The tide is turning for European industrial property

8 minutes to read

Recent attacks on shipping vessels in the Red Sea will drive continued focus on supply chain resilience

The Suez shipping route that connects Europe with China and East Asia continues to be impacted by the threat from Houthi rebels, who have been attacking commercial and military shipping in the Red Sea since November 2023. Around 30% of global container trade travels through this route, and vessels are currently being forced to take much longer routes (around the southern tip of Africa). These longer transit times are adding to lead times. European manufacturers and retailers that depend on components or products from China and East Asia may seek to increase their stock to protect their order books and continue to service customer demand, which may result in additional demand for warehouses or temporary storage space.

The longer route is driving up shipping costs, adding inflationary pressures. The cost of shipping for a 40' container (FEU) from China/East Asia to Northern Europe is currently US$5,802, up from US$2,682 last year (Source: Freightos). The longer the situation persists, the more significant the disruption for supply chains, with congestion at ports resulting from changes to vessel schedules and the displacement of shipping containers causing additional disruption.

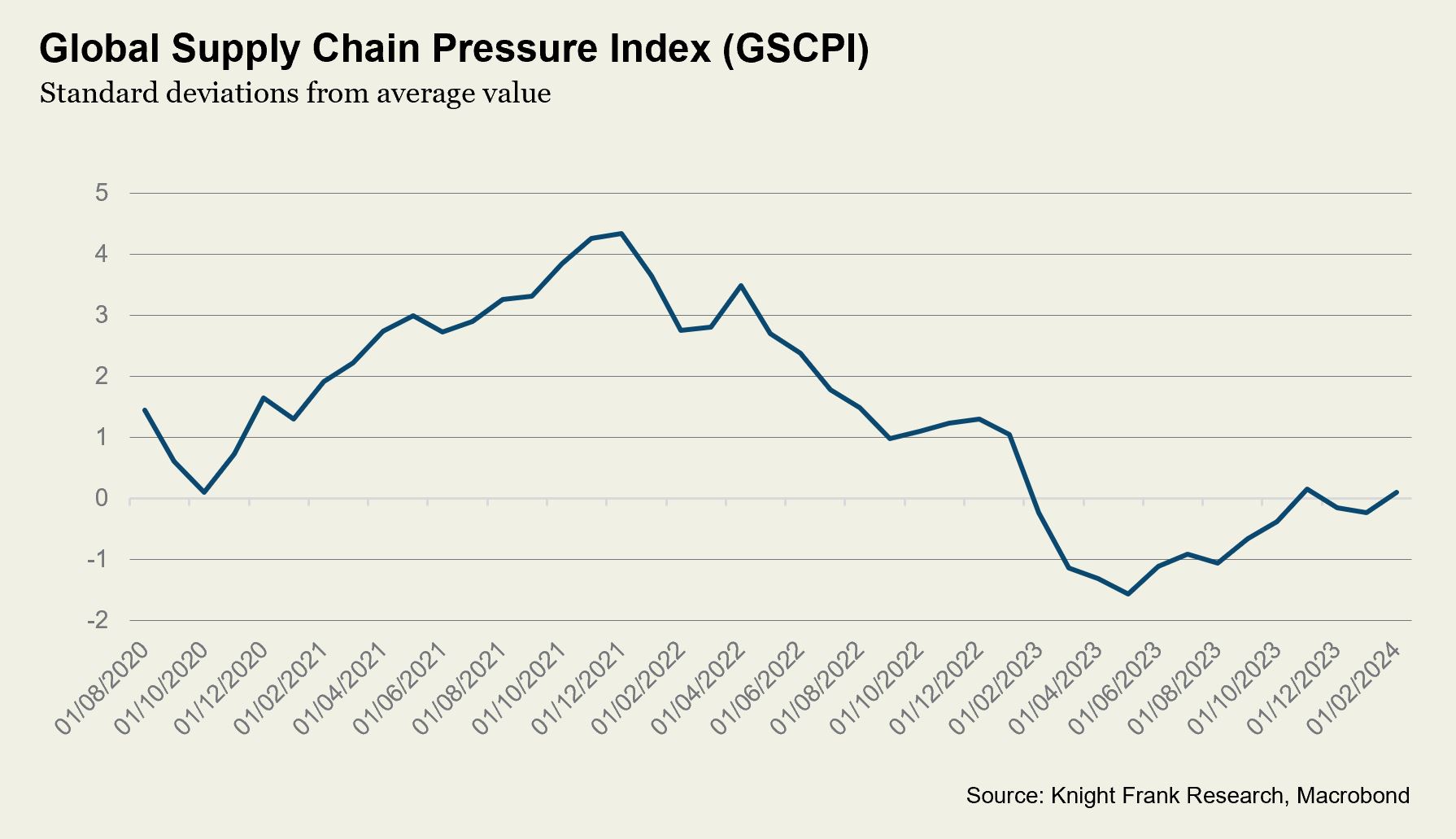

The Global Supply Chain Pressures Index rose above 0 in February, indicating an above-average reading. However, it remains significantly below levels recorded in 2020-2022. The Covid-19 pandemic and the associated supply chain disruptions, along with geopolitical tensions and rising barriers to trade, have already prompted many firms to reassess their supply chains and improve resilience through various strategies, including holding additional stock or diversifying their supplier base or reshoring/near-shoring operations.

The ecommerce market in Europe still has considerable growth potential, particularly in Eastern and Southern Europe, where online penetration rates are lower

