A big upwards revision to our house price forecasts

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

In October, financial markets were expecting the Bank of England to execute a single interest rate cut of 0.25% by the end of 2024. At the end of last week, they were expecting five.

The change in outlook has been driven by substantial falls in the annual rate of inflation. The five-year swap rate dropped a full percentage point during the final three months of 2023, and the best five-year fixed rate mortgage now sits below 4%.

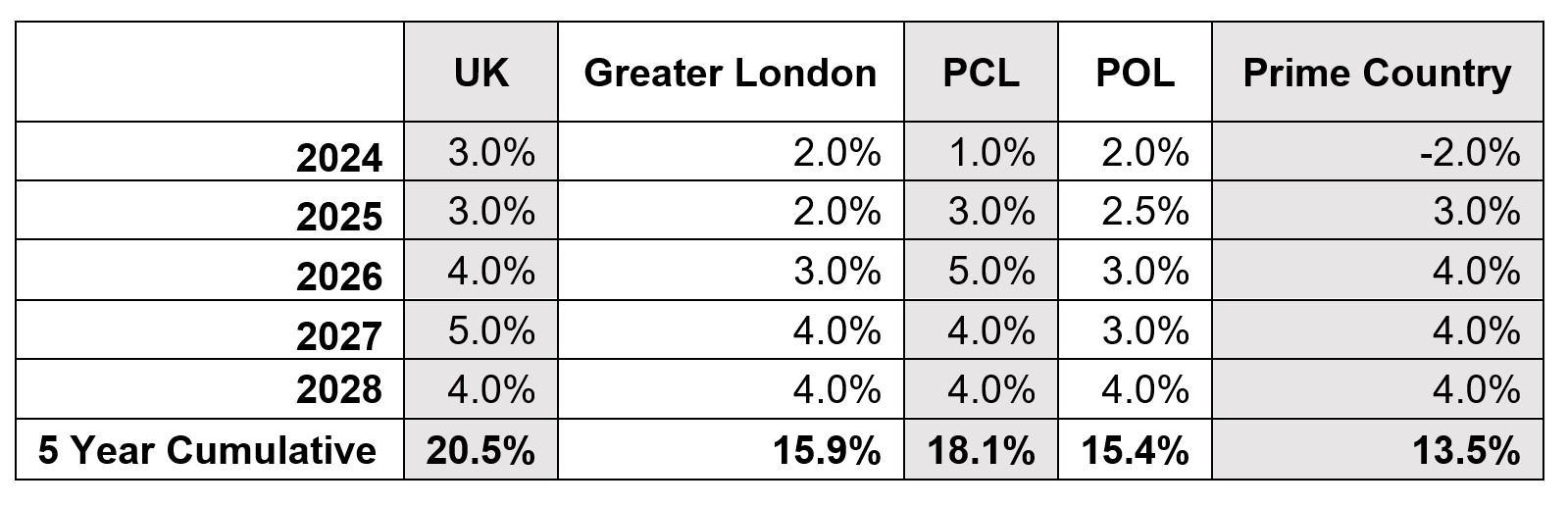

Given the shift in borrowing costs, we have revised our UK house price forecasts (see chart). We now expect UK mainstream prices to rise by 3% in 2024, up from the 4% decline we were expecting back in October. With low-level single-digit growth in subsequent years, we expect cumulative growth of 20.5% in the five years to 2028. You can read more from Tom Bill here.

A busy January

“We’re being inundated with emails from the banks with rate reductions,” Hina Bhudia of Knight Frank Finance told the Times last week. “Business has been slow for the banks over the past year, and if there was any excuse for them to try and win market share, they were going to do it as quickly as they could.”

Indeed, six of the seven largest mortgage lenders, and 31 banks and building societies in total, have made big rate cuts this year, according to a running tally by the Times's George Nixon. Rolling coverage of those rate cuts has done a lot to improve sentiment during the first fortnight of the year.

Asking prices rose 1.3% this month, the biggest jump for eight months, according to Rightmove figures published on Friday. The website also recorded nine of its 10 busiest days for buyers securing an agreement in principle for a mortgage.

What next?

We'll get another inflation print on Wednesday morning. Economists polled by Reuters expect the headline rate to have remained stable at 3.9% in December, a two year low.

The average economist expects the Bank of England to reach its 2% target by April or May before accelerating slightly by the end of the year. Investors are betting the Bank will begin cutting in May.

Capital Economics expects UK inflation to fall to 1.7% by April, which would be the first time in two years that the UK's annual rate of inflation would be running below that of the Eurozone or the US. Still, the consultancy reckons the Bank will wait until June to make its first cut.

There remains plenty of scope for the narrative to change. Spikes in fuel and shipping costs as a result of the conflict in the Red Sea could lead central banks to delay any loosening of monetary policy.

A 1997-style wipeout

The Labour Party wants to oversee a "revolution" in home ownership by opening the door to 25-year mortgages, Labour Shadow Chancellor Rachel Reeves said in an interview with the Times over the weekend:

“In other parts of the world the housing market is less exposed to changes in interest rates than it is in Britain. More people are locked into longer mortgages. As a result, when you have volatility in mortgage rates, [which] we’ve seen on stilts in the UK, people are less affected in their pockets."

