Logistics occupier landscape: treading carefully in challenging times

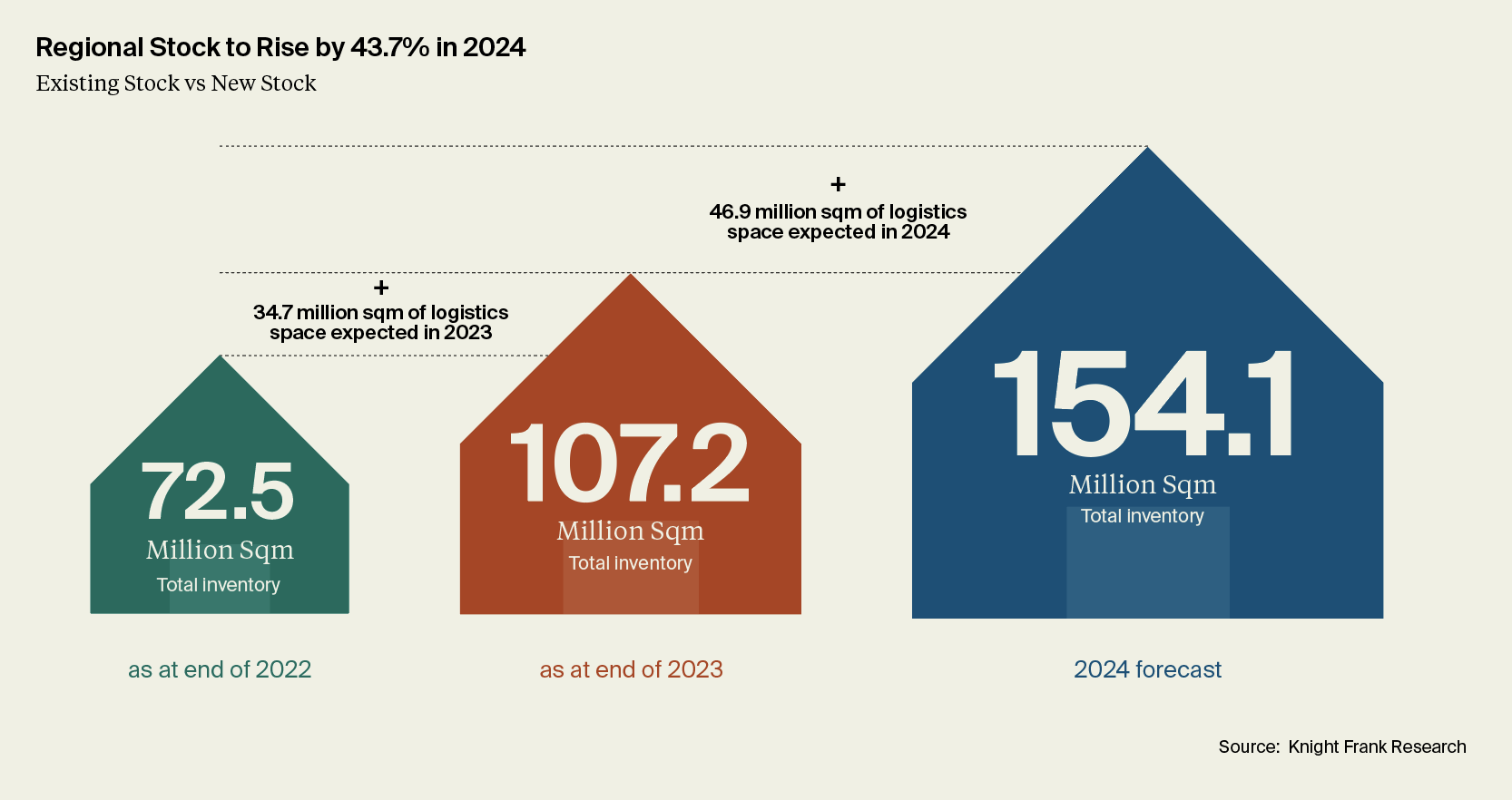

Logistics supply is set to hit a record 43.7% of current stock, offering relief for occupiers amid a recent surge in rental rates.

2 minutes to read

In our Horizon: Asia-Pacific Tomorrow report, we spotlight its implications for the region’s logistics sector.

Despite economic uncertainty, rising interest rates, and inflationary pressures, prime logistics spaces are weathering the storm with demand staying resilient across Asia-Pacific. Competition for industrial development land, particularly in strategic locations close to major cities, has remained strong.

According to the Horizon: Asia Pacific Tomorow report, Asia-Pacific logistics supply is projected to rise by a record 43.7% in 2024, which will provide a much-needed relief to the tight supply conditions in the region.

The institutional logistics development pipeline, previously constrained, is experiencing a rapid expansion, with a substantial influx of new supply in 2024, notably in key Chinese mainland markets – Beijing and Shanghai. In these cities, over 17 million square metres of new supply is on the horizon. The region’s expanding options of logistics real estate will offer expansion prospects for businesses and investment opportunities for those seeking to capitalise on the region’s long-term growth dynamics.

The drive to optimise the logistics footprint within the sector has spurred a heightened demand for state-of-the-art facilities, both core areas and last-mile locations, which remains a key driver of leasing activity across the region. Simultaneously, China+1 strategies by major manufacturers in Southeast Asia contributed to ongoing expansions. However, anticipating a continued focus on minimising inventory levels and enhancing supply chain efficiency, businesses are poised to moderate their demand within the sector.

The great supply chain reboot in a post-pandemic world

The tumult of geopolitical tensions, lingering pandemic concerns, and environmental themes are redefining the region's logistics ecosystem, driving innovative solutions that mitigate supply chain resistance, address emerging trends, and cultivate occupier demand.

These include:

- The adoption of Electric Vehicles (EV)

- Diverse sourcing strategies

Asia-Pacific at the forefront of Electric Vehicles adoption

According to McKinsey, the Chinese mainland is set to be the largest EV market in absolute terms, with a 60% adoption rate. This represents over 40% of new EVs sold worldwide by 2030. As the sale of EVs is expected to rise, the demand for batteries and electric power trains is due to increase in tandem.

Critical to success is diversifying manufacturing capabilities and securing a steady supply of core components, as these factors play an important role in shaping a robust electric vehicle ecosystem within the region.

Diverse sourcing strategies

Reshoring and friend-shoring trends, especially in critical technologies and components, are gaining momentum amid continued geopolitical rivalry. Although China's dominance remains formidable, the push for enhanced resilience is reshaping entire supply chains, necessitating additional infrastructure and logistical capabilities to incorporate an extra layer of security.