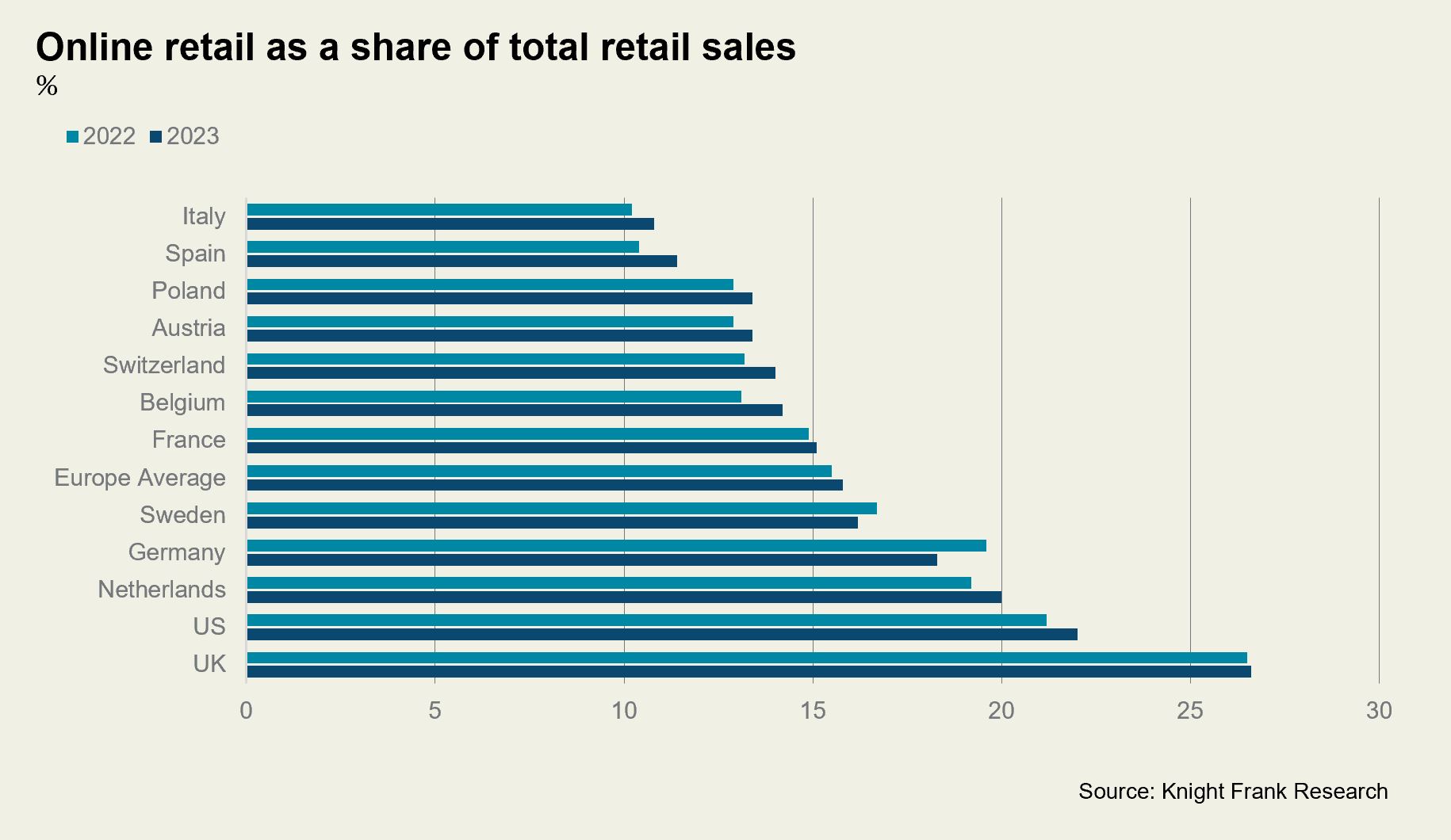

Meanwhile, ecommerce penetration rates are stabilising in Western Europe following a post-pandemic correction. The surge in take-up driven by ecommerce growth linked to the pandemic was inevitably going to slow as restrictions on physical retail lifted. Online penetration rates in the UK peaked at 30.9% in 2021; this declined to 26.5% in 2022, while 2023 saw a slight increase y/y to 26.6%. Data for the Netherlands indicates a rise in penetration rates from 19.2% to 20.0% in 2023. However, this is also below the 2021 peak of 23.9%. Most markets recorded a rise in penetration rates in 2023, and the Europe average rose from 15.4% to 15.8%, but below the 2021 figure of 16%. Germany and Sweden were the only European markets to record a decline in online penetration rates in 2023.

In Italy, online sales accounted for just 10.2% of total retail sales last year, and 10.4% in Spain. Figures for 2023 indicate a rise in penetration rates in these markets to 10.8% and 11.4%, respectively. The growth of these markets will require further development of logistics networks and specialist fulfilment facilities. The current cost of living crisis and associated pressures on household finances may also help support growth, with most shoppers believing the best prices can be found online.

Ecommerce is a key structural demand driver for logistics real estate, and our analysis found that every additional €1bn of ecommerce sales requires approximately 108,000 sq m of dedicated warehouse space. However, a few behemoths dominate the market, and their network expansion has come in waves, resulting in peaks and troughs of demand. The covid pandemic spurred online retailers to bring forward their expansion plans, and there were some instances of over-expansion or where the rush to gain scale led to a reduction in efficiencies. This has led to some space coming back to the market. However, the European online retail market is forecast to expand over the next five years, and this will result in rising demand. We expect ecommerce to drive growth in demand for the UK market, totalling 37 million sq ft over the next five years (2024-2028) (Future Gazing, 2024).

Increased appetite for risk could boost development

The ANREV/INREV/PREA Investment Intentions Survey 2024 results note a sharp shift towards higher-risk strategies when investing in Europe. Investors' preference for non-core strategies rose from 43% in 2023 to 64% in 2024.

The supply of modern logistics stock in Europe remains constrained, and both debt and equity are in limited supply. The development of new stock or the redevelopment or repositioning of older assets has the potential to generate higher returns than standing investment assets. This could offer an opportunity for non-core/value-add investors.

However, supply constraints are not equal across all markets. Providing the right assets, in terms of location and specification, that can meet the sustainability and operational aims of modern operators will require specialist knowledge and local market expertise. Investors who have or can access this knowledge and expertise, perhaps through a partnership arrangement, may be well-positioned to capitalise on this opportunity.

