Another defiant year of trading performance for the UK hotel market

Occupancy was the main driver in London, whilst strong momentum in ADR cemented growth in the Regional UK hotel market in H2-2023.

1 minute to read

Download the latest hotels dashboard here

The ongoing recovery of overseas visitors has been a key driver behind London’s robust growth in occupancy, up almost 11 points in 2023 (v FY2022).

Each quarter of 2023 saw occupancy in London edge closer to its pre-pandemic performance, such that by the end of Q4 2023 the gap had narrowed to just under one percentage point. For the full-year, occupancy has narrowed to just three percentage points below 2019 levels.

Across Regional UK, strong occupancy growth in H1 was followed by consistent, robust ADR growth in H2-2023. Annual ADR growth averaged more than 5%, to reach £103, whilst it’s full-year occupancy remains three percentage points lower than compared to 2019, recording the same variance as the London market.

Double-digit RevPAR growth of just under 20% in London and 12% in Regional UK was achieved in 2023 versus the previous 12 months of 2022.

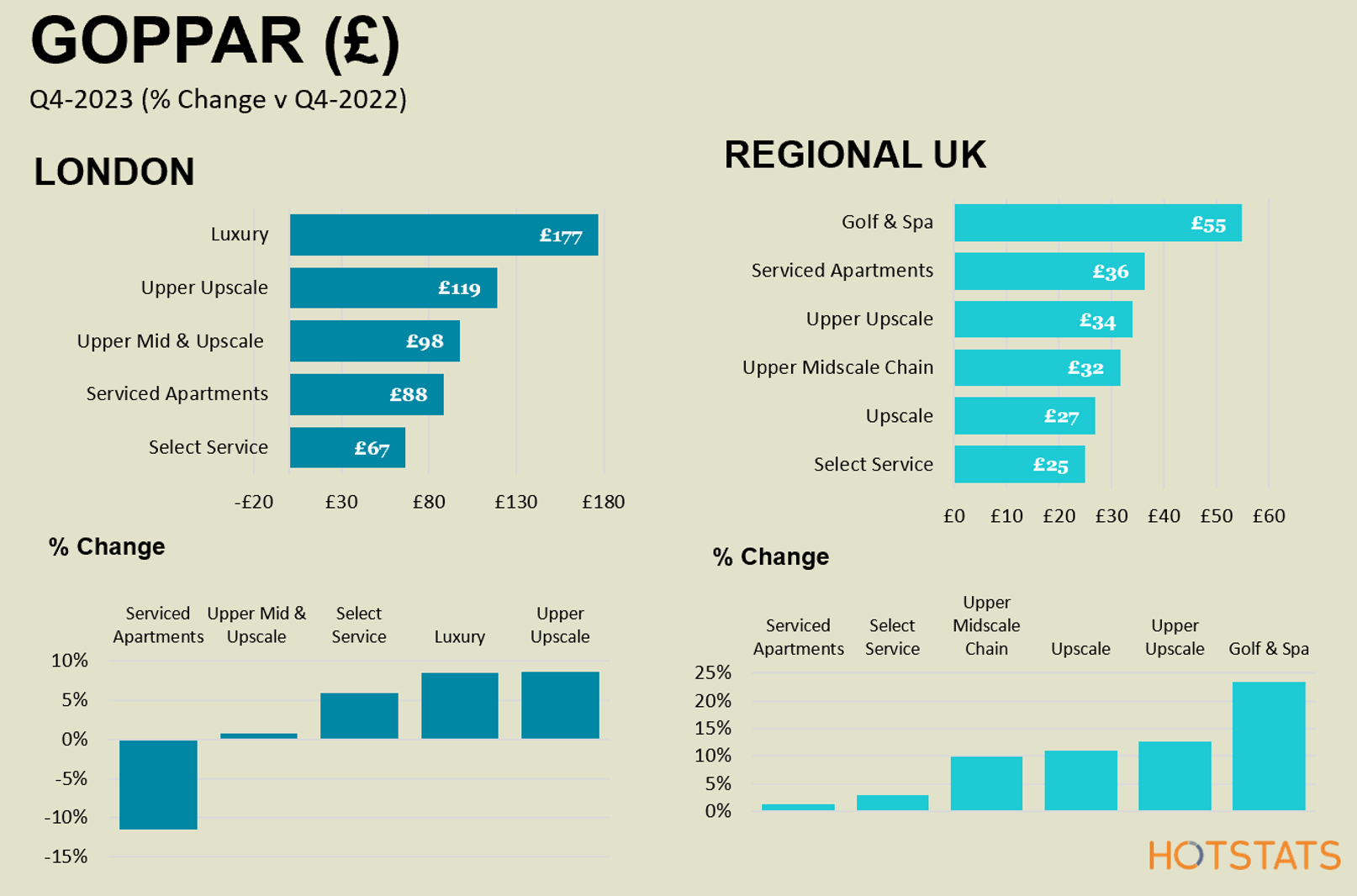

The strength of London’s RevPAR has had a significant positive impact on GOPPAR, with full-year 2023 profits up by 17.5% PAR versus 2022. Meanwhile, Regional UK recorded GOPPAR growth of 11% PAR year-on-year.

Strong RevPAR growth has also ensured that GOP margins have held mostly steady over the same period but remain significantly lower when compared to 2019. In London the GOP margin has fallen by 3.6 percentage points, whilst across Regional UK the GOP margin is 1.5 percentage points lower over this four-year period.

For further detailed analysis of the UK Hotel Market, take a look at Knight Frank’s new look UK Hotel Dashboard, which in 2024 will now be a quarterly publication, and will include an investment summary in addition to reviewing trading performance for both London & Regional UK.