-commerce and AI demand.

Simultaneously, Amazon has spun up new business units - such as its in-house robotics R&D arm and an AI-driven supply-chain optimisation team - while shuttering underperforming content divisions like parts of its Kindle operations. This dual strategy of aggressive expansion and targeted pruning ensures both capital and talent flow to the growth engines of the decade: cloud computing, automation, and next-gen logistics.

Google’s data temples, city campuses, and M&A drive

For Google, 2025 has been a year of constructing computer cathedrals and urban innovation hubs while reshaping its workforce and making blockbuster acquisitions. In the United Kingdom, Google committed $1 billion to a 33-acre data centre at Waltham Cross, Hertfordshire, set to come online in 2026 and run entirely on renewables via local PPAs and offshore wind agreements. Globally, sister facilities are rising in Moncks Corner, South Carolina, a seawater-cooled campus in Hamina, Finland, and a new build in Osaka, Japan, each underpinned by local renewable PPAs.

At the same time, Google is completing its signature “landscraper” at King’s Cross - an 11-storey, 330 m-long headquarters designed by Thomas Heatherwick to house 7,000 employees, including teams from DeepMind and Google Brain, beneath rooftop gardens and collaborative labs. The campus is Google’s first wholly-owned space outside the US. Similar urban campuses have sprouted in Tel Aviv, Sydney, and San Francisco, marking Google’s belief that co-locating creators and compute delivers outsized innovation gains.

To sharpen its AI and Cloud focus, Google trimmed roughly 200 roles from its Global Business Organisation in May and hundreds more from its Platforms & Devices unit (covering Android, Pixel, Chrome) in April, redirecting resources to AI and Cloud expansion. Behind the scenes, Google agreed to buy Wiz - a cloud-security startup - for $32 billion in March, its largest acquisition ever and a direct bet on strengthening multicloud safety. Smaller bolt-on deals, such as acquiring Israeli monitoring specialist Keep in May and defence-AI contractor EpiSci in February, have further deepened Google’s AIOps and national-security offerings.

Microsoft’s hybrid cloud, copilot push and workforce realignment

Microsoft’s 2025 narrative weaves together a global cloud-infrastructure surge, the commercialisation of Copilot AI, and rigorous workforce streamlining. Building on a £2.5 billion investment in the UK and South Wales announced in late 2023, Microsoft in April unveiled plans to boost European data-centre capacity by 40 per cent over two years, expanding across 16 countries and more than 200 facilities by 2027, with advanced cooling, low-latency interconnects, and green-energy partnerships. Branded as part of Microsoft’s “digital commitments” to sovereignty and resilience, the initiative features European-only governance boards and bespoke renewable PPAs to reassure clients and regulators.

On the consumer-facing side, Microsoft has rolled out new Azure AI regions in São Paulo, Mumbai, Melbourne, Vienna and Cape Town. At the same time, edge-zone partnerships in Rwanda and Chile bring compute closer to local innovators and industrial operators. To free up resources for its $80 billion AI capex programme, Microsoft executed two major layoff rounds - cutting about 6,000 roles in May and a further 9,100 positions in July, including cuts in Xbox (650 jobs) and LinkedIn’s Barcelona “King” studio (200 jobs) - and reorganised engineering teams around Copilot and AI R&D, elevating leaders from GitHub and OpenAI.

Microsoft’s 2025 narrative weaves together a global cloud-infrastructure surge, the commercialisation of Copilot AI, and rigorous workforce streamlining. Building on a £2.5 billion investment in the UK and South Wales announced in late 2023, Microsoft in April unveiled plans to boost European data-centre capacity by 40 per cent over two years, expanding across 16 countries and more than 200 facilities by 2027, with advanced cooling, low-latency interconnects, and green-energy partnerships. Branded as part of Microsoft’s “digital commitments” to sovereignty and resilience, the initiative features European-only governance boards and bespoke renewable PPAs to reassure clients and regulators.