Heightened operational costs and a drive for efficiencies will whet operators' appetite for IOS (Industrial Open Storage)

One way to mitigate rising operational costs while retaining locational efficiencies is to utilise IOS. This is true of both first and last mile logistics markets.

IOS properties can be a cost-effective way to store or reload last-mile delivery vehicles. Last mile delivery operations typically have a large fleet to dispatch goods across their catchment area. With key European cities introducing Clean Air acts and the EU seeking to tighten the bloc's air quality guidelines, the number of electric delivery vehicles is rising. However, current electric vehicles have limited charging capabilities, with a shorter range than petrol or diesel vehicles, which means more vehicles are needed to cover the same catchment area. Most urban logistics facilities have limited yard space. The need to accommodate additional fleet may result in some operators choosing IOS as a cost-effective option for storing and charging delivery vehicles.

Another demand driver for IOS is the need for greater supply chain resilience. With heightened uncertainty around shipping times, companies must increase their holdings of finished stock or component parts to ensure they can meet demand. For some firms, IOS located close to port locations, may be a convenient and efficient way to increase domestic stock without the need for additional facilities.

Interest rate cuts on the horizon

The European Central Bank held their rates at their March 7th meeting as expected, with the main refinancing rate at 4.5%, marginal lending at 4.75% and deposit facility at 4%. However, with new forecasts pointing to lower inflation and growth, ECB policymakers have indicated they are preparing for a first cut in interest rates later this year, provided incoming data, especially on wages, confirms the trend.

President Christine Lagarde said that while cuts were not discussed for this meeting, "We are just beginning to discuss the dialling back of our restrictive stance". The next ECB meeting is in April. However, the market consensus is that the ECB will likely cut rates at their June meeting following the publication of Q1 wage data.

With uncertainty around the timing, pace and depth of future interest rate cuts, investors will focus on rental growth potential as the key to driving returns

The Netherlands, Ireland and Germany have recorded strong rental growth over the past year. Along with Belgium and the UK, strong rental growth is expected in these markets over the next four years. According to Capital Economics forecasts, the top markets for prime rental growth (2024-2027) are Antwerp, Dublin, Lyon, Brussels, and Amsterdam.

Positive capital growth set to return

In Europe, it was the logistics sector that saw the fastest repricing and values in most markets now appear to have bottomed out. The cost of debt will remain elevated throughout 2024, however, and this will limit the scale of any rebound in pricing.

Investment volumes will improve as stabilising values give buyers and sellers more comfort around new price levels

However, deal activity growth will be gradual as price discovery continues and valuations better reflect market pricing, further reducing the bid-ask spread. The sector currently offers an attractive long-term entry point, with pricing in many markets now appearing to be close to fair value.

