UK Hotel Trading Performance Review 2023

Hotel trading performance defies expectations, with profits exceeding pre-pandemic levels across most hotel segments.

3 minutes to read

In the wake of a particularly challenging macro-economic environment, the resilience and strength of the UK Hotel sector has been proven once again. Pro-active and competent hotel operators have generated strong cash-flows, with the robust trading performance serving to counter softening yields and protect values.

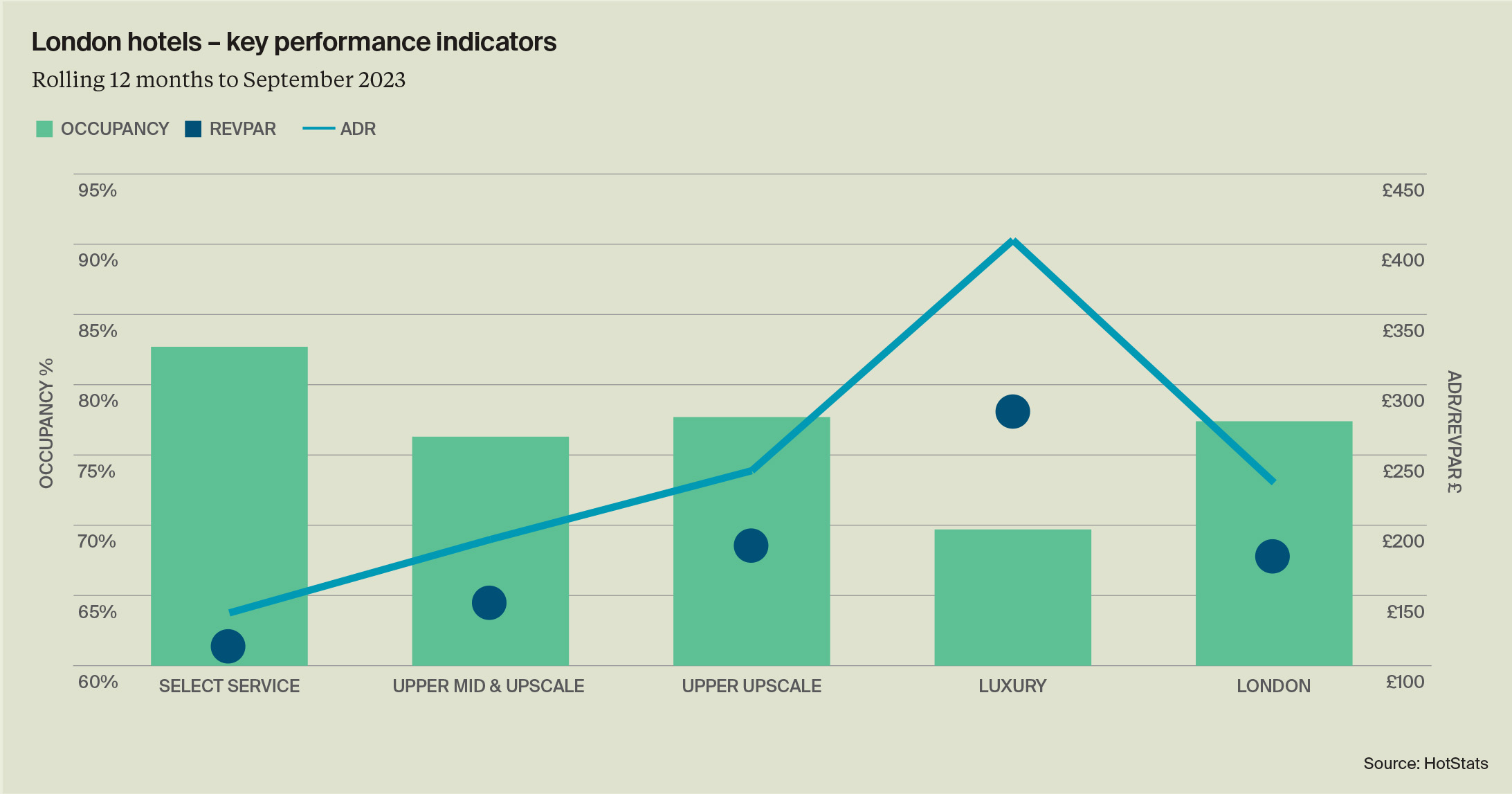

Strong rebound in London wide occupancy

London’s 12-month occupancy to September 2023 has increased by 16 percentage points to reach 77% - ahead of Regional UK for the first time since the post-pandemic recovery began and in line with historical trends. Meanwhile, the high inflationary environment has supported pricing, with London’s ADR rising by 8% over the same period and is ahead of its 2019 performance by 22%. The ongoing recovery of overseas visitors has been the key driver behind the significantly boosted occupancy levels, with trading further supported by strong growth in corporate and meetings and events business, as well as continued robust leisure demand.

