Can Paris take London's financial services crown?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Bank of France governor François Villeroy de Galhau used a speech in New York last month to hail the "momentum of Paris as a financial centre post-Brexit".

Success breeds success, he told the Paris Europlace gathering, before listing the expansion plans of various banks in the French capital, which he credited to post-2016 reforms in labour and tax laws.

Britain's vote to leave the EU triggered a race among European capitals to topple London as the continent's dominant financial centre and Villeroy is right: Paris has the momentum. As we covered in this year's Wealth Report, French officials have been courting the titans of financial services and trying to find out which reforms might coax more bankers and hedge fund managers to Paris. They are being assisted by the European Central Bank (ECB), which insists that banks must move more senior staff to within its remit if they are to manage risks appropriately.

Paris is unquestionably enjoying an upswing. It is generally favoured by high earners compared to other financial capitals in the bloc, in large part due to softer factors like its proximity to the French Riviera. Large infrastructure and regeneration schemes are progressing well and the city is enjoying a bout of Olympic fever. While compiling the Wealth Report, however, sceptical voices were easy to find. Does Paris really pose a serious threat to London's financial dominance?

Measuring attractiveness

Ecosystems are hard to dislodge once they take hold. The UK's legal system and London's network of banks, accountancy and concierge services make life easy for the wealthy. That's to say nothing of the lifestyle that London offers. This ecosystem effect is in large part why Switzerland's financial hubs have survived the various disclosures enforced on it by US authorities.

Data published by EY this morning suggests that the French government has more to do. London still leads Europe when it comes to foreign direct investment in financial services, according to a survey of 900 decision makers by EY. The UK capital secured 81 projects in 2023, 76% more than the previous year and more than double that of second-placed Paris, which saw an 11% decline, according to the Bloomberg write up.

Bloomberg has a snapshot of a broader EY survey that isn't yet online - France may well have outstripped the UK on other measures of FDI, but on financial services it's not even close. The UK secured a third of all European projects in the finance sector. "The stability of the UK’s financial services sector has ensured foreign investor confidence remains strong,” says Anna Anthony, EY's UK financial services managing partner.

This is an ongoing story: investors rank Paris above London as the most attractive European city for future financial investment over a three-year horizon. But as one European investor told the wealth report, institutions are finding workarounds to the more tricky aspects of Brexit and, for now at least, London's crown as Europe's dominant financial capital is looking more secure.

Elusive targets

On Wednesday we'll see another crucial set of inflation figures - one that will have a significant bearing on whether the Bank of England's Monetary Policy Committee votes to cut the base rate next month.

The Bank of England's forecasts, and many city economists, suggest the annual rate of inflation will ease to 2.1%, within a whisker of the 2% target. If the rate does fall to target, it will be the first time since July 2021.

Several major lenders announced cuts to mortgage rates late last week following the latest Bank of England report that included a more benign set of inflation forecasts. At the very least, we could do with a prolonged period of stability to allow the recovery to bed in, but we could see mortgage rates ease further if Wednesday's figures make the BoE's June decision more clear cut.

Home sellers were largely undeterred by the uptick in mortgage rates that we saw during the four weeks to mid May, according to Rightmove figures out this morning. Asking prices rose 0.8% during the period to hit a new record.

Relocations

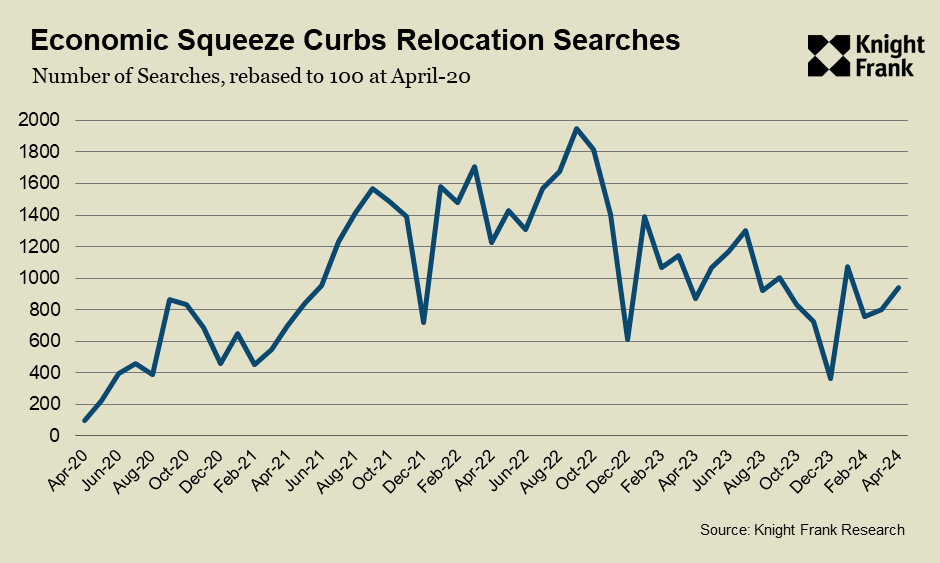

Companies are relocating fewer staff amid the uncertain economic outlook - the number of corporate relocation searches in the first four months of this year was 20% lower than last year, Knight Frank data shows.

“Economic headwinds and higher debt costs have been weighing somewhat on demand,” says John Humphris, head of relocation and corporate services at Knight Frank. “It means more companies, particularly in some sectors, are moving staff based on a business need rather than as a nice-to-have. If a law firm needs to move a prominent lawyer from the US to the UK to attract clients, they will still do that, but the general mood is more considered.”

See the piece for more.

In other news...

Last week I joined John Engel and Roberto Cabrera on the Boroughs & Burbs podcast to discuss the key insights from the Wealth Report. We covered emerging wealth hotspots, investment strategies, and the impact of geopolitics on wealth creation. Listen here, or wherever you get your podcasts.

Also from our team - Stephen Springham delves into the good, the bad and the ugly of shopping centre trades.

Elsewhere - Transatlantic air fares to jump under net zero fuel rules (Telegraph), and finally, dollar rally falters as falling inflation raises hopes of rate cuts (FT).