On the consumer-facing side, Microsoft has rolled out new Azure AI regions in São Paulo, Mumbai, Melbourne, Vienna and Cape Town. At the same time, edge-zone partnerships in Rwanda and Chile bring compute closer to local innovators and industrial operators. To free up resources for its $80 billion AI capex programme, Microsoft executed two major layoff rounds - cutting about 6,000 roles in May and a further 9,100 positions in July, including cuts in Xbox (650 jobs) and LinkedIn’s Barcelona “King” studio (200 jobs) - and reorganised engineering teams around Copilot and AI R&D, elevating leaders from GitHub and OpenAI.

Apple’s heritage HQ’s, AI pivot and potential perplexity acquisition

Apple’s strategy marries iconic real estate with high-tech laboratories. Since 2019, the company has invested over £18 billion in the UK - transforming Battersea Power Station into a 500,000 sq ft, six-storey HQ powered by 100 per cent renewable energy; opening AI and silicon-engineering labs in Cambridge; and establishing new offices in St Albans and Swindon.

Globally, Apple announced ¥200 billion of spending in China’s Shenzhen and Liaoning provinces to build a consumer-experience centre, a joint AI hardware-software research institute with Tsinghua University, and a second campus in Shanghai - each aiming for LEED Platinum certification and 100 per cent renewable power. In Bangalore, Apple’s Indian engineering campus is tripling in size, adding tens of thousands of square metres for AI-accelerated silicon design and software development.

Amid these projects, Apple is weighing its largest acquisition ever: Perplexity AI, valued at $14 billion, to supercharge Siri and develop an independent search offering - a sign that Apple is finally opening its wallet for external AI talent after years of in-house caution. Internally, teams have been realigned, trimming less-critical hardware groups and expanding the Apple Intelligence division to lead generative-AI feature integration across iOS, macOS, and developer tools introduced at WWDC 2025.

TikTok’s creative campuses and Meta’s financial engineering

Even social-media platforms recognise that digital communities need a local footprint. In June 2025, TikTok confirmed plans to expand its UK workforce to 3,000 people, adding over 500 jobs, and invest £140 million in a 135,000 sq ft HQ in London’s Barbican, due to open in early 2026. This follows its 2022 Farringdon HQ and brings total UK infrastructure spend to about £140 million, underscoring that global platforms require local footholds to navigate regulation, foster community ties, and attract regional talent.

Meta Platforms, meanwhile, is rewriting the playbook on capex by raising $29 billion from private-credit firms - targeting $3 billion in equity and $26 billion in debt - to finance its AI-focused data-centre expansion in the United States. This strategy enables rapid deployment of hyperscale facilities without loading up public debt. Major projects include a $10 billion AI data centre in northeast Louisiana and a $1 billion facility in central Wisconsin, each designed to host millions of AI processors by 2026. Meta also trimmed 5 per cent of its workforce in 2025 -targeting low performers as part of an efficiency drive - and restructured Reality Labs to sharpen its mixed-reality roadmap, even as it doubled down on its $14.3 billion stake in Scale AI for data-labelling pipelines.

NVIDIA’s global AI fabric: Factories, skills centres and acquisitions

At GTC Paris in June 2025, NVIDIA CEO Jensen Huang unveiled alliances across Europe to build “AI factories” - sovereign clouds and GPU hubs - in France, Italy, Spain, Germany, and the UK, alongside technology centres in Finland, Germany, Spain, Italy, and Britain dedicated to skills development and local innovation. A marquee project is Germany’s Industrial AI Cloud, a 10,000-GPU facility powered by DGX B200 systems and CUDA-X libraries, tailor-made for heavy-duty simulation, engineering, and design workloads.

