The offshoring sector in the Philippines enters a new era of growth and transformation

The Philippines' Information Technology and Business Process Management (IT-BPM) sector has shown resilience throughout the pandemic, among the few industries that remained operational even during the first wave of community quarantines in early 2020.

3 minutes to read

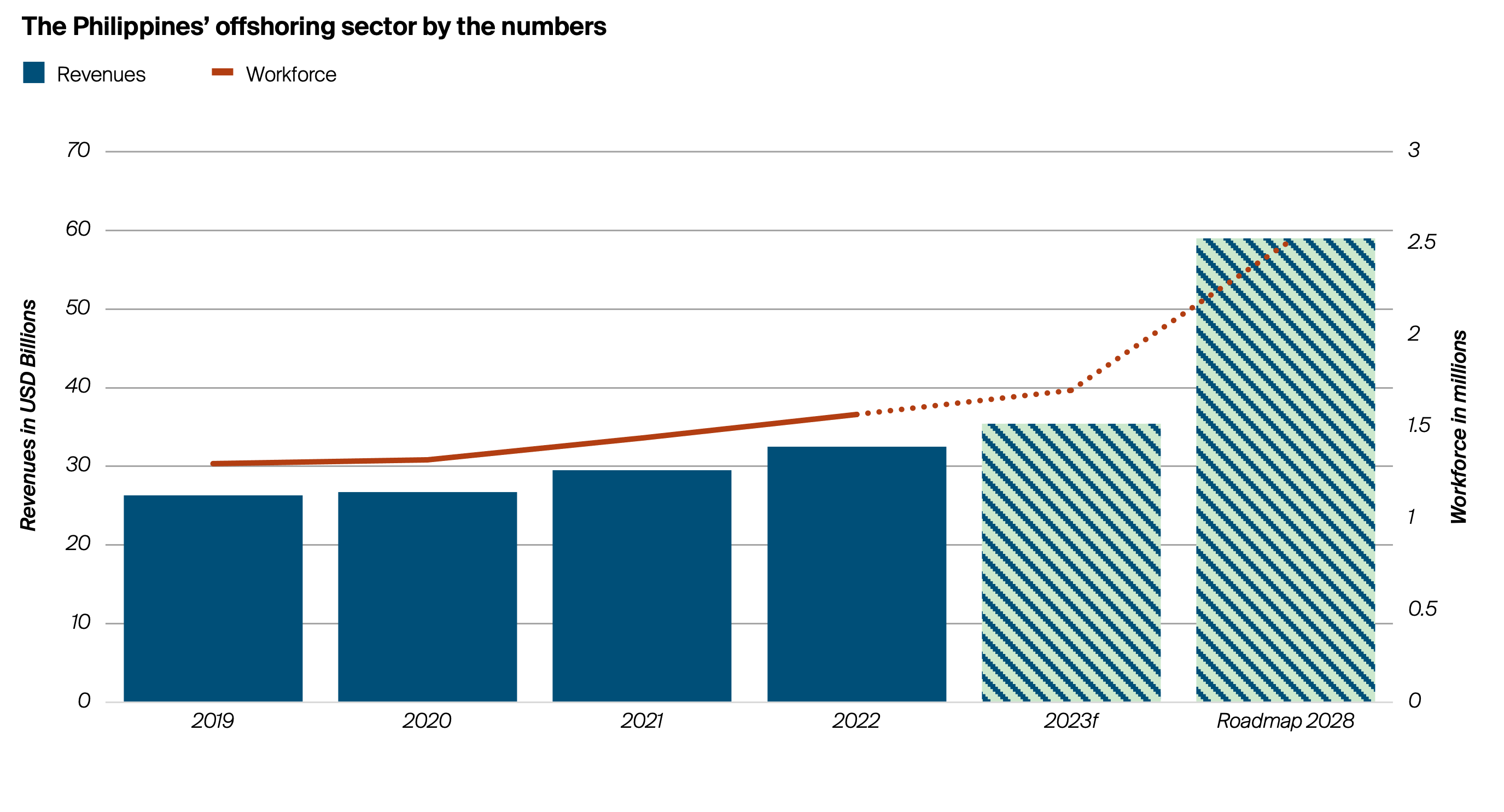

Contrary to initial estimates of a 0.5% year-on-year (y-o-y) decline in revenues for 2020, the sector grew by 1.4% y-o-y to USD 26.7 billion. The sector experienced double-digit growth in the following years, with revenues reaching USD 29.5 billion in 2021 and USD 32.5 billion in 2022.

Expectations for the sector remain optimistic as the country continues to benefit from multinational companies seeking cost-effective offshoring solutions to recover from the COVID-19 pandemic. In 2023, revenue is projected to reach USD 35.4 billion, with a 7% y-o-y growth forecast for 2024, reaching an estimated USD 37.87 billion. Healthcare, banking & finance, and contact centres are expected to exhibit significant growth among the various offshoring segments.

The IT and Business Process Association of the Philippines (IBPAP) has projected significant growth in the country's offshoring sector through its IT-BPM Industry Roadmap 2028. The roadmap estimates that the sector will reach USD 59 billion in revenue and employ 2.5 million people by 2028, indicating a substantial increase in both financial performance and job creation.

A key aspect of the projected growth is a strong emphasis on regional development. IBPAP anticipates that most new jobs will be generated outside Metro Manila, reflecting a commitment to promoting inclusive growth across the country.

Beyond Manila

The Department of Information and Communications Technology (DICT) has launched the Digital Cities 2025 Program to identify and promote 25 emerging locations with high potential for hosting businesses in the IT-BPM sector. These locations are selected based on talent availability, infrastructure, cost-effectiveness, and business environment, making them attractive to investors and property developers.

In addition to showcasing these up-and-coming locations, the DICT aims to support their development through institutional development, talent attraction and development, infrastructure development, and marketing and promotion initiatives. The program's ultimate goal is to drive inclusive growth in the IT-BPM sector by creating opportunities outside of the traditional Centers of Excellence, such as Metro Manila, Metro Cebu, Metro Clark, Bacolod City, Davao City, and Iloilo City.

By fostering the growth of these digital cities, the DICT seeks to strengthen further the Philippines' position as a global leader in the IT-BPM industry while driving economic development and job creation.

Top three drivers

Cost-effective talent

The Philippines is poised to benefit from the ongoing demand for cost-effective talent in the global market. With its competitive labour costs and skilled workforce, the country is well-positioned to capitalise on the increasing need for affordable and high-quality talent across various sectors.

Government incentives

The Philippine government is actively promoting the establishment of offshoring companies outside Metro Manila through various incentives, attracting developers and locators to explore growth opportunities in provincial areas.

Flexible Work Arrangements

Recent legislative action in the Philippines supports more flexible work arrangements for offshoring companies, making the country more attractive to businesses that adopt hybrid work setups.

Outlook

The offshoring sector has been a primary driver of office space demand in the Philippines since its rise in the early 2000s. The offshore gaming sector briefly surpassed offshoring as a key demand driver from 2018 until 2020, when Philippine Offshore Gaming Operators (POGOs) exited the market due to the pandemic and tightened regulations.

Despite the increasing popularity of flexible work arrangements, the Philippines has witnessed the adoption of an "office-first" strategy in the offshoring sector. This approach combines remote work and in-person collaboration, ensuring the best of both worlds for businesses and their employees.

Given the highly competitive offshoring landscape in the country, companies are providing various incentives to encourage on-site work. These include free or subsidised meals and refreshments, health and wellness facilities, and amenities for socialisation and recreation. As a result, the Philippines’ offshoring sector is expected to remain a stable and significant contributor to the country's office space demand.