Asian investors set to return in 2024

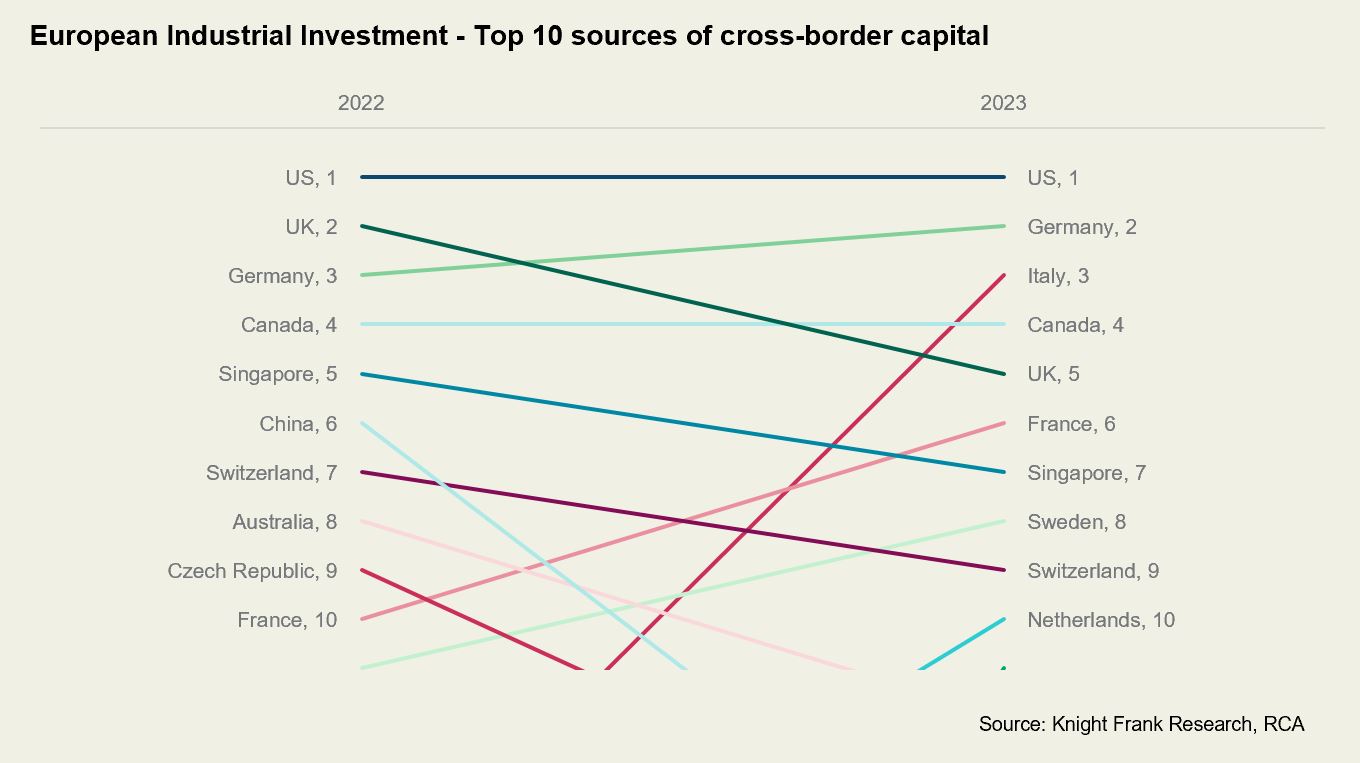

US capital continued to dominate cross-border investment into the European logistics market in 2023, and we expect this to be the case again in 2024. Asian investors slipped down the rankings in terms of sources of capital in 2023, but they are expected to be more active in 2024. In 2022, Chinese investors ranked as the 6th largest source of cross-border capital but just 16th in 2023. In particular, Singaporean REITs, as well as Chinese investors, are expected to be more significant sources of capital in 2024.

REIT consolidation ramps up with activity set to continue in 2024

The REIT market has witnessed several M&A announcements recently. Mergers and acquisitions can enable larger REITs to leverage their scale and stock to expand their portfolios and scale up in a market where debt is more costly and difficult to access. M&A also can be a good way to access high-quality assets, with public reporting providing transparency on performance.

LXi and Londonmetric agreed to a merger in January. In February, Tritax Big Box agreed to a takeover of UK Commercial Property Reit (UKCM), creating the UK's fourth-largest real estate investment trust. Blackstone recently announced their intention to combine St. Modwen and Industrials REIT, creating a new company named Indurent, which will have a portfolio of c.200 properties across the UK totalling around 26 million sq ft. Also in February, Abrdn European Logistics Income Trust announced that they are exploring a possible sale or merger and had received several preliminary proposals. Meanwhile, Abrdn Property Income has received bids from both Custodian Property Income REIT and Urban Logistics REIT.

The outlook for European logistics REITs in 2024 is much improved. They performed strongly in the last quarter of 2023 and interest rate cuts in 2024 could provide a boost to their property values. We expect to see continued activity for listed logistics funds as investors are drawn to the market due to the structural growth drivers for the sector.