Good news on inflation (really it is)

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

UK CPI rose at an annual rate of 4% in January, matching December’s rate, and beating the Bank of England’s own prediction of 4.1% and market expectations of 4.2%.

The Bank’s own forecasts confirm its view that inflation would return to its 2% target 'temporarily' in the second quarter of 2024 but then increase during the rest of the year. However, Huw Pill, the Bank’s chief economist, last week reiterated his view that inflation would not necessarily need to return all the way to 2% for rate cuts to begin, due to the lagged impact of recent higher rates.

Despite the better-than-expected result, markets were unsettled, with the pound falling on the announcement of the news. This skittishness comes on the back of yesterday’s release of figures showing US inflation eased less than expected in January, dashing hopes that the Federal Reserve might start cutting interest rates as soon as May.

A piece here, by the FT unhedged team, goes some way to explain why the markets may have overreacted to news from the US: “We’ve long argued that inflation would grind down slowly but that it would be bumpy. That still looks right. The Fed, which has all but sworn off a March cut, has months to collect data, and won’t change its view based on one noisy report. If February is similarly hot, that will be a different story. For now, reserve judgment.”

The mortgage market read-through

Last week I talked a lot, here and here, about how the move to lower inflation is helping property markets inch towards a recovery. This week, there is more on the same theme, with Moneyfacts confirming that mortgage rates are on their way down. The average two-year fixed mortgage rate falling sharply, by 0.37%, its biggest monthly decline since December 2022.

Its good news for borrowers, but let’s just take a step back. Right now, lenders are positive; they want to build market share, after a weak 2023, and they can see rates coming down this year, which has impacted swap rates, which has given them some wriggle room. But margins are very thin, and there isn’t really a lot more they can do until those base rate cuts arrive.

So what to do? Here’s Hina Bhudia, partner at Knight Frank Finance: “Rates are moving quickly and whilst we have seen a general downward trend, lenders are keen not to be at the top of the table with their offerings. So, we are seeing quick bursts of competitive rates followed by strategic increases. Our advice would be to lock something in as soon as possible rather than speculate on future improvement, rates can be re-negotiated as many times as required until draw down”.

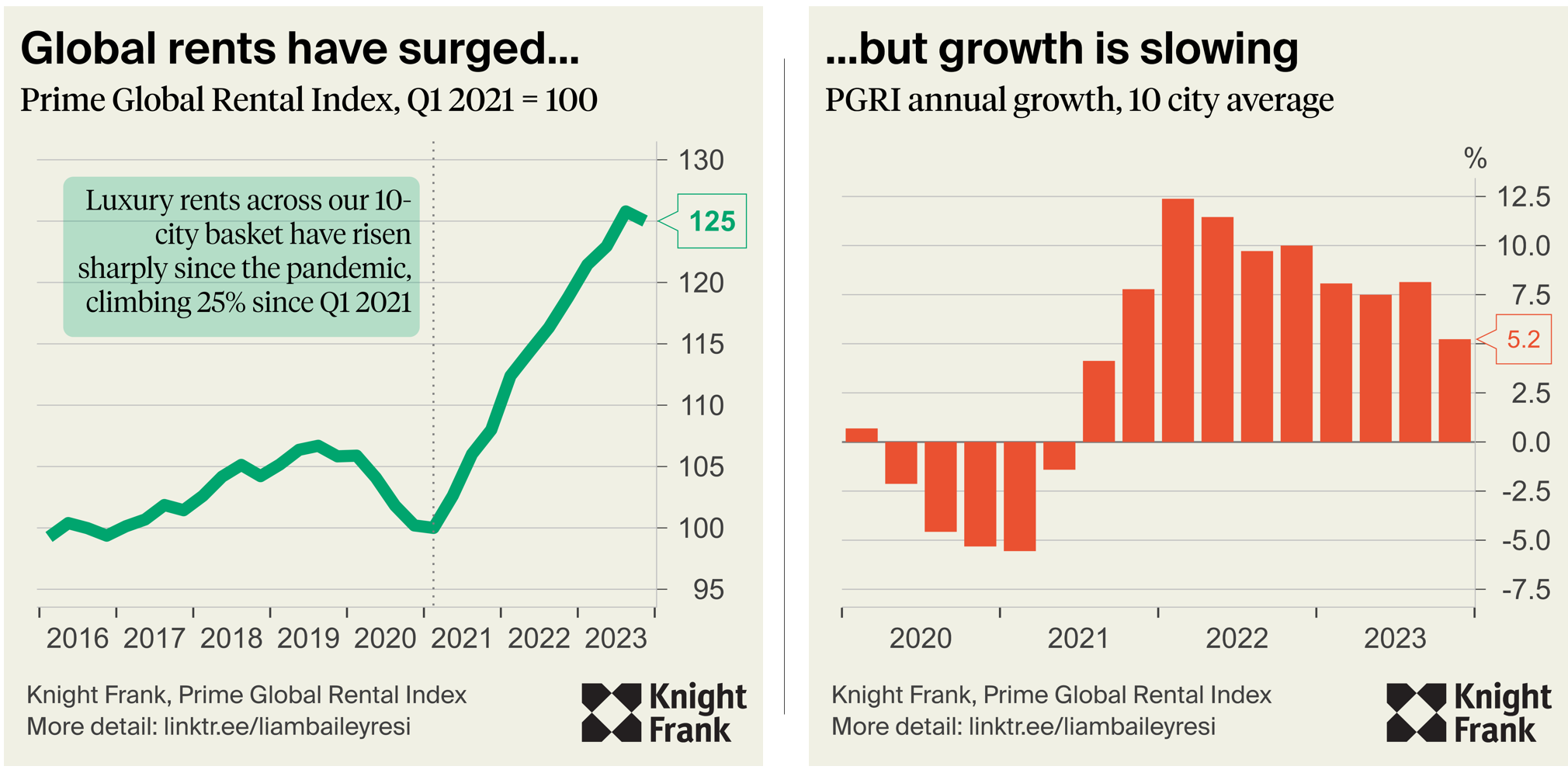

Rental moderation

Finally, the latest edition of the Knight Frank’s Prime Global Rental Index was released this morning, and it confirms that luxury rental growth across key world cities is starting to ease. The 10 cities covered by the index saw luxury rental values rise by an average of 5.2% in the year to December. While this rate is down from the 8.1% seen in Q2 and is the lowest level observed since 2021 Q3, rents are still rising above their long-term pre-pandemic trend rate.

On a quarterly basis, average rental growth declined by -0.6%, providing some relief for tenants. This marks the first quarterly fall observed since Q1 2021.

As with most residential rental markets, the luxury segment has been characterised by a chronic mismatch between supply and demand for over three years. However, while demand remains strong, the ability for tenants to continue bidding rents higher is being limited by affordability constraints. This, together with a slight improvement in rental supply, is limiting the pace of rental growth. For a full city by city breakdown follow the above link.

And in other news...

Andrew Shirley on food security versus grain prices, Stephen Springham on "a better 2024 for retail?", and Tom Bill on how the map of £1 million postcodes is getting bigger.