Beyond the Numbers: Why Q1 market data doesn't tell the full story for the logistics sector

According to the Q1 market data, occupier take up is flat, vacancy rates are rising and rental growth slowing. However, a look beyond the market data, at the fundamentals underpinning demand and supply is needed to get a complete picture of the market. As we look ahead, prospects of looser monetary policy, a consumer-led recovery, manufacturing growth and the ongoing geopolitical uncertainties all point to expanding requirements for the sector

5 minutes to read

Strong fundamentals persist, despite lacklustre take up in Q1

Preliminary Q1 figures point to stabilised occupier demand, with 7.3 million sq ft of space taken up, the same as last year's first quarter. However, the five-year average offers a less favourable comparison. Economic uncertainty, higher interest rates and rising operational cost pressures continue to weigh on occupiers, making them hesitant to commit to new facilities. However, the economic outlook is improving; inflation is falling, and it appears that interest rate cuts are likely later this year. Meanwhile, the structural trends and fundamentals underpinning occupier demand remain strong.

Prospects for a loosening in monetary policy grow as inflation eases

Following a peak of 11.1% in October 2022, inflation (CPI) has trended downwards, reaching 3.2% in March 2024, from 3.4% in February and 4.0% in January. This is expected to continue through 2024, with Oxford Economics expecting it to reach 2.3% by the end of the year.

Lower inflation is likely to drive a consumer-led recovery. Retail occupiers have been far less acquisitive in terms of space over the past couple of years. However, retail-driven demand could see growth, as rising retail sales and continued growth in online penetration rates support the need for network expansion.

Despite moderating inflation, the timing of interest rate cuts remains uncertain. Oxford Economics believe that June looks the most likely timing of the first cut, with rates cut a total of 75bps by the end of the year. However, as of Monday, 22nd April, the markets (interest rate futures) are pricing in the first rate cut (25bps) for August, with a total of 54bps this year. The MPC's decision on whether to cut rates in June will likely hinge on April data for core inflation and wage growth.

Geopolitical uncertainties continue to make a case for just-in-case strategies

Though many firms have reverted to just-in-time inventory strategies post-Covid due to cost pressures and improved efficiencies, inventory levels remain elevated (compared with pre-pandemic levels). Ongoing geopolitical concerns, including tensions in the Middle East and the war in Ukraine, continue to pose risks for international trade and highlight the need for resilient supply chains. This is helping support occupier demand, with a need to source or store more goods or components domestically rather than rely upon lengthy, just-in-time supply chains.

Rental growth continues… though the pace has slowed

Though the pace of the market has slowed, with occupiers taking longer to commit, new developments continue to set new headline rents, driving up prime rents.

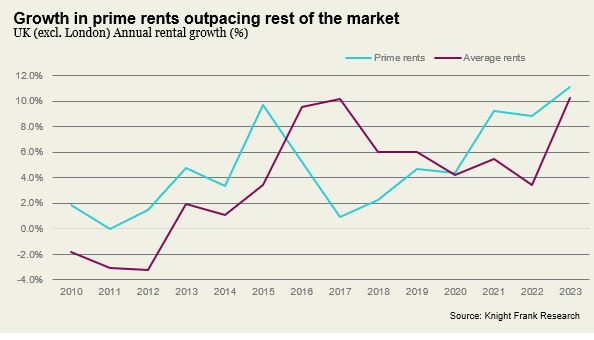

From both an investor and increasingly an occupier perspective, there's a polarisation in demand, with interest focused on 'best-in-class' assets that meet ESG (environmental, social and governance) requirements. This is reflected in performance, with rental growth for prime assets outpacing the wider market.

In 2023, average rents (in units over 50,000 sq ft, outside of London) were 10.2% higher than in 2022, while prime rents were 11.1% higher. Preliminary figures for the first quarter show that average rents (in units over 50,000 sq ft, outside of London) have risen 2.0% q/q, while prime rents have risen faster.

Vacancy rising

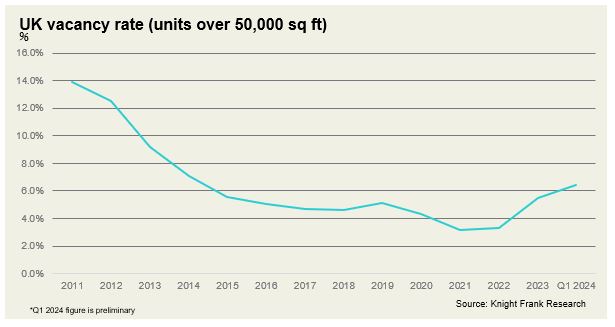

The vacancy rate continues to soften due to a combination of development completions and secondhand space returning to the market. Preliminary figures point to approximately 72 million sq ft of space available (excluding units under construction) at the end of Q1 2024, and a vacancy rate of c.6.4%, up from 5.5% at the end of last year. The Midlands and North West markets in particular, saw availability rise significantly.

The slower pace in the occupier market has meant less pre-let activity, and thus development completions have led to higher vacancy levels. The vacancy rate is at its highest level for ten years, meaning that occupiers willing to commit, have a good selection of readily available facilities to choose from. And despite continued growth in headline rents, incentives for occupiers (rent-free periods) have shown a slight upward trend over the past few quarters.

However, development completions are now slowing, and this will limit any further softening in vacancy. With high inflation and increased debt costs, development IRRs have struggled over the past year and development activity has decreased as a result.

UK manufacturing set for growth… But competition from China could pose a risk

Following two years of contraction, industrial production is anticipated to expand in 2024 and beyond. Indeed, the latest March manufacturing PMI figure points to increased optimism for the UK manufacturing sector, with a reading of +50, pointing to expansion for the first time in two years, with rising domestic orders the key to recent growth. The S&P survey found that 58% of manufacturers expect production to increase over the next year, compared to 7% expecting contraction.

Despite falling production levels over the last two years, manufacturing firms have represented a quarter of all space taken up by occupiers in 2022/23. Additional production and distribution space requirements will likely materialise as the sector enters growth mode this year.

The rate of growth forecast for the sector overall is relatively modest and lags wider GDP growth expectations. However, the overall growth projections mask a mixed bag of performance expectations across the sub-sectors. Over the next five years, robust growth is forecast for machinery and equipment, computer, electronics and optical products, as well as transportation equipment and pharmaceuticals, while several heavy manufacturing sub-sectors are expected to contract.

However, competition from overseas poses a downside risk to the growth of high-value manufacturing in the UK. China is also looking to grow its capabilities in advanced manufacturing and green technology sectors, as well as upgrade existing manufacturing processes and supply chains. Investments into manufacturing in China have gained momentum, growing at 9.4% y/y YTD in January-February. Chinese banks are facilitating a surge in new borrowing for the manufacturing sector as they expand their manufacturing capabilities, and across China, new factories producing electric vehicles (EVs), batteries, and other products integral to the green transition (such as solar panels and wind turbines) are popping up.

In March, China reported its strongest manufacturing PMI since February 2023, driven by an uptick in overseas demand. Chinese domestic consumption remains weak, and the expansion of the manufacturing sector in China will mean more goods being produced for the export market.