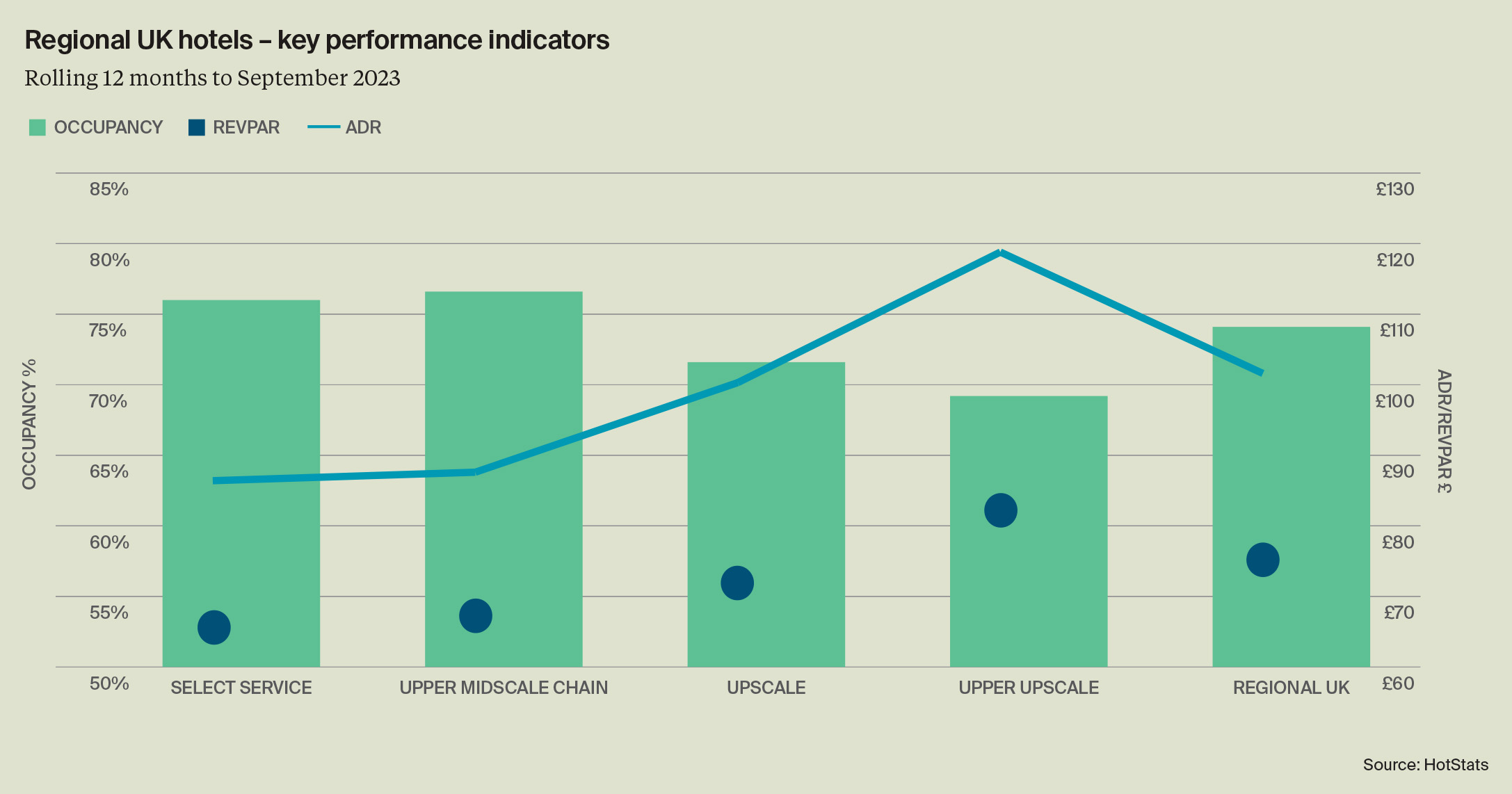

Regional hotel market closer to a stabilised position

The Regional UK market has remained strong throughout 2023, buoyed by conference business returning and continuing strong demand for short break leisure trips. With much of the recovery having taken place in 2022, growth rates were lower than compared to London. For the 12 months to September, hotel occupancies remain more than three percentage points lower than compared to the same period in 2019. ADR in real terms is roughly in alignment with 2019, whilst in nominal terms is up by 26%.