In North America, NVIDIA is onshoring AI manufacturing at unprecedented scale: commissioning over 1 million sq ft of factory space in Arizona and Texas to produce its latest Blackwell chips and turnkey AI supercomputers entirely on U.S. soil - an effort to bolster domestic supply-chain resilience and create hundreds of thousands of jobs. To feed its infrastructure machine, NVIDIA has made targeted acquisitions - closing on CentML, Lepton AI, and Gretel - to bolster efficiency and data-generation toolsets while maintaining annual attrition below 5 per cent and avoiding layoffs since 2008.

Tesla’s gigafactories, energy pivot and market pressures

Tesla entered H2 2025 under intensifying scrutiny. In Q2, it produced 410,244 vehicles – an uptick from its Q1 output – but delivered only 384,000 vehicles, marking a 13.5 per cent decline from Q2 2024. That gap between production and deliveries points to rising unsold inventory as consumer demand softens and competition heats up. The company also deployed 9.6 GWh of stationary storage - one of its highest quarterly totals - even as storage growth showed early hsigns of plateauing after a record 31.4 GWh in 2024.

On the factory front, Tesla is extending its Gigafactory network. A new 1 million sq ft megafactory near Katy, Texas, will produce Megapack energy systems and serve as an R&D hub for grid-scale storage solutions. Tesla’s first lithium-iron-phosphate (LFP) cell factory is near completion in Nevada, promising up to 10 GWh of capacity annually and reducing reliance on Asian suppliers. In China, a $557 million deal with the Shanghai government funds the nation’s largest Megapack station. Yet to rein in costs, Tesla has cut 14% of its workforce since the start of 2024 and deferred the long-promised $25,000 “affordable” EV until 2026.

Thematic pillars of a new infrastructure era

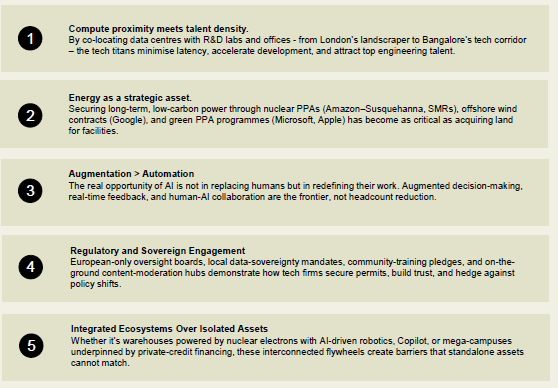

Stepping back and reviewing these various strategies, five themes emerge that capture the essence of how the tech titans care physically, financially, and organisationally positioning themselves to lead the next wave of AI and digital services.

Restructuring for the next wave

Tech’s most prominent players are doing more than just rolling out new products - they’re physically and financially rewiring the world to power AI, data, and energy infrastructure at unprecedented scale. From Amazon’s nuclear-backed AWS regions and Google’s landscraper mega-campuses to Microsoft’s sovereign clouds, Apple’s heritage HQs, NVIDIA’s AI factories, Tesla’s Gigafactories, TikTok’s creative labs, and Meta’s private-credit gambit, these companies are weaving a planet-spanning web of compute, energy, finance, and talent.

Yet this rapid build-out carries systemic implications. Long-term PPAs and SMR projects reshape local energy markets, risking traditional utility models and challenging regulators to ensure fair access and resilience. The proliferation of data-sovereignty boards, edge networks, and autonomous-vehicle trials underscores the geopolitical stakes of digital infrastructure, where export controls, content mandates, and regulatory fragmentation can ripple through the services billions rely on.

Looking ahead, the next frontier will emphasise distributed architectures - edge micro-data halls in emerging markets, floating modular reactors on coastal grids, and portable AI labs embedded in smart-city initiatives - united by open interoperability standards and governed through multistakeholder frameworks. The companies that master not only the digital stack but the intricate interplay of real estate, energy, finance, regulation, and workforce transformation will define whether the global digital economy of tomorrow delivers inclusive, sustainable growth or deepens divides across regions and communities.