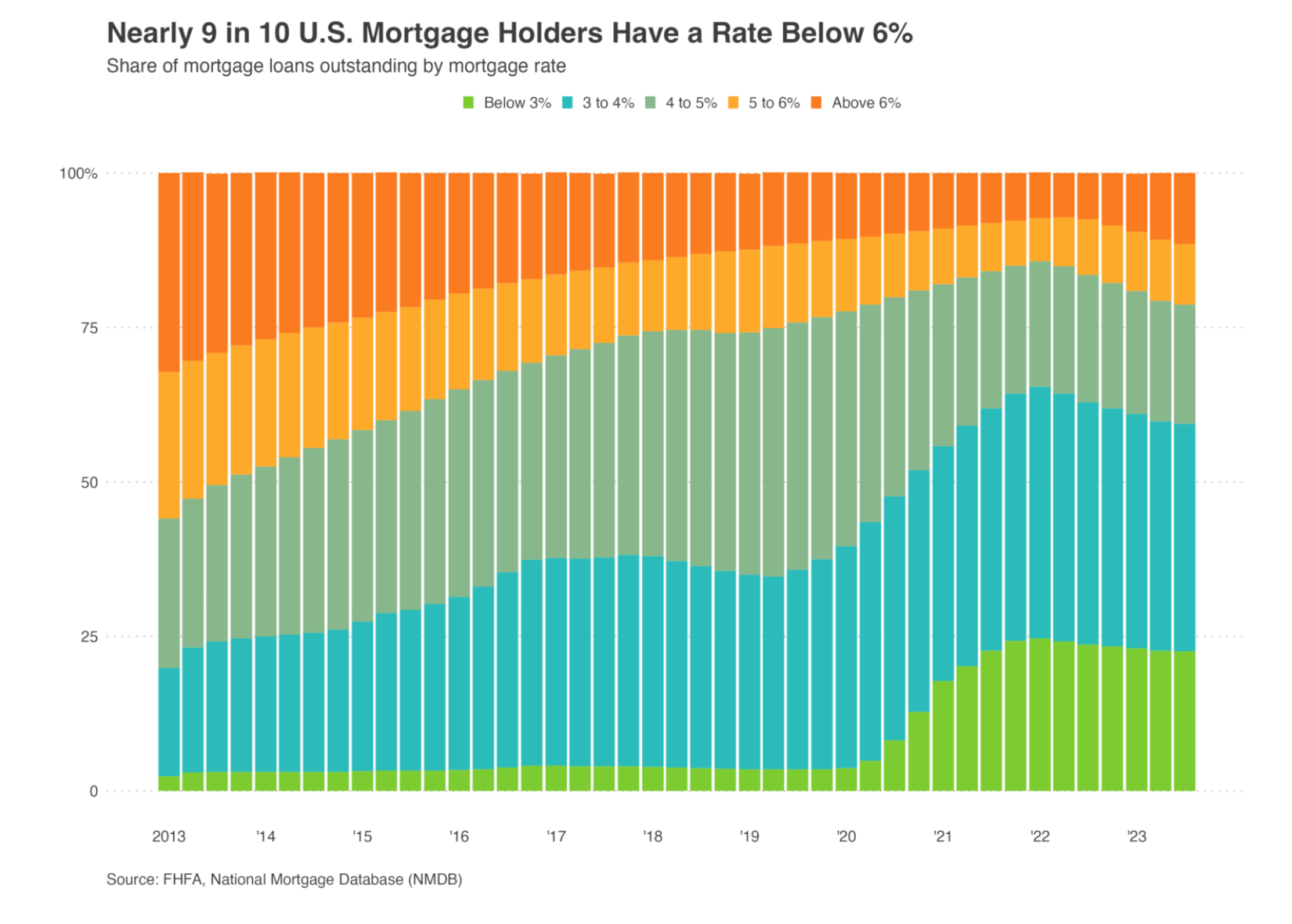

Indeed, the prevalence of longer mortgage terms means that well over half of US homeowners are still enjoying sub 4% mortgage rates, according to Redfin (see chart). Longer mortgage terms do have other consequences - transaction activity tends to collapse amid spikes in mortgage rates because borrowers feel handcuffed to their current home. Still, locking people in for as many as 25 years should make bank stress tests easier to pass, which should in theory enable people to borrow more, cutting the size of any deposit, Reeves told the Times.

Polling published by YouGov this morning suggests the Conservatives are on course for a 1997-style electoral wipeout. The seat-by-seat polls suggest that every red wall seat won from Labour by Boris Johnson in 2019 would be lost, giving Labour a 120-seat majority.

In other news...

Stephen Springham's latest Retail Note analyses last week’s newsflow on Christmas trading – with major retailers far more upbeat than industry bodies. Andrew Shirley looks at the delayed implementation of Biodiversity Net Gain regulations.

Elsewhere - London finance job vacancies slumped nearly 40% in 2023 (Reuters), survey shows ECB to cut rates four times in 2024 (Bloomberg), AI will impact 40% of jobs (Bloomberg), and finally, why is it still so hard to build new homes in England? (FT)