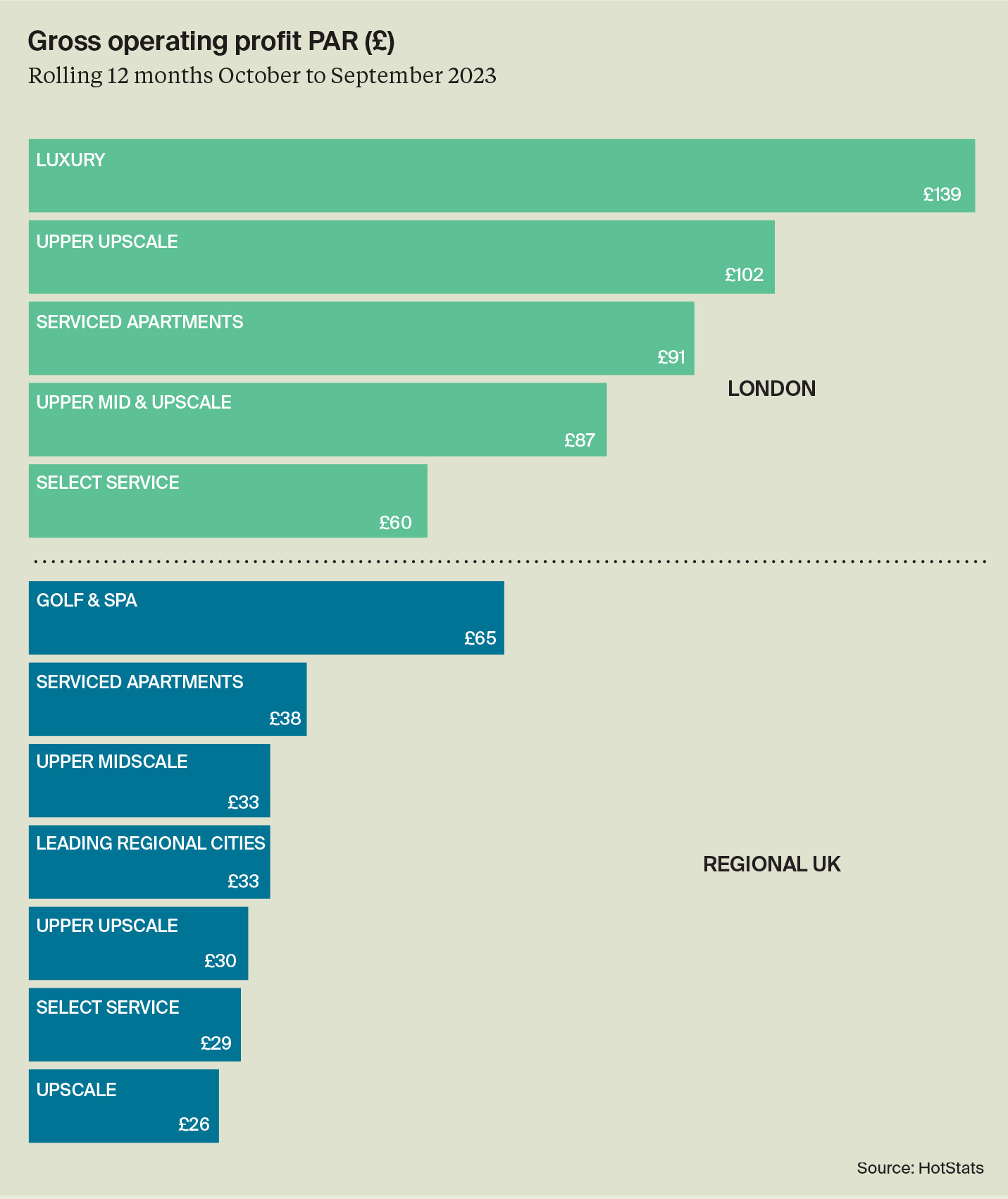

London delivers impressive GOPPAR performance

London’s strong revenue growth significantly outpaced rising costs, to deliver an impressive GOPPAR performance for the 12-month period to September 2023, surging ahead of its 2022 performance by 40%. GOPPAR performance is now 1.7% ahead of its 2019 performance.

Across Regional UK over the same period, total costs PAR increased at a faster pace than TRevPAR growth, with costs rising by 17%. Despite the GOP margin falling by 1.5 basis points to 29.1%, respectable GOPPAR growth of 9% was achieved, rising to over £34. GOPPAR performance is now 5.1% ahead of 2019 profits.

For the leading regional city-centre markets the rise in costs was closely aligned with TRevPAR growth, which led to a stronger GOPPAR recovery than the wider Regional UK hotel market. As such, GOPPAR increased by 13% to £33, but remains 5% below its 2019 performance.

Forecasts and Outlook

For the full year 2023, our forecast for London envisages occupancy rising to above 78% and ADR of £231, equating to a year-on-year uplift of 19% in RevPAR, to reach £180. For Regional UK, occupancy is forecast to reach above 74% and ADR to grow to £103, the first time in history to achieve above £100. (Our forecasts are based off defined HotStats datasets, which typically exclude the budget hotel sector, as such these forecasts are higher than if all hotel segments were included).

After such strong growth in many markets over the past 2 years, it is inevitable that the pace of growth in 2024 will be slower, particularly with strong levels of new supply opening and the return of some hotels currently operating under exclusive-use contracts. Yet demand drivers remain robust, occupancy is edging closer to pre-pandemic levels and operators remain under pressure to continue to drive upwards their ADR, due to the planned increase in the National